Introduction

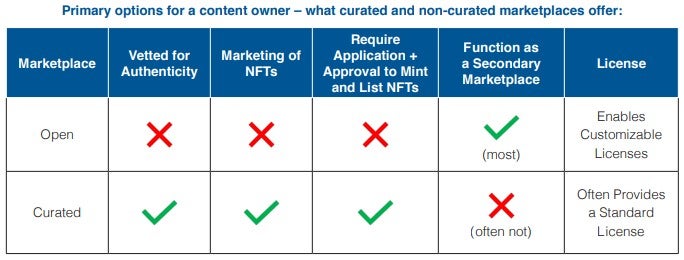

At least three different types of marketplaces facilitate the sale and/or resale of NFTs1 . These include open marketplaces, curated marketplaces and proprietary marketplaces. Other variations do exist, however, and it is likely that other alternatives will be developed. This article will explain some of the differences between these types of marketplaces, highlight some of the varying license terms of these marketplaces and discuss why IP owners who license their IP for NFTs often are best served by developing their own licenses to be used in connection with sale of their NFTs.

1. Open Marketplaces

Two popular “open” marketplaces are OpenSea and Rarible, where anyone can mint2 and sell NFTs. On these marketplaces, there is no need to apply and get accepted – creators just connect to a wallet and mint the NFTs. Existing owners of NFTs can list their NFTs for resale.

OpenSea, one of the first and largest NFT marketplaces, recently surpassed over $1 billion in cumulative NFT volume.3 In early August 2021, OpenSea saw a trading volume of $95 million in just two days. That amount is about four times the volume it recorded for all of 2020.4 On OpenSea, users can develop digital collectibles, their own smart contracts for games, art, domain names, virtual worlds, trading cards, and more using OpenSea’s item minting tool. OpenSea also allows users to post NFTs for sale that were not minted on its marketplace. Additionally, some other platforms are even set up so that when NFTs are minted on their sites, the NFTs are automatically listed on OpenSea’s marketplace.

Rarible is more focused on art assets such as books, music, albums, digital art, movies, photography, games, metaverses, domains, and memes. Rarible is one of the platforms with OpenSea integration – minting on Rarible can populate the NFTs on OpenSea. Users can view the collectibles they created on Rarible on OpenSea and manage the NFTs on OpenSea as well. However, unlike OpenSea, Rarible only lists NFTs that were minted on Rarible.

2. Curated Marketplaces

The second type of marketplace is “curated,” meaning that the platform determines which NFTs are allowed to be minted, posted and sold on directly its marketplace. Compared to an open marketplace, a curated marketplace is more limited and exclusive, requiring artists to apply and be accepted before being able to mint or sell NFTs in an attempt to keep fraud down and quality high. Some of the more well-known curated marketplaces include SuperRare, Foundation, KnownOrigin, Nifty Gateway and MakersPlace.

SuperRare’s marketplace focuses on a limited number of hand-picked artists. Though aspiring creators can submit an artist profile form, entry barriers are high. Artists must submit their work for approval before it can be minted and listed on SuperRare’s marketplace.

Foundation’s marketplace is community led, so artists invite new artists to join the platform and mint their NFTs. Creators can access the “creator invites” feature after selling their first NFT. Foundation also has OpenSea integration, so by minting on Foundation, the NFT can automatically be displayed on OpenSea.

KnownOrigin focuses on digital art. It is more difficult for creators to get accepted onto its platform. Artists submit their artwork in .jpeg or .gif format to the KnownOrigin gallery. As of April 2nd, 2021, applications are closed to creators.

Nifty Gateway offers crypto assets and art called Nifties. Nifty Gateway partners with top creators, brands, athletes and artists, so it is difficult to get accepted for crypto art – only famous artists, brands, and celebrity creators will be selected to use the platform. Collectors can even buy items for sale on OpenSea using Nifty Gateway and pay using a credit card.

MakersPlace also offers digital art. MakersPlace is invite-only, so an invited artist will fill out the creator application and sign and mint its NFT.

3. Proprietary Marketplaces

The third type of marketplace is “proprietary.” These platforms typically only offer NFTs created by the marketplace operator and usually do not facilitate the sale or display of other NFTs. Given that third-party creators are not invited to list NFTs on their sites, the exclusivity and scarcity of their NFTs often results in very high demand and high prices. In contrast to proprietary marketplaces, which only mint their own items, creators on other marketplaces retain the rights to the IP underlying their NFTs. This is because marketplaces that permit minting on their platforms are merely facilitating the creation of the NFT, but are not developing the actual artwork. Another distinguishing aspect of proprietary marketplaces is that some offer their own online “Showcases” where users can display their collection of the marketplaces’ NFTs. While OpenSea similarly allows users to display their items on its marketplace, the Showcase is not OpenSea’s proprietary collection, so it contains NFTs with other third party IP. Some examples of proprietary marketplaces include Top Shot, Vee Friends, and Bored Ape Yacht Club.

On Top Shot, users buy NFTs representing NBA video highlights as a form of digital collectibles. Top Shot’s NFTs are licensed by the NBA and minted on the Flow Blockchain.

Vee Friends is an NFT project created by Gary Vaynerchuk, a well-known social media influencer. An interesting aspect of Vee Friends is that all NFT owners get access to VeeCon, which is a multi-day event exclusively for NFT holders. The fact that the Vee Friends NFT functions as both an art and collectible and has additional benefits provides an example of how NFTs can represent more than just ownership of a digital asset. Rather, they can provide additional utility. Each NFT has different levels of access and activities, which are managed through the smart contract associated with each NFT. Primary sales of Vee Friends NFTs are on its site, and the Vee Friends NFTs will appear on secondary marketplaces like OpenSea and Rarible for resale purchase. Vee Friends are minted on the Ethereum Blockchain.

Bored Ape Yacht Club is another successful NFT project. The initial sale on its platform is currently sold out, but on OpenSea, as of September 2021, the total volume traded for Bored Apes is 143.5K ETH, which is around $531M (assuming ETH is at $3,700). Like Vee Friends, the Bored Ape NFT doubles as a Yacht Club membership card, and grants access to member-only benefits. BAYC NFTs are also minted on the Ethereum Blockchain.

NFT-Specific Marketplace License Terms

The license terms on the various marketplaces vary based on the type of marketplace, the business model and other factors. The following summarizes examples of some of the standard terms commonly used across the NFT marketplaces, regardless of business models. All of the relevant standard terms for electronic marketplaces in general should be included as well (i.e., age restrictions, privacy, user conduct, DMCA, and user feedback), but the focus here is to highlight how the NFT-specific issues are addressed by these marketplaces. It is important to note that often the terms are designed to protect the operator of the marketplace. As detailed below, the terms often do not fully address the protections needed by the owners of the IP in the underlying digital asset associated with the NFT. Examples of terms that will impact those operating under NFT marketplaces include the following.

Introduction

The terms will typically begin with a general overview of the scope and applicability of the terms. In general, the terms govern the access to and use of the marketplace platform. The terms also function as a binding legal contract between the marketplace operator and the user and govern the user’s activities on the marketplace. Depending on the type of marketplace, some terms govern the creation, purchase, sale, exchange, and display of NFTs.

Account Registration

Nearly all NFT marketplace terms have a section relating to registering an account. Less than half of the marketplaces explored in this article require users to register accounts before using their platforms. These marketplaces – Top Shot, Nifty Gateway and MakersPlace – all allow payment on a credit card (except for auctions on MakersPlace)5 . The remaining marketplaces require users to link an electronic non-custodial wallet like MetaMask prior to using their platforms. For instance, to access their platforms and engage in transactions on their marketplaces, users of Vee Friends, KnownOrigin, Rarible, and SuperRare must install a compatible browser extension such as MetaMask. After connecting the external digital wallet to the platform, users can interact directly with the marketplace and may sign up for an account. An interesting point to note is that any NFT bought with an individual’s MetaMask is automatically reflected on his or her OpenSea account. This is because when users link their MetaMask wallets to OpenSea, their OpenSea accounts reflect the items held in their external digital wallets.

Linking a Digital Wallet

For marketplaces that require users to set up a digital wallet to purchase NFTs, the terms typically provide instructions on how to connect to a browser extension and/or digital wallet. Most NFT platforms allow users to link any supported electronic wallet (a Flow-compatible browser for Top Shot or an Ethereum-compatible browser for Ethereum-based NFTs). Nifty Gateway and MakersPlace do, however, allow users to log-in or sign-in to their accounts on their platforms without a digital wallet and then purchase NFTs with credit cards. Foundation requires users to connect to a specific MetaMask browser extension. If a marketplace’s transactions are all conducted on Ethereum, the terms will specify that users must connect to a supported Ethereum wallet application.6 MetaMask is the most popular Ethereum-based electronic wallet and Ethereum web browser plugin. The terms may also include a statement notifying users that their public wallet addresses will be made publicly visible on the blockchain whenever they engage in transactions on the marketplace.7 The ramifications of setting up a digital wallet are discussed below in connection with the business considerations.

Ownership of Platform IP

The NFT marketplaces generally own their software and content (but not user content that is uploaded to their platforms). This term discusses ownership of the platform itself, and the marketplace will usually protect its ownership. The users’ rights only extend to accessing and using the platform. In this article, our focus is on ownership of the NFT’s content, not ownership of the platform’s software and content. In most cases, the content owner will be licensing the NFT to the buyer or user, not the marketplace. However, proprietary marketplaces typically do own the NFTs and the IP underlying the digital assets they initially sell.

Indemnification

To cover themselves, NFT marketplaces usually include an indemnification provision in which the user must agree to indemnify, defend, and hold harmless the platform (and its subsidiaries, affiliates, etc.) against any claims arising from the user’s breach of the terms, misuse of the platform, or violation of any laws / regulations in connection with accessing or using the platform. Many marketplaces’ terms will also include indemnification against any claim brought because of a violation of a third party’s rights (e.g., if a user uploads content to the platform that infringes a third party’s IP right).

Arbitration Process

Most NFT marketplaces will includes a provision on dispute resolution, which will state that any disputes arising under the terms or from the use of the marketplace are to be resolved by arbitration. Some marketplaces will specify that the resolution process does not apply to other claims, such as those by a copyright owner that its rights are being infringed through an NFT offered on the marketplace. In the event that arbitration will not cover disputes over the NFT, content owners can impose in their own licenses a requirement that the buyer arbitrates claims. However, arbitration may not be in the content owner’s best interest, as arbitrators do not have the power to grant injunctions or enforce payment of damages. Thus, if a buyer is infringing upon the IP owner’s rights, the content owner may want to consider seeking an injunction instead of arbitrating. Nevertheless, to the extent content owners want to have certain types of claims arbitrated between themselves and NFT purchasers, they can include an arbitration provision in their license if such a term is not already addressed in the marketplace’s terms.

The terms also generally address class action waivers in this arbitration section. OpenSea, MakersPlace and VeeFriends allow their users to opt out of the arbitration agreement, which may require users to only bring claims on an individual basis and not as a class member. In contrast, Nifty Gateway, Foundation, Rarible, SuperRare and Top Shot state (or imply) in their terms that users expressly waive their right to file a class action or seek relief on a class basis.

License to User and Creator Information and Content

Some platforms like KnownOrigin, Nifty Gateway, and MakersPlace state that they have a right to use the content users or creators upload for various purposes, including to display it on the platform, for promotional purposes, and in some cases, to create derivative works for certain purposes. The platform may also have a right to use and modify the creator’s name and image for marketing or promotional purposes. The promotional activities may include use of the content in digital galleries, promotions and events, and compilations. Foundation and SuperRare creators grant the platform a license to all minted works, which includes similar rights to promote the works on social media and visual environments, to create and distribute digital or physical derivative works based on the work, and storing, distributing, and reproducing one or more copies of the work within a distributed file system such as the InterPlanetary File System (IPFS).

Seller’s Representations8

In most terms, minters / sellers / creators must make certain representations and warranties. The marketplaces will generally require that the seller be responsible for the accuracy and content of their creations, for respecting (and not infringing upon) the intellectual property rights of others, and for not coordinating pricing with other creators. This section will typically state that the creator is agreeing to mint only original works. In addition, the creator must have the authority to mint, display, and sell the work. Moreover, some marketplaces prohibit any behavior that would lead to unauthorized commercialization or counterfeiting of digital assets.

Rarity Representation

SuperRare and Foundation creators must agree not to mint multiple NFTs for the same artwork. This is one of the few restrictions on the content owner. Although the content owner may sell less of their NFTs, the guaranteed scarcity generally increases the value of each NFT. As a content owner using a marketplace, it is important that you are aware of any terms subjecting you to a restriction on what you can do in the future, and that you agree to abide by such terms. Content owners must make the personal business decision whether to agree to limit the number of NFTs they will ever mint for their work or to instead go mass market and sell as many NFTs as they can.

Affirmative Acceptance

Initial Purchasers: The introduction usually explains how users accept the terms (either by clicking “I accept”, accessing, using or transacting on the site / platform, or creating an account). With terms, just as with any other contract, there needs to be an affirmative acceptance. Typically, an initial purchaser must agree to be bound by the marketplace terms. As part of the terms, the initial purchaser usually gets ownership of the NFT but only a license to the digital asset associated with the NFT. Often, by accepting the terms, the initial purchaser agrees to be bound by the license terms from the copyright owner.

IP owners should ensure that there is a license, that the licenses applies, and that the license is clear on what the restrictions are so that buyers may abide by them. NFT buyers need to have notice of the terms, be given a means to accept the terms, or be bound by the license and its restrictions through some other legally binding mechanism.

Subsequent Buyers: A subsequent buyer of an NFT also needs to be covered by the same license that initially bound the first purchaser. However, the license may not automatically transfer. Although some marketplaces physically permit the NFT to be resold on a secondary market, it is unclear whether or how the NFT license is applicable to subsequent purchasers. Moreover, if an initial buyer merely sells the NFT directly to a subsequent buyer (as opposed to resale via a marketplace), there may not be an opportunity for the subsequent buyer to affirmatively accept the terms and agree to the license.

Copyright owners would be well advised to ensure that with any resale of an NFT, the license to the digital asset is binding on the subsequent purchaser. Ensuring the transferability of the original license with the NFT can help eliminate the lack of clarity and misunderstanding on the applicability of the license to the subsequent purchaser. Subsequent NFT buyers, in order to be both entitled to and covered by the NFT license, should determine whether the license is automatically transferable to them. Additionally, content owners who want their NFT license to be binding on subsequent purchasers may want to consider sound mechanisms by which the subsequent buyer becomes legally obligated to and bound by the license and the restrictions of the license (e.g., where the NFT can be displayed, prohibition on commercial uses, etc.).

Various techniques can be used to ensure both initial buyers and subsequent purchasers are aware of and bound to the license.

Initial Sale

One way to ensure the license terms are binding on the initial purchaser is for the copyright owner to ensure the marketplaces’ terms refer to the license and to ensure that the license terms are presented in juxtaposition to the NFT display on the marketplace. For instance, another approach (discussed in more detail below) is for a third party content owner to provide terms in juxtaposition to the NFT. The NFT listing can include a separate PDF attachment of the terms, which states that by buying the NFT, the purchaser is agreeing to the third party’s terms. This is an attempt to ensure that the user is affirmatively accepting the terms.

Subsequent Sale

Even if the initial purchaser is legally bound by the license, a question arises as to how a subsequent purchaser can be legally bound. Whether the NFT transfer is a resale on a marketplace other than the original marketplace where the terms were initially posted (which the first buyer agreed to abide by) or merely a wallet to wallet transfer, ensuring that the license terms persist through either transfer is critical. Content owners should be aware that just because the terms state that the buyer is bound, a subsequent purchaser could argue that they are not subject to the license terms if they are not aware or do not affirmatively accept them.9 This is likely an issue that will be litigated in the near future. To avoid this uncertainty, it is best for copyright owners to take certain steps to increase the likelihood that the subsequent purchaser has notice and that the license is binding on subsequent purchasers.

The copyright owner can include various terms in the license that would help mitigate such risks. These terms could specify conditions upon which the license is transferrable, including, for example, that the initial purchaser must notify the subsequent purchaser of the license and indicate that the subsequent purchaser must agree to be bound for the license to transfer. We have often included other terms to bolster this position.

Another option is to embed a copy of or reference to the license in the metadata of the NFT. This is analogous to how open source software licenses are implemented. This arguably gives all buyers notice and permanently links the license to the digital asset.

Terms that Differ Based on the Business Model of the Marketplace

How to Become an Artist

A term that would typically be found in curated marketplaces such as KnownOrigin and Foundation relates to how artists can create their NFTs. This section will usually describe how users can apply to be an artist, mint and then sell their limited-edition or unique NFTs on the platform. The terms may also state the type of NFTs the marketplace offers, such as digital artwork, animations, audio, and photographs. Some marketplaces which are invite-only, like SuperRare and Foundation, clarify that an artist or creator must be invited and approved to mint and later list NFTs for sale.

Integration

One aspect of SuperRare, Foundation and Rarible that deviates from the norm among some of the marketplaces is that NFTs minted on SuperRare, Foundation or Rarible are automatically displayed and manageable on OpenSea.

Non-Custodial Service Provider

Depending on the business model of the marketplace, some terms specify the extent of the marketplace’s involvement in transactions. Many NFT marketplaces function as intermediaries and primarily consist of content created by their users. Some marketplaces are “non-custodial” (e.g., OpenSea, KnownOrigin, MakersPlace, SuperRare and Foundation) as they do not take possession of the NFTs. Their terms typically contain a clause that the platform is administrative only and merely facilitates transactions between buyers and sellers, but is not involved in the actual transaction between the parties. Thus where NFTs are transferred directly from the buyer to the seller, the platform terms seek to structure the contract to be directly between the buyer and seller. In addition to stating that the platforms are not the custodians of any user-owned digital items, some marketplaces, like SuperRare and Foundation, will also include an acknowledgement by the user that the site will not buy, sell, or have any custody, possession or control of any NFTs for the purpose of facilitating the transactions.

Proprietary marketplaces differ from open marketplaces because open marketplaces typically do not take custody of their users’ NFTs – these marketplaces only mint the NFTs for their content owners, transfer the NFTs to the creators’ wallets, and the content owners can then list their NFTs on the platforms. Open marketplaces usually avoid taking custody of NFTs because they do not want to directly sell the NFTs. Rather, they merely provide the service for sellers and buyers to use and transact directly.

The terms for Vee Friends vary for the initial sale and resale. The initial sale of NFTs on Vee Friends is sold by the platform and the agreement for sale is between Vee Friends and the initial purchaser. Secondary sales are directly from the initial purchaser to the subsequent purchaser and the site is not a party to the agreement but only facilitates the transaction.

Top Shot’s terms are similar to Vee Friends for the initial purchase on its site. Because Top Shot exclusively mints and sells its own NFTs, the platform is involved in the initial sale of the NFT. However, Top Shot’s terms state that any purchase or sale of a “moment” made, accepted, or facilitated outside of its marketplace is not within Top Shot’s control. Top Shot only allows users to purchase moments by buying the NFTs directly from Top Shot on its platform or by buying moments from other users on its marketplace.

Separate License Terms – Marketplace Licenses vs. Custom Licenses

Some marketplaces provide a “standard” license that applies to all NFT sales, while other marketplaces, like Rarible and MakersPlace, allow the minters of NFTs to apply a custom license to their particular NFTs. For example, MakersPlace provides a general limited license that applies “unless otherwise specified by the seller of the crypto asset in writing.” Therefore, the NFT itself may carry different license terms than the default terms set by the marketplace. Moreover, a marketplace’s terms may be silent on license rights (i.e., Nifty Gateway and OpenSea). For reasons stated herein, it can be confusing and may lead to issues if there is no clear license.

If a marketplace has a standard license that does not adequately protect a content owner’s IP rights, the content owner may want to consider creating a custom license for its NFT. OpenSea is the only marketplace examined in this article that lists NFTs minted on other platforms or by another third party. OpenSea’s terms state that third party content may be subject to separate license terms. In such an event, any third-party links may include license terms governing use of the NFT. The terms for the Vee Friends NFTs are visible on OpenSea. So a collector who buys a Vee Friends NFT on OpenSea will also have access to the separate terms attached to the NFT.

License to Current Owner and Effect of Transferring the NFT

The initial user’s license should terminate upon resale of the NFT. As mentioned above, content owners should ensure that the subsequent purchaser is bound by the original license. Some of the NFT marketplaces (i.e., SuperRare and Top Shot) include a Term that the limited license belongs only to the current owner of the NFT, and any transfer, sale or other dispossession of the NFT terminates the former owner’s rights and interest in the license and NFT. Assuming reasonable steps have been taken, the new NFT recipient will be subject to the terms. However, as previously discussed, a subsequent purchaser may not automatically be bound by the terms, including the limited license to the digital asset associated with the NFT.

One company’s licensing approach is to include the following provision in the first paragraph of its NFT terms: “The recipient of [Company’s] NFT, whether through an initial transfer from [Company] or a subsequent transfer or purchase, agrees to the [Company’s] NFT terms which can be found here: [LINK TO TOS].” This is intended to ensure that the company’s terms are properly conveyed to subsequent purchasers. Nevertheless, if the buyer does not have notice of these terms, the license may not be legally binding. Therefore, to further clarify the license and its restrictions on the purchaser, we recommend having separate license terms, requiring notice to any purchaser and embedding the license in the metadata of the NFT. Some form of affirmative acceptance also helps. This can help assure content owners that the limited license and buyer’s restrictions are included in the subsequent NFT sale to continuously and seamlessly effect the transfer of rights in the manner intended by the content owner

IP owners using a marketplace to create and list their content should ensure that they can apply their own licenses with certain restrictions in the event that the marketplace’s standard license does not sufficiently protect the content of copyright owners. Content owners may either choose to follow the alternative model mentioned above and attach separate terms to the NFT listing on the marketplace and/or embed the license terms in the metadata of the NFT.

Sample License Terms

In the discussion that follows, we will discuss key terms to consider including in the limited license, depending on the scope and extent of rights a content owner wants to grant to a buyer.

Scope of the NFT License

Given the potential for confusion in drawing a distinction between ownership of the NFT and a license to the content in the NFT, the marketplace terms and any content license should make this clear. Content owners have the ability to grant broad or limited rights and impose specific restrictions based on their individual needs and business model. There is no one right licensing model. However, all content owners should make clear in the license what a user can or cannot do, which is applicable to all the provisions discussed below. The following are some of the rights content owners may want to consider addressing in their licenses to protect their IP.

1. Display Right

It is important for content owners to specify what purchasers can do with the NFT. Users can generally display one instance of the NFT, but not for commercial purposes. On proprietary marketplaces, typically the user can only display the NFT on those platforms. Top Shot grants purchasers a limited license to display its NFTs on third-party marketplaces or websites only if the third party cryptographically verifies that it is the actual purchaser who has the necessary rights to display the NFT.

On SuperRare and Foundation, the creator grants the purchaser a limited license to display the underlying work; such right includes promoting or sharing the buyer’s purchase, ownership, or interest in the work (i.e., on social media platforms), discussing, sharing, or commenting on the work, displaying the work on third-party marketplaces, exchanges, platforms, or applications to sell or trade the NFT associated with work, and displaying the work within decentralized virtual environments.

2. Right to Copy

Some licenses permit the user to copy the NFT in a way that does not involve selling or using it for commercial gain. Some licenses do not grant the right to create merchandise from the digital asset, to issue / sell copies of the original digital asset, or to modify the digital asset underlying the NFT in any way. Some licenses may permit users to print a copy of their NFT’s art on a t-shirt or hat that the users intend to wear themselves or give to a small group of friends, to commission someone to paint a picture of their NFT art if the users put the painting on a wall in their home, or to make a video using the NFT art, but only if it is shared with family or a few friends.

3. Right to Sell

The limited license usually grants, in addition to the display right, the right to sell, trade, or transfer the NFT, as long as the buyer is not otherwise making commercial use of the digital asset.

4. Right to Store

The limited license may allow users to store their NFTs in a digital wallet. Some marketplaces store a user’s NFT on their platforms. There are several digital wallets (such as Metamask) and NFT marketplaces (such as Nifty Gateway) that store NFTs in multiple forms.

5. Right to Use

The license typically grants the user a limited license to use the content underlying the NFT, where it can be used either in a digital wallet, within the marketplace’s platform, or sometimes through a third-party platform.

6. No Right to Commercialize

In most cases, the limited license does not grant the buyer a right to commercialize the content. Typical licenses state: “your purchase of [the NFT] does not give you the right to publicly display, perform, distribute, sell or otherwise reproduce [the NFT] for any commercial purpose.”

Top Shot, Foundation, and SuperRare have similar provisions discussing this prohibition: “The collector / buyer will not modify the work, use the work to advertise, market, or sell a third-party product or service, use the work in connection with images, videos, or other forms of media that depict hatred, intolerance, violence or cruelty or infringes upon the rights of others, incorporate the work in a form of media for commercial purpose, sell merchandise that contains the work, or attempt to acquire intellectual property rights in the work.”

KnownOrigin’s terms state: “You (buyer) do not acquire any intellectual property rights in the Content, but instead you receive ownership (or title) of the Token. You have the right to display the Token and resell it to another person if you wish; the original artist of the Content does not give up any copyright in the Content, meaning that you cannot prevent the original artist from using the Content for further commercial work; and you have no right to use the content for commercial purposes.”

The terms for Vee Friends contain the following statement: “You further agree that you are not receiving any copyright interest in the VFNFT or its content, and indeed, you agree that Company may sell, license, modify, display, broadcast and create derivative works based upon your VFNFT or its content.” Vee Friends ensures its terms state that it will retain the right to create derivative works because Gary Vaynerchuk plans to utilize the NFTs in other markets.

One company’s NFTs include the Term: “Although the NFT itself is owned by the recipient of the NFT, the Artwork and Brand associated with the NFT is licensed and not transferred or sold to such recipient…license to access, perform and/or display the Artwork and Brand using the NFT, solely for your personal, non-commercial purposes… [Company] and its affiliates retain all right, title, and interest in and to the Artwork and Brand.”

This company’s license also states: “You may not use the Brand in connection with any product or service that is not [Company’s] product or service, or in any manner that is objectionable, likely to cause confusion or dilute, blur, or tarnish the Brand. All use of the Brand, including any goodwill generated by such use, shall inure to the benefit of [Company].”

As more famous brands enter the NFT space, it is likely that similar terms will be used in their NFT agreements.

Alternative License Provisions

Notwithstanding the above, there are situations in which the copyright owner elects to grant broader rights than those in the typical limited license terms above.

Some NFT marketplaces expressly grant the purchaser some rights to commercialize the work. One example of a platform that specifically permits commercial use is Bored Ape Yacht Club. BAYC grants the buyer of a Bored Ape an unlimited, worldwide license to use, copy, and display the purchased art for the purpose of creating derivative works based upon the art (i.e., producing and selling T-shirts displaying copies of the art).

Another license that grants broader rights is Dapper Labs’ CryptoKitties license. The purchasers of a CryptoKitty receive a license to use, copy, and display the Art for the Purchased Kitty for the purpose of commercializing their own merchandise that includes, contains, or consists of the Art for their Purchased Kitty, provided that such commercial use does not result in the purchaser earning more than $100,000 in gross revenue each year.

While there are instances of content owners granting purchasers broad use of their NFTs, the norm is restrictive. If content owners choose to permit broader use of their NFTs, they should be clear on what the uses are and what restrictions they are imposing on the buyer.

Other Rights

The owner of Vee Friends intends to utilize the content of his NFTs in other markets, like television. Some purchases of the Vee Friends NFTs include special experience opportunities, which are further described in the NFT’s “Experience terms.” This aspect of the Vee Friends NFT license deviates from other NFT agreements as it grants purchasers the right to be admitted to “VeeCon” in future years.

It is possible that as more companies begin entering the NFT space and releasing their own NFTs, such companies will also offer a physical experience (such as a ticket to an event) in addition to just the NFT. The fact that NFTs can be created to have functionalities in both the digital and physical world, as both a collectible and a certificate of some sort, is revolutionary, and we look forward to seeing how NFTs will be similarly utilized across industries in the future.

Royalty and Resale

All the curated marketplaces (including Rarible and Vee Friends) include in their terms a provision explaining fees and royalties on both primary and secondary sales. Royalties are completely automatic payments so creators (or proprietary marketplaces) can just sit back and earn royalties in perpetuity each time collectors re-sell their NFTs to another person at a higher price. Thus, the creator (or platform) is entitled to a continuing royalty even after the initial sale.

Vee Friends: The initial purchaser of a Vee Friends NFT pays all amounts due to Vee Friends, LLC. Subsequent purchasers pay all amounts due to the current holder of the NFT. Vee Friends receives 10% (royalty) of every subsequent sale of a Vee Friends NFT. When a Vee Friends NFT is sold on a third-party marketplace, the seller must include a statement in the description of the NFT that is substantially similar to: “10% Royalty Applies. See Vee Friends terms for details.”

KnownOrigin: KnownOrigin collects 15% of the total value of the initial transaction, and for all secondary sales that take place on its marketplace, a further 2.5% royalty fee for KnownOrigin and a 12.5% royalty for the artist. While most of the NFT platforms do not take a percentage of the resale cost for sales on secondary marketplaces, KnownOrigin does. For any secondary sales of such NFTs made on the OpenSea marketplace, KnownOrigin also receives a 2.5% commission of the total value of that transaction. KnownOrigin is unique in this regard.

Foundation: When NFTs are traded on Foundation in a primary sale, the creator receives 85% of the total sale price and Foundation collects the remaining 15%. For secondary sales on Foundation, the seller receives 85% of the total sale value, and out of the remaining 15%, the original creator receives 10% and Foundation collects 5%. Unlike KnownOrigin, Foundation does not collect fees, commissions, or royalties for transactions occurring outside of its marketplace. An interesting aspect of Foundation is “splitting,” which means a creator can share earnings with up to 3 other recipients. Everyone participating in a split receives funds from the primary market sale and also receives earnings for all secondary market sales in perpetuity.

Rarible: Sales on Rarible’s marketplace is subject to a 2.5% service fee payable to Rarible. With respect to secondary sales, Rarible is appealing to creators in comparison to the other marketplaces because commissions are set in the sole discretion of the creator. Artists minting on Rarible are allowed to select any royalty percentage they want to receive from lifetime re-sales, ranging from 0% all the way up to 100%. If a collector buys an NFT with a 100% commission, Rarible states in its terms that the buyer would be unable to collect any proceeds from a resale of that NFT on the Rarible Platform.

SuperRare: For primary sales on SuperRare’s platform, the artist receives 85% of the total sale price and SuperRare collects 15%. For subsequent sales in SuperRare’s secondary market, the artist receives a 10% royalty based on the total sale price which is paid by the collector who re-sells the NFT. As of July 2021, SuperRare also now has Collector Royalties. The first collector of a qualifying artwork will receive a 1% transaction royalty, paid from the SuperRare network fee, upon completion of the first secondary market transaction to which they are no longer a direct participant. This royalty will decay by 50% for each subsequent transaction until exhaustion (1% → 0.5% → 0.25% → 0.125% → 0.0625%, etc). Unlike KnownOrigin, but similar to Foundation, SuperRare does not collect fees, commissions, or royalties for off market transactions occurring outside of its marketplace. Notwithstanding the provision in SuperRare’s terms encouraging collectors to list their NFTs for sale on SuperRare’s marketplace, collectors are still permitted to sell or transfer their NFTs on third party exchanges.

Nifty Gateway: Nifty Gateway artists can set their own royalties, just like Rarible creators. For every sale of a Nifty on its platform, Nifty Gateway collects 5% plus 30 cents.

MakersPlace: MakersPlace takes a 15% commission of the total sale price from a primary sale, and the buyer pays an extra 2.9% fee if purchasing via credit card. For resales on its marketplace, MakersPlace takes 2.5% and 10% goes to the creator as a royalty.

Payment

All the marketplaces ensure that the NFT buyer agrees to pay all applicable fees associated with the transaction. Most NFT transactions are generally irreversible since they are conducted through either the Flow or Ethereum blockchain. As a result, the payments are collected automatically and no refunds on purchases are typically permitted. NFT marketplaces whose payments are conducted through a blockchain also have a Term that the buyer will need to pay a Gas Fee for each transaction that occurs on its platform.10 Transaction fees that users are responsible for can vary significantly – high gas prices can reach up to $50 per transaction.

Payments can apply to either the initial sale or the resale of the NFT. Some of the marketplaces may not address payment in their terms, which can be problematic for content owners. Content owners should consider how they will get paid for their NFTs. In many cases, there is a direct wallet to wallet transfer of the NFT from the seller’s wallet to the buyer’s wallet and cryptocurrency from buyer to seller. This method of payment is typically managed through a smart contract. Thus, the initial sale price is paid directly to the content owner (and on a secondary sale, a portion of the resale price is paid directly to the seller and the remaining royalty fee is paid directly to the content owner). For this payment method, the content owner must be willing and able to accept cryptocurrency. This requires the content owner to handle the necessary crypto accounting and accept potential fluctuations in the value of the crypto unless immediately converted to fiat currency.

Another payment model is a typical reporting structure in which the marketplace receives the currency (whether in cryptocurrency or other form of payment) from the buyer, and sends a report and payment due to the content owner. The marketplace facilitating this transaction will typically charge a service fee, which may be taken from either the seller or the buyer. One risk of relying on the marketplace for payment in this way is that the marketplace may shut down or go out of business, therefore resulting in uncertainty whether the content owner will continue to receive royalty / resale payments.

If a marketplace’s payment structure pays the content owner directly in crypto, but the content owner wishes to accept a less volatile currency such as the USD, there are alternatives. Coinbase and BitPay are companies that offer a service (for a fee) where they accept the crypto and immediately credit the seller in USD or other fiat.

In sum, content owners can choose to be paid however they want, but they need the mechanism to accept cryptocurrency if that is the selected payment method. In such an event, content owners should understand how to manage a digital wallet, be aware of the volatility of cryptocurrency and the risk of loss if the cryptocurrency goes down in value, and be mindful of the tax and accounting implications for both regular income and capital gains on the value of the cryptocurrency being held.

Conclusion

The NFT market is just getting started, as the innovation is only in its infancy. Careful consideration of potential, forthcoming legal issues will be necessary as more industries begin to utilize NFTs. As content creators get more creative, as business models change and as NFTs represent more than static digital art, the licenses will evolve. The foregoing is just a snapshot of some of the licenses and license terms that are currently used. Even with these “basic” NFT license terms, there are many legal issues that may arise. It is likely some of the current licenses will lead to litigation. Companies getting involved with NFTs should definitely think through these and other issues that will arise and work with knowledgeable counsel to get ahead of the issues to come.

Co-authored by Molly Tomer, a Summer Associate in Sheppard Mullin’s San Diego (Del Mar) office.

1 NFTs, or non-fungible tokens, are digital tokens, the ownership of which gets recorded on a blockchain.

2 Minting is the process by which artists, creators or others on their behalf tokenize their work and create NFTs. The minting process uses smart contracts to create and, in some cases, manage aspects of the resale of the NFT.

3 https://cryptoticker.io/en/opensea-billion-trading-volume-2021/

4 https://cryptopotato.com/trading-volume-on-nft-marketplace-opensea-hits-record-high-of-95m-in-48-hours/

5 Due to the structure of an auction, MakersPlace requires immediate payment if the bid is accepted. A credit card is not capable of having the verified and ready on-hand amount of funds to make an instant transfer between the buyer and seller. Because MakersPlace needs the funds already converted to Ethereum, MakersPlace only allows users to participate in auctions by linking their digital wallets on MetaMask. OpenSea similarly requires users to register for an account, but only if they are participating in an auction. Otherwise, users can just link their MetaMask to purchase, store, and engage in transactions using Ethereum cryptocurrency.

6 Once the NFT is minted on a certain blockchain, it is generally not compatible with other blockchains and typically cannot be moved to another blockchain network. However, future developments can potentially pave the way for cross-chain functionality or interoperability.

7 A third party could identify and link the public key to the individual purchasing the NFT and see what NFTs the purchaser owns.

8 This section would not apply to Top Shot, Vee Friends, and Bored Ape Yacht Club because as proprietary marketplaces offering their own NFTs, they are the sellers.

9 Whether such an argument would prevail is uncertain. The initial purchaser cannot grant to the subsequent purchaser greater rights than the initial purchaser has. Moreover, any use by the subsequent purchaser beyond the scope of the license could be a copyright infringement.

10 Gas Fees fund the network of computers that run the decentralized Flow or Ethereum blockchain network

/>i

/>i