The Securities and Exchange Commission recently adopted Rule 498A, the long-awaited variable contract summary prospectus rule. Rule 498A not only allows your company to use a new concise and brief selling document, it can begin generating very significant cost savings as soon as May 1, 2021. Importantly, though, regardless of whether your company chooses to use summary prospectuses, new prospectus disclosure requirements adopted by the SEC contemporaneously with Rule 498A will require your company to make extensive revisions to existing prospectuses by May 1, 2022.

With a coordinated project implementation plan, your company can make the requisite statutory prospectus revisions and prepare and obtain SEC approval of summary prospectuses by May 1, 2021. While this date may seem far off, your company may want to start thinking now about a project plan to implement the necessary disclosure and operational changes.

In March 2020, the Securities and Exchange Commission (the “SEC” or the “Commission”) adopted Rule 498A under the Securities Act of 1933 (the "1933 Act") — the long-awaited variable contract summary prospectus rule. The new rule (together with related rule and form amendments, collectively, the "Rule") represents the culmination of years of coordinated and hard work by the SEC staff and variable contract industry participants to provide variable contract investors with the same type of summary prospectuses that mutual fund investors have enjoyed for years. The Rule is intended to help investors make informed investment decisions regarding variable annuity and variable life insurance contracts.

The Rule does not require insurers to use summary prospectuses, but there are several compelling reasons for doing so. The Rule not only allows insurers to use a new concise and brief selling document, it can begin generating very significant cost savings as soon as May 1, 2021.

Cost savings will come from a new, more streamlined regulatory regime for variable contract disclosure documents. Insurers will no longer be required to provide investors with statutory prospectuses that may run 100 to 150 pages or more.1 Going forward, the only printed documents insurers are required to provide investors are an initial summary prospectus (for new sales) and an updating summary prospectus (for in-force blocks). Statutory contract prospectuses and Statements of Additional Information ("SAIs") may simply be posted online at the insurer's website. Additional cost savings will be realized because Rule 30e-3, recently adopted under the Investment Company Act of 1940 (the "1940 Act"), permits insurers to satisfy their obligation to provide variable contract owners with portfolio company shareholder reports by making them available online rather than mailing them.2

Importantly, though, because the amendments were also intended generally to update and enhance disclosure provided to investors, regardless of whether an insurer chooses to use summary prospectuses it will be required to significantly revise the statutory prospectuses in its variable contract registration statements to comply with new statutory prospectus disclosure requirements.

In summary, the Rule will provide significant benefits to investors and issuing insurance companies.3

-

It will modernize disclosures by using a layered disclosure approach designed to provide investors with key information relating to the contract's terms, benefits and risks in a concise and more reader-friendly presentation, with access to more detailed information available online and electronically or in paper format on request.

-

It will permit insurers and distributors to satisfy their prospectus delivery obligations under the 1933 Act for a variable annuity or variable life insurance contract by sending or giving a summary prospectus to investors (generally in paper form) and making the statutory prospectus and other disclosure documents available online.

-

It will permit insurers and distributors to satisfy their prospectus delivery obligations for underlying portfolio companies offered as investment options under a variable annuity or variable life insurance contract by posting portfolio company prospectuses online.

-

It will update and enhance the disclosure provided to investors in variable contract statutory prospectuses.

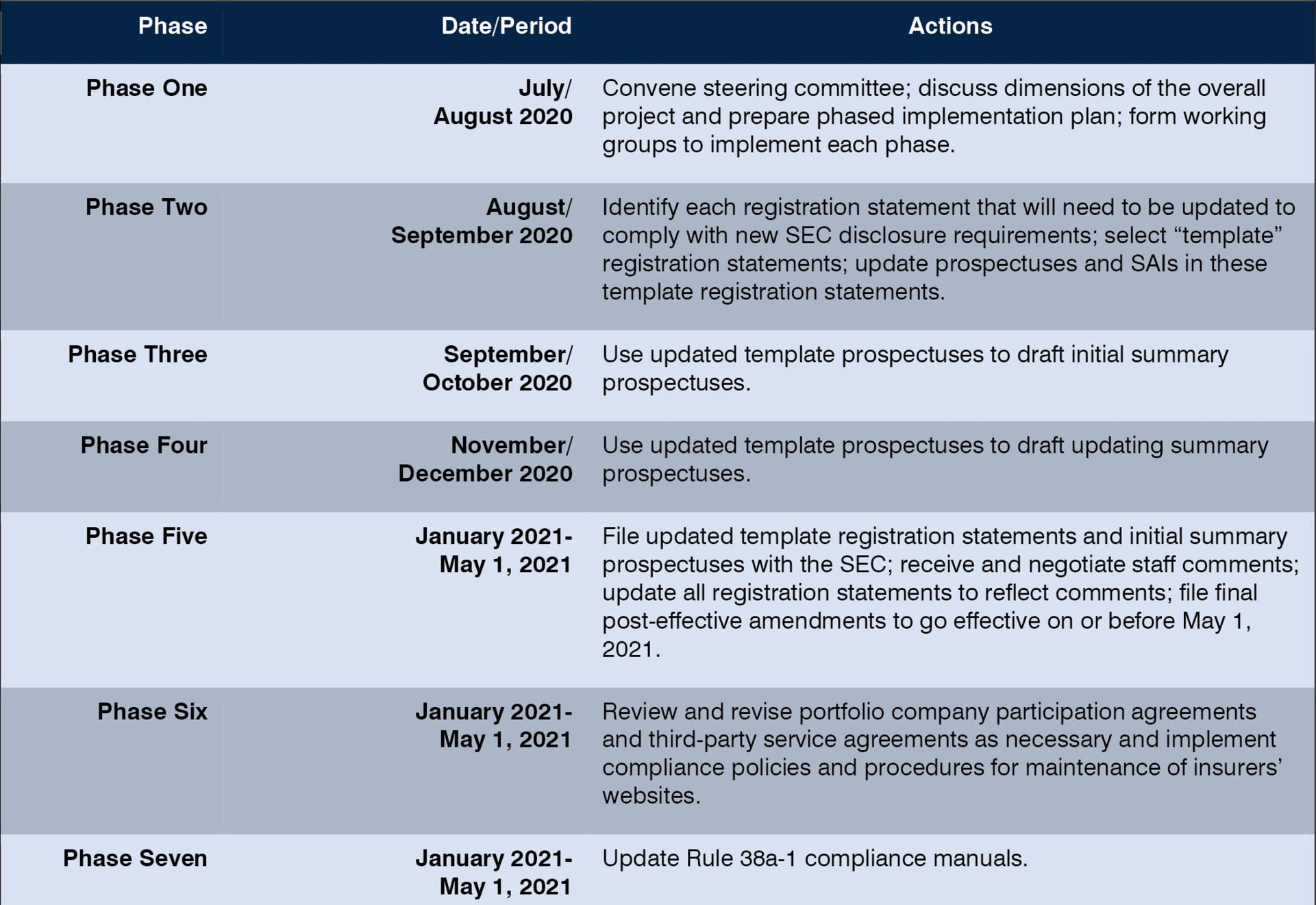

As with any significant new SEC rule, insurers will implement the Rule in varying ways. This article discusses what we believe might be a representative implementation plan for consideration by our insurance company clients and other interested parties. The implementation plan consists of seven phases:

-

Phase One – Convene steering committee; discuss dimensions of the overall project and prepare phased implementation plan; form working groups to implement each phase.

-

Phase Two – Identify each registration statement that will need to be updated to comply with new SEC disclosure requirements; select "template" registration statements (discussed below); update prospectuses and SAIs in these template registration statements.4

-

Phase Three – Use updated template prospectuses to draft initial summary prospectuses.

-

Phase Four – Use updated template prospectuses to draft updating summary prospectuses.

-

Phase Five – File updated template registration statements and initial summary prospectuses with the SEC; receive and negotiate staff comments; update all registration statements to reflect comments; file final post-effective amendments to go effective on or before May 1, 2021.

-

Phase Six – Review and revise portfolio company participation agreements and third-party service agreements as necessary and implement compliance policies and procedures for maintenance of insurers' websites.

-

Phase Seven – Amend Rule 38a-1 compliance manuals.

IMPLEMENTATION PROJECT PLAN5

Phase One – Convene steering committee; discuss dimensions of overall project and prepare phased implementation plan; form working groups to implement each phase

Insurers will be required to allocate significant resources to implement the Rule. The sheer breadth of the disclosure changes triggered by the Rule will require effective marshalling of data streams and input from various constituencies within an insurer's organization, including legal, compliance, product administration, asset management and IT, among others. Some insurers may form a steering committee to oversee the entire implementation process. The steering committee may discuss and finalize a phased implementation plan and form and task working groups with specific responsibilities for each phase of the implementation plan.

While engaging in a "10,000 foot" overview, steering committees may want to consider any administrative restrictions or limitations, whether internal or external, that might impact project implementation. For example, existing prospectus management software systems and/or established administrative processes may impact groups of contracts differently. In this regard, some insurers file post-effective amendments for actively sold contracts in a first wave and then non-selling contracts in a second wave. In addition, the steering committee may want to consider cost-benefit analyses for different groups of contracts (e.g., contracts with large blocks of contract owners versus those with relatively few contract owners).

Phase Two – Identify each registration statement that will need to be updated to comply with new SEC disclosure requirements; select "template" registration statements (discussed below); update prospectuses and SAIs in these template registration statements

To implement the new summary prospectus disclosure framework, the SEC amended the registration forms for variable contracts — Form N-4 (for variable annuity contracts) and Form N-6 (for variable life insurance policies).6 Importantly, though, the amendments were also intended generally to update and enhance disclosure provided to investors in these contracts. Accordingly, regardless of whether an insurer chooses to use summary prospectuses, it will be required to significantly revise the statutory prospectuses in its variable contract registration statements to comply with the new disclosure requirements.7

January 1, 2022 is the "compliance date" for updating registration statements. Any new registration statements filed on or after January 1, 2022 are required to comply with the new disclosure requirements, regardless of whether an insurer uses summary prospectuses. However, only post-effective amendments that are annual updates (as opposed to off-cycle post-effective amendments filed for other purposes) are required to be updated. Accordingly, insurers may wait until May 1, 2022 to incorporate the new disclosure requirements in existing registration statements. Nonetheless, transitioning to summary prospectuses will drive such significant cost savings that it is likely many insurers will want to start realizing those savings beginning May 1, 2021 rather than waiting until 2022. Accordingly, the remainder of this article focuses on insurers that want to begin using summary prospectuses beginning May 1, 2021.8

Identifying Registration Statements That Do Not Need to Be Updated

Not all registration statements will need to be updated to comply with the new SEC disclosure requirements. A significant percentage of variable contracts are no longer offered to the public and operate in a manner consistent with the "Great-West" line of SEC staff no-action letters by providing "alternative disclosures" to existing contract owners in lieu of filing post-effective amendments to update a registration statement and providing updated prospectuses to existing contract owners.9 (The SEC now refers to "Great-Wested" contracts as "Alternative Disclosure Contracts" and we will use this term as well.)

While the SEC initially contemplated withdrawing the Great-West no-action letters and requiring all registration statements that had already been Great-Wested to be updated, the SEC ultimately grandfathered existing Alternative Disclosure Contracts. More specifically, the SEC explained in the adopting release that grandfather treatment would extend to each "issuer of an existing discontinued contract that is discontinued as of July 1, 2020" that provides alternative disclosures and satisfies other stipulated requirements. Accordingly, registration statements for contracts that qualify as Alternative Disclosure Contracts will never need to be updated as long as the requirements for grandfather treatment are satisfied. All other registration statements must continue to be updated.10

Insurers may take one of two alternative approaches with respect to eligible Alternative Disclosure Contracts:

-

Conventional Alternative Disclosures. Insurers may continue to use existing procedures where certain "alternative disclosure" documents (e.g., insurer financial statements and portfolio company prospectuses) are provided to contract owners, generally in paper form.

-

Modernized Alternative Disclosures. Insurers may use a "modernized" alternative disclosure approach where a new updating "Notice Document" would be filed with the SEC and provided in paper form to contract owners. This Notice Document would contain the same type of updating information provided by the new updating summary prospectus. Additionally, insurers would be required to post to a website portfolio company summary and full prospectuses, SAIs and shareholder reports, as well as the financial statements that under existing Great-West procedures are provided to existing contract owners in paper form. These financial statements must be filed with the SEC.

Identifying Registration Statements That Do Need to Be Updated

Registration statements for contracts that are not eligible for grandfather treatment must be updated in accordance with the new disclosure requirements imposed by Form N-4 and Form N-6. This updating process will represent a significant undertaking for many insurers. We discuss below several options for easing the associated administrative burden.

Options for Easing the Administrative Burden: Template Filing and Selective Review Requests

To comply with the new disclosure requirements, insurers are required to file post-effective amendments to amend existing registration statements. As a general matter, post-effective amendments that include material changes must be filed under Rule 485(a) under the 1933 Act, but if the amendment includes only routine or non-material changes it may be filed under Rule 485(b). Filings under Rule 485(b) are generally not subject to SEC staff review and become effective automatically upon filing (or up to 30 days after filing at the discretion of the insurer). Filings under Rule 485(a), on the other hand, while also becoming effective automatically, do so only after a 60-day (or up to 80 days at the discretion of the insurer) SEC staff review and comment period. Further revisions are often necessary to respond to staff comments, which may necessitate the filing of another post-effective amendment (generally under Rule 485(b)).11

To comply with the new disclosure rules insurers will be required to make extensive revisions to the prospectuses in their existing registration statements and file those revised prospectuses in a post-effective amendment.12 Since post-effective amendments may be filed under Rule 485(b) only for routine or non-material changes, revised prospectuses will be required to be filed under Rule 485(a).13 Accordingly, post-effective amendments filed to make the required disclosure changes will have to be filed under Rule 485(a) 60 to 80 days in advance of May 1, 2021. Insurers will also need to have drafted initial summary prospectuses and file them as exhibits for the SEC staff to review.14

Insurers often maintain a number of registration statements that are not eligible for Alternative Disclosure Contract treatment. If insurers are required to update each of their registration statements by a Rule 485(a) filing with full staff review and comment, the sheer number of those filings will likely strain, if not overwhelm, both SEC staff and insurers. For this reason, commenters on the Rule as initially proposed urged the SEC to permit insurers to make "template" filings under Rule 485(b)(1)(vii) or to request "selective review."15

Although the SEC did not provide guidance in the adopting release on precisely how either of these approaches would work, it did note that nothing in its rules prohibits an insurer from seeking template relief or requesting selective review. While the SEC provided guidance on the two approaches several years ago, that guidance is not directly applicable to the situation facing insurers in complying with the new disclosure requirements of the Rule.16 The guidance, issued in December 2016, primarily concerned disclosure issues and procedural requirements arising from mutual funds offering intermediary-specific sales load variations (including waivers), and funds offering a new share class—product developments that, at the time, were intended to enable intermediaries to comply with the Department of Labor's fiduciary rule. Nevertheless, the administrative processes described in the SEC staff's guidance may be instructive.

Specifically, to expedite the review process for mutual funds offering intermediary-specific sales load variations and/or new share classes, the guidance encouraged registrants to request selective review of a filing that contains disclosure that is not substantially different from disclosure contained in one or more prior filings by the fund or other funds in the same fund complex. The guidance stated that a request for selective review may be appropriate for a Rule 485(a) filing by a fund that first incorporates sales load variations or a new share class that is expected to be implemented for additional funds in the same complex.

A request for selective review, the guidance explained, should be made in the cover letter accompanying the finding and include:

-

a statement about whether the disclosure in the filing already has been reviewed by the staff in another context,

-

a statement identifying the prior filings that the registrant considers similar to, or intends as precedent for, the current filing,

-

a statement of the material changes in the current filing from the prior filings, and

-

any specific areas in the current filing that the registrant believes warrant particular attention by the staff.

The SEC staff also advised that in circumstances in which a mutual fund complex makes "substantially identical" changes to multiple funds, it may be appropriate for the registrant to request Rule 485(b)(i)(vii) relief to avoid the need to file multiple Rule 485(a) filings. Instead, the guidance noted, the registrant could file a single Rule 485(a) filing—a “template filing”—for staff review, together with a template filing request for other funds with substantially identical disclosure.

If a registrant wishes to request template filing relief, it should do so in correspondence filed on EDGAR under the central index key ("CIK") of the template filing. The registrant's request should state: (i) the reason for making the post-effective amendment; (ii) the identity of the template filing; (iii) the identity of the registration statements that intend to rely of the relief—referred to as "replicate filings"; and make the following representations:

-

The disclosure changes in the template filing are substantially identical to disclosure changes that will be made in the replicate filings.

-

The replicate filings will incorporate changes made to the disclosure included in the template filing to resolve any staff comments.

-

The replicate filings will not include any other changes that would otherwise render them ineligible for filing under Rule 485(b).

Finally, the guidance advised that any Rule 485(b) filing relying on template filing relief should include a cover letter or an explanatory note in the filing explaining that it is relying on this relief.

Regardless of whether registrants request selective review or template filing relief, we believe the two approaches would get insurers to the same goal: substantially reducing the administrative burden of complying with the Rule across multiple registration statements. For instance, an insurer could identify groups of registration statements where the prospectuses therein contain substantially similar disclosure (or meet a similar standard). Then, rather than updating each of the registrations statements in that group and filing it under Rule 485(a), a representative prospectus would be selected, updated to comply with the Rule, and filed with the SEC in a post-effective amendment under Rule 485(a) as a template filing, along with the representations noted above. SEC staff members would review the updated disclosure in that post-effective amendment template and provide comments to the insurer. After all comments have been negotiated and cleared, the insurer would make the same changes to the substantially similar registration statements—i.e., the replicate filings.

It will be critical to know early on whether the SEC staff will entertain template filing relief or selective review requests and what the contours of that relief may be because it will have a significant impact from a timeline planning perspective. Accordingly, we expect insurers and their counsel to engage in these discussions with the SEC staff early on. We also expect that the SEC staff will be open to such a dialogue, and the implementation plan discussed herein assumes that some type of template relief will be afforded.17

In summary, the first steps in implementing Phase Two will be for insurers to reach out to the SEC staff to discuss the feasibility of filing post-effective amendments under a template approach. Assuming that template filings are viewed by the staff as feasible, insurers will then need to identify which contracts are "substantially" similar and therefore may be grouped together. One registration statement out of each group may then be selected to act as the template filing for that group.

New Disclosure Requirements

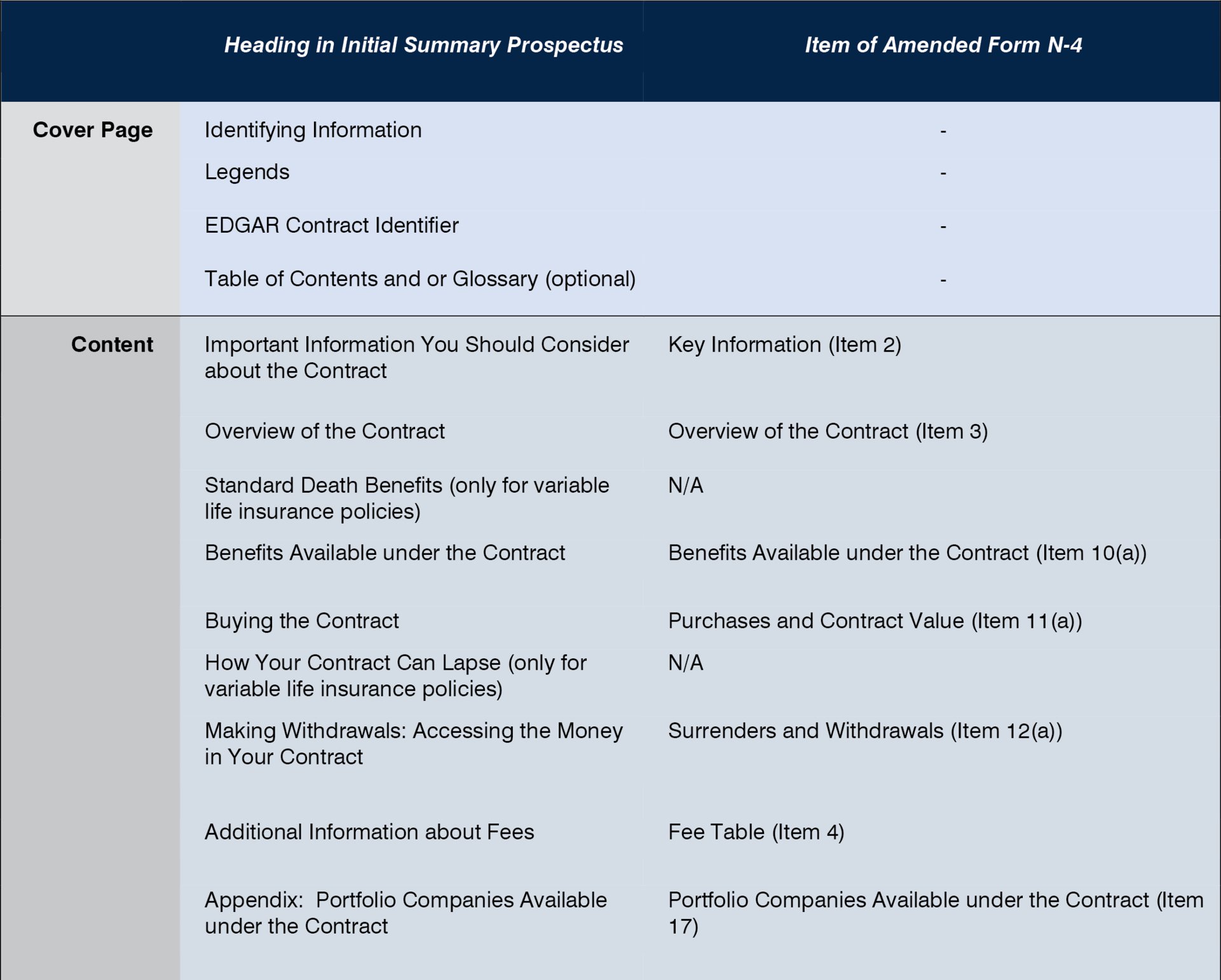

In requiring new disclosure, the SEC made widespread and impactful revisions to Forms N-4 and N-6.18 In formulating the new disclosure requirements, the SEC took the playbook from the mutual fund summary prospectus regime, requiring three key informational "Items" — Item 2 (Key Information), Item 3 (Overview of the Contract) and Item 4 (Fee Table) — to appear at the beginning of the statutory prospectus in numerical order and not be preceded by anything other than a cover page (Item 1), a glossary or a table of contents.19 The disclosure in these Items, together with the "Additional Information about Investment Options Available under the Contract" (sometimes referred to as the "Fund Appendix") required by Item 17 of Form N-4, form the "core" disclosure of both the statutory prospectus and the initial summary prospectus and, to a lesser extent, updating summary prospectuses.

The disclosure requirements of these four core Items reflect SEC staff and industry analysis of how variable contracts have evolved over the past several decades and the types of new and/or different disclosure approaches that may therefore be appropriate. Each of these four Items are discussed briefly below. (The disclosure requirements for these four Items are the same for the initial summary prospectus and Form N-4 registration statements.)

Key Information

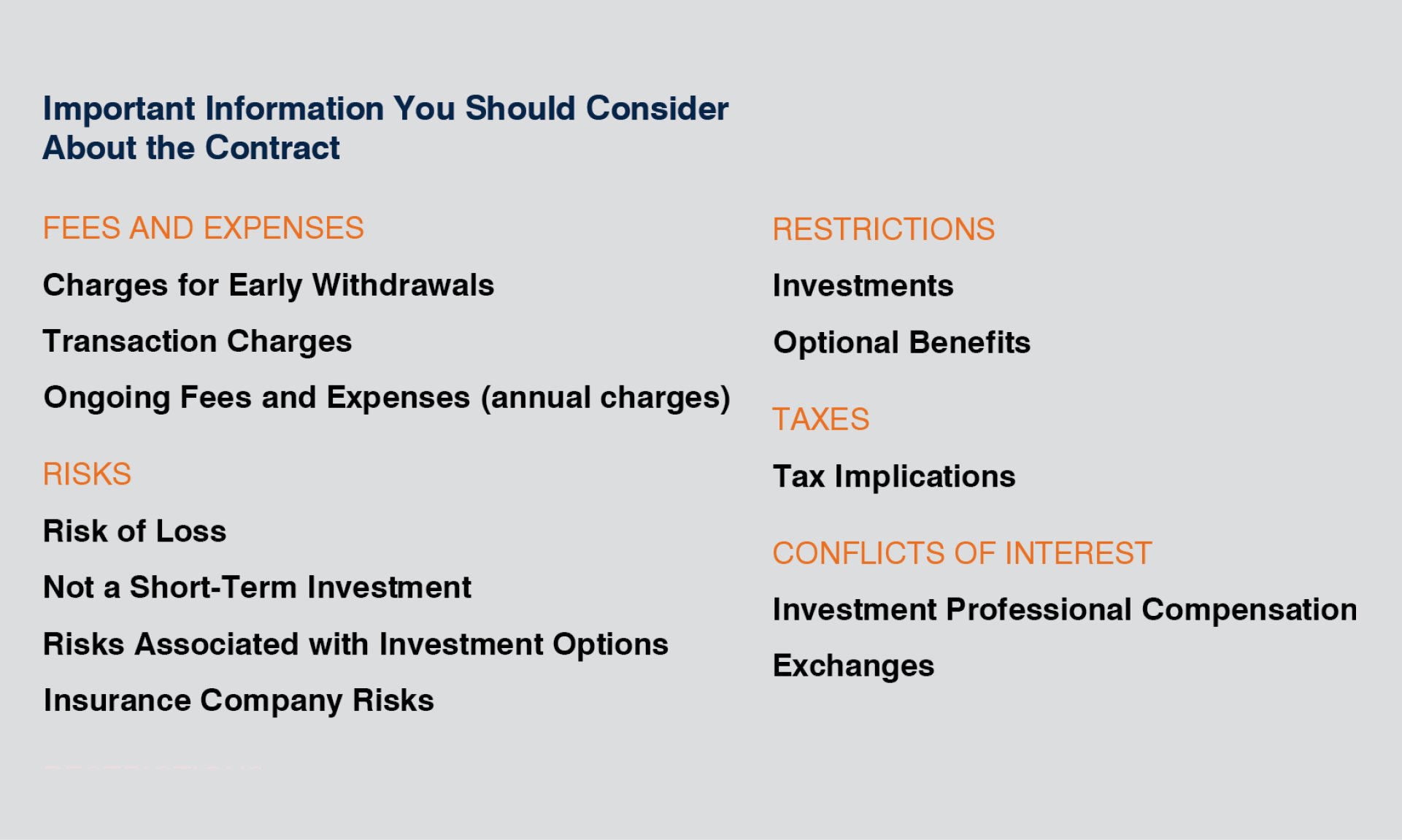

The Key Information section (referred to hereinafter as the "Key Information Table") is designed to provide investors with a brief discussion of key facts about a contract in a specific sequence and in a standardized tabular presentation of "Fees and Expenses," "Risks," "Restrictions," "Taxes" and "Conflicts of Interest." Much of the information required in the Key Information Table is new, and particular attention will need to be paid to the "Fees and Expenses" section of the Key Information Table because of the new types of information required.

The basic format of the Key Information Table is as set forth below. (Explanatory information will, of course, also be required.)

Each of the five sections of the Key Information Table is summarized below. As noted, significant new and detailed information is required. As noted above, we have prepared initial and summary prospectuses to provide a pictorial view of the new and detailed information required.

Fees and Expenses.

The SEC designed the new "Fees and Expenses" section of the Key Information Table to provide investors with a concise discussion of how an investor's elections under a contract (e.g., as to classes, optional benefits, portfolio companies, etc.) will impact the fees and expenses they will pay under their contract.20 At the same time, investors who wish to see more detailed information may access the full Fee Table. This framework will allow an investor to determine the level of fee information that best suits his or her informational needs.21

Risks.

The Key Information Table includes a condensed discussion of contract risks, intended to consolidate current risk disclosures in variable contract statutory prospectuses that typically span multiple pages into a more concise presentation of contract risks. Like the summary of fee and expense information currently required in the Key Information Table, these risk summaries are intended to provide a concise overview, with additional information available for an investor who desires or requires additional details.22

Restrictions.

The "Restrictions" section of the Key Information Table requires insurers to briefly disclose those features of a variable contract that commonly include restrictions or limitations, namely the investment options and optional benefits that the contract offers. For example, many variable annuity contracts have optional benefits that restrict the percentage of assets that investors may allocate to certain investment options, such as more volatile categories of equity funds, in order to facilitate the insurance company's ability to reserve for the guarantees under the benefit.23

Taxes.

The SEC explained in the adopting release its view that because variable contracts are subject to different tax rules than other investment products, with both tax advantages and potential tax impacts in certain circumstances, the Key Information Table should include tax-related disclosures. The "Tax Implications" line item of the table requires a statement that investors should consult with a tax professional to determine the tax implications of an investment in, and payments received under, the variable contract. Insurers must also state that there is no additional tax benefit to the investor if the contract is purchased through a tax-qualified plan or individual retirement account (IRA), and that withdrawals will be subject to ordinary income tax and may be subject to tax penalties. These types of disclosures have been standard in many variable contract prospectuses for years.

Conflicts of Interest.

The "Conflicts of Interest" section of the Key Information Table must include, if applicable, a discussion of conflicts of interest that may arise in the context of variable contracts, specifically with regard to investment professional compensation and contract exchanges. These types of conflicts are already disclosed in many variable contract prospectuses and are specifically required to be disclosed in mutual fund prospectuses.

Overview of the Contract

Item 3 of Form N-4 requires registrants to include certain basic and introductory information about the contract and its benefits. Registrants must describe the primary purposes of the contract, for whom the contract may be appropriate, the accumulation and payout phases of the contract, and a summary of the contract's features (including death benefits, withdrawal options and any available optional benefits).

Fee Table

Like the current versions of Forms N-4 and N-6, prospectuses are required to include a "Fee Table." The SEC's revisions to the Fee Table are intended to complement and build upon the high-level summary of contract fees and expenses in the Key Information Table by providing additional detail for those investors who may wish to review more comprehensive fee and expense information. Some of the new Fee Table information differs significantly from the current Form N-4 Fee Table and may require significant attention from drafters.

Portfolio Companies Available under the Contract

The SEC adopted new Item 17 to Form N-4 to implement a new and somewhat controversial requirement for registrants to disclose a variety of new information about portfolio companies. This new information must be set forth in an "appendix" to both statutory and summary prospectuses.

The appendix provides summary information in a tabular form about the portfolio companies offered under a contract. The appendix requires portfolio company expense and performance information. Based on historical challenges some insurers have experienced in obtaining necessary information from portfolio companies in a timely manner, some commenters were opposed to the proposed requirement to include performance information.

Once working groups have drafted disclosure required by Items 2, 3, 4 and 17, these Items will form the core around which revised template prospectuses can be constructed. Some insurers may use their current prospectuses, drop in Items 2, 3, 4 and 17, and revise the remaining disclosure in each prospectus to conform to the new disclosure requirements. Others may construct new prospectuses from whole cloth.

Phase Three – Use Updated Template Prospectuses to Draft Initial Summary Prospectuses

The Rule provides a new option for an insurer or a distributor to satisfy its prospectus delivery obligations for variable contracts by: (1) sending or giving to new investors24 (generally in paper form) key information contained in a variable contract statutory prospectus in the form of an "initial summary prospectus;" (2) sending or giving to existing investors each year a brief description of certain changes to the contract, and a subset of the information in the initial summary prospectus, in the form of an "updating summary prospectus;" and (3) providing the statutory prospectus and other materials online.25

The initial summary prospectus uses a layered disclosure approach that provides investors with key information relating to the contract's terms, benefits and risks in a concise and more reader-friendly presentation, with access to more detailed information available online and electronically or in paper format on request.

Insurers will be required to file their proposed initial summary prospectuses as exhibits to each post-effective amendment that will be filed to comply with the new disclosure requirements. In some cases, more than one initial summary prospectus may be required for a particular registration statement.26 Before starting the initial summary prospectus drafting process, working groups may want to identify those registration statements that will require more than one associated initial summary prospectus.

Initial summary prospectuses are required to begin with certain introductory disclosures and legends on the outside front cover page or the beginning of the initial summary prospectus. The disclosure provided under Items 2 and 3 of both Form N-4 and Form N-6 must follow immediately after the introductory disclosure. The SEC adopted this standardized presentation to require the disclosure Items that it believes are potentially the most relevant to investors (such as the Key Information Table and Overview of the Contract), to appear prominently at the beginning of the initial summary prospectus. Disclosure from several additional Items of Form N-4 and Form N-6 constitute the remainder of the initial summary prospectus, with the Fee Table placed at the end of the initial summary prospectus, followed only by the Fund Appendix.27 The required presentation is intended to facilitate comparison of different variable contracts.

Initial summary prospectus disclosure requirements are as follows:

Phase Four – Use Updated Template Prospectuses to Draft Updating Summary Prospectuses

The mutual fund summary prospectus regime was adopted in 2009. It took another two decades for the SEC and industry participants to develop a workable variable contract summary prospectus. One of the primary challenges in developing a variable contract summary prospectus was that many contract statutory prospectuses had evolved as new "generations" of optional benefits were introduced. However, older generations of optional benefits no longer offered were described in the same prospectus as currently offered benefits. In thinking about the contours of a variable contract summary prospectus, it did not make sense to include older benefits no longer offered in the initial summary prospectus, a document designed for new rather than existing investors.

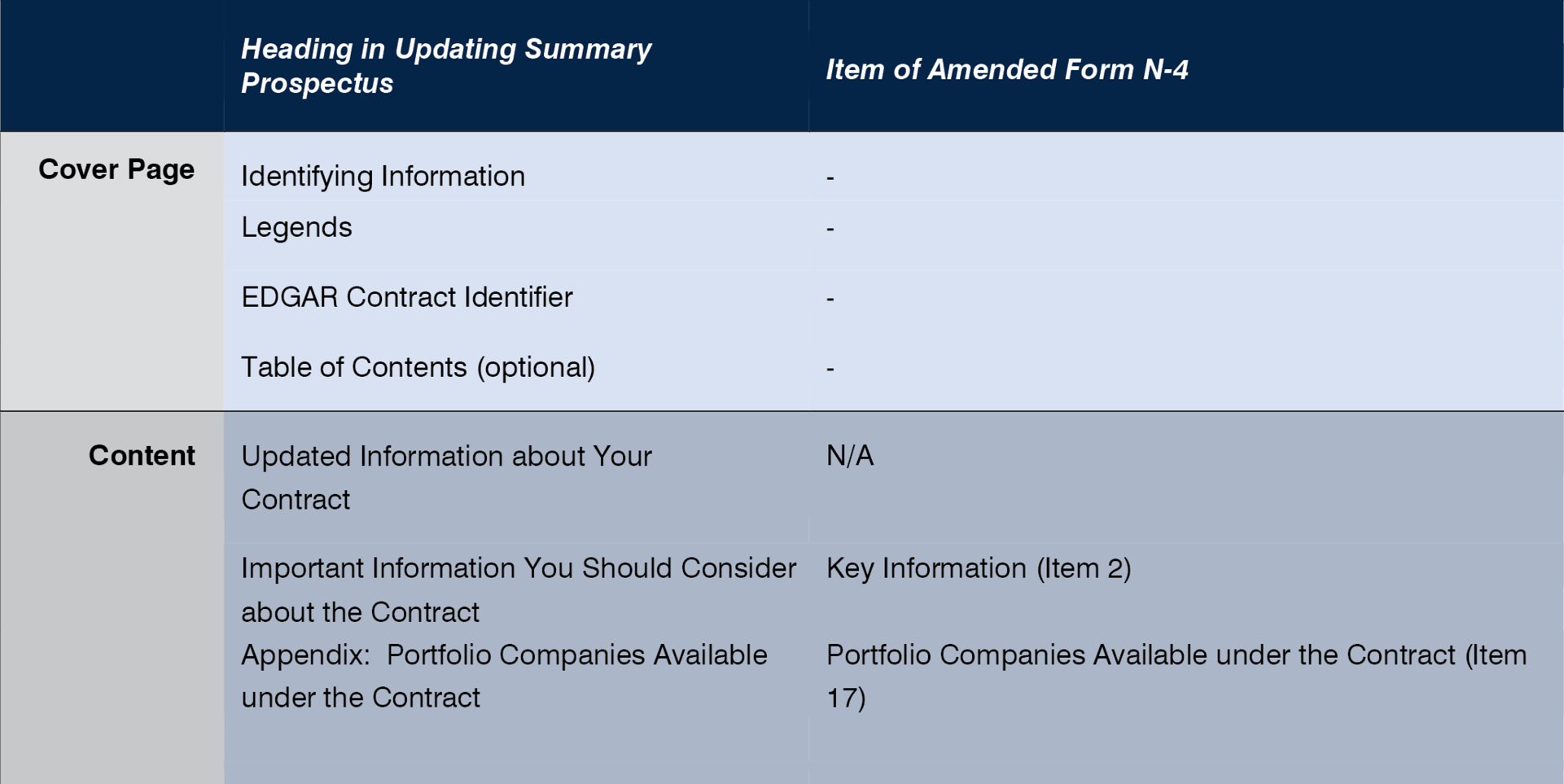

The solution was to have an initial summary prospectus describe versions of the contract currently being offered, and then, instead of sending variable contract investors an updated current contract statutory prospectus each year, a registrant (or the distributing broker-dealer, as applicable) could satisfy contract prospectus delivery obligations with respect to existing investors by sending or giving an updating summary prospectus in lieu of the statutory prospectus.28

The updating summary prospectus provides a brief description of any important contract changes that occurred within the prior year to allow investors to better focus their attention on new or updated contract information. The updating summary prospectus also includes certain of the information required in the initial summary prospectus that was considered to be most relevant to investors when considering additional investment decisions.

As working group members begin drafting updating summary prospectuses, they will need to first determine how to map each of the template registration statements to one or more updating summary prospectuses in accordance with the following requirements:

-

A registrant may only use an updating summary prospectus if it uses an initial summary prospectus for each currently offered contract described under the contract statutory prospectus to which the updating summary prospectus relates.29

-

The Rule permits an updating summary prospectus to describe one or more contracts covered in the statutory prospectus to which the updating summary prospectus relates.30 Of note, this scope is different than that of the initial summary prospectus, which may only cover a single contract that the registrant currently offers for sale. Similar to the initial summary prospectus, though, the Rule also permits an updating summary prospectus to describe more than one class of a contract.

As discussed, updating summary prospectuses are required to include a concise description of certain changes to the contract made after the date of the most recent updating summary prospectus or statutory prospectus that was sent or given to investors.31 Working group members may want to discuss and identify the changes required to be discussed in the updating summary prospectus. Importantly, the SEC views the term "contract changes" more broadly than contract changes for purposes of state insurance law. Updating summary prospectuses must include changes "with respect to" any of the disclosure Items of the initial summary prospectus. Some of these changes will be self-evident, such as changes to the portfolio companies offered under the contract and corresponding expense and performance information. Other changes may not be as evident.

After drafting the contract changes section, insurers may largely build their updating summary prospectuses by copying sections from the statutory prospectus into the updating summary prospectus.

Updating summary prospectus disclosure requirements are as follows:

Phase Five – File updated template registration statements and initial summary prospectuses with the SEC; receive and negotiate staff comments; update all registration statements to reflect staff comments; file final post-effective amendments to go effective on or before May 1, 2021

Under normal circumstances where an insurer was making substantially similar disclosure changes to a discrete set of prospectuses and wanted to have a template and qualifying "replicate" post-effective amendments become effective on May 1, 2021, the insurer would file a template post-effective amendment under Rule 485(a) 60 to 80 days prior to May 1, 2021 so that the SEC staff has an opportunity to review and comment on the template filing. After negotiating staff comments and agreeing to a specific set of disclosure changes, as long as the changes to be made to each prospectus in the specified group were substantially similar, the insurer would then make the same set of changes to the template prospectus and the remaining prospectuses (i.e., non-template). Each of the prospectuses would then be filed under Rule 485(b)(1)(vii) and become effective May 1, 2021. 32

Under current circumstances, though, due to the significant new or revised disclosure and initial summary prospectuses that will require SEC staff review, as well as the sheer volume of those changes, the SEC staff may ask for initial Rule 485(a) template filings to be made further out than 60 to 80 days before May 1, 2021.

If template filings are made before the 60 to 80 day period prior to May 1, 2021, there may be several ways to handle this from a procedural standpoint. The initial template filings could be filed "informally" with the formal initial filings to be made no later than 60 to 80 days prior to May 1, 2021. If the staff is reticent to permit informal filings, early initial filings could be made under Rule 485(a) with effectiveness delayed by one or more short-form "delaying (b)" amendments under Rule 485(b)(1)(iii).33

Whichever filing process is used, after filing initial template post-effective amendments and negotiating and clearing staff comments on the template registration statements, template post-effective amendments may be refiled and non-template post-effective amendments filed to reflect those staff comments. The staff may engage in further review of these post-effective amendments and/or conduct spot checks of non-template post-effective amendments to ensure conformity with agreed upon template filing procedures. All post-effective amendments would then become effective on or about May 1, 2021.35

Phase Six – Review and revise portfolio company participation agreements and third-party service agreements as necessary and implement compliance policies and procedures for maintenance of insurers' websites

The Rule permits insurers (and distributors) to satisfy their delivery obligations with respect to contract prospectuses by providing investors with a paper summary prospectus setting forth essential product information in a concise format, provided that initial summary prospectus, updating summary prospectus, contract statutory prospectus, and contract SAI are publicly accessible, free of charge, on a website in the manner that the Rule specifies. In addition, insurers (and distributors) may satisfy delivery obligations for portfolio company prospectuses if contract initial summary prospectuses are used for each currently offered contract described under the related registration statement, the portfolio company uses summary prospectuses, and the current portfolio company summary prospectus, statutory prospectus, SAI and the most recent annual and semi-annual shareholder reports are publicly accessible, free of charge, at the same website address as contract disclosure documents.

Phase Six working groups may want to develop policies and procedures for obtaining portfolio company documents on an ongoing basis in a timely manner as well as to amend their participation agreements with portfolio companies to require portfolio companies to adhere to such procedures. Insurers will need to reach out to portfolio companies with proposed amendments. This effort may be similar to what insurers recently went through to implement Rule 30e-3 under the 1940 Act, which permits insurers to deliver portfolio company shareholder reports by posting them on their websites and complying with other conditions. Some insurers proposed amendments to participation agreements with portfolio companies. Some portfolio companies agreed to the amendments, while other portfolio companies indicated their belief that amendments were not necessary.

In addition to any necessary amendments to portfolio company participation agreements, Phase Six working groups will also need to review third-party service provider agreements, including printer contracts, distribution agreements and administration agreements, and shareholder service agreements with portfolio companies, to reflect any new or revised services that may be required to use summary prospectuses.36

Phase Seven – Update Rule 38a-1 Compliance Manuals

Rule 38a-1 under the 1940 Act requires insurers to establish compliance policies and procedures, which are included in a compliance manual. The compliance manual will need to be updated to reflect the new or revised policies and procedures developed to support the use of summary prospectuses.

SUMMARY

We hope this implementation plan will generate thought and discussions within your company. Based on the foregoing discussions, we offer the following timeline for implementation of each phase of your company's implementation plan.

References

1 Full prospectuses are referred to hereinafter as "statutory" prospectuses.

2 Rule 30e-3 permits insurers to satisfy their obligations under Rule 30e-2 to deliver portfolio company shareholder reports to contract owners by making them available online. See Optional Internet Availability of Investment Company Shareholder Reports, Release Nos. 33-10506; 34-83380; IC-33115; File No. S7-08-15 (June 5, 2018). Rule 30e-3 has required insurers that want to use the Rule beginning January 1, 2021 to provide certain prospectus disclosures over the past two years. Judging from the number of insurers that have included this disclosure, many insurers apparently intend to transition to online delivery of shareholder reports.

3 As a technical matter, variable contracts are issued by "separate accounts" established by insurance companies to segregate assets under variable contracts from the company's general account assets. These separate accounts are investment companies that register with the SEC under the 1940 Act. For ease of reference this article may refer to "registrant" instead of "separate account" and "investor" instead of "contract owner."

4 As discussed herein, this article assumes that the SEC staff will approve some type of "template" filing approach instead of submitting all updated registration statements for a full 60 to 80-day staff review.

5 This implementation plan focuses on variable annuity contracts; certain provisions that differ for variable life insurance policies are also discussed.

6 Registration statements on Form N-3 for managed separate accounts are beyond the scope of this article.

7 SAIs will need to be updated as well; this article focuses hereinafter on requisite prospectus revisions.

8 For insurers that decide to implement summary prospectuses by May 1, 2022, the implementation calendar discussed below can be less compressed, and these insurers may nonetheless find the implementation plan phases discussed herein useful.

9 More specifically, Great-Wested contracts are variable annuity and variable life insurance contracts for which insurers no longer amend their registration statements and do not distribute updated prospectuses to contract owners in reliance on the Great-West series of no-action letters issued by the SEC's staff. See Great-West Life & Annuity Insurance Co., SEC Staff No-Action Letter (pub. avail. Oct. 23, 1990). In Great-West, the SEC staff stated it would not recommend enforcement action if post-effective amendments were not filed under the Securities Act and the 1940 Act and if updated prospectuses were not distributed to existing contract owners, subject to certain conditions. The conditions included that no new contracts would be offered to the public and the following material would be provided to all existing contract owners: (i) annual and semi-annual reports of the underlying fund portfolio companies in which the sub-accounts of the separate account invest, current prospectuses for the portfolio companies, proxy statements and voting instructions, and other shareholder materials pertaining to the portfolio companies; (ii) confirmations of policy transactions, including transfers among the investment options, withdrawals, reduction of insurance, reinstatement, loan repayments and due and unpaid loan interest added to loan principal; (iii) within 120 days after the close of the fiscal year, audited financial statements for the registrant (and the depositor for variable life insurance contracts); and (iv) at least once a year, a statement of the number of units and values in each contract owner's account.

10 In some cases, this may require registration statements that have already been Great-Wested — for example, if the registration statement has over 5,000 contracts, one of the requirements of grandfather treatment — to be updated. See ADI 2020-10 – Filing and Delivery Obligations for Certain Discontinued Variable Insurance Contracts, available at https://www.sec.gov/investment/accounting-and-disclosure-information/adi-2020-10-filing-and-delivery-obligations. In the ADI, the SEC staff stated its view that, for purposes of the first year following July 1, 2020, if an issuer of a contract that is currently being treated under Alternative Disclosure Contract procedures is not eligible after July 1, 2020 for such treatment under new Commission guidelines (e.g., there are more than 5,000 contracts under the associated registration statement), then it should meet its obligations to update the registration statement for the variable contract or deliver updated prospectuses to existing investors by May 1, 2021 (the annual update subsequent to July 1, 2020).

11 The SEC staff typically reviews and provides comments on Rule 485(a) filings prior to the effective date of the Rule 485(a) filing. Registrants receiving such comments usually respond to the SEC staff in the form of a letter that is filed as correspondence on the SEC's EDGAR database.

12 While certain changes might also need to be made to SAIs, this article focuses on prospectus revisions.

13 This requirement was specifically noted by the SEC in the adopting release for the Rule.

14 Although the SEC initially proposed to require updating summary prospectuses to be filed as well, that proposal was dropped from the final Rule.

15 Under Rule 485(b)(1)(vii), the Commission may approve the filing of a post-effective amendment to a registration statement under Rule 485(b) for a purpose other than those enumerated, including to permit template filings or to request selective review.

16 See Mutual Fund Fee Structures, IM Guidance Update No. 2016-06 (Dec. 2016).

17 We refer to template relief and selective review hereinafter collectively as "template relief."

18 Form N-4 will be used hereinafter as the chief point of reference.

19 Discrete "Items" of Forms N-4 and N-6 specify the disclosure that must be provided relating to particular subject matter. These forms are flexible with respect to the ordering of Items and will remain so in the new disclosure regime, with the exception discussed above that registration statements will be required to present the Key Information Table, Overview of the Contract and Fee Table in numerical order and may not include additional information outside of that required. These items serve as the core of an initial summary prospectus.

20 The SEC explained in the adopting release that it views variable contracts as typically having multiple layers of fees, expenses and charges that can be confusing to investors, and while the Fee Table currently required in variable contract prospectuses provides comprehensive fee and expense information, that information is frequently presented over a span of two or more pages.

21 For the "Ongoing Fees and Expenses" section of Key Information Tables for variable life insurance policies, because the costs associated with variable life insurance contracts are largely based on the personal characteristics of the insured (e.g., age, sex, health history), the SEC decided not to require specific numeric information about the fees covering the cost of insurance and optional benefits. Instead, this section of the Key Information Table is required to include: (1) a brief statement that investment in a variable life insurance contract is subject to certain ongoing fees and expenses that are set based on characteristics of the insured; and (2) the minimum and maximum annual fees for the investment options in a tabular presentation.

22 Specifically, the table will include four line items under the heading "Risks," each of which includes disclosure about a risk to which the SEC believes investors should be alerted: (1) risk of loss; (2) risks that could occur if an investor believes a variable annuity is a short-term investment; (3) risks associated with the contract's investment options; and (4) insurance company risks. Each of these line items will include succinct descriptions of the respective risk.

23 To date there has been no specific requirement in Form N-4 instructing where to disclose these restrictions, and insurers have developed different approaches. The "Investments" and "Optional Benefits" line items in the Key Information Table specifically require registrants to disclose whether there are any restrictions that may limit the investments that an investor may choose. The SEC recognizes that there may be some overlap between these two line items.

24 As is currently the case with prospectus delivery obligations, there may be questions as to whether certain persons with indirect interests in a variable contract are "new investors." These situations might include group variable universal life and group variable annuity contracts, where there are new participants added to existing participants covered under an existing contract, and where there is a spousal or non-spousal continuation of a variable annuity contract.

25 The Rule requires an insurance company (or the financial intermediary distributing the variable contract) that relies on the Rule to send the variable contract statutory prospectus and other materials to an investor in paper or electronic format upon request.

26 Some insurers describe more than one contract in a single prospectus and/or include more than one prospectus in an existing registration statement. The SEC is "grandfathering" these arrangements if they exist before January 1, 2022. However, these arrangements will impact insurers with multiple contracts currently described in one prospectus because an individual initial summary prospectus must be prepared for each contract in a prospectus covering multiple contracts. In the same vein, informal guidance provided by the SEC staff suggests that an individual initial summary prospectus might be required for each prospectus in a registration statement that includes multiple prospectuses, with the possible exception of multiple prospectuses that differ only because they describe a different "class" of a contract. "Class" is defined narrowly as “a class of a Contract that varies principally with respect to distribution-related fees and expenses.â€

27 While Form N-4 requires statutory prospectuses to present the Key Information Table, Overview of the Contract and Fee Table first in that order, the initial summary prospectus requires only the Key Information Table and the Overview of the Contract to be the first sections. The reason for this is that the SEC concluded that the Key Information Table gives enough basic fees and charges information for the purposes of a summary prospectus (as opposed to the statutory prospectus). In addition, while the initial summary prospectus may include examples and illustrations (other than those relating to how optional benefits work) similar to those permitted in sales material and statutory prospectuses and terminology that varies from the form requirements (but not certain standardized headings), it may contain only the information required by the Rule.

28 Investors generally must be provided with a prospectus when they make additional purchase payments or reallocate variable contract value. As an administrative convenience, insurers typically mail updated statutory contract prospectuses after May 1st to all contract owners, thereby avoiding the need to determine on an episodic basis whether they need to provide an updated contract prospectus when a contract owner makes additional payments or reallocates contract value.

29 However, the Rule permits insurers to use an updating summary prospectus even if the insurer did not provide an initial summary prospectus to an existing investor that previously received a full statutory prospectus. The Rule only requires an insurer to use an initial summary prospectus for each currently offered contract described in the statutory prospectus if the insurer wishes to use an updating summary prospectus.

30 While not discussed in the adopting release, this provision would appear to support describing multiple "versions" of a single contract in one updating summary prospectus.

31 For insurers drafting updating summary prospectuses that will become effective on or before May 1, 2021, the most recent statutory prospectus that was sent or given to investors will generally be the prospectus dated May 1, 2020.

32 See IM Guidance Update No. 2016-06 (Dec. 2016).

33 The SEC staff has informally taken the position in the past that a delaying amendment may only be filed once, but there are various examples of mutual funds doing so more than once.

34 As noted above, there may be administrative limitations that will dictate the order of post-effective amendment filings, such as selling products first, followed by non-selling products.

35 Under true template procedures under Rule 485(b)(1)(vii) the final post-effective amendments would be filed under Rule 485(b); under less formal template procedures amendments would be filed under Rule 485(a) and then accelerated by the SEC staff under delegated authority.

36 Among other things, Phase Six working groups may want to review the amendments that the SEC made to Regulation S-T, including a requirement that variable contracts use the Inline eXtensible Business Reporting Language (often referred to as "Inline XBRL") format for the submission of certain required disclosures in the variable contract statutory prospectus.

/>i

/>i