The entitlement to bring claims for breaches of the investment standards and protections contained in Section A of Chapter 11 of the North American Free Trade Agreement will soon end.

The entitlement to bring claims for breaches of the investment standards and protections contained in Section A of Chapter 11 of the North American Free Trade Agreement will soon end.

NAFTA countries agreed to withdraw their consent to arbitrate investment disputes arising from any “legacy investment” on the third anniversary of the termination on July 1, 2020 of NAFTA. The legal effect of that withdrawal of consent, in conjunction with NAFTA’s requirement to file a notice of intent 90 days before a claim can be initiated, means that the last day to commence NAFTA’s dispute resolution process is March 31, 2023.[1]

Background

NAFTA Chapter 11, when it entered into force in 1994, was at the forefront of the upsurge in the implementation of regional trade agreements and bilateral investment treaties that included investor-state arbitration provisions.

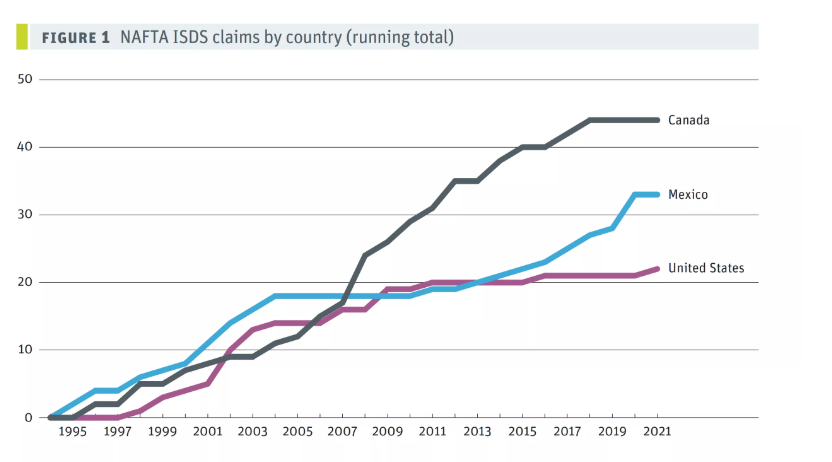

From the beginning of the 1990s to the end of that decade, the number of such treaties quadrupled. Today, there are more than 2800 investment-related treaties in force worldwide.[2] We discussed in our previous Alert statistics concerning the number of cases initiated, including on a sectorial basis, and provided our prognosis and analysis for the continuation of the upward trend. The number of claims filed under Chapter 11 of NAFTA surprised most observers. Unexpectedly, it was Canada and not Mexico that was most frequently the respondent. All the claims filed against Canada were by US investors.

Source: Canadian Centre for Policy Alternatives

Chapter 11 claims filed against Canada predominantly concerned provincial government resource management and environmental protection measures Canada prevailed in most of these arbitration claims. It was ordered to pay damages in a total of 10 arbitration proceedings out of 44, which totaled USD 263 million.

However, notwithstanding a successful track record, during USMCA negotiations, it did not take long for Canada to take up the Trump administration’s predilection against international tribunals intervening in trade and investment matters. As a result, it agreed with the US position to drop the provisions of Chapter 11 of NAFTA so that Canadian investors could no longer bring claims against the United States.

Canadian trade and investment policy continues to promote providing Canadian investors a right to challenge host countries where they make investments if the host country implements measures that cause economic harm to Canadian investors. In addition to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and potentially the EU-Canada Comprehensive Economic and Trade Agreement (CETA),[3] Canada presses on with its policy of expanding the large network of bilateral investment treaties.[4]

This is also true of the United States and Mexico as each has a large network of investment treaties in force.

We discuss below the transitional provisions of USMCA which will come to an end soon, such that NAFTA Chapter 11 will cease altogether to have any role in North American investment protection for investors of each of the three countries.

What is a “legacy investment” and how long does it remain protected under NAFTA?

The transitional provisions of USMCA restrict the application of NAFTA Chapter 11 to “legacy investments.”

The term “legacy investment” is defined under USMCA Annex 14-C (Legacy Investment Claims and Pending Claims) as an investment of an investor of a NAFTA Party made in the territory of another Party before July 1, 2020, the date on which NAFTA was terminated.

Further, USMCA establishes that a “legacy investment” remains protected under NAFTA until June 30, 2023, which is the third anniversary of the termination of NAFTA.[5]

Investors planning to bring a claim have to provide notice of their intention 90 days in advance of initiating their claim and seeking arbitration. Effectively, this means that any putative claimant under Chapter 11 of NAFTA must deliver a Notice of Intent to bring a claim by the end of March, 2023.

Are investment protection provisions available after July 1, 2023?

While both the United States and Mexico have provided in Chapter 14 of USMCA for investment claims by investors of the other country, USMCA contains limitations that did not exist under NAFTA. Specifically, USMCA curtails the procedural rights of investors, that have not entered into government contracts to invest in certain sectors: oil and gas, energy production, transportation, or ownership or management of roads, railways, bridges, or canals. For all other investors, USMCA permits claims after the exhaustion of domestic remedies for 30 months and only for direct expropriation or violations of national treatment or most-favored nation treatment protections, i.e., nationality-based discrimination.

In the case of Canadian investors in the other two USMCA countries and investors in Canada from the other two countries, there will no longer be any mechanism for seeking investor-state protection under this agreement.

However, the CPTPP, which was renegotiated after the United States withdrew from the Trans-Pacific Partnership Agreement (TPP), and now has 11 member countries, will allow claims to be filed against Mexico by Canadian investors, and vice versa. Not all investment treaties are the same and so there are some significant differences between Chapter 11 of NAFTA and Chapter 9 of the CPTPP.

North American investors able to bring “legacy claims” before termination of NAFTA should be giving serious consideration, before it is too late, whether it is to their advantage to rely on Chapter 11 NAFTA.

Summary

As we approach the last days for investors to file claims based on NAFTA Chapter 11, investors should urgently assess their legal rights.

US investors with potential claims must establish within the next month whether they still have recourse to bring legacy claims under NAFTA, or if the potentially weaker protections provided under USMCA suffice.

Canadian investors with potential claims under NAFTA must decide within the same period whether they would like to proceed under the legacy provisions of NAFTA or under the CPTPP.

As expected, we are seeing an uptick in cases being filed against Mexico before the deadline. Just within the past week, two proceedings by Canadian mining companies against Mexico have become public. We anticipate more cases to be filed in the coming weeks and urge those companies that have potential claims to carefully review their options.

FOOTNOTES

[1] Saturday, April 1, 2023 is exactly 90 days from the June 30, 2021 deadline. The prior weekday is Friday, March 31, 2023.

[2] See, https://investmentpolicy.unctad.org/international-investment-agreements.

[3] That agreement provides for investor-state dispute provisions. Ratification by certain members of the EU of the investor-state provisions is still pending although in all other respects the CETA is in force between Canada and the EU.

[4] Canadian investors have found investment treaties to be invaluable in their dealings with foreign states, and the largest users are mining companies, energy companies, engineering and infrastructure (e.g., pipelines, airports, etc.), which are the very industries where Canadian companies tend to excel on a world-wide basis.

[5] The three-year legacy period for bringing claims is much shorter than the typical “survival period” under bilateral investment treaties which tend to allow for 15 years (and in some cases longer) for bringing a claim after a unilateral repudiation of a treaty. The survival period clause ensures that the repudiation of an investment treaty does not absolve a state from its obligation to foreign investors who have made investments while the treaty was in force.

/>i

/>i