Disputes in these sectors are likely to continue to grow as the global demand for metals and minerals rises to meet the climate change targets for a cleaner and more renewable energy system.

Mexico is ranked at the very top with 10 registered disputes.

ICSID

The ICSID, established in 1966, plays a critical role in the resolution of investment disputes between international investors and sovereign states. It operates under the auspices of the World Bank Group and is headquartered in Washington, DC, United States.

ICSID membership currently consists of 154 contracting states. While there are other institutions that also facilitate dispute resolution between investors and states, ICSID plays a dominant role in this area, and it regularly publishes its caseload statistics including annual reports.

2023 Caseload Statistics

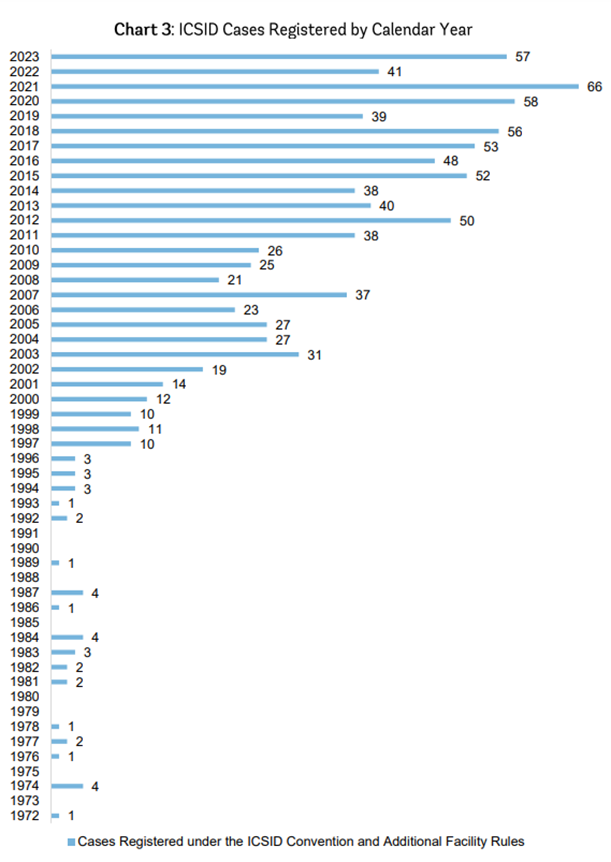

ICSID reported that 57 disputes were registered in 2023, the third highest number since its inception in 1966. This was a nearly 40% jump from 2022 and slightly lower than the record of 66 cases in 2021.

The chart below shows the steady rise of disputes registered with ICSID over the past two decades. This reflects the growing number of Bilateral Investment Treaties (BITs) in force, which currently exceed 3,000, with a large number negotiated and ratified since the mid-1990s.

Treaty-Based Disputes Continue to Dominate

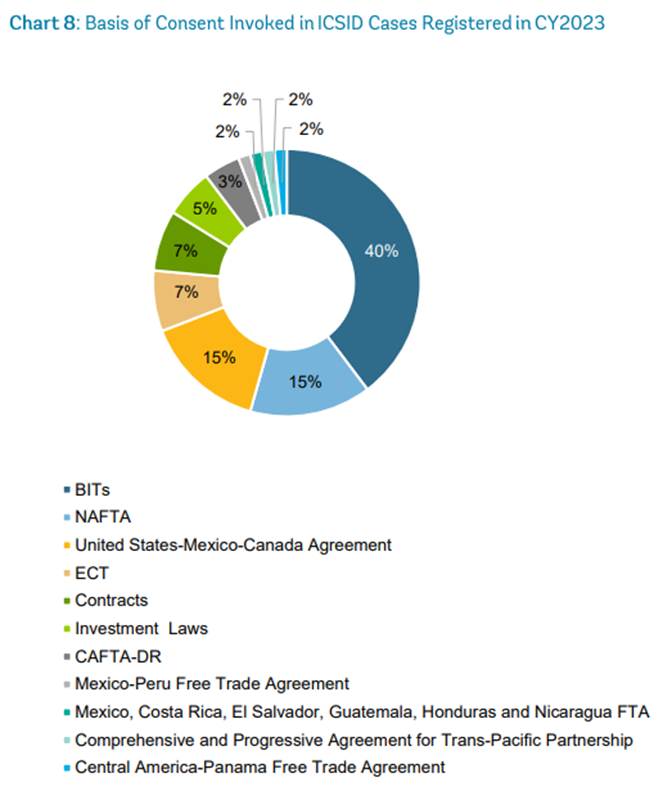

Foreign investors initiated most of the disputes registered in 2023 based on the provisions of BITs, making up 40% of the new cases. The North American Free Trade Agreement (NAFTA) and the United States-Mexico-Canada Agreement (USMCA), under its NAFTA legacy provisions, were the basis for 30% of the disputes.

Mexico was named as the Respondent in 20% of 2023 registered disputes and ranked at the top of the list of states defending foreign investor claims. According to the ICSID’s statistics, with the exception of Honduras which ranked second with nine registered disputes, Mexico far outpaced most other countries in 2023 as a respondent. The third highest number of disputes were registered against Argentina with a total of three.

Economic Sectors

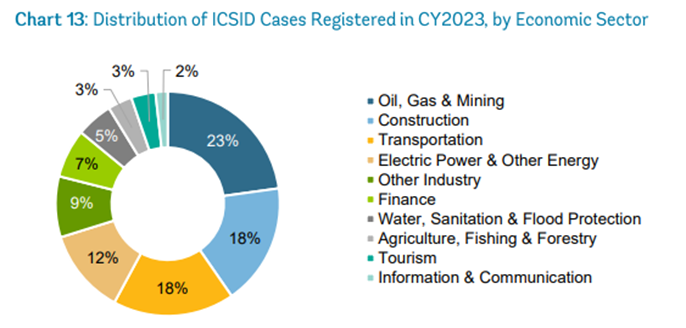

Oil, gas, electricity (and other energy), and mining disputes accounted for 35% of all newly registered disputes. Constructions and transportation disputes followed, accounting for 18% each of all newly registered disputes.

Outcomes Between States and Investors

Among the disputes concluded in 2023, 69% were subject to a decision of an arbitration tribunal, whereas 39% were settled or otherwise discontinued.

Of the disputes decided by a tribunal, 55% upheld the investor’s claims — either in part or in full, 31% rejected the investors’ claims on the merits, and 14% of the awards were based on the tribunal declining jurisdiction.

Rise in Energy and Mining Disputes

Mining, energy, and construction disputes are expected to dominate the future caseload of ICSID.

Foreign investors in Latin America have shown a willingness to resort to investor-state dispute resolution mechanisms when their investments are affected by breaches of international law. Latin American countries face 40% of the pending arbitrations, mostly in these sectors.

Mexico is the most frequent respondent, especially in mining and energy, due to its recent adoption of highly protectionist and nationalist policies.

/>i

/>i