Longtime Dodgers broadcaster Vin Scully quipped that “statistics are used much like a drunk uses a lamppost: for support, not illumination.” He was talking about how the numbers on the back of a baseball card can be twisted to fit a narrative, distorting a player’s actual impact on the game. He’s not wrong. (Full disclosure, I’m a longtime Mets fan, which basically qualifies me as an expert in statistical disappointment.) But Scully’s insight applies just as readily to commercial litigation funding, a very niche industry that is often falsely portrayed as much larger and more influential than it actually is.

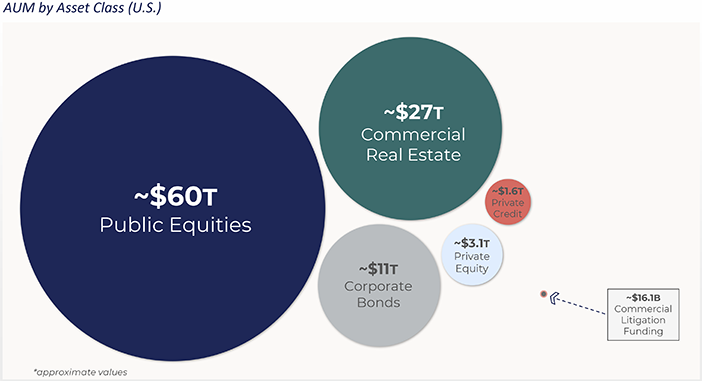

Opponents of commercial litigation funding routinely invoke the supposed “$16 billion” size of the industry as a bogeyman to justify special-purpose, punitive regulation. They rely on this cherry-picked headline assets under management (AUM) figure to dramatically overstate the industry’s footprint and portray it as a major asset class, all to prop up the false narrative that funders exert outsized, nefarious influence over the U.S. legal system. And from this flawed premise flows a cascade of wrongheaded policy proposals that would disadvantage funded litigants or kneecap the industry altogether.1

There is no codified “materiality threshold” that dictates when an industry warrants special regulation. However, by any reasonable metric, as an asset class, commercial litigation funding simply isn’t in the ballpark.

In reality, the commercial litigation funding industry is very small and very specialized. Annual investment commitments, both in terms of dollars and deal count, provide a contextualized and more accurate reflection of market size than AUM. These figures clearly illuminate the industry’s limited, highly specialized role in the broader litigation ecosystem, touching only an infinitesimal fraction of domestic cases.

But don’t just take my word for it. The numbers speak for themselves.

Empty Stats: Why AUM Is a Misleading Metric

Westfleet Advisors, a litigation funding advisory firm, publishes the most comprehensive annual analysis available for the commercial litigation funding industry. Westfleet’s latest report estimated the total AUM for U.S. commercial litigation funders at $16.1 billion in 2024.2 In isolation, this may sound like a big number, which is undoubtedly why it is so commonly thrown around by industry opponents. But as with baseball stats, context is everything.

For starters, it should be obvious that AUM is an especially poor proxy for market size or influence. Consider commercial real estate: its AUM is estimated at around ~$27 trillion, which is roughly equivalent to the entire U.S. GDP of ~$30 trillion. But no one would contend that commercial real estate is essentially the entire domestic economy, or that every dollar of asset value is reflective of actual market impact. That’s because AUM is a stock, not a flow. It’s a snapshot of capital under management at a given moment, not a measure of actual market activity or industry influence.

The same principle applies to litigation finance. Indeed, while Westfleet reports a modest uptick (~6%) in the commercial funding industry’s total AUM, the report also finds that annual funding commitments (i.e., actual market activity) are declining from year to year, and by a much steeper margin (e.g., down ~16% from 2023, and 20% from 2022).3

That said, let’s start out where the opponents want you to look, with the industry’s AUM. But this time, let’s add the context they conveniently omit. Once we do, it is abundantly clear that commercial litigation funding is a mere rounding error, if even that, compared to major asset classes:

| Asset Class | Approximate AUM

(Billions) |

|---|---|

| Public Equities | $60,000 |

| Commercial Real Estate | $27,000 |

| Corporate Bonds | $11,000 |

| Private Equity | $3,100 |

| Private Credit | $1,600 |

| Commercial Litigation Funding | $16 |

The takeaway jumps off the scorecard. Commercial litigation funding plays a vital role for those who depend on it, which are typically small and mid-sized businesses that lack the resources to pursue multimillion-dollar meritorious claims against deep-pocketed corporate defendants. But at the macro level? Commercial litigation funding is immaterial. It is 100x smaller than private credit, nearly 200x smaller than private equity, and over 1,500x smaller than commercial real estate. Indeed, the entire litigation funding industry is significantly smaller than many individual asset managers, ~130 of which in the U.S. alone each individually manage more capital than the entirety of the U.S. commercial funding market combined.4

In addition to being a qualitatively misleading measure of market size, the commercial funding AUM figure often cited by critics is ripe for misinterpretation, particularly because growth in AUM does not correspond linearly to growth in funded cases. Which is important, because opponents of litigation funding use AUM as “evidence” of the industry’s supposedly outsized, illicit influence in the legal system, with funders allegedly controlling cases and pulling the strings behind the scenes. But aggregate AUM figures do not correlate with the number of cases actually filed, funded, or otherwise impacted. Here’s why:

- Double Counting Through Fund Cycles. AUM reflects all capital that funders have raised across all active funds, the lifecycles of which overlap. For example, if a funder raises a $100 million fund (Fund 1) and deploys it into a dozen or so commercial cases, that capital remains on the books for years while those matters work their way to resolution. Meanwhile, the funder raises a second $100 million fund (Fund 2) and repeats the same deployment pattern (i.e., a dozen or so investments). The funder’s reported AUM is now $200 million (Fund 1 + Fund 2). But that 100% increase in AUM does not correlate to any growth of the market. To the contrary, the funder is deploying capital at the same cadence and into the same number of cases. Evidence of market expansion, this is not. As observed by Westfleet, annual investment volume is actually down considerably across the industry, and new commitments are declining year over year, despite a modest uptick in AUM.5

- Oversized Investments. Commercial funding investments vary widely in size, and a small number of large investments account for a disproportionate share of total capital deployed. This is especially true when the financing takes the form of operating capital, i.e., money provided to businesses for general operational purposes, not to pay legal fees. A prime example is Burford Capital’s recent $140 million investment with Sysco Corp., the world’s largest food distributor. There are a multitude of similar-sized investments that skew perceptions of market scale. These investments typically involve large, highly sophisticated corporate players (Sysco Corp., with a market cap of ~$38 billion, being a textbook case), which make use of litigation finance capital no differently than other forms of traditional corporate finance. But the size of these jumbo-sized investments overwhelms the stat sheet. They inflate perceptions of scale in the same way that a handful of monster games at the plate can skew a batter’s otherwise modest statistical performance.

- Secondary Investments. AUM also misleads because a significant portion of managed capital is tied up in secondary investments, e.g., a deal in which one funder sells a particular investment to another funder. These investments can be appealing because they allow early investors to see a return of capital and manage tenor (i.e., duration risk), while newer entrants acquire mature assets. But here is the key point: these investments do not involve funding new cases. It is simply a reshuffling of existing risk among funders. So while the dollars committed to secondary investments get lumped into the AUM statistic, they don’t impact the number of cases actually receiving funding.

- Dry Powder. AUM includes capital that has been raised but not yet deployed. A fund may tout $500 million in AUM, while only $100 million is actually at work in active matters. The full $500 million headline figure counts towards the AUM, but 80% of that capital is in reserve and may take years to deploy, if it is deployed at all. Using the full AUM as a proxy for the funding market is like pointing to a reserve player’s .300 batting average as proof of hitting prowess, without mentioning he only had limited at-bats all season. The significance of the stat is very much distorted.

- Non-U.S. Exposure. Many U.S.-based funders invest heavily in non-U.S. legal matters, such as overseas class actions, international arbitrations, patent campaigns, and more. Westfleet’s AUM figures include all capital commitments, even when the litigations themselves are foreign. But international proceedings have no relevance to U.S. regulatory policy. Their inclusion in AUM badly muddles any attempt to use this metric to assess domestic footprint.

AUM, therefore, not only lacks nuance, but it also actively misleads. Critics who lean on the commercial funding industry’s AUM either fundamentally don’t understand the business, or are reframing it to serve a policy agenda.

So how do you assess the size of the commercial litigation funding market if not by AUM? Two other statistics published by Westfleet, annual capital commitments and annual deal counts, provide much more useful data points.

Annual Capital Commitments Provide a Clearer View

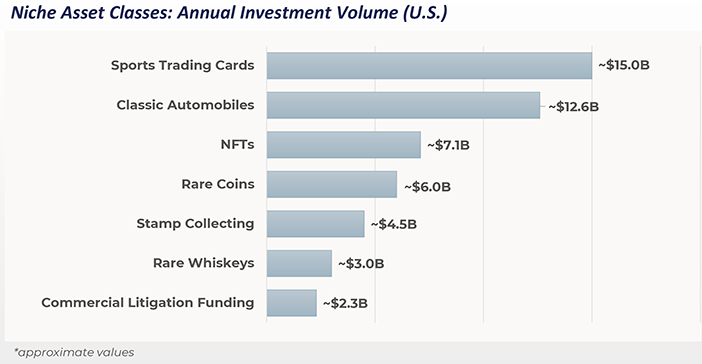

Annual capital commitments (i.e., how many dollars funders commit to investments each year) offer a more meaningful, if still imperfect, proxy for assessing market scale. And those numbers reveal a very different picture than that “$16 billion” AUM figure, which gets thrown around to mislead.

According to Westfleet, just $2.3 billion in new commitments were made across the entire U.S. commercial litigation funding market in 2024.6 To put that figure in context, the commercial funding industry is smaller, on an annual basis, than numerous indisputably niche asset classes, such as:

| Market | Approximate Annual Investment Volume

(Billions) |

|---|---|

| Sports Trading Cards | $15 |

| Classic Automobiles | $12.6 |

| NFTs | $7.1 |

| Coin Collecting | $6 |

| Stamp Collecting | $4.5 |

| Rare Whiskeys | $3 |

| Commercial Litigation Funding | $2.3 |

In other words, when it comes to the size and impact of the commercial litigation finance industry, you should really be thinking trading cards, not trading desks.7

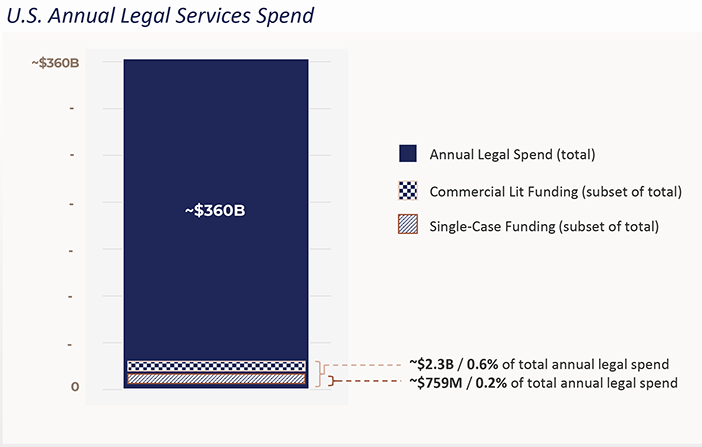

But even that $2.3 billion headline figure, which would place commercial litigation funding well behind even whiskey speculation (not exactly a blue-chip asset class), is still dramatically overstating the industry’s actual activity and influence in the litigation ecosystem. Why?

Annual commitment figures suffer from many of the same distortions as AUM. For starters, committed capital is most often deployed over multiple years, not all at once, so a significant segment of the $2.3 billion is just idling on the bench. Moreover, annual commitment figures include secondary investments, which simply recycle existing investments without funding any new litigation. Furthermore, the statistical skew is exacerbated by a handful of outsized investments. These big-ticket investments, often entered into with large corporates, boost the headline number for the year, but are not representative of wider industry adoption.

And perhaps most telling, only 1/3rd of the commercial litigation funding dollars committed in 2024 actually went to claimants to fund individual cases. According to Westfleet, single-case funding totaled just $759 million in new commitments.8 These are cases where plaintiffs are in privity with litigation funders, and are the type of structure pointed to by industry opponents to support regulation efforts. That $759 million figure is about the market value for a single top-tier MLB slugger these days. (Good work, if you can get it.) But in asset class terms, to state the obvious, it is super niche. To put that number in perspective, that level of annual market activity is dwarfed by even other ultra-niche corners of the marketplace, such as music royalty securitization (~$3.5 billion) and sneaker collecting (~$2 billion).9 Yes, flipping Jordans.

The Investment Count Numbers Reveal a Small, Specialized Market

“In G*d we trust; all others must bring data.” So said W. Edwards Deming, the economist and business consultant. Let’s take him up on that.

We’ve now gone from $16 billion to $2.3 billion to $759 million. But if the discussion has shown us anything, it’s that gross dollar figures can present a misleading sense of scale. A more accurate way to assess the footprint of the U.S. commercial litigation funding market is to examine actual deal flow. Because, to state the obvious, any serious discussion about regulating litigation funding should begin with consideration of how much (or more accurately, how little) litigation is actually funded.

Per the Westfleet report, there were just 287 new commercial litigation finance investments in 2024 (a significant drop from the 353 investments consummated in 2023).10 That’s it. In a country of 340 million people, home to roughly 33 million businesses and more than 450,000 law firms, the grand total of commercial litigation investments for all of last year didn’t even crack 300.

Now stack that up against the full litigation landscape. In 2024, the federal courts saw over 271,000 civil filings. State courts? More than 13 million. Meanwhile, the American Arbitration Association and JAMS administered hundreds of thousands of additional disputes.11

By now, you are probably in on the joke. Noise from the cheap seats aside, commercial litigation finance isn’t some dominant force altering the legal system. It’s one highly specialized strategy operating at the outer edges of a vast, multi-faceted litigation ecosystem. A valuable role player? Sure. An all-star power hitter? Not even close.

Let There Be Light

So this brings me back to where I began, with Vin Scully. The numbers, in isolation, often mislead. That’s true in baseball, and it’s true in commercial litigation funding.

Yankees catcher Yogi Berra once said, “You can observe a lot by just watching.” Hard to argue with that. Yet those opposed to commercial litigation funding for ulterior reasons would much prefer that you didn’t look too closely.

Properly contextualized, the industry is small, specialized, and peripheral to the U.S. legal system. Yet opponents use selectively framed statistics to justify sweeping, punitive regulation. That isn’t analytics, it’s an agenda.

The supposed “$16 billion” size of the industry is a complete misnomer, which is intended to mislead. The figures that, though still overstated, at least come closer to reflecting its limited scale and highly specialized function are these: just $2.3 billion in annual commitments, only $759 million for single-case funding, and a mere 287 investments in total. Which raises the obvious question: what, exactly, are opponents seeking to regulate here, and moreover, why?

Policymaking rooted in distortions is bad ball. Sound policy starts with relevant facts, presented in context. That’s where the focus belongs.

1 A particularly brazen example of this agenda-driven regulatory approach was the failed attempt to exploit the Congressional reconciliation process by inserting into the Big Beautiful Bill Act an unprecedented, highly punitive tax microtargeting the litigation funding industry. See Punitive, Unprecedented Taxation, International Legal Finance Association (ILFA), https://www.ilfa.com/punitive-unprecedented-taxation.

2 Westfleet Advisors, The Westfleet Insider: 2024 Litigation Finance Market Report 3 (2024).

3 See Emily R. Siegel, Litigation Finance’s New Money Fades in ‘Tight’ Capital Market, Bloomberg Law (Mar. 26, 2025); Westfleet Advisors, The Westfleet Insider: 2024 Litigation Finance Market Report 3 (2024).

4 See Thinking Ahead Inst., The World’s Largest 500 Asset Managers (Pensions & Invs. & Thinking Ahead Inst. eds., Oct. 2024).

5 Westfleet Advisors, The Westfleet Insider: 2024 Litigation Finance Market Report 3 (2024).

6 Westfleet Advisors, The Westfleet Insider: 2024 Litigation Finance Market Report 3 (2024).

7 See Jeremy Aisenberg, The Future of Collectibles: Sports Memorabilia Market to Hit $271 Billion by 2034, Sports Illustrated (Dec. 18, 2024); Credence Research, United States Classic Cars Market Size, Share & Trends Analysis Report (2024); Grand View Research, U.S. Non‑fungible Token Market Size, Share & Trends Analysis Report By Type, By Application, By End‑Use, And Segment Forecasts, 2024 – 2030; 2024: An Extraordinary Year for U.S. Rare Coins, Blanchard & Co. (Jan. 1, 2025); Stamp Collecting Market Size, Share & Trends Analysis (2025–2033), Market Research Intellect (July 2025); Rare Whiskeyplace Market Research Report 2033, DataIntelo (2025).

8 Westfleet Advisors, The Westfleet Insider: 2024 Litigation Finance Market Report 6 (2024).

9 See Blake Bainou, David Eisman & Michelle Gasaway, The Resurgence of Music Securitization: Issuer and Investor Appeal in the Data‑Driven Era, Reuters (July 8, 2025); Jordan Cole, Future Predictions for the Sneaker Resale Market, BlockApps (Sept. 8, 2024).

10 Westfleet Advisors, The Westfleet Insider: 2024 Litigation Finance Market Report 3 (2024); Westfleet Advisors, The Westfleet Insider: 2023 Litigation Finance Market Report 3 (2023).

11 Admin. Office of the U.S. Courts, U.S. District Courts–Civil Federal Judicial Caseload Statistics (March 31, 2025); The Pew Charitable Trusts, How Many Cases—and What Kind—Do State and Local Courts Handle?; Am. Arbitration Ass’n (AAA), 2024 ADR Data by Practice Area; JAMS, JAMS Resolution Report 2024 (2024).

All of the views and opinions expressed in this article are those of the author and not necessarily those of The National Law Review.

/>i

/>i