With the rising number of filings over the past four years, historically large amounts of market capitalization losses, as measured by Disclosure Dollar Loss (DDL) and Maximum Dollar Loss (MDL), are the subject of litigation.

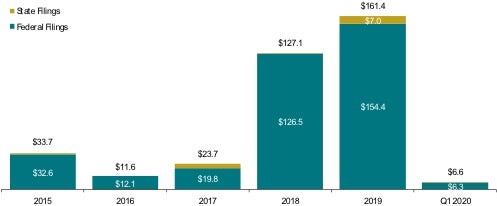

Disclosure Dollar Loss Index® (DDL Index®)[i]

DDL is the dollar value change in the defendant firm’s market capitalization between the trading day immediately preceding the end of the class period and the trading day immediately following the end of the class period.

The DDL Index of tech company filings rose to $161 billion in 2019 from $127 billion in 2018—a 27 percent increase.

The median DDL of tech company filings rose to $337 million in 2019 from $199 million in 2018—a 69 percent increase.

Tech company cases filed in state courts were generally smaller in terms of market capitalization losses. In 2019, state court cases constituted only 4 percent of the DDL Index of tech company filings, while making up 24 percent of the number of filings.

Cases filed in Q1 2020 have had relatively small market capitalization losses. The DDL Index of tech company filings was less than $7 billion.

The DDL Index of tech company filings increased significantly after 2017.

Figure 1: Disclosure Dollar Loss Index® (DDL Index®) of Tech Company Filings 2015–Q1 2020

(Dollars in billions)

Source: Bloomberg BICS Manual; Cornerstone Research and Stanford Law School Securities Class Action Clearinghouse

Note: Dataset includes state and federal core filings from 2015 through Q1 2020. Tech companies are defined as those in the Computers, Internet, Semiconductors, Software, and Telecommunications subsectors according to the Bloomberg Industry Classification Systems (BICS).

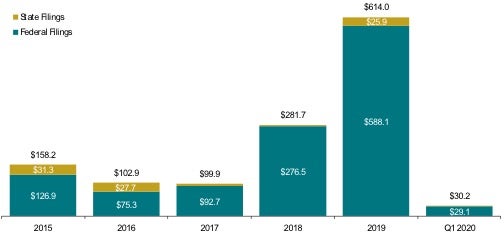

Maximum Dollar Loss Index® (MDL Index®)[ii]

MDL is the dollar value change in the defendant firm’s market capitalization from the trading day with the highest market capitalization during the class period to the trading day immediately following the end of the class period.

The MDL Index of tech company filings more than doubled in 2019 to $614 billion from $282 billion in 2018.

The median MDL of tech company filings also rose in 2019 to $1.4 billion—nearly three times the 2018 figure of $0.5 billion.

The MDL Index of tech company filings soared after 2017, more than doubling in 2018 and again in 2019.

As with DDL, state court cases involving tech companies are also generally smaller in terms of MDL. In 2019, state court cases constituted 4 percent of the MDL Index of tech company filings, while making up 24 percent of the number of filings.

In Q1 2020, the MDL Index of tech company filings was $30 billion.

More than half of the MDL Index of tech company filings in Q1 2020 stems from a single case in the Computers subsector: Electrical Workers Pension Fund, Local 103, I.B.E.W. et al. v. HP Inc. et al.

Figure 3: Maximum Dollar Loss Index® (MDL Index®) of Tech Company Filings 2015–Q1 2020

(Dollars in billions)

Source: Bloomberg BICS Manual; Cornerstone Research and Stanford Law School Securities Class Action Clearinghouse

Note: Dataset includes state and federal core filings from 2015 through Q1 2020. Tech companies are defined as those in the Computers, Internet, Semiconductors, Software, and Telecommunications subsectors according to the Bloomberg Industry Classification Systems (BICS).

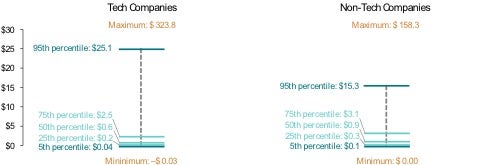

The size distributions of filings (measured by both DDL and MDL) involving tech and non-tech companies are similar, except at the upper end. While both distributions are concentrated within a similar range, tech companies have larger outliers.

Tech company filings represent a disproportionally high percentage of big-dollar cases.

The biggest filings against tech companies are much larger than the biggest filings against non-tech companies.

The largest market capitalization loss (measured by DDL) for a tech company filing is nearly three times that of the largest non-tech company filing ($74 billion vs. $27 billion).

The highest MDL is $324 billion for a tech company filing, approximately double that of the largest non-tech company filing ($158 billion).

The 95th percentile MDL for tech company filings is 64 percent higher than that of non-tech company filings.

Figure 4: Distribution of Disclosure Dollar Loss (DDL) and Maximum Dollar Loss (MDL)—Tech vs. Non-Tech Company Filings 2015–Q1 2020

(Dollars in billions)

Disclosure Dollar Loss (DDL)

Maximum Dollar Loss (MDL)

Read more about Tech Company Securities Class Action Filings and Settlements--2015-Q1 2020 Review and Analysis.

Read Tech Company Securities Class Action Filings and Settlements—2015–Q1 2020 Review and Analysis

[i] Disclosure Dollar Loss Index® (DDL Index®) measures the aggregate DDL for all federal and state filings over a period of time. DDL is the dollar value change in the defendant firm’s market capitalization between the trading day immediately preceding the end of the class period and the trading day immediately following the end of the class period. DDL should not be considered an indicator of liability or measure of potential damages. Instead, it estimates the impact of all information revealed at the end of the class period, including information unrelated to the litigation. In this report, the DDL Index of tech company filings only measures the aggregate DDL for core federal and state filings involving tech companies.

[ii] Maximum Dollar Loss Index® (MDL Index®) measures the aggregate MDL for all federal and state filings over a period of time. MDL is the dollar value change in the defendant firm’s market capitalization from the trading day with the highest market capitalization during the class period to the trading day immediately following the end of the class period. MDL should not be considered an indicator of liability or measure of potential damages. Instead, it estimates the impact of all information revealed during or at the end of the class period, including information unrelated to the litigation. In this report, the MDL Index of tech company filings only measures the aggregate MDL for core federal and state filings involving tech companies.

/>i

/>i