Securities Class Action Filings—2021 Midyear Assessment

Executive Summary

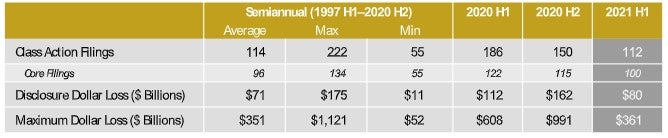

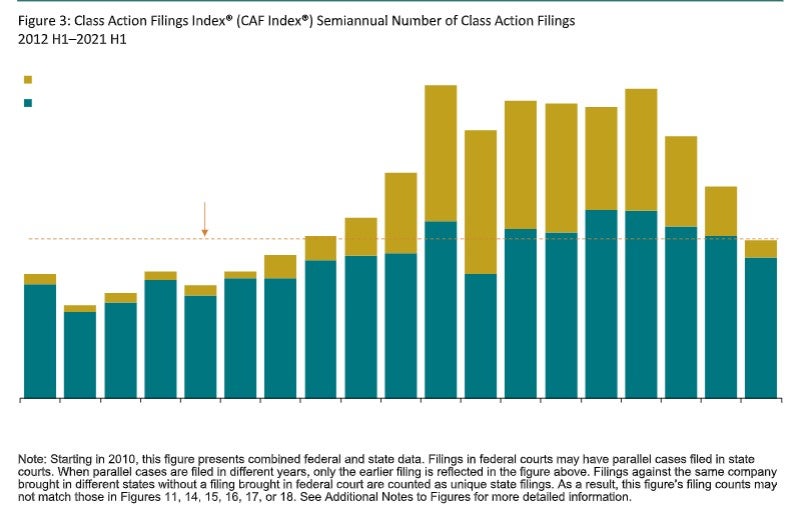

Overall filing activity dropped considerably in the first half of 2021, falling to 112 filings from 150 filings in the second half of 2020. This decline was largely driven by a substantial reduction in the number of M&A class actions and federal and state 1933 Act filings, although core filings with Section 10(b) allegations were also down modestly.

Filings in the first half of 2021 were generally smaller, resulting in lower MDL and DDL indices. DDL fell 50% from $162 billion in 2020 H2 to $80 billion in 2021 H1. Similarly, MDL fell 64% from $991 billion in 2020 H2 to $361 billion in 2021 H1.

Special purpose acquisition company (SPAC) IPOs have continued to explode. Filings against SPAC-related entities increased sharply in the first half of 2021. There were also 10 filings related to COVID-19, largely concentrated in the first four months of the year.

Number and Size of Filings

-

Plaintiffs filed 112 new class action securities cases (filings) across federal and state courts in 2021 H1, down 25% relative to 2020 H2. This decline was largely driven by a sharp drop in M&A filings. Of the 112 filings, 100 were core filings.

-

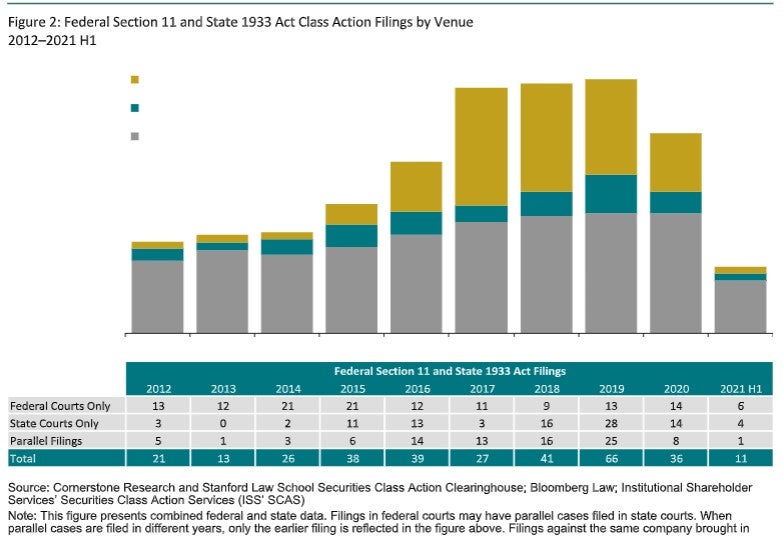

The number of state filings with causes of action under the Securities Act of 1933 (1933 Act) in 2021 H1 was dramatically lower than in 2018 H1–2020 H1, continuing the 2020 H2 trend. Federal Section 11 filings also fell sharply in 2021 H1.

-

Maximum Dollar Loss (MDL) decreased 64% to $361 billion from the near-record high of $991 billion in 2020 H2, only slightly above the 1997–2020 semiannual average of $351 billion. Three Oil and Gas filings accounted for 38% of total MDL.

-

Disclosure Dollar Loss (DDL) decreased 50% from $162 billion in the second half of 2020 to

$80 billion in the first half of 2021.

Other Measures of Filing Intensity

-

In the first half of 2021, the likelihood of a filing against a U.S. exchange-listed company decreased to an annualized rate of 4.2%. This would be the lowest rate since 2014. (page 11 )

Filings fell 25% in the first half of the year, largely driven by a 66% decline in M&A filing activity relative to the second half of 2020.

Figure 1 : Federal and State Semiannual Class Action Filings Summary

Key Trends in Federal Filings

Despite the substantial decrease in federal filings overall, there were twice as many federal SPAC filings in the first half of 2021 as there were in all of 2020. COVID-19 filings were largely concentrated in the first four months of 2021 and have declined since.

Filings against non-U.S. companies fell dramatically from the record high in 2020. Only 16% of core federal filings were against non-U.S. issuers.

M&A Filings

-

There were 12 federal M&A filings in the first half of 2021, the fewest in the federal courts since the second half of 2014. M&A filings declined 66% relative to the second half of 2020 and declined 83% relative to the semiannual average over the past five years.

(pages –4) -

Filings in the Ninth Circuit accounted for 58% of all M&A filings in the first half of 2021.

SPAC Filings

-

There were 14 federal SPAC filings in the first half of 2021, twice the number of such filings in all of 2020. All 14 filings included Section 10(b) claims. (page 8)

-

The median filing lag for core federal SPAC filings over the last three years was roughly four and a half months. (page 7)

-

Consumer Cyclical core federal SPAC filings made up half of all core federal SPAC filings in 2021 H1 (seven filings). Six of these were against companies in the automotive industry. (page 6)

Trend Cases

-

COVID-19-related filings were largely concentrated in the first four months of 2021. Allegations included misrepresentations about COVID-19 treatments or vaccines that failed to make it to market as well as the effects of COVID-19 on business operations.

-

Other trend-related filings (e.g., those involving cannabis companies or stemming from the opioid epidemic) continued to decline. (page )

Non-U.S. Issuers

-

Only 16% (15 of 96) of core federal filings were against non-U.S. issuers in 2021 H1, the lowest rate observed since 2009.

-

The number of federal filings against non-U.S. issuers is on track to be only 41% of what it was in 2020, when it reached a record high of 74 filings.

-

Of core federal filings against non-U.S. issuers, 60% were against Asian firms, the largest share in any semiannual period since 2015 H1. (pages –)

U.S. Issuers

-

Core federal filings against companies listed on major U.S. exchanges in 2021 occurred at an annualized rate of 3.8%, which would be the lowest rate since 2015. (page )

By Industry

-

Financial sector filings declined in the first half of 2021 compared to the previous semiannual period, with the number of filings decreasing by 31%, and DDL decreasing by 96%.

-

The Consumer Cyclical sector (16 filings) returned to the high level of activity seen in 2020 H1 (17 filings), after decreasing in 2020 H2 to levels that were in line with the historical average. (pages , )

By Circuit

-

Ninth Circuit filings decreased 35% from 43 filings in the second half of 2020 to 28 filings in the first half

of 2021. -

There were no core filings in the Seventh, Eighth, Tenth, or D.C. Circuits. (page )

Combined Federal and State Filing Activity

-

Federal M&A filings continued to drop precipitously in 2021 H1 relative to 2020 H2 and other recent semiannual periods, a trend noted in the Securities Class Action Filings—2020 Midyear Assessment and Securities Class Action Filings—2020 Year in Review.

-

The decline in Section 11 and 1933 Act filings in the first half of 2021 relative to 2020 H2 was concentrated in federal-only and parallel filings, which dropped from a combined 11 filings in 2020 H2 to only seven filings in 2021 H1. State-only 1933 Act filings remained at the low levels observed in 2020 H2. (See Figure 13)

-

The decline in Section 11 and 1933 Act filings in 2021 is even more notable considering that Section 11 filings in 2020 had already declined 45% compared to 2019

-

Other core federal filings—those excluding Section 11 and state 1933 Act filings—are on pace to be only 11% fewer than their 2020 totals.

In 2021 H1, federal M&A filings were just 12% of their total in all of 2020 and are on pace to be at their lowest level since 2014.

Number of Federal and State Filings

-

There were 112 filings in the first half of 2021, the lowest number since 2015 H1. The primary reason for the overall reduction in filing activity in the first half of the year was the decline in M&A and federal Section 11 and state 1933 Act filings.

-

Semiannual M&A filings fell to the lowest level since 2014 H2—a 66% decrease in M&A filings from 2020 H2 to 2021 H1. This 2021 figure represents an 83% decrease from the semiannual M&A filing average over the last five years.

-

Merger deal activity, however, increased in the first half of 2021. According to FactSet MergerMetrics, the number of non-withdrawn mergers with a transaction value greater than $100 million and with a public company target traded on the NYSE or Nasdaq rose from 88 with announcement dates in 2020 H2 to 111 with announcement dates in 2021 H1.

Total filing activity dropped 25% in 2021 H1 relative to 2020 H2, and was below the 1997–2020 average.

-

As discussed in Figures 11 and 13, the overall decline in filings is also explained by a drop in federal Section 11 and state 1933 Act filing activity. From 2020 H2 to 2021 H1, the number of federal Section 11 and state 1933 Act filings dropped 27%; federal-only Section 11 filings dropped 33%. State-only 1933 Act filings remained at the low levels observed in 2020 H2.

/>i

/>i