On June 22, 2018, the IRS issued Notice 2018-59, which provides long-awaited guidance relating to the “beginning of construction” requirement for solar projects and other renewable energy projects that qualify for the 30% investment tax credit (ITC) under Section 48 of the Internal Revenue Code of 1986, as amended (the Code). In addition to solar projects, this notice applies to qualified fuel cells, qualified microturbines, combined heat and power systems (CHP), wind farms using small turbines of 100 kilowatts or less, and geothermal heat pump properties. This guidance is very similar to the beginning of construction guidance issued for wind facilities and other qualified facilities under Code Section 45.

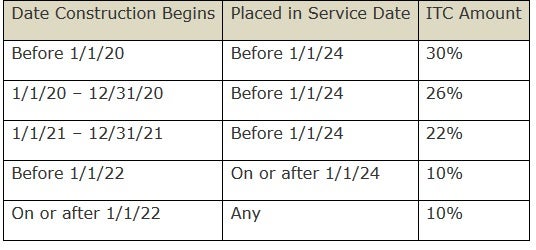

Background. Code Section 48 provides that the ITC for any taxable year is equal to the applicable energy percentage multiplied by the tax basis of the property placed in service during such taxable year. Eligibility for the ITC and the amount of the ITC are dependent upon meeting certain time deadlines for beginning construction of the energy property and placing the energy property in service. For solar projects, the ITC is as follows:

Two Methods. Notice 2018-59 provides guidance to determine when construction has begun on energy property eligible for the Code Section 48 ITC. Like the prior guidance issued for wind projects, Notice 2018-59 provides two methods for satisfying the beginning of construction requirement, as follows: (i) starting physical work of a significant nature (the “Physical Work Test”), or (ii) having paid or incurred 5% or more of the total cost of the energy property (“5% Safe Harbor”). Both methods require the taxpayer to make continuous progress towards completion once construction has begun (the “Continuity Requirement”).

Although a taxpayer may satisfy both methods for establishing the beginning of construction, construction will be deemed to have begun on the date the taxpayer first satisfies one of the two methods. For example, if a taxpayer performs physical work of significant nature on a solar project in 2018, and then pays or incurs 5% or more of the total cost of the solar project in 2019, then construction will be deemed to begin in 2018 under the Physical Work Test and not in 2019 under the 5% Safe Harbor. Thus, the Continuity Requirement will be applied beginning in 2018 and not 2019.

Physical Work Test. The Physical Work Test requires a taxpayer to begin physical work of a significant nature. This test focuses on the nature of the work performed, not the amount or the cost. Assuming that physical work performed is of a significant nature, there is no minimum amount of work or monetary or percentage threshold required to satisfy the Physical Work Test. After the taxpayer commences physical work of a significant nature, the taxpayer must the Continuity Requirement by maintaining a continuous program of construction (as described below).

Whether and when a taxpayer has begun construction based on the Physical Work Test will depend on the relevant facts and circumstances. Work performed by the taxpayer or work performed for the taxpayer by other persons under a binding written contract that is entered into prior to the manufacture, construction or production of the energy property or its components is taken into account to determine whether construction has begun.

Both off-site and on-site work may be taken into account for purposes of demonstrating that physical work of a significant nature has begun. In general, off-site physical work may include the manufacture of components, mounting equipment, support structures (such as racks and rails), inverters, transformers (used in electrical generation that step up the voltage to less than 69 kilovolts) and other power conditioning equipment. For solar projects, on-site physical work of a significant nature may include installation of racks or other structures upon which to affix the PV panels.

Importantly, and not unlike the wind guidance, Notice 2018-59 states that physical work of a significant nature does not include preliminary activities even if the cost of these preliminary activities is properly included in the depreciable basis of the energy property. Preliminary activities include planning, designing, and securing financings for the project, researching, obtaining permits and licensing, environmental and engineering studies, clearing a site, excavating to change the contour of the land (as distinguished from excavation for a foundation) and removing old energy property. Also, physical work of significant nature does not include work to produce components of energy property that are either in existing inventory or are normally held in inventory by a vendor.

5% Safe Harbor. Construction of energy property will be considered as having begun under the 5% safe harbor if: (i) the taxpayer pays or incurs 5% or more of the total cost of the energy property, and (ii) the taxpayer subsequently satisfies the Continuity Requirement described below.

All costs properly included in the depreciable basis of the energy property are taken into account to determine whether the 5% safe harbor has been satisfied (including the cost of preliminary activities that may not be included in satisfying the Physical Work Test that would otherwise be included in the depreciable basis of the energy property). Also, consistent with the guidance for wind facilities, the total cost of the energy property does not include the cost of land, fencing or any property not integral to the energy property.

Continuity Requirement. For the Physical Work Test, a taxpayer satisfies the Continuity Requirement by maintaining continuous program of construction involving physical work of significant nature as determined by the relevant facts and circumstances.

For purposes of the 5% Safe Harbor, a taxpayer must make continuous efforts to advance towards completion of the energy property to satisfy the Continuity Requirement based on the relevant facts and circumstances, which include: (i) paying or incurring additional amounts included in the total cost of the energy property, (ii) entering into binding written contracts for the manufacture, construction or production of components or for future work to construct the energy property; (iii) obtaining necessary permits, and (iv) performing physical work of a significant nature.

Certain disruptions in a taxpayer’s continuous construction (in the case of the Physical Work Test) or continuous efforts to advance towards completion of the energy property (in the case of the 5% Safe Harbor) that are beyond a taxpayer’s control, such as severe weather, natural disasters, delays in obtaining permits or licenses, and interconnection delays, will not be considered as indicating that a taxpayer has failed to satisfy the Continuity Requirement.

Continuity Safe Harbor. If a taxpayer places an energy property in service by the end of a calendar year that is no more than four calendar years after the calendar year during which construction of the energy property began (the “Continuity Safe Harbor Deadline”), the energy property will be treated as satisfying the Continuity Safe Harbor. The excusable disruption rules (as set forth above) do not apply for purposes of the Continuity Safe Harbor.

For example, if construction begins on a solar project on January 15, 2018, and the solar project is placed in service by December 31, 2022, the solar project will have satisfied the Continuity Safe Harbor. If the solar project is not placed in service by December 31, 2022, then whether a taxpayer has satisfied the Continuity Requirement will be determined by the relevant facts and circumstances.

It should be noted that the Continuity Safe Harbor applies only for determining the date when construction of a solar project begins. A project will still need to satisfy the statutory deadline for being placed in service before January 1, 2024 in order to realize the benefit of the 30%, 26% or 22% ITC, as the case may be.

Under a special disaggregation rule, multiple energy properties that are operated as a single project (and treated as a single project for determining whether construction has begun) may be disaggregated and treated as multiple separate energy properties for purposes of the Continuity Safe Harbor. Those disaggregated separate energy properties that are placed in service before the Continuity Safe Harbor Deadline will qualify for the Continuity Safe Harbor. The remaining disaggregated separate energy properties may still satisfy the Continuity Requirement under a facts and circumstances determination.

Transfer of Energy Property. A taxpayer that owns energy property on the date it is originally placed in service may elect to claim the Section 48 ITC even if the taxpayer did not own the energy property at the time construction began. Except as provided below, a fully or partially developed energy property may be transferred without losing qualification under the Physical Work Test or the 5% Safe Harbor. In the case of a transfer consisting solely of tangible personal property (including contractual rights to such property under a binding written contract) to a transferee not related to the transferor, any work performed or amounts paid or incurred by the transferor with respect to the transferred property will not be taken into account with respect to the transferee for purposes of the Physical Work Test or the 5% Safe Harbor.

A taxpayer may begin construction of an energy property with the intent to develop the energy property at a certain site, and, thereafter, transfer components of the energy property to a different site, complete its development and place it in service. The work performed or the amounts paid or incurred prior to the site transfer by such taxpayer may be taken into account for purposes of determining whether the Physical Work Test or 5% Safe Harbor has been satisfied.

/>i

/>i