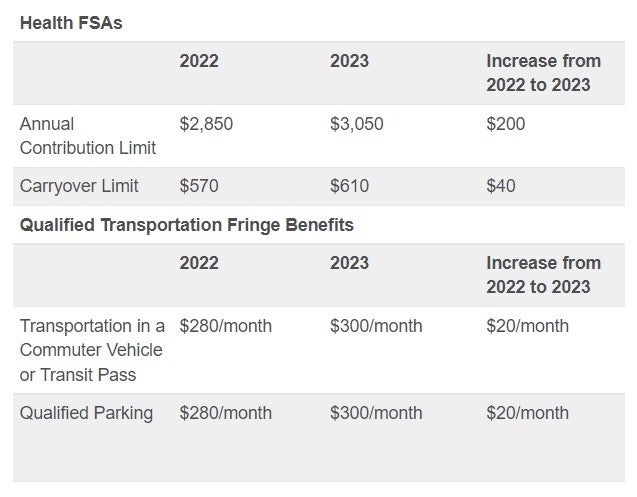

On October 18th, the IRS announced a slew of inflation adjustments for 2023, including to the annual contribution and carryover limits for healthcare flexible spending accounts and the monthly limit for qualified transportation fringe benefits. The IRS did not increase the annual contribution limit for dependent care flexible spending accounts because that limit is not indexed to inflation. The new limits are set forth below. Earlier this year, the IRS released the 2023 inflation adjustments for health savings accounts and high deductible health plans. The 2023 inflation adjustments for tax-qualified retirement plans are expected to be announced soon.

Jesse T. Foley also contributed to this article.

/>i

/>i