The tax reform legislation known as the Tax Cuts and Jobs Act1 that was passed by Congress and signed by President Trump on Dec. 22, 2017, has significantly changed how many businesses and their tax advisors approach the choice of entity decision. When deciding on how to be classified for tax purposes, most businesses are treated as either C corporations, S corporations or partnerships. Prior to tax reform, partnerships were practically considered to be the default choice of entity. However, several provisions in the new law make C corporations a much more attractive entity choice once again.

Following tax reform, the choice of entity consideration is still an individualized determination with respect to each business, and there is no single solution that is appropriate for all situations. The entity choice will continue to involve a number of considerations, such as the makeup of the investor base, capitalization structure, borrowing requirements, likelihood of distributing earnings, state tax environment, compensation and benefit considerations, participation of owners in the business, presence of foreign operations, and sale or exit strategies.

Background

C corporations are subject to double taxation, meaning that the corporation itself pays tax on its earnings and shareholders pay tax on dividends when paid by the corporation. Unlike owners of flow-through entities, C corporation shareholders are not entitled to increase their stock basis as the corporation increases its retained earnings. Under prior law, C corporations were subject to a maximum federal corporate income tax rate of 35%. When a domestic C corporation paid a dividend to its shareholders, the dividend was taxed at a maximum income tax rate of 20%, and that dividend was also subject to a 3.8% net investment income tax for many higher-income individuals and trusts. Without taking into account state income taxes, the income of a C corporation was subject to a maximum effective federal tax rate of 50.5%, assuming all net income was distributed to shareholders and the shareholders were subject to the net investment income tax.

On the other hand, S corporations and partnerships, as flow-through entities, are subject to a single layer of taxation. Rather than tax being paid at the entity level, the owners of these entities pay tax on their share of the entity’s income on the owner’s tax return, regardless of whether the entity distributes income to the owners. Flow-through entities can generally distribute earnings to owners on a tax-free basis to the extent the owner has basis in the entity. Furthermore, owners can build up their tax basis in the entity as income and gain flow through to the owner. Under prior law, the individual owners of a flow-through entity paid tax at individual income tax rates as high as 39.6%, plus the 3.8% net investment income tax for certain passive owners.

Without taking into account state income taxes, passive flow-through owners were subject to a maximum effective federal tax rate of 43.4%, regardless of whether any or all net income was distributed to owners.

Compared to the relatively high 50.5% C corporation rate, flow-through entities were often considered the preferable choice of entity for businesses distributing income, due to their significant tax rate advantage. However, major reductions to the corporate income tax rate as part of tax reform are making many reconsider this conventional wisdom.

Major changes impacting C corporations

C corporations are now subject to a flat corporate income tax rate of 21%, down from a maximum rate of 35% under prior law. The corporate alternative minimum tax has also been repealed, which simplifies tax reporting for many corporations. Although the state income tax deduction has been severely limited for individuals as discussed below, the deduction has been preserved for corporations. Dividends paid by domestic C corporations are still subject to the maximum 20% qualified dividend rate that applied under prior law.

Following tax reform, C corporations are now subject to a maximum effective federal tax rate of 39.8%, assuming that all net income is distributed to shareholders and that the 3.8% net investment income tax applies to all dividends paid.

Major changes impacting partnerships and S corporations

The highest individual income tax rate is now 37%, down from a maximum of 39.6% under prior law. The 3.8% net investment income tax applicable to passive income earned by individuals in higher tax brackets has been retained. The alternative minimum tax has also been retained for individuals but phases in at a higher level that will now be adjusted for inflation. The maximum qualified dividend income and long-term capital gain rate of 20% remains unchanged for individuals.

Significantly, individual deductions for state and local taxes are now limited to $10,000, including both income and property taxes. Individuals may still deduct their allocable share of state and local property and sales paid by a flow-through entity in which the individual owns an interest. Since many flow-through entity owners will reach the $10,000 deduction limitation from other sources such as property taxes on their home or state income taxes paid on wage and investment income, these individuals will obtain no federal income tax benefit from state income taxes paid in connection with their allocable share of income from a flow-through entity.

While the reductions in individual rates represent a small savings for flow-through entities that are owned by individuals, the tax reform legislation also creates a new deduction that some owners of flow-through entities may be able to claim in order to lower their effective tax rate. Individuals may now deduct up to 20% of net "qualified business income" earned through a flow-through entity or sole proprietorship. Individual owners of flow-through entities who are able to fully claim this deduction now have a maximum federal income tax rate of 32.6%, assuming that the owner is a passive investor subject to the 3.8% net investment income tax.

Qualified business income generally includes any income derived from a trade or business carried on within the United States. However, it generally excludes income from many service businesses, such as those in the areas of health, law, accounting, consulting, financial services, brokerage services, investment management, securities trading, or any business in which the reputation or skill of employees or owners is the principal asset. Individuals with income from all sources under a certain threshold ($157,500 for unmarried individuals or $315,000 for married individuals filing jointly) may, however, treat flow-through income from these fields as qualified business income. Wages, guaranteed payments, capital gains, dividends, and non-business interest income are all excluded from the definition of qualified business income.

For individuals with income over the $157,500/$315,000 threshold, the qualified business income deduction may be limited based on the individual’s allocable share of wages paid and assets owned by the business. This limitation is equal to the greater of (i) 50% of the individual’s allocable share of wages paid by the business or (ii) the sum of 25% of the individual’s allocable share of wages paid by the business plus 2.5% of the individual’s allocable share of unadjusted basis of depreciable property used in the business that is still being depreciated or was otherwise placed into service within the past 10 years.

Individuals are required to net the qualified business income from all flow-through businesses, so losses from one qualified business net against income from another business for purposes of calculating the deduction.

Importantly, this qualified business income deduction is scheduled to expire for tax years beginning after 2025. While this deduction could always be extended by Congress in the future, business owners and advisors should not rely on this deduction being available indefinitely.

New choice of entity considerations

Tax Rate Considerations During Operations

With the maximum corporate income tax rate now being significantly lower than the maximum individual income tax rate, the double taxation regime of C corporations is no longer the steep penalty that it once was. For a business that plans on distributing most of its earnings, C corporation rates are now comparable to flow-through entities, and even have a slight rate advantage. For startup or growth-oriented businesses that plan to retain their earnings and reinvest them in the business, C corporations now have the clear rate advantage during operations. C corporations that plan to retain their earnings now have a 21% effective federal tax rate during operations, while the owners of flow-through entities pay tax at the 40.8% rate if the business does not qualify for the qualified business income deduction or 32.6% if it does qualify, assuming that the owner is a passive investor subject to the 3.8% net investment income tax.

Although the qualified business income deduction could help make the flow-through tax rate more competitive with the reduced C corporation tax rate, its application varies from business to business and depends in part on the owner’s income level. The deduction may be completely unavailable to service-oriented businesses in which the owners are primarily above the income thresholds for claiming the deduction. On the other hand, the deduction could be fully claimed by the owners of a manufacturing business, for example, that has high levels of wages or high equipment cost.

State tax rate environment should also factor into any choice of entity consideration. Although C corporations retain the ability to deduct state taxes in full, this deduction is now severely limited for individual owners of flow-through entities. This limitation could therefore be an important factor in the choice of entity decision for an entity operating in higher-tax states.

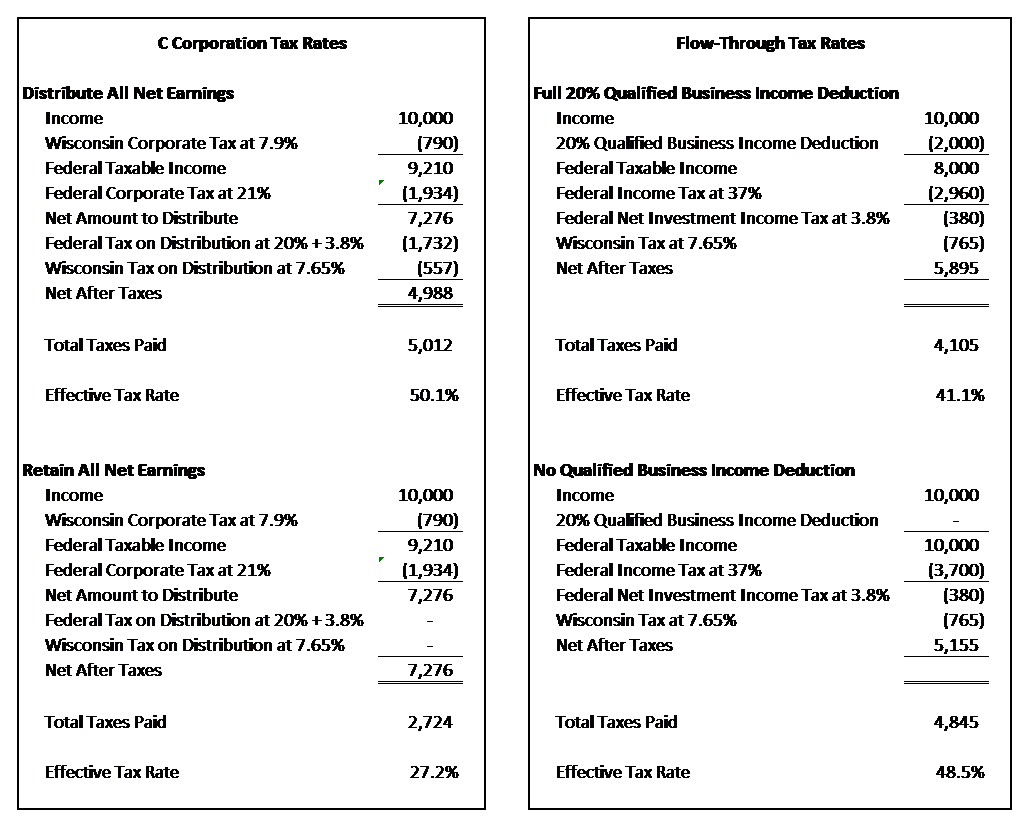

For example, a corporation subject to Wisconsin’s flat 7.9% corporate income tax that distributes all of its net earnings is now subject to an effective combined state and federal rate of 50.1%. On the other hand, a passive owner of a flow-through entity who pays taxes at Wisconsin’s maximum 7.65% individual income tax rate has an effective combined tax rate of 40.3% if the income qualifies for the 20% flow-through deduction, or 48.5% if it does not qualify for the full deduction. If the business retains its earnings (which does not affect the flow-through tax rate), the effective combined federal and Wisconsin tax rate for the C corporation drops to 27.2%, compared to 40.3% or 48.5% for the flow-through entity, depending upon whether the passive owner is able to claim the qualified business income deduction. These federal and state tax rate calculations are shown in the tables at the end of this article.

Exit Considerations

Flow-through entities have historically had a tax advantage over C corporations upon a sale of the business. For tax and successor liability reasons, the buyer of a business generally wants to purchase assets from the business rather than purchase equity from the owners, and C corporations have had the problem of double taxation when selling assets. On the other hand, an asset sale in a flow-through structure does not typically produce tax results for the seller that are significantly higher than an equity sale, depending upon the makeup of the underlying business assets. Although these fundamental principles remain unchanged under the new law, obtaining a step-up in the tax basis of the purchased assets no longer provides as large of a tax benefit to the purchaser given lower tax rates. Furthermore, selling assets out of a C corporation will no longer be as cost-prohibitive as it once was. While asset sales with C corporations were previously a non-starter in many transactions, they might now be a viable option for parties to negotiate. However, C corporation shareholders will still prefer a stock sale if feasible, since tax applies only at the shareholder level.

Significantly, the shareholders of C corporations may also avoid tax on all or a significant portion of their gain from an equity sale if the corporation meets certain "small business stock" requirements. Generally, for C corporation "qualified small business stock" acquired at original issuance after September 27, 2010, an individual may exclude 100% of gain from the sale of the stock if held for at least five years. The amount of gain that can be excluded is limited to the greater of $10,000,000 or 10 times the individual’s basis in the stock. Businesses must meet certain requirements that prohibit excess passive holdings, and most service-oriented businesses do not qualify. No similar provision applies to the sale of S corporation stock or partnership interests.

For a business that does not plan on distributing earnings to owners during operations and that has potential for its shareholders to claim the qualified small business stock exclusion, C corporations should be given serious consideration. With lowered tax rates during operations combined with the ability to avoid tax altogether on an equity sale, C corporations may now be advantageous for many newly formed startup or high-growth businesses that have the potential for an equity sale. On the other hand, C corporations may not be a viable entity choice for businesses that plan to distribute significant earnings or that have a likelihood of selling assets, such as a business division, in the future.

Converting an existing entity to a different structure

Although new businesses have the benefit of a clean slate when making the choice of entity decision, existing businesses may want to reconsider their choice of entity following tax reform. Some changes to entity choice may come with a tax cost, which should always be taken into consideration.

For the reasons described above, many S corporations or partnerships may now want to consider converting into a C corporation for tax purposes, and a conversion can generally be done without a tax cost.

For a partnership converting into a corporation, whether a C or an S corporation, the transaction will generally be treated as a tax-free contribution to a newly formed corporation. The conversion can be done at any time during the taxable year. Tax treatment and reporting of the conversion may differ slightly depending on how the conversion is effected under state law or under the check-the-box rules. However, in all cases, some tax may be triggered if the partnership has liabilities in excess of basis at the time of conversion.

An S corporation can also terminate its S corporation election and convert into a C corporation on a tax-free basis. Note that once the S corporation election is revoked, the corporation cannot re-elect S corporation status again for five years without IRS approval.

On the other hand, a C corporation-to-partnership conversion generally comes with a tax cost. The conversion is treated as a taxable liquidation of the corporation, with taxation at both the corporate and shareholder levels. When corporate tax rates were higher under prior law, the tax liability imposed on a conversion was often prohibitive. However, with reduced corporate tax rates, these conversions are now more feasible, particularly if the corporation has net operating loss carryovers that could reduce or eliminate corporate tax on the conversion.

Lastly, the conversion of a C corporation into an S corporation generally does not trigger an immediate tax liability, except with respect to inventory accounted for using the last-in-first-out (LIFO) method, but there may be some trailing tax consequences. This type of conversion must coincide with the beginning of the tax year and cannot be made effective mid-year. The corporation will also have to ensure that it is eligible to qualify as an S corporation. Among other requirements, an S corporation can only have a single class of stock, and all shareholders must generally be U.S. individuals, certain qualifying trusts, and certain tax-exempt entities, with an overall limitation on 100 shareholders.

At the time of the conversion, the corporation is required to calculate the amount of built-in gain that it has in its assets. If any of these assets are sold during the five-year period following the conversion, this built-in gain will effectively be taxed at the corporate level as if the corporation were a C corporation.

International tax considerations

The tax reform legislation introduced many significant reforms to U.S. taxation of foreign operations. For domestic businesses with foreign operations, the entity structure should also be revisited at this time with respect to foreign operations. Importantly for C corporations, there is now a 100% deduction for the foreign-source portion of dividends received from certain foreign subsidiary corporations. This deduction is not applicable to such dividends received by a domestic partnership or S corporation.

1 P.L. 115-97, An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018

/>i

/>i