Immigration and Customs Enforcement (ICE) audited the I-9 records of 2,400 employers in fiscal year 2011, double the number audited two years ago. The Wall Street Journal reported that in the past few weeks ICE has sent 500 Notices of Inspection to employers.

A recent case, US v. Alyn Industries, Inc., decided by the Department of Justice’s Executive Office for Immigration Review Office of the Chief Administrative Hearing Officer (OCAHO), provides some useful information for employers concerned about their I-9s. The timing of ICE’s activities is also worth noting.

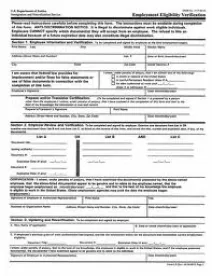

Alyn Industries received a Notice of Inspection (NOI) of its I-9s in July, and attempted to fix 1-9 problems before ICE arrived. Important note: an NOI provides the employer with 72 hours’ notice that ICE is coming to inspect its I-9s, but an employer’s I-9s should be in order before the NOI arrives. The Alyn Industries decision states that corrections after the NOI arrives, but before the actual inspection occurs, will not avoid fines. Therefore, it is advisable to schedule an internal I-9 audit annually to ensure that, in the event of an inspection, your I-9s are ready to go.

Alyn Industries was also fined for its complete failure to prepare and/or present an I-9 form for two employees. The lesson here: if an I-9 goes missing, complete a new one immediately - do not back-date.

The Company was also fined because an employee failed to complete Section 1 of the I-9. The employer is responsible for being sure the employee completes Section 1 properly. It is therefore critical to review diligently what the employee writes in Section 1 of the I-9, to point out any missing information, and request the employee to complete Section 1 fully. While this defect was deemed serious, it was not considered to be as serious as the employer’s failure to complete or sign Section 2 of the I-9.

Failure to provide sufficient information on an I-9 is known as a paperwork violation. These errors are assessed in accordance with certain statutory parameters, and range from $110 to $1,100 per violation. OCAHO considered the following factors in reviewing the $63,767 fine in this case:

- size of the employer’s business

- good faith of the employer

- seriousness of the violation(s)

- whether the employees involved were employment authorized or not

- a history of any previous violations by the employer.

To summarize: NOIs are increasing. ICE looks dimly on corrections occurring after the NOI is received by the employer but before the inspection 72 hours later, and an employer is liable for an employee’s failure to complete Section 1. The good news in this case is that the employer’s fine was reduced from $63,676 to $43,000. However, legal fees and expenses surely added considerably to that employer’s ultimate cost. Most importantly, no fine would have been assessed if the employer’s I-9s were complete and correct when the NOI was first received.

As the Alyn Industries case reminds us, prudent employers should review their I-9s at least annually.

/>i

/>i