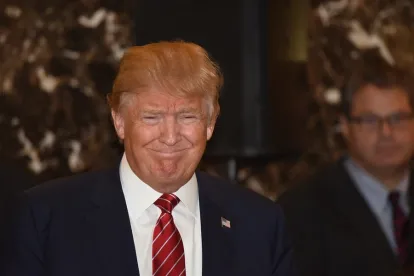

On December 14, 2016, House Freedom Caucus Chairman Mark Meadows released a special report (the “Report”) detailing over 200 rules, regulations, and executive orders the Caucus recommends that President-Elect Donald Trump should examine, revoke, or issue in his first 100 days in office.

The report targets for repeal a diverse set of regulations finalized or proposed during the Obama Administration, including several that are important to the financial services industry. These include the fiduciary rule for investment advisers, the proposed arbitration rule for consumer financial institutions, and rules setting recovery plan guidelines for OCC-regulated banks. The vast majority of the targeted regulations can be nullified by Congress pursuant to the Congressional Review Act (“CRA”), which could fuel further speculation that House Republicans may push for an omnibus resolution to nullify many regulations at once.

As our sister blog, Global Policy Watch, recently explained, the 115th Congress can, under the CRA, overturn many regulations issued in the last year of the Obama Administration. Such a resolution of disapproval would not be subject to the filibuster. There have been reports that members of Congress have not reached a consensus on whether they could repeal a large number of rules in a single bill, though the Congress Research Service has stated that it believes each such resolution would need to be voted on separately. Rep. Darrell Issa has introduced a bill, the Midnight Rules Relief Act, which has passed the House, that would explicitly allow Congress to consider a joint resolution of disapproval of multiple rules at once under the CRA.

The Report lists many significant changes to financial regulation that it hopes President Trump will support. Some of the most significant include:

-

Repeal the proposed arbitration agreement rule issued by the Consumer Financial Protection Bureau (“CFPB”). In May, the CFPB issued a proposed rule that would prohibit covered financial institutions from including in consumer contracts arbitration agreements that prevent consumers from participating in class actions, the rule has proven highly controversial. The Bureau may finalize the rule shortly before President-Elect Trump takes office, at which point the 115th Congress could seek to nullify it under the CRA.

-

Repeal the fiduciary rule issued by the Department of Labor (“DoL”). DoL issued a rule altering the definition of “fiduciary” for purposes of ERISA to include investment advisers. This rule is controversial, and is generally opposed by both industry and Republican lawmakers. Significantly, the fiduciary rule was finalized in April, meaning it should not be repealable under the CRA. Perhaps notably, the Report does not list the date the rule was finalized, but the effective date, June 7th, 2016. Under the terms of the CRA, however, it is the date the rule is submitted to Congress, which was in April, that is relevant.

-

Repeal the rule establishing standards for recovery planning for certain banks regulated by the Office of the Comptroller of the Currency (“OCC”). This rule requires OCC-regulated banks with average consolidated assets of $50 billion or greater to establish recovery plans addressing severe financial stress.

It is unlikely that President-Elect Trump and the 115th Congress will make all of the changes proposed in the Report, but the list does highlight the coming push to undo Obama Administration regulations.

The following table provides a more complete list of financial regulations listed in the Report:

/>i

/>i