Introduction

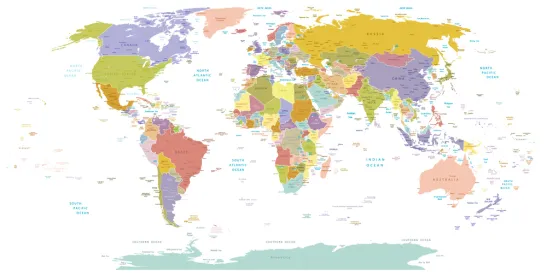

Welcome to the latest edition of the McDermott Will & Emery Global Employment Law Update. The purpose of this publication is to provide you with concise summaries of many of the laws and court decisions from 2020 that significantly affect employers and employees all over the world. No publication has ever captured all new employment law developments from every single country. However, our effort to create the most comprehensive global employment update ever assembled has resulted in updates from 53 countries.

Many of the updates presented in this publication describe changes in the law that are well known to lawyers and human resources professionals from those countries, but are lesser known in other parts of the world. Our aim is to provide you and your colleagues with a useful reference guide to significant changes in employment law all across the globe. Furthermore, we hope this guide—and other specially designed products we create for our clients—will serve as a tool to assist multi-national businesses in their ongoing struggle to maintain a consistent global corporate culture amidst an ever-changing landscape of local employment laws.

Local employment lawyers from each country, who are either McDermott lawyers or part of McDermott's Global Employment Law Network, prepared these updates. We select each law firm participating in our network based on their outstanding local reputation and, in most cases, our prior experiences in working with them. Participants in the network work closely with McDermott lawyers on client projects, article writing, seminar and webinar presentations as well as signature client events.

Mauritius

AMENDMENTS BROUGHT TO THE WORKERS’ RIGHTS ACT 2019 (WRA) AS A RESPONSE TO THE CONSEQUENCES OF THE COVID-19 PANDEMIC

From June 1, 2020, to June 30, 2021, employers who, as a result of being financially affected by COVID-19, have benefitted from or have not applied for financial assistance from a prescribed list of government agencies are prohibited from effecting retrenchments. This prohibition does not apply to employers whose applications for financial assistance have been rejected. Although it has been argued before the Redundancy Board that this prohibition on redundancy shall apply only to redundancies resulting out of COVID-19, the Redundancy Board has taken the view that this prohibition shall apply to all redundancies. Additionally, employers providing the services listed in the third schedule of the Employment Relations Act 2008 (Exempted Employers) may, subject to regulations being made to that effect, be exempted from retrenchment prohibitions and have access to simplified and abridged retrenchment procedures (as at January 15, 2020, solely two companies providing airline and aviation-related services have been exempted from the retrenchment prohibitions). (More information available here.)

The WRA further makes provisions, subject to regulations, for Exempted Employers to be discharged from their obligations of maintaining equally favourable conditions of employment and/or of recognizing the continuity of employment of employees in the event of a takeover or transfer of undertaking (as at January 15, 2021, no such regulations have been made).

In an attempt to alleviate the financial struggles of employers following the COVID-19 pandemic, monthly contributory obligations to the Portable Retirement Gratuity Fund (the Fund) have been suspended until January 1, 2022, such moratorium being applicable to employers who have not contributed or who have ceased to contribute to the Fund. However, contributions for past services have to be effected when employment is terminated.

The Workers’ Rights Act 2019 https://labour.govmu.org/Documents/Legislations/THE WORKERS RIGHTS Act 2019/Consolidated Version of the Workers' Rights Act 2019 as at 7 September 2020.pdf

The Workers’ Rights (Prescribed Period) Regulations 2020 https://labour.govmu.org/Documents/Legislations/THE%20WORKERS%20RIGHTS%20Act%202019/183_The%20Workers%20Rights%20(Prescribed%20Period)%20Reg%202020.pdf

Amendments brought to the Employment Relations Act 2008 by the Covid19 (Miscellaneous Provisions) Act 2020 https://labour.govmu.org/Documents/Legislations/Employment%20relations%20act%202008/Extract%20of%20the%20amendments%20to%20the%20EReA%20by%20the%20COVID19%20(MP)%20Act%202020.pdf

The Workers’ Rights (Exempt Employers) Regulations 2020 https://labour.govmu.org/Documents/Legislations/THE%20WORKERS%20RIGHTS%20Act%202019/The%20Workers'%20Right%20(Exempt%20Employers)%20Regulations%202020.pdf

The Workers’ Rights (Portable Gratuity Retirement Fund) Regulations 2020 https://labour.govmu.org/Documents/Legislations/THE%20WORKERS%20RIGHTS%20Act%202019/The%20Workers'%20Rights%20(P%20R%20G%20F)%20(Amend)%20Regulations%202020.pdf

Mexico

OUTSOURCING

To reduce the use of illegal outsourcing, on November 12, 2020, President López Obrador announced a bill that, if enacted, will have a significant impact on outsourcing, by banning subcontracting of personnel and only allowing the provision of specialized services, which are not part of the corporate purpose or business activity of the beneficiary of the services. Those service providers must obtain an authorization by the Labor Ministry. Such authorization is important so as not to incur fines (which were increased significantly) and to make the expense tax-deductible. This bill bans the use of insourcing companies (using companies owned by the same corporate group) that had been previously used in Mexico for better control of profit sharing among related companies.

Telework

In December 2020, Congress approved reforms to the Federal Labor Law regarding telework (in force as of January 2021) (the Reform). In general terms, the Reform creates an employer obligation to provide, install and maintain all the equipment and tools that the employee will need to conduct remote work, including any telecommunication services and paying for a proportional part of the employee’s electricity bill. Telework will be permitted if it is mutually agreed, not occasional or sporadic, and if it is done for more than 40% of the total work shift. Special telework rights include: (a) the right to disconnect (respecting the time limits of the employee’s work shift); (b) that telework is voluntary for both parties; (c) reversibility (return to on-site modality); (d) privacy; and (e) special provisions for psychosocial or ergonomic risks.

CREATION OF NEW LOCAL LABOR COURTS

In November 2020, the first phase of the implementation of labor reform in the judicial system started, in which the Conciliation and Arbitration Labor Boards (parts of the Executive branch) stopped receiving new claims and/or collective bargaining agreements, to give way to Local Labor Courts—new judicial institutions created to hear labor matters. Eight Mexican states have already created new Local Labor Courts, where labor-related matters will be adjudicated. These states have also created local offices of the Federal Center for Labor Conciliation and Registration, where employees should exhaust pre-litigation conciliation efforts and where collective bargaining agreements are now presented. In October 2021, 14 Mexican states will join in the implementation of this new judicial system.

NEW TERMS OF THE PENSION SYSTEM

In December 2020, Congress approved a bill that modifies the pension system in Mexico. By modifying the Mexican Social Security Law and the Employee Retirement Law, Congress limited the commissions charged by the Administradoras de Fondos para el Retiro (fund administrators) in Mexico to a 0.54% and increased retirement payments from 6.5% to 15%, increasing the employer’s obligations from 5.5% to 13.88%. The increase will be take place incrementally over the next several years.

USMCA LABOR IMPLICATIONS

On July 1, 2020, the US-Mexico-Canada Agreement (the USMCA) entered into force and replaced its predecessor, the North American Free Trade Agreement. The USMCA accelerates compliance of new robust labor protections, including rights related to collective bargaining, and a new dispute mechanism known as the “Rapid Response Mechanism.” Some of the new labor-related trade obligations for Mexico under the USMCA include: (1) implementing legislation establishing worker rights to hold secret ballot votes in union leadership elections, challenge existing collective bargaining representatives, and approve new and existing collective bargaining agreements; and (2) establishing an independent entity to verify the validity of collective bargaining agreements and independent courts to settle labor disputes. Mexico has created new courts to address labor disputes (see above) and is still working on eliminating protective collective bargaining agreements, which favored employers and did not give voice to employee concerns. Under the USMCA, penalties for breaching these rights range from losing preferential tariffs to prohibiting exports to Canada or the United States.

Mozambigue

Laws

Law 10/2020 (Management and Reduction of Disasters Risk)

This law approves the legal regime of Management and Reduction of Disasters Risk, which declares the Situation of Public Calamity.

Decree 102/2020 (Measures against COVID-19)

The purpose of this decree is to establish prevention and combat measures against COVID-19 during the Situation of Public Calamity.

The companies have to apply and implement some of those measures in their facilities, such as the use of masks and/or visors, frequent hand washing with soap and water, interpersonal distance of at least 1.5 meters, cough etiquette, no sharing of personal utensils, body temperature measurement before the start of the working day, airing of facilities, disinfection of premises and equipment with recommended solutions, and reducing the number of people at meetings or gathering places to no more than 40 attendees. Finally, except in cases where the operation of the state cannot be postponed, citizen-employees who are at high risk of hospitalization or serious illness from COVID-19 have priority to be excused from on-site work, and employees exhibiting fevers or flu symptoms should not be allowed at the work site.

Myanmar

OCCUPATIONAL HEALTH AND SAFETY

Though originally passed in March 2019, Myanmar’s Occupational Health and Safety Law (OHS) reshaped much of the employment environment in Myanmar in 2020. OHS was aimed at the development and implementation of workplace health and safety measures in the country—something that became an even higher priority with the outbreak of COVID-19. It also had the goal of reducing and eliminating workplace accidents, the spread of diseases in the workplace and other occupational hazards. Prior to the enactment of the OHS, there was no specific legislation in Myanmar that governed occupational health and safety, although relevant provisions could be found in the Factories Act of 1951 and the Shops and Establishments Law of 2016. While some of the provisions under the OHS mirror the requirements under the Factories Act and the Shops and Establishments Law, the OHS goes further, including establishing the National Occupational Health and Safety Council of Myanmar to facilitate the administration of the OHS. Further, the OHS also introduces the requirement for certain enterprises to register themselves with the Factory and General Labor Laws Inspection Department and for such enterprises to appoint an Occupational Health and Safety Manager or Committee. The OHS also specifies the obligations of employers and employees. Businesses and their employees in Myanmar should take note of the requirements under the OHS because failure to comply with the new law may lead to administrative action, imprisonment, fines or a combination of all three.

To mitigate COVID-19’s impact in Myanmar, the government announced a number of labor-related relief policies. For example, on March 20, 2020, the Social Security Board (SSB) announced that it would allow employers to make social security payments quarterly instead of monthly. In June 2020, the SSB also provided limited social security contribution assistance to qualified injured workers.

By Orders dated September 20, 2020 (Order No. 107/2020), and September 22, 2020 (Order No. 108/2020), the Ministry of Health and Sport allowed employees in certain industries to work from home. Employees of certain essential businesses, however (e.g., financial services, food production, medical supplies, etc.), may not take advantage of these Orders.

On December 29, 2020, the Ministry of Health and Sports extended related public statements, orders, directives and notifications on the control and prevention of COVID-19 until January 31, 2021.

Netherlands

KEY LEGISLATION

The Balanced Labour Market Act (BLMA) was enacted on January 1, 2020. The BLMA affects a number of aspects of the employer-employee relationship.

Severance Payments Expanded to All Employees

Under the BLMA, all employees, regardless of how long they have worked for an employer, are now entitled to a statutory transition payment (the severance payment) if their employer terminates the employment relationship. Previously, only employees who had been employed for two years or longer were entitled to the statutory severance payment. The severance payment is calculated as follows: one-third of a monthly salary for each full year of employment. For any additional period of employment of less than one year, the severance payment is calculated pro rata. The severance payment is capped at one year’s salary or €84,000 for 2021 (severance payment amounts are updated yearly), whichever is higher. (More information available here.)

Employers May Now Rely on a Combination of Grounds of Dismissal

Before the BLMA was enacted, unilateral dismissal of an employee was, in principle, only possible if the employer could demonstrate that one of the enumerated grounds for dismissal listed in the Dutch Civil Code applied entirely to the case at hand. However, under the BLMA, employers may now combine several grounds for dismissal listed under the Dutch Civil Code. For example, employers can now cite poor job performance and an impairment of working relations to justify dismissal. However, in the event that the court terminates an employment contract based on a combination of reasons, the court may award extra severance pay in addition to the severance payment. This extra severance pay cannot exceed 50% of the severance payment. (More information available here.)

The BLMA Extends the Chain Rule

In Dutch employment law, the chain rule determines the maximum period during which parties may enter into consecutive fixed-term employment contracts, as well as the maximum number of consecutive fixed-term employment contracts. The BLMA extends the maximum period under the chain rule from two years to three years but does not change the maximum number of consecutive fixed-term employment contracts (which remains at three years). As was the case before the BLMA came into force, the chain is broken if there is an intermission of at least six months between consecutive contracts. The updated chain rule is applicable to contracts terminated on or after January 1, 2020. An applicable collective labor agreement (CLA) may set out a different regime. In such a case, the CLA governs. (More information available here.)

On-Call Contracts

In addition to the aforementioned changes, the BLMA extends the rights of on-call employees. Effective January 1, 2020, on-call employees must be called on by the employer at least four days in advance. The employer must call on the employee in writing or electronically. If notice of less than four days is given, the employee is not obligated to comply with the call. On-call employees remain entitled to salary if a call is fully or partially withdrawn within four days before work commences. Furthermore, if an on-call employee has been employed for a period of 12 months or longer, the employer must offer the employee an employment contract with fixed hours (i.e., not an on-call contract but a "regular" employment contract) within one month. The working hours included in this employment contract must, at a minimum, amount to the average working hours of the on-call employee over the previous 12 months. (More information available here.)

Key cases

COVID-19 Case on Employer Accountability and Continued Salary

As was to be expected, courts rendered myriad decisions related to COVID-19. Several of these cases related to the payment of salary. In accordance with Article 7:628 of the Dutch Civil Code, the employer must continue to pay the employee’s salary even where the employee cannot perform their duties as a result of circumstances for which the employer should reasonably be held accountable. On May 29, 2020, the Oost-Brabant court ruled that employers should reasonably be held accountable where employees cannot perform their duties because no work is available because of the COVID-19 crisis. In keeping with this, the employer is obligated to continue to pay the employee’s salary for the duration of the time that work is unavailable. (More information available here.)

X/City of Amsterdam Case – Party Intent Is Irrelevant to Whether an Agreement Constitutes an Independent Contractor Contract or Employment Contract

The difference between employment contracts and independent contractor agreements has been the topic of much discussion over the years. The difference is not always clearly defined, though the distinction significantly impacts the applicability of fiscal, social security and employment laws. Generally speaking, even if a contract is labeled as an independent contractor’s agreement, it legally and technically qualifies as an employment contract if it meets the following criteria: (i) performance of services, (ii) under the authority of the counterparty, in return for (iii) remuneration. On November 6, 2020, the Dutch Supreme Court ruled that, contrary to what was commonly recognized by lower courts, the parties’ intent is irrelevant with regard to the question of whether a contract meets the criteria of an employment contract. As such, the manner in which the parties to the contract behave in practice has become even more significant in determining whether the contract constitutes an employment contract. (More information available here.)

Psychotherapist Case – The Closed Dismissal System Does Not Protect Employees Who Defrauded the Employer into Hiring Them

An employee interviews for the position of psychotherapist and director at a healthcare institution. His resume states that he is a member of multiple specialists’ associations and that he has completed several medical courses. The employee is offered an indefinite employment contract and named statutory director. Not long thereafter, the employer is informed by a specialists’ association that the employee is not, in fact, a member, nor is there any proof that he completed the courses listed on his resume. The employer proceeds to annul the shareholders’ resolution naming the employee director and moves to annul the employment contract extrajudicially. The latter action is unusual, as Dutch employment law utilizes a so-called closed dismissal system, meaning that the grounds and methods for dismissal are exhaustively listed in the Dutch Civil Code. However, after a challenge by the employee, the Dutch Supreme Court ruled on February 7, 2020, that the closed dismissal system is not intended to protect an employee who acts fraudulently when entering into an employment contract. As such, the closed dismissal system does not preclude the extrajudicial annulment of an employment contract based on fraud. (More information available here.)

Nicaragua

WORKPLACE HARASSMENT AND ITS PROTECTION THROUGH THE SPECIAL PROCESS OF FUNDAMENTALS RIGHTS

Although protection against workplace harassment is not considered a fundamental right by the Declaration on Fundamental Principles and Rights at Work (adopted by the International Labour Organization in 1988), the Labor and Social Security Process Code included it in article 111. Article III considers that workplace harassment might be a manifestation of discrimination or a way to cover it up. As a result, workplace harassment lawsuits are processed through a special procedure referred to as “Protection to Union Freedom and Other Fundamental Rights,” which allows access to a special legal process and the possibility (if workplace harassment is proven) to receive compensation, as long as it is formally requested and quantified in the lawsuit and reasonably ordered by the labor authority. (More information available here.)

North Macedonia

EMPLOYMENT-RELATED MEASURES FOR SUPPORT IN OVERCOMING THE CONSEQUENCES OF COVID-19

During 2020 the country faced a health and economic crisis resulting from the COVID-19 pandemic. In attempt to provide support for overcoming the consequences of the pandemic, the government adopted multiple employment-related measures, decrees and laws during the state of emergency. These measures included financial support for sole proprietors and employers in the form of subsidizing salaries for the employees of the entities affected by the crisis, subsidizing the payment of contributions from the mandatory social security, special rules for application of labor laws during the state of emergency in terms of prolonging maternity leave and manners of using annual leave of employees during imposed quarantine as well as freezing the increase of minimum wage. In addition, measures for support of employees who have lost their jobs as result of the pandemic were implemented in the form of providing financial allowance payable by the state to employees who lost their job, regardless of previous years of experience and grounds for termination of the previous employment, in duration of two months. The measures also referred to restricting payment of bonuses and salary compensations to public institution employees during the state of emergency. Deadlines which were to expire during the state of emergency, connected to realization of rights arising out of pension and disability insurance, insurance in event of unemployment as well as employment of persons with disabilities, were prolonged to ensure proper protection and ensure all concerned parties are able to enjoy their rights provided by applicable laws.

FREEZING THE MINIMUM WAGE INCREASE DURING STATE OF EMERGENCY

Although according to law the minimum wage was set to increase in April 2020, because of the pandemic and the crises resulting out of it, the minimum wage was frozen and during April, May and June was paid in net amount of MKD 14,500 (approx. €235). After expiration of this period the planned increase occurred, and minimum wage is now paid in gross amount of MKD 21,776 (approx. €355), i.e., in net amount of MKD 14,934 (approx. €243).

ALIGNING OF REGULATIONS

Amendments to the Labor Law and Law on health and safety at work were made to harmonize the provisions regulating inspection supervision and prescribed fines with the newly adopted Law on Inspection and Law on Misdemeanors.

Norway

COVID-19-RELATED MEASURES

The most defining aspect of Norwegian employment law in 2020 has been changes to the legislation because of the ongoing COVID-19 pandemic. Similar to many other countries, a large number of employers were forced to perform layoffs when Norwegian society was shut down from mid-March 2020, where many of the layoffs happened virtually overnight. In an effort to mitigate the impact the pandemic could have on the companies and employees' economy, the Norwegian government implemented a number of employment-related measures.

Employers are obligated to pay the employees' salaries during the initial phase of temporary layoffs, called the employers' period. In an attempt to prevent permanent layoffs and mitigate the financial consequences for the employers, the employers' period of the temporary layoffs was reduced from 15 workdays to two workdays but was later expanded to 10 workdays. Furthermore, the maximum duration an employee may be temporarily laid off has been expanded from a maximum of 26 weeks within the last 18 months to 52 weeks within the last 18 months.

The Norwegian government has also implemented several measures to mitigate the economic impact for employees. Notable examples include expansions in the number of days of possible sick leave and other personal days because of the pandemic that the National Insurance will compensate, and contribution from the National Insurance to temporarily laid off employees having been increased.

#METOO SUPREME COURT RULING

In December 2020, the Norwegian Supreme Court passed a ruling in a case where a female employee had been sexually harassed by two customers in the workplace. The employee, who worked as a mechanic in a business with only male coworkers, had experienced unwanted advances from two customers, among other by being patted underneath her sweater on the small of her back and by being tickled several times, as well as being patted on the bottom. The question for the Supreme Court was whether this constituted sexual harassment. Both customers were found guilty of sexual harassment, as the advances had had a sexually character and had been unwanted and annoying for the employee.

In the court cases before the District Court and Court of Appeal, the employer was also charged with neglecting to prevent the sexual harassment. However, as the verdict from the Court of Appeal was not appealed by the employer; only the customers' conduct was tried by the Supreme Court. Nevertheless, the case has shown that employers may be liable for financial damages caused by customers if the employer fails to prevent that employees are harassed in the workplace.

EQUAL TREATMENT OF PERMANENT AND HIRED EMPLOYEES

In November 2020, the Norwegian Supreme Court passed a ruling in a case where two hired employees claimed to be unequally treated in the company's bonus scheme. The question was whether the bonus scheme was considered to be "salary" pursuant to the Norwegian implementation of Directive 2008/104/EC of the European Parliament and of the Council of November 19, 2008, on temporary agency work, and thus whether the requirement regarding equal treatment was applicable.

In the case, the annual bonus was decided based on the company's results and goal achievement, as well as the employees' collective work contribution. The Supreme Court found that as long as the bonus was regarded as "compensation for performed work," it was considered "salary," regardless of whether the bonus is a company-wide bonus or an individual bonus scheme. Furthermore, the court found that the objective of obtaining actual equal treatment must be an important factor when interpreting the term "salary." On that basis, the Supreme Court found that the bonus scheme was considered "salary," which meant that the hired employees was entitled to the bonus as well.

TRANSFER OF UNDERTAKING FROM GOVERNMENT-OWNED COMPANY TO PRIVATE UNDERTAKING

In the summer of 2020, the Supreme Court tried a case regarding employees' rights when their employments were transferred to a new company as a part of a transfer of undertaking. In this case, the employees were transferred from a government-owned company to a private undertaking and in the process had their notice periods and early retirement schemes changed.

In Norway, there are separate laws regarding employees' rights and obligations for civil servants and other employees. The Civil Servants Act offers the employees longer notice periods. The employment agreements the employees had entered into when starting their employment with the government-owned company made reference to the Civil Servants Act's rules, without specifying the length of the notice periods. According to the employer, the intention was to provide information regarding where the notice periods were found. However, the court found that the reference made the notice periods individual terms, which would transfer to the new employer. The court found that if the intention was solely to provide information, this must be explicitly stated.

Furthermore, the government-owned company had two pension schemes, which in short were early retirement schemes. Pursuant to the Norwegian Working Environment Act, the new employer may choose not to be bound by the transferring company's pension schemes regarding pension due to age, pensions for widows and disability pensions. The court found that the pension schemes were considered pension because of age, even though the schemes applied to cases of early retirement, as the schemes entailed a normal exit from the working life for the relevant employees.

Poland

The Polish government enacted an array of legislative measures in 2020 addressing subject matter ranging from the pandemic to an increase in the minimum wage. The Polish Supreme Court handed down an important decision on the viability of a condition precedent to non-competition agreements. A description of these developments is below.

AN INCREASE IN THE MINIMUM WAGE

As of January 1, 2021, the minimum monthly wage for persons working under employment contracts has been increased from 2,600 zlotys to 2,800 zlotys gross. The minimum hourly wage for persons rendering work or services to entrepreneurs under mandate or service agreements has also been increased from 17 zlotys to 18.30 zlotys gross. (More information available here and here.)

REGULATIONS RELATED TO COVID-19

The COVID-19 pandemic dominated employment legislation last year, which was focused on minimizing the negative effects of the pandemic and finding the most effective solutions. In response to the pandemic, Poland launched COVID-19-related legislation called the Anti-Crisis Shield that aimed to give as much protection as possible to employees against dismissal and prevent employment establishments from closing. The Anti-Crisis Shield has been subject to several changes and is still amended as circumstances require. Among other things, the Anti-Crisis Shield provides the following protections and employer obligations:

Facilities for Employers

The Anti-Crisis Shield provides for: (i) the subsidization of employee remuneration; (ii) the possibility to reduce working time; (iii) a temporary exemption from the obligation to pay social security contributions for certain employees; and (iv) the right to terminate non-competition agreements after the termination of employment with seven days’ notice or limit severance pay, compensation or other cash benefits payable by the employer to the employee upon the termination of an employment agreement up to 10 times the minimal remuneration. The terms and conditions as well as the admissible period of using these particular solutions were specified in detail by the provisions of the Anti-Crisis Shield.

Remote Work

Remote work is not regulated by the Polish Labour Code. This caused problems for employers during the pandemic because they were required to allow employees to work from home. The Anti-Crisis Shield has temporarily regulated remote work and specified some general rules under which remote work can be performed during the pandemic. The Anti-Crisis Shield also allows employees, under certain conditions, to work remotely if they are in quarantine or isolation.

Employee Health and Safety

COVID-19 forced employers to ensure that special rules of safety for their employees were in place. These rules were often related to the reorganization of workplaces. Anti-COVID-19 ad hoc regulations obliged employers to ensure:

-

Social Distancing: A distance of 1.5 meters between workstations unless impossible due to the nature of the performed tasks; and

-

Personal Protective Equipment (PPE): Personal Protective Equipment (PPE): Employers must provide PPE related to fighting epidemics and other personal protective measures, like disposable gloves and hand sanitizer. Employers may also require employees to cover their mouth and nose in the workplace if another person is in the same room. (More information available here.)

Further Introduction of Employee Capital Plans (PPK)

As we mentioned in the last edition of the Global Employment Law Year in Review, the Act on Employee Capital Plans (Act) came into effect on January 1, 2019, and introduced an additional pension-saving vehicle. The Act divided employers into four groups, which will sequentially introduce this special pension scheme. Employers from the first group (entities with at least 250 workers) were required to comply with the PPK in 2019. The process is still ongoing, and, due to the COVID-19 pandemic, compliance by the second group (entities that hired at least 50 employees as of June 30, 2019) was delayed by six (6) months to coincide with that for the third group (entities employing at least 20 people), both of which had to begin compliance in 2020. The fourth and final group is to apply the PPK scheme in 2021.

Amendments to the Labour Code

New amendments to the Labour Code that aim to improve the efficiency of the enforcement of maintenance payments entered into force on December 1, 2020. The changes extended the catalog of offenses to discourage employers from illegally employing maintenance debtors, as well as paying the above-mentioned debtors’ remuneration in a higher amount than stated under the applicable contract, without making any deductions for maintenance payments. A fine in the amount of PLN $1,500 to PLN $45,000 may be imposed on the employer if:

-

The employer does not confirm the employment contract concluded with the employee in writing before allowing the employee to work if such employee is a maintenance debtor and is in arrears with the fulfilment of maintenance payments for a period longer than three (3) months; or

-

The employer pays such employee a remuneration higher than that resulting from the concluded employment agreement

without making any deductions to satisfy maintenance payments.

Amendments to the Act on Posted Employees

The Polish Act on Posted Employees was amended as Poland implemented EU Directive 2018/957, passed on June 18, 2018, concerning the posting of workers in the framework of the provision of services. A “posted worker” is an employee who is sent by his employer to carry out a service in another EU Member State on a temporary basis, in the context of a contract of services, an intra-group posting, or a hiring out through a temporary agency.

The amendments specified the principles of posting employees. In particular, they varied the conditions that should be guaranteed to employees depending on the period of posting. The new regulations also extended the scope of the State Labour Inspectorate’s competences, in particular, granting the power:

-

To receive reasoned notifications to extend the posting period by six months; or

-

To request information from employers, entrepreneurs, the Social Security Institution (ZUS), tax offices or other public administration bodies regarding the posting of an employee from the territory of the Republic of Poland and to request information in the case of suspected violations of the member state's provisions to which the employee was posted.

(More information available here.)

Conditional Non-Competition Agreement

In a Supreme Court case (judgment dated February 20, 2020, I PK 241/18), the parties concluded a non-competition agreement after the termination of employment. The agreement included a condition precedent, i.e., the non-competition obligation and the obligation to pay compensation will apply if the employer submits a written declaration on the last day of the employment contract at the latest; otherwise, the non-competition agreement terminates on the last day of the employment.

The Supreme Court confirmed that the conclusion of such agreement under the condition precedent is lawful and it does not oppose principles of social coexistence. (More information available here.)

Portugal

Laws

COVID-19 Legislation

Several laws were approved to mitigate the effects of the pandemic, including:

-

Decree-Law no. 79-A/2020: establishing an exceptional and transitory regime of work reorganization, intended to minimize the risks of transmission of COVID-19

-

Decree-Law no. 10-G/2020, altered by Decree Law no. 14-F/2020: establishing a simplified layoff legislation, granting additional financial support per employee to companies, for purposes of the payment of wages during the period of temporary reduction of working hours or suspension of employment contracts

-

Decree-Law no. 46-A/2020: creating additional support for the progressive resumption of activity in companies experiencing a business crisis with temporary reduction of the normal work period

-

Decree-Law no. 90/2020: modifying the extraordinary support related to the progressive resumption of activity in companies experiencing a business crisis

-

Decree-Law no. 101-A/2020: changing the additional support for the progressive resumption of activity in companies experiencing a business crisis and clarifying the temporary regime of absences justified by the need to assist family members

-

Resolution of the Council of Ministers no. 114/2020: approving a set of new measures aimed at business and employment in the context of the COVID-19 pandemic

Decree-Law 109-A/2020 (Minimum Wage)

The minimum wage, already increased from 2019 to 2020 from €600 to €635, was once again increased to €665 for 2021. It is expected to reach €775 by 2023. (More information available here.)

Decree-Law 101-E/2020 (Posting of Employees in the Framework of the Provision of Services)

On December 8, 2020, Decree-Law no. 101-E/2020 was approved by the Council of Ministers, replacing Directive (EU) 2018/957 of the European Parliament and of the Council of 28 June 2018 amending Directive 96/71/EC. (More information available here.)

The main new features of this law are: (i) an increased protection of posted workers (workers who are temporarily sent to another EU member state by their employer) for fraud and abuse situations; (ii) the development of the concept of remuneration, reinforcement of the monitoring and control of secondments (for situations in which the secondment lasts longer than 12 months, requiring the companies to guarantee all the conditions granted by the law and by an eventual Collective Labour Agreement); and (iii) the requirement to disclose, on official websites and in formats accessible to people with disabilities, information on the working conditions to which workers posted in Portuguese territories are entitled.

Ministerial Order 122/2020 (Amendment to the Regulation of the System of Incentives to Entrepreneurship and Employment)

This amendment, primarily focused on the industry and tourism sector, is intended to strengthen and boost the competitiveness of micro and small enterprises, particularly those located in inland territories. It is also focused on the expansion and modernization of national productive capacity, through maintaining employment levels, a crucial factor for local economies. Companies are given priority for accessing the law’s benefits based on a number of criteria, including the newly added criteria of maintenance of the labor work force and the investment in the interior. (More information available here.)

Parliament Resolution 87/2020 and Presidential Decree 59/2020 (Approval and Ratification of the Protocol of 2014 to the Forced Labour Convention of 1930 (No. 29), Adopted by the International Labour Conference at Its 103rd Session, Held in Geneva on June 11, 2014)

Portugal ratified the Protocol of 2014 to the Forced Labour Convention of 1930. The Protocol aims to reaffirm that measures of prevention, protection and remedies, such as compensation and rehabilitation, are necessary to effectively continue to suppress forced or compulsory labor. (More information available here.)

Ministerial Order 2/2020 (Informal Caretaker Regime)

The Law no. 100/2019, given effect through Ordinance 2/2020, regulates the terms of recognition and maintenance of the informal caretaker statute. Key features include the conciliation between professional activity and care providing activities, granting rights to informal caretakers that are equivalent to parental rights. (More information available here.)

Case Laws

Court of Appel of Coimbra, Procedure 4354/19.7T8CBR-A.C2 (Paychecks and Personal Data)

The Tribunal da Relação de Coimbra (Court of Appeal of Coimbra) heard a case that required the analysis of other employees’ paychecks to determine whether a specific employee had experienced discrimination through the payment of wages. The court decided that the amount of the other employees’ salary, including all salary components, must be disclosed without reference to any other information included in the paychecks, since this additional information constituted personal data (as defined by the General Data Protection Regulation). (More information available here.)

/>i

/>i