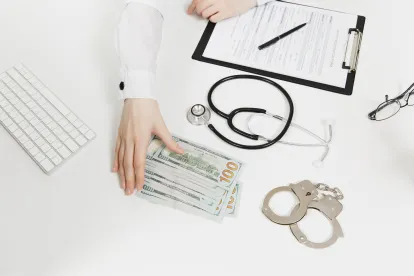

Headlines that Matter for Companies and Executives in Regulated Industries

Florida Doctor Receives 20-Year Prison Sentence for Substance Abuse Treatment Fraud

Following a guilty plea to conspiracy to commit health care and wire fraud, a Florida doctor was sentenced to 20 years in prison for engaging in a decade-long scheme to bill health care benefit programs for fraudulent tests and services to vulnerable patients seeking drug and/or alcohol addiction treatment.

Court documents reflected that the defendant, who served as Medical Director or Authorizing Physician for over 50 sober homes, substance abuse treatment facilities, and clinical testing laboratories, routinely signed standing orders for expensive and medically unnecessary urine drug tests for patients at addiction treatment facilities. These facilities sent the patients’ urine specimens to clinical testing laboratories, which then billed health care benefit programs for unnecessary urine drug tests, often costing thousands of dollars per test. In exchange for the defendant’s authorization of the tests, the treatment centers required their patients to submit to additional testing at the defendant’s clinic or by the defendant’s staff so that the defendant could bill the patients’ private health insurance plans for duplicative, medically unnecessary, and expensive treatments. As a result of this scheme, health care benefit programs were billed over $746 million and paid approximately $127 million for fraudulent urine drug tests and addiction treatments. As part of his sentence, the defendant was ordered to surrender his medical license.

Read the press release here.

International Telemarketing Scheme Participant Sentenced to 133 Months

After a trial in the Western District of North Carolina on one count of conspiracy to commit mail and wire fraud, six counts of wire fraud, one count of conspiracy to commit international money laundering, and six counts of international money laundering, a Florida man was sentenced to 133 months in prison for his role in an international telemarketing scheme that defrauded more than 400 victims out of millions of dollars.

According to court documents and evidence presented at trial, the defendant participated in a fraudulent scheme orchestrated from a call center in Costa Rica. As part of the scheme, telemarketers posed as US government officials and contacted victims — many of whom were elderly — to tell them they had won a substantial “sweepstakes” prize and needed to make a series of up-front payments to cover purported taxes or other fees. The defendant then transmitted the funds fraudulently obtained from the victims from the United States for the benefit of the call center and others involved in the scheme in Costa Rica.

Two others involved in the scheme were sentenced in related cases to three and seven years in prison, respectively.

Read the press release here.

California Agricultural Companies and Their Owner to Pay $600,000 to Resolve False Claims Act Allegations

Four California agricultural companies and their owner agreed to settle allegations that they violated the False Claims Act (FCA) and the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) by knowingly submitting false information to obtain Paycheck Protection Program (PPP) loan applications. Congress created the PPP in March 2020, as part of the Coronavirus Aid, Relief and Economic Security (CARES) Act, to provide emergency financial support to those suffering economic hardship due to the COVID-19 pandemic. The CARES Act authorized billions of dollars in forgivable loans to small businesses to assist with paying employees and other business expenses. When applying for PPP loans, borrowers were required to certify the truthfulness and accuracy of all information provided in their loan applications, including their number of employees and average monthly payroll.

The companies and their owner allegedly violated the FCA by improperly counting non-employee contract workers as employees in their loan applications, thereby artificially inflating the number of employees. The qui tam lawsuit that initiated these claims alleged that the inclusion of these additional “employees” caused one company to receive approximately $1.8 million in additional PPP funds. The company previously repaid the excess PPP loan funds to the lender, thereby relieving the US Small Business Administration of liability for approximately $1.8 million in loan guarantees. As a part of the settlement, the company will pay approximately $400,000 in damages and penalties under the FCA and approximately $200,000 in civil penalties under FIRREA. There has been no determination regarding the amount of the recovery to be paid to the whistleblower that filed the lawsuit.

Read the press release here.

/>i

/>i