The failure of numerous banks and financial institutions during the past several years has shown, in its harshest fashion, that such institutions did not fully embrace a strict risk management regimen. Things have changed since then, however, and Deloitte’s Global Risk Management Survey shows just that.

Deloitte surveyed 131 financial institutions from around the world with total assets of more than $17 trillion. The following are a few key findings from the report:

-

Roughly 90% of institutions had a defined risk governance model and approach, and 78% reported that their board of directors had approved their risk management policy or ERM framework

-

86% of institutions had a CRO or equivalent position, up from 73% in 2008 and 65% in 2002

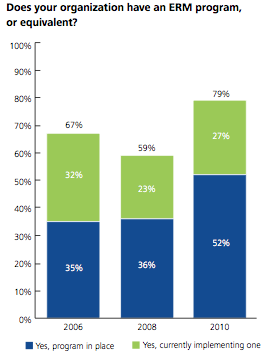

- 79% of institutions reported having an ERM program or equivalent in place or in progress, an increase from 59% in 2008 (see below)

-

For insurance institutions subject to Solvency II, 70% or more said they plan to focus over the next 12 months on program initiation, gap analysis, and planning; risk governance; and Own Risk and Solvency Assessment (ORSA)

-

88% of institutions used stress testing for risk factors affecting their credit portfolio, an increase from 79% in 2008, while 74% conducted stress testing for market risk in their trading book

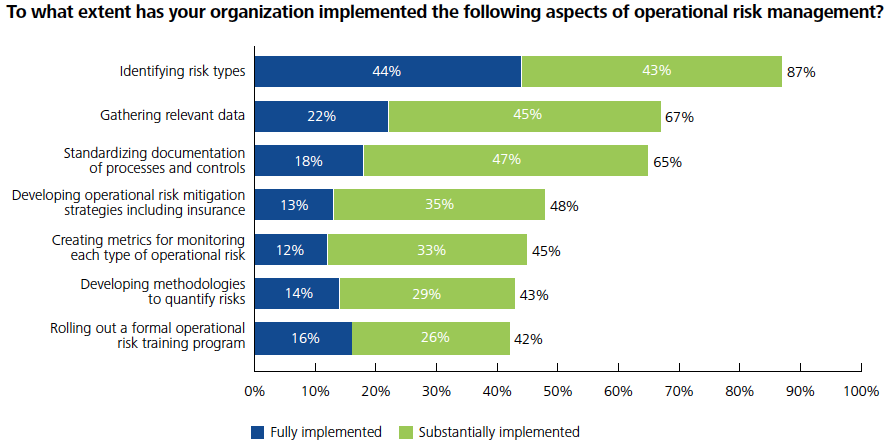

- 60% of executives considered their operational risk assessments and internal loss event data to be extremely or very well developed, an increase of 40% in 2008 (see below)

In all, Deloitte’s report is optimistic. It clearly shows financial institutions (finally) taking certain aspects of risk management, such as ERM, capital reserves, governance and, to an extent, technology risk assessments, very seriously. This is promising and can provide a certain amount of relief to those worrying about another catastrophic financial collapse of the U.S. economy. Of course, we can never say never, but with financial institutions continuing to fully embrace risk management in all its forms, we can all sleep a little better.

/>i

/>i