The fund and asset management industry has been more focused on environmental, social and governance (“ESG”) issues in the last two years than it has been in, perhaps, the last decade. Climate change and environmental issues have long been on the agenda for firms globally, gaining significant momentum due, in part, to political policies becoming more aligned to voter values. This is a trend observed equally in the fund and asset management industry, whereby managers have been under increasing investor pressure to demonstrate their commitment to responsible investing. In the European Union (“EU”), formal regulatory developments have certainly accelerated the focus on ESG and has formalised the way both managers and investors have addressed and disclosed against their firm and product related ESG credentials. The year ahead looks to carry as much momentum as the previous year as regulatory developments show no signs of slowing down and this is shaking up the fund and asset management industry - globally.

-

ESG - EU Developments

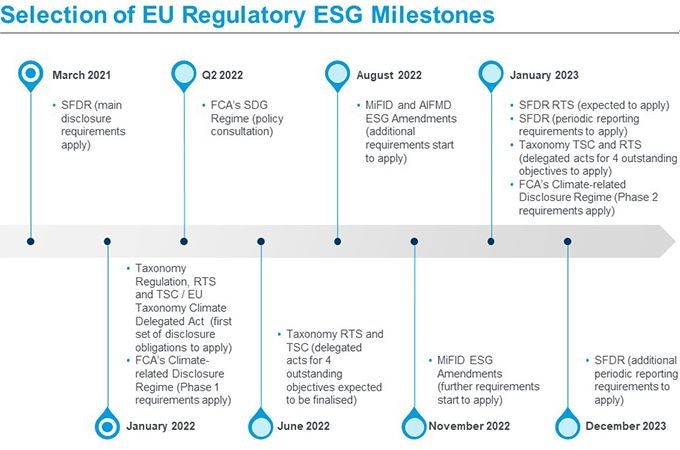

The Sustainable Finance Disclosure Regulation (the “SFDR”) entered into force in December 2019 and started to apply across the EU from March 2021. This was followed by a new EU Regulation on the establishment of a framework to facilitate sustainable investment (the “Taxonomy Regulation”). The Taxonomy Regulation has applied on a phased basis since 1st January 2022.

Each of the SFDR and the Taxonomy Regulation (together, the “ESG Regulations”) apply to “financial market participants,” which, as set out in our previous alert, includes (among others) EU MiFID investment firms that provide portfolio management, UCITS (or their EU management companies), and alternative investment fund managers (“AIFMs”). Non-EU AIFMs that have marketed one or more of their funds in the EU since 10 March 2021 would count as a financial market participant for these purposes. The ESG Regulations set out requirements relating to financial products made available by financial market participants. The term “financial products” includes (among other things) portfolios managed by MiFID investment managers and alternative investment funds managed by AIFMs.

-

SFDR

The SFDR has applied since March 2021, requiring in-scope firms (which includes EU AIFMs, or non-EU AIFMs marketing their products in the EU under national private placement regimes) to categorise their investment funds that are managed or marketed in the EU, as either Article 8 (which applies to funds which promote environmental or social characteristics (so-called ‘light-green’ funds)) or Article 9 (which applies to funds with a sustainable investment objective (so-called ‘dark-green’ funds)) or neither (so-called ‘grey’ or Article 6 funds), and make specific relevant product disclosures in relation to those products both in offering materials provided to investors and on firm websites.

See here for our previous alerts setting out the requirements on firms in scope of the SFDR.

-

Taxonomy Regulation

Where an investment product falls within Article 8 or Article 9 of SFDR under the Taxonomy Regulation, it must disclose if it will invest in environmentally sustainable economic activities and, if so, it must disclose the proportion of such investments against all other investments selected for the financial product. For any other products (i.e. Article 6 funds), the Taxonomy Regulation requires the AIFM to include a statement that the investments underlying this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

The relevant sustainable economic activity must also comply with technical screening criteria (“TCS”) determining which economic activities can substantially contribute, or cause significant harm, to each of the six environmental objectives of the Taxonomy Regulation, and comply with minimum social and governance safeguards. The TSC will be set out in delegated acts adopted by the Commission. The Taxonomy Delegated Climate Act has applied since January 2022 and covers the TSC for climate mitigation and adaptation objectives. The final TSC for the four remaining environmental objectives (water, circular economy, pollution prevention & control, and biodiversity & ecosystems) will be established in further delegated acts for application by 1 January 2023.

-

Final report on draft regulatory technical standards

In October 2021, the latest draft rules for financial product disclosures under the SFDR were published by the European Supervisory Authorities in their ‘Final Report on Draft Regulatory Technical Standards’ (the “Draft RTS”). This Draft RTS aims to create a “single rulebook” for sustainability-related disclosures for SFDR pre-contractual and periodic product disclosures, including Taxonomy-related product disclosures. They set out the requirements for Article 8 (light green funds) and Article 9 products (dark green funds), which are products that promote environmental or social characteristics or that have sustainable investment objectives, respectively.

The Draft RTS was due to apply in full from July 2022; however, this has been further delayed by 6 months, with the EU Commission recently confirming in a letter it published, that the timeline will be revised, with new rules now applying from 2023. This provides some additional time for firms to prepare their pre-investment disclosures and consider how they will obtain relevant data from underlying investments and counterparties.

-

United Kingdom

While the United Kingdom did not transpose or apply the EU SFDR or Taxonomy Regulation (it was not required to do so following its withdrawal from the EU), the UK Financial Conduct Authority (“FCA”) is in the process of developing its own sustainability disclosure framework, which is broadly intended to be aligned with the EU sustainable financing framework.

-

Sustainability disclosure regime

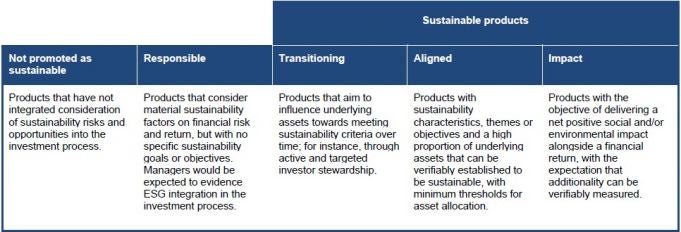

Coinciding with COP26 Finance Day on 3 November 2021, the FCA published a discussion paper (DP21/4, “DP”) outlining its approach to new UK sustainability disclosure requirements (“SDR”) and a sustainable investment labelling system that will apply to asset managers, (i.e., full-scope UK authorized AIFMs, UK portfolio managers and UK sub-threshold AIFMs) and asset owners which will have significant implications for the funds and wider financial services industry in the UK. The key aspect of the product labelling system will see a new product classification and labelling system designated as ‘not sustainable’, ‘responsible’, ‘transitioning’, ‘aligned’ or ‘impact’ products. Products must meet the criteria for ‘transitioning’, ‘aligned’ or ‘impact’ products in order to be labelled as ‘sustainable’, whereas products with lower ESG ambitions may be labelled as ‘responsible’. The table below sets out the FCA’s proposed labelling regime for financial products:

The proposed product-level sustainability disclosures apply at a level targeted more to a retail consumer base and includes a more detailed supplementary layer in circumstances where the product is aimed at professional investors.

Wider, customer-focused disclosures

The wider customer-focused disclosures proposed in the DP include the following:

-

Investment product label

-

Objective of the product, including specific sustainability objectives

-

Investment strategy pursued to meet the objectives, including sustainability objectives

-

Proportion of assets allocated to sustainable investments (including alignment with the UK Taxonomy)

-

Approach to investor stewardship

-

Wider sustainability performance metrics

Additional disclosures for institutional investors

The DP proposes the following additional product level disclosures aimed at professional investors:

-

Information on data sources, limitations, data quality etc.

-

Further supporting narrative, contextual and historical information

-

Further information about UK Taxonomy alignment

-

Information about benchmarking and performance

At this stage the FCA is still contemplating whether prescribed disclosure templates should be used, as is the case under SFDR. The deadline for responses to DP21/4 closed on 7 January 2022 with the FCA planning to consult on policy proposals to implement the new system in Q2 2022.

-

FCA’s Climate related disclosure regime

As discussed in a previous alert, on 17 December 2021, the FCA published its policy statement (PS21/24) setting out final rules and guidance relating to the requirements under a new climate-related disclosure regime which contains the final rules applicable to FCA-authorised asset managers (i.e., full-scope UK authorized AIFMs, UK portfolio managers and UK sub-threshold AIFMs) and asset owners.

The rules, which will be phased in from January this year and are closely aligned to the Recommendations of the Task Force on Climate-Related Financial Disclosures (“TCFD”), require in-scope firms to make firm-level disclosures on an annual basis relating to how they take climate-related risks and opportunities into account when managing their investments as well as product level disclosures.

In short the policy provides the following entity and product level requirements:

-

Entity-level — an annual TCFD entity report will need to be published in a prominent place on the main website of the firm, setting out how the firm takes climate-related matters into account in managing or administering investments on behalf of clients and consumers.

-

Product-level — disclosures (including a core set of climate-related metrics) on the firm’s products and portfolios made publicly in a prominent place on the main website of the firm, and included or cross-referenced in an appropriate client communication or made on request to certain eligible institutional clients.

Unlike the SFDR, the FCA’s rules will apply only to UK asset managers, life insurers, and pension providers that are authorized by the FCA, though the FCA has clarified that it will consider how foreign funds marketed into the UK should be treated, as part of the forthcoming SDR as described above.

The new rules are set out in the new ESG sourcebook in the FCA Handbook and apply from 1 January 2022 for the largest firms with more than £50 billion in assets under management (or £25 billion assets under administration for asset owners) and with the first set of reports due by 30 June 2023, reflecting the 2022 calendar year for these firms.

Remaining in-scope firms, with assets greater than £5 billion, will be subject to the new rules starting from 1 January 2023, with reports for calendar year 2023 due by 30 June 2024.

These developments in the UK will require UK firms to invest significant time in scoping, categorising products and implementing the requirements to ensure there are no data gaps, where producing these new suitability disclosures in the same way firms will have to do, and where managing funds or marketing products in the EU under the requirements of the SFDR.

2022 looks to be a busy year in the fund and asset management sector on ESG issues, and this is the year for firms to dedicate resources to ensure that they are able to comply with the various rules that have started to apply or will apply to them in the future.

/>i

/>i