In Central States, S.E. & S.W. Pension Fund v. McKesson Corp., No. 23-cv-16770, 2025 WL 81358 (N.D. Ill. Jan. 13, 2025), the district court affirmed that a multiemployer pension plan’s calculation of withdrawal liability should not have included contribution rate increases imposed after the plan had implemented a rehabilitation plan.

An employer that withdraws from a multiemployer pension plan is generally liable for its proportionate share of the plan’s unfunded vested benefits. The statutory methods used to calculate the employer’s share are all based in part on the amount of contributions the employer was required to remit to the plan in the years preceding its withdrawal. The employer’s withdrawal liability is payable immediately in a lump sum or pursuant to a statutory payment schedule. The payment schedule is calculated by: (i) determining the employer’s maximum annual payment, (ii) determining how many payments the employer must make to pay off the withdrawal liability with interest, and (iii) capping the number of payments at no more than twenty years (even if the withdrawal liability would not be paid off in twenty years). One of the most important variables used to calculate the employer’s withdrawal liability and its payment schedule is the contribution rate at which the employer was required to contribute to the plan. All else equal, a higher rate will result in greater withdrawal liability and larger annual payments.

For plans that have adopted a funding improvement or rehabilitation plan, the Multiemployer Pension Reform Act of 2014 (MPRA) amended the statute to generally exclude from these calculations any contribution rate increases imposed after 2014 unless the increases: (i) were due to increased levels of work or employment, or (ii) were used to provide an increase in benefits or benefit accruals that an actuary certifies is paid using contributions not contemplated by the funding improvement or rehabilitation plan and that will not imperil the plan from satisfying the requirements of its funding improvement or rehabilitation plan.

The District Court’s Decision

McKesson Corporation was a contributing employer to the Central States Pension Fund. The Fund adopted a rehabilitation plan in 2008 that called for annual increases in McKesson’s contribution rate. The rehabilitation plan did not alter the Fund’s formula for benefit accruals, which called for participants to accrue 1% of all contributions made to the Fund on their behalf during the year. When McKesson withdrew from the Fund, the Fund demanded that it pay $1,437,004.08 per year for 20 years to pay off its withdrawal liability. McKesson commenced arbitration to challenge the assessment, arguing that the Fund should have excluded the contribution rate increases pursuant to MPRA, which would have lowered its required payments to $1,091,819.04 per year for 20 years.

The arbitrator agreed and the District Court affirmed. The Court concluded that the statute was unambiguous and that once a multiemployer pension plan adopts a funding improvement or rehabilitation plan, there is a presumption that any subsequent contribution rate increases are to be excluded from the withdrawal liability calculation unless the plan satisfies one of the two statutory exceptions. The Court rejected the Fund’s argument that it qualified for the second exception because, pursuant to its 1% accrual formula, any increase in contributions resulted in increased benefits to participants. The Court noted that the resulting increase in benefits predated the Fund’s rehabilitation plan, and thus could not satisfy the statute’s requirement that increased contributions be used to pay for additional benefits or benefit accruals, and that in any event, the Fund had not obtained the actuarial certification needed to satisfy the statutory exception. The Court also rejected the Fund’s alternative argument that only the portion of the increased contribution rates used to reduce the Fund’s underfunding should be excluded from the withdrawal liability calculation and that the portion used to pay for increased benefit accruals should not. The Court held that the statute does not make any such distinction, and rejected the Fund’s reliance on a proposed rule by the PBGC that would have interpreted the statute to allow for such a distinction because the PBGC did not end up adopting the rule.

Proskauer’s Perspective

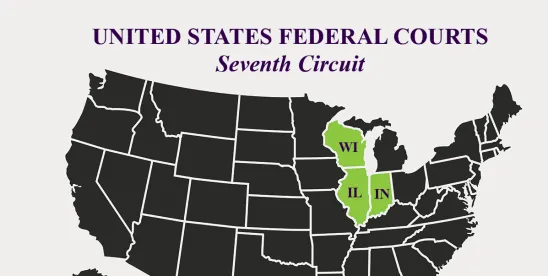

Several other employers have challenged the Fund’s efforts to include post-2014 contribution rate increases in its withdrawal liability calculations, and the Seventh Circuit is expected to resolve the issue later this year. Plans that have taken a similar approach to the Fund will want to monitor these cases, as they may have a significant impact on their approach to calculating employers’ withdrawal liability. In the meantime, for employers that contribute to or have withdrawn from plans that have adopted funding improvement or rehabilitation plans, the decision is a reminder to review closely withdrawal liability calculations to assess whether rate increases are being included in the calculation of withdrawal liability or the corresponding payment schedule.

/>i

/>i