Summer is here and we’re back with another edition of the Cost Corner, where we provide practical insight into the complex cost and pricing requirements that apply to Government contractors. We just completed a two-part series on the Truthful Cost or Pricing Data Statute, commonly known as the Truth in Negotiations Act (TINA).[1] We will return to TINA in a few months to address the Defense Contract Audit Agency’s (DCAA) playbook for defective pricing audits. But first, we embark on a two-part series regarding DCAA audits generally. Part 1 (this article) provides an overview of DCAA’s mission, organization, audit guidance, and audit rights. We also address the types of audits DCAA conducts and recent DCAA audit statistics. Part 2 (our next article) will focus on DCAA’s audit guidance, audit procedures, and best practices for contractors dealing with DCAA audits.

DCAA’s Mission

Prior to 1965, each military department conducted its own contract audits.[2] Contractor and government personnel recognized the need for consistency. In May 1962, Secretary of Defense, Robert S. McNamara, instituted “Project 60” to examine the feasibility of centrally managing contract administration and audit functions.[3] This study resulted in a decision to create a single contract audit capability within the Department of Defense (DoD).[4] Secretary McNamara then established DCAA as a separate DoD agency on June 8, 1965.[5]

DCAA’s mission is to conduct contract audits and to provide accounting and financial advisory services to all DoD components responsible for procurement and contract administration.[6] DCAA provides these services for the negotiation, administration, and settlement of DoD contracts and subcontracts to “ensure that taxpayer dollars are spent on fair and reasonable contract prices.”[7] DCAA also provides contract audit services for other Federal agencies through inter-agency agreements.[8]

DCAA interprets its contract audit function broadly. The DCAA Contract Audit Manual, DCAA’s primary source of guidance for auditors, describes contract audits as extending to all aspects of a contractor’s organization, including not only financial data, but also operations, policies and procedures, internal controls, management decisions, and any other activities that have the potential to impact contract costs:

The purpose of contract auditing is to assist in achieving prudent contracting by providing those responsible for Government procurement with financial information and advice relating to contractual matters and the effectiveness, efficiency, and economy of contractors’ operations. Contract audit activities include providing professional advice on accounting and financial matters to assist in the negotiation, award, administration, repricing and settlement of contracts. Audit interest encompasses the totality of the contractor’s operations. Audits are performed to assure the existence of adequate controls which will prevent or avoid wasteful, careless, and inefficient practices by contractors. These audits include the evaluation of a contractor’s policies, procedures, controls and actual performance, identifying and evaluating all activities which contribute to, or have an impact on, proposed or incurred costs of Government contracts. Areas of concern to the auditor include the adequacy of contractor’s policies, procedures, practices, and internal controls relating to accounting, estimating, and procurement; the evaluation of contractors’ management policies and decisions affecting costs; the accuracy and reasonableness of contractors’ cost representations; the adequacy and reliability of contractors’ records for Government-owned property; the financial capabilities of the contractor; and the appropriateness of contractual provisions having accounting or financial significance. Contract auditors perform evaluations of contractors’ statements of costs to be incurred (cost estimates) or statements of cost actually incurred to the extent deemed appropriate by the auditors in the light of their experience with the contractors and relying upon their appraisals of the effectiveness of the contractors’ policies, procedures, controls, and practices. Such evaluations may consist of test checks of a limited number of transactions or in-depth examinations at the discretion of the auditor.[9]

DCAA frequently takes aggressive audit positions. Fortunately for contractors, DCAA’s role in the procurement process is advisory.[10] DCAA is responsible for advising the contracting officer regarding the acceptability of incurred and estimated costs, reviewing the financial and accounting aspects of the contractor’s internal controls, and performing other analyses and reviews that require access to the contractor’s financial and accounting records.[11] DCAA does not have the authority to make final determinations regarding the allowability of costs, the contractor’s compliance with regulatory or contractual requirements, or the acceptability of the contractor’s business systems. The contracting officer has the exclusive authority to make those determinations.

Notably, contracting officers do not always adopt DCAA’s audit findings.[12] DCAA’s FY 2022 Report to Congress indicates that contracting officers sustained less than half the dollar value of DCAA’s audit exceptions.[13] This demonstrates the importance of responding thoroughly to adverse DCAA audit findings in order to present the contractor’s best defenses to the contracting officer. Audit responses can be particularly effective when they include a detailed contractual and legal analysis of DCAA’s audit position (including citations to applicable contract provisions, regulations, regulatory history, case law, and DCAA audit guidance).

DCAA’s Organization

DCAA’s organizational structure consists of a Headquarters, four Corporate Audit Directorates (CADs) organized by major contractors, three geographical regions (Eastern, Central and Western) for other contractors, and a Field Detachment that focuses on classified work.[14] Overall, DCAA has approximately 230 offices located throughout the United States, Europe, and the Middle East.[15]

DCAA’s Headquarters is located at Fort Belvoir, Virginia.[16] Effective October 1, 2016, DCAA reorganized to bring its largest, multi-segment contractors under CADs to improve efficiency, communication, collaboration, and customer service. Each CAD serves one or two of the six largest defense contractors and has approximately 300 employees.[17] The regions are headed by Regional Directors and include Regional Audit Managers that exercise line authority over designated field audit offices (FAOs).[18] Each Region has approximately 650 employees and serves 2,000 to 3,000 contractors.[19] The Field Detachment has approximately 500 employees and serves about 700 contractors.[20]

DCAA’s FAOs include resident offices, branch offices, and suboffices. DCAA established resident offices at specific contractor locations (including both regions and CADs) where the workload justifies a permanent staff.[21] Branch offices provide audit services within their assigned geographical areas.[22] Suboffices are extensions of branch offices established to provide additional geographical coverage.[23]

Overall, DCAA has approximately 4,000 professional employees.[24] Approximately 89% of those employees are auditors.[25] DCAA’s workforce is well educated — roughly 93% have a bachelor’s degree, 47% have a higher-level degree, and 19% are Certified Public Accountants (CPAs).[26] Approximately 10% of DCAA employees have other professional certifications, such as Certified Fraud Examiner (CFE), Certified Information System Auditor (CISA), or Certified Defense Financial Manager (CDFM).[27]

DCAA’s Audit Guidance

DCAA issues several types of audit guidance. Publicly available resources include the DCAA Contract Audit Manual (DCAM), the Selected Areas of Cost Guidebook (Guidebook),[28] Memoranda for Regional Directors (MRDs),[29] and Audit Programs.[30]

-

The DCAM is the primary resource for DCAA auditors. It provides technical audit guidance, audit techniques, audit standards, and technical policies and procedures for contract audits.[31] The DCAM also contains DCAA’s interpretation of applicable cost and pricing requirements.

-

The Guidebook replaced Chapter 7 of the DCAM. It provides interpretations and audit guidelines for the FAR Subpart 31.2 Cost Principles and related requirements.

-

MRDs provide supplemental audit guidance that may be incorporated into the DCAM simultaneously or at a later date.[32] Open MRDs supersede earlier DCAM sections.[33]

-

Audit Programs provide a roadmap for most types of audits. They include detailed guidance regarding the documents to be reviewed, the questions to be asked, the procedures to be followed, and the analyses to be conducted at each step of the audit.

DCAA’s audit guidance does not have the force and effect of law.[34] Nevertheless, it provides contractors valuable insight into what to expect from each type of DCAA audit as well as DCAA’s substantive interpretation of the applicable cost and pricing regulations. Contractors can also use DCAA’s published audit guidance to identify and respond to aggressive audit positions that may be inconsistent with DCAA’s official policies, procedures, and interpretations.

DCAA’s Audit Rights

DCAA’s audit rights are based on statute and contract.[35] DCAA’s statutory audit rights correspond roughly to the “examination of costs” and “certified cost or pricing data” paragraphs of FAR 52.215-2, Audit and Records – Negotiation. With regard to flexibly priced contracts, DCAA, as an authorized representative of the contracting officer, has the right to “examine and audit all records and other evidence sufficient to reflect properly all costs claimed to have been incurred or anticipated to be incurred directly or indirectly in performance of [the] contract.”[36] This includes the right to inspect contractor facilities engaged in contract performance.[37] With regard to contracts covered by TINA, DCAA, again as an authorized representative of the contracting officer, has the right to “examine and audit all of the [c]ontractor’s records … in order to evaluate the accuracy, completeness, and currency of the [contractor’s] certified cost or pricing data.”[38] This includes computations and projections related to proposals, discussions, pricing, and performance pertaining to the applicable contract, subcontract, or modification.[39]

Several other contract clauses allow DCAA to exercise audit rights on behalf of the contracting officer. For example:

FAR 15.408, Table 15-2 provides that, by submitting a proposal, the contractor grants the contracting officer, or an authorized representative, the right to conduct pre-award audits of “books, records, documents, and other types of factual data … that will permit an adequate evaluation of the proposed price.”[40]

The Allowable Cost and Payment clause allows the contracting officer to “have the [c]ontractor’s invoices or vouchers and statements of cost audited”[41] and identifies a list of “supplemental information” that may be required for incurred cost audits, including, among other things, a list of all internal audit reports, the contractor’s internal audit plan, board minutes, and contract briefings.[42]

The Payments Under Time-and-Materials and Labor-Hour Contracts clause allows the contracting officer, and by extension DCAA, to audit “vouchers and supporting documentation.”[43]

The Progress Payments clause requires the contractor to provide access to “reports, certificates, financial statements, and other pertinent information (including estimates to complete) reasonably requested by the Contracting Officer for the administration of this clause” as well as a “reasonable opportunity to examine and verify the [c]ontractor’s books, records, and accounts.”[44]

The Performance-Based Payments clause provides similar audit rights that also extend to “determinin[ing] that an event or other criterion prompting a financing payment has been successfully accomplished.”[45]

The Cost Accounting Standards and Disclosure and Consistency of Cost Accounting Practices clauses require the contractor to permit any authorized representative of the Government to “examine and make copies of any documents, papers, or records relating to compliance with the requirements of this clause.”[46]

DCAA has adopted an expansive interpretation of its audit rights. DCAA takes the position that, in addition to access to specific cost records, access to records refers to contractor policies, procedures, systems, management reports (including internal audit reports), personnel, board minutes, charter and bylaws, and “any other information source which affects and reflects the incurrence, control, and allocation of costs to contracts.”[47]

There is a strong argument that DCAA lacks authority to enforce this extraordinarily broad interpretation of its audit rights. In United States v. Newport News Shipbuilding and Dry Dock Co., the United States Court of Appeals for the Fourth Circuit held that DCAA lacked authority to subpoena the contractor’s internal audit reports.[48] The court explained that “DCAA does not have unlimited power to demand access to all internal corporate materials of companies performing cost-type contracts for the Government.”[49] The court further explained that DCAA’s statutory audit rights cover “objective factual information concerning contract costs, such as invoices, vouchers, and time logs, rather than … subjective assessments.[50]

DCAA’s position that it is entitled to interview contractor employees is equally tenuous. The applicable audit rights statutes afford the Comptroller General – but not the contractor or an authorized representative (DCAA) – the right to “interview any current employee” regarding transactions relating to Government contracts.[51] Likewise, the applicable audit rights clauses afford DCAA access to books, records, and various other types of information, but they do not suggest any right to interview contractor personnel.

Contractors who receive DCAA requests for internal audit reports, board minutes, or employee interviews should weigh their options carefully. There may be a legal basis to object to such overly broad requests. On the other hand, contractors also must consider the potential impact on their relationship with DCAA and the contracting agency, including the potential consequences of denial of access to contractor records, which we will address in Part 2.

Types of DCAA Audits

DCAA conducts many types of audits. For statistical reporting purposes, however, DCAA identifies four broad categories of audits: (1) Forward Pricing; (2) Incurred Cost; (3) Claims and Terminations; and (4) Systems, CAS, and TINA.[52]

Forward Pricing audits are generally completed before contract award at the request of the contracting agency.[53] The objective is to evaluate the contractor’s forward pricing proposal to assist the Procuring Contracting Officer (PCO) to determine a fair and reasonable price; rates and factors for the award; administration, modification, or repricing of contracts; and compliance with FAR Parts 15 and 31, CAS, and the solicitation terms.[54]

Incurred Cost audits are conducted after award and assist the cognizant Administrative Contracting Officer (ACO) to negotiate final indirect cost rates.[55] They examine the contractor’s indirect rate proposal to determine if the costs claimed are allowable, allocable, reasonable, and in accordance with contract terms, generally accepted accounting principles (GAAP), the cost accounting standards (if applicable), and other acquisition regulations.[56]

Claims and Terminations audits are typically conducted after award in response to requests from the contracting agency.[57] Claims audits evaluate the quantum aspect of a request for equitable adjustment or claim to provide the PCO a report regarding the acceptability of proposed or claimed costs and the reliability of the contractor’s supporting data.[58] The auditor’s evaluation focuses on determining the reasonableness, allocability, and allowability of the amounts proposed or claimed.[59] Terminations audits examine the contractor’s termination proposal to assist the Termination Contracting Officer (TCO) in the negotiation of a termination settlement.[60] They focus on determining if the contractor’s termination settlement proposal contains allowable costs; settlement expenses; applicable profit and/or loss; and proposed costs that are compliant with applicable acquisition regulations and the contract terms.[61]

Systems, CAS, and TINA audits may be requested by the contracting agency or initiated by DCAA.[62] Business systems audits support the ACO’s adequacy determination by examining the compliance of the contractor’s business systems with the applicable DFARS business systems requirements, including DFARS 252.215-7002, Cost Estimating System Requirements, DFARS 252.242-7004, Material Management and Accounting System, and DFARS 252.242-7006, Accounting System Administration.[63] CAS audits include: CAS Disclosure Statement audits to evaluate the adequacy and compliance of the contractor’s initial CAS Disclosure Statement and any revisions; CAS Compliance audits that evaluate the contractor’s disclosed policies, procedures, and practices used to estimate, accumulate, and report costs are compliant with applicable CAS criteria; and Cost Impact Proposal audits that evaluate the impact of a contractor’s CAS noncompliance or changes in cost accounting practices.[64] TINA compliance (defective pricing) audits evaluate whether the negotiated contract price may have been increased by the contractor’s failure to submit or disclose accurate, complete, and current certified cost or pricing data.[65]

DCAA Audit Statistics

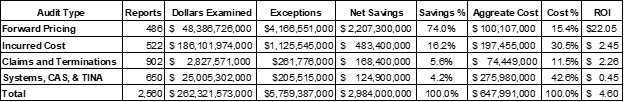

In FY 2022, DCAA issued 2,560 audit reports, examined $262.3 billion in costs, identified $5.7 billion in audit exceptions, and claimed $3.0 billion in net savings at an aggregate cost of $647.8 million, representing a claimed return on investment (ROI) of $4.60 per $1 of cost incurred.[66] The table below summarizes DCAA’s results by audit type for FY 2022.[67]

As reflected in the table above, Forward Pricing audits net the highest return on investment ($22.05 net savings per $1 invested).[68] They accounted for 74.0% of the net savings but only 19.4% of the audit reports generated and 15.4% of the costs incurred by DCAA.[69] At the opposite end of the spectrum, Systems, CAS, and TINA audits represented the lowest return on investment ($0.45 net savings per $1 invested).[70] They accounted for only 4.2% of the net savings but 25.4% of the audit reports generated and 42.6% of the costs incurred by DCAA.[71] Incurred Cost and Systems, CAS, and TINA audits represented 16.2% and 5.6% of DCAA’s claimed net savings and 16.2% and 5.6% of DCAA’s aggregate costs, respectively.[72]

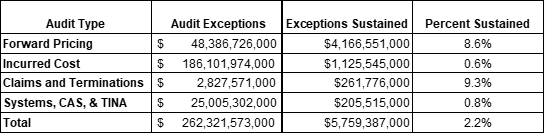

DCAA also tracks the dollar value of audit exceptions by contract type. The details for FY 2022, based primarily on audit reports issued in prior years, are reproduced below:[73]

Surprisingly, contracting officers sustained less than half (46.9%) of the dollar value of DCAA’s exceptions.[74] The percentage ranged from a low of 26.2% for Incurred Cost audits to a high of 56.2% for Forward Pricing audits.[75] The rates for Claims and Terminations and Systems, CAS, and TINA audits were 26.2% and 45.4%, respectively.[76]

DCAA also tracks the average duration of audits by type. In FY 2022, DCAA took an average of 88 days to complete Forward Pricing audits as measured from the date DCAA received the audit request or an adequate proposal to the date of the audit report.[77] At the other extreme, DCAA took an average of 280 days to complete Systems, CAS, and TINA audits, as measured from the date the audit commenced to the date of the audit report.[78] The average time required for Incurred Cost and Claims and Termination Audits in FY 2022 was 204 days and 148 days, respectively.[79]

DCAA’s audit statistics tell an interesting story. Forward Pricing audits took the least time (88 days), resulted in the majority of net savings (74%), and had the highest sustain rate (56.2%) and ROI ($22.05).[80] Systems, CAS, and TINA audits required the most time (280 days), resulted in the lowest percentage of net savings (4.2%), and had the second lowest sustain rate (28.3%) and the lowest return on investment ($0.45) of any audit type.[81] Nevertheless, DCAA invested nearly twice as much in Systems, CAS, and TINA audits ($276 million) as it did in Forward Pricing audits ($100.1 million).[82]

Conclusion

We have now covered DCAA’s mission, organization, audit guidance, and audit rights. We have also addressed the types of audits DCAA conducts and observations regarding recent audit statistics. The next edition of the Cost Corner will focus on DCAA’s audit procedures and best practices for contractors dealing with DCAA audits.

/>i

/>i