On June 22, 2023, the US Senate passed a resolution consenting to the ratification of the Income Tax Treaty between Chile and the United States (Treaty). The resolution opens the door for President Biden to formally ratify the Treaty, which he is expected to do. The Treaty was initially signed by both countries in 2010 and ratified by Chile in 2015.

The United States currently has only two income tax treaties in force with Latin American countries – Mexico (1992) and Venezuela (1999), but Chile is poised to become the third country if the Treaty is ratified.

The Treaty was initially signed in 2010, and was previously considered (but not approved) by the Senate Foreign Relations Committee on three occasions (in 2014, 2015, and 2022). Following final committee approval on June 1, 2023, the long-awaited Senate resolution was passed on June 22, 2023.

A major impetus to ratify the Treaty over the past decade has been the threat to US businesses from Chile’s increase of its corporate tax rate in 2014. Due to limitations on foreign tax credits in the United States, US businesses with Chilean operations could face substantially higher worldwide tax burdens without the Treaty. The Treaty would address these concerns by expressly allowing a foreign tax credit against US taxes for Chilean income taxes paid.

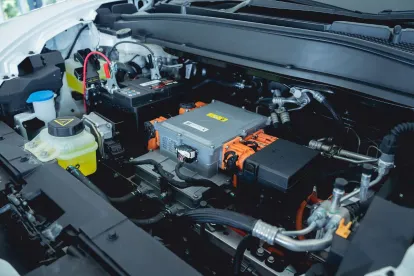

The threat of increased tax burdens took on increased importance because of the growing need for critical minerals. Lithium in particular, as Senate Majority Leader Chuck Schumer noted, is a key component in most electric vehicles as well as consumer electronics. Chile is home to the world’s largest lithium reserves. Crucially, in April 2023, Chilean President Gabriel Boric announced proposals to shift the country’s lithium industry extraction model from the current royalty-based concessions to private entities, including to one US company, to models in which Chilean state-owned entities had majority interests (alongside private investors) and control.

What Does the Treaty Do?

The Treaty includes generally follows the 2006 US Model Treaty. Certain key provisions include the following:

-

Reduced Withholding Rates. The Treaty reduces the withholding rates on dividends, interest, and royalties to the following rates:

-

Dividends: 15% generally and 5% if the beneficial owner is a company that owns at least 10% of the voting stock of the company paying dividends (subject to certain modifications in the event of a change in Chilean tax law under the current two-tier system of Chilean corporate income tax).

-

Interest: 15% generally for the first five years after the date the interest withholding provision takes effect and 10% thereafter. Four percent in certain cases (including for interest paid to banks and insurance companies).

-

Royalties: 10% or 2%, depending on the type of property from which the royalties are derived.

-

-

Permanent Establishment. Consistent with other modern US tax treaties, the Treaty provides additional protections requiring that a permanent establishment (PE) be present before certain types of business profits and other income generated by a resident of one country before the other country may tax such income. The provision generally follows the 2006 US Model Treaty, but also provides that a PE will also be deemed to arise if services are performed for a specified period of time and if certain resource exploration activities are conducted.

-

Limitation on Benefits. Consistent with other modern US tax treaties, the Treaty contains a comprehensive limitation on benefits (LOB) provision that restricts Treaty benefits to persons that meet certain substance requirements. The provision follows the 2006 US Model Treaty LOB provision but adds a headquarters company test and a provision addressing certain triangular structures using a PE in a third country.

-

Exchange of Information. The Treaty includes a comprehensive exchange of information provision requiring exchange of information between authorities of the United States and Chile to carry out the provisions of the Treaty.

The Senate’s resolution included two substantive reservations. First, the resolution provides that the Treaty will not prevent the United States from imposing the Base Erosion and Anti-Abuse Tax (BEAT) on a company that is a US resident or a company that is a Chilean resident with profits attributable to a US PE. Second, the resolution amends the relief from double taxation provision of the Treaty to account for changes to US federal income taxation of certain foreign derived dividends under the Tax Cuts and Jobs Act of 2017 (TCJA). The two reservations mean that the Treaty will need to be sent back to Chile and approved by the Chilean government before the Treaty can enter into force. The Senate’s resolution also included a declaration that future tax treaties need to reflect changes to US federal income tax law due to the TCJA, signaling that future US tax treaties and model treaties may include provisions expressly addressing US federal income tax concepts such as the BEAT.

/>i

/>i