China’s life sciences sector is undergoing significant transformation due to recent technological advancements, legislative changes, and regulatory reforms aimed at balancing risk mitigation with innovation. As explored in this GT Advisory, these shifts are fostering growth within the sector:

- Record-breaking number of clinical trial registrations in 2023

- Accelerated approval pathways for foreign product launches with the emphasis on orphan products

- Shanghai Free Trade Zone’s Whitelist facilitating cross-border data transfers

China Sees Record-Breaking Clinical Trial Registrations, but the United States’ New Policy May Overshadow Long-Term Growth

In 2023, China saw a 26.1% surge in clinical trial registrations, reaching 4,300, compared to 3,410 in 2022. This marks a consistent five-year growth trend, with an average annual increase of 16%. Key insights from the Center for Drug Evaluation (CDE) include:

- Small molecule drugs continued to be the primary focus, making up 76.0% of all new registrations, while studies involving biologics expanded to 22.2%.

- Domestic sponsors accounted for 91.7% of new registrations, while the number of overseas sponsors declined 3.2% in 2023 compared with 2022.

- Trials for Class I innovative new drugs continued their upward trajectory; in this category, small molecules constituted 53.7% of new registrations and biologics made up 44.8%.

- 40 innovative drugs registered in 2023, with 90% of them held by domestic market authorization holders. The average approval time for innovative drugs in 2023 was 7.2 years, shorter than 7.6 years in 2022.

- Oncology treatments, comprising both small molecules and biologics, accounted for over 70% of new registrations, with large molecules representing 41.5% and chemical anticancer drugs representing 28.7%.

- Phase I study applications comprised 42.1% of all new trial registrations, followed by Phase II (21.3%) and Phase III (15.8%).

Despite China’s efforts to support drug development, the United States has, in the past, emphasized that many of the U.S. Food and Drug Administration’s requirements must be undertaken in the drug development process. Now, the United States’ emphasis on sufficient ethnic representation for clinical studies under the FDA’s recent draft guidance may divert resources from China. This new compliance requirement may compel Chinese companies to relocate resources toward the United States so they can align their drug development with global companies’ expectations around the pace of dealmaking or ultimate product approval in the United States.

Proposed Refinement to Accelerated Drug Approval Pathways

On June 25, 2024, the National Medical Products Administration (NMPA) of China proposed streamlining the fast-track approval process for overseas new drugs with unmet medical need and is seeking public feedback until July 24, 2024.

The draft proposal, “Announcement on Further Optimizing the Review and Approval of Overseas Listed Drugs in Urgent Clinical Needs,” outlines several refinements to accelerate the drug approval process, such as clinical trial waivers and reduced inspection timelines. In recent years, China’s demand for new overseas drugs, especially for orphan drugs, has increased. To meet the needs of patients requiring these specialized treatments, NMPA proposed to refine the approval process for orphan drugs in April 2024.

Some significant points include:

- Clinical trials could be waived if (i) the drug sponsor has submitted to Center for Drug Evaluation (CDE) the complete set of clinical trial data from both domestic and foreign sources, clinical trial literature, data from international multicenter drug clinical trials conducted in China, and other supportive materials demonstrating no racial differences, and (ii) CDE and the applicant have reached consensus on the waiver.

- The original 90-day inspection period for orphan drugs will be reduced to 70 days. If during registration inspection NMPA solely inspects the product samples, the timeframe will further shorten to 40 days.

- CDE will prioritize the review of the new drug applications (NDA) that are eligible for an accelerated pathway and will provide intensified guidance to the applicant.

Relaxing Cross-Border Data Transfers in the Biomedical Sector

Established in 2013 as China’s first special economic zone, the Shanghai Free Trade Zone (Shanghai FTZ) serves as a pioneering platform for economic reform and implements a range of distinctive policies designed to draw foreign investment. After the Shanghai government introduced policies designed to cultivate growth within the biomedical industry, and establish over 50 multifunctional innovative headquarters by 2050, the sector has emerged as a magnet for foreign investment.

In its efforts to foster innovation and grow business, Shanghai FTZ has introduced a whitelist to streamline cross-border data transfers (CBDT) specifically for biomedical enterprises.

Under the previous Data Security Law, Personal Information Protection Law (PIPL) and other regulations, a data exporter must report or file its CBDT activities with the Cybersecurity Administration of China (CAC). The data exporter would undergo a mandatory security assessment when such CBDT activities met the specified thresholds, or, if such thresholds were not met, enter into the CAC’s standard contract clauses (SCC) and file the SCC and the privacy impact assessment (PIA) with CAC. These time-consuming requirements may result in substantial compliance costs for data exporters.

In February 2024, the Lingang Area of the Shanghai FTZ implemented the “Data Cross-Border Flow Classification and Grading Management Measures (For Trial Implementation).” The new policy created general data lists, allowing data to flow freely after the data exporter has filed with the local governmental authority, i.e., the Management Committee of Lingang Area, and has met the relevant regulation requirements. The general data lists introduce an exemption from the abovementioned clearance process overseen by CAC, saving time and money.

In May 2024, the Lingang Area Management Committee released the first batch of general data lists (Lingang Whitelist), which included the biomedical sector. This move has clarified the data that can flow freely under specific scenarios, potentially helping biomedical enterprises looking to expand their global footprint.

| 1. |

Covered Scenarios and Categories of Data |

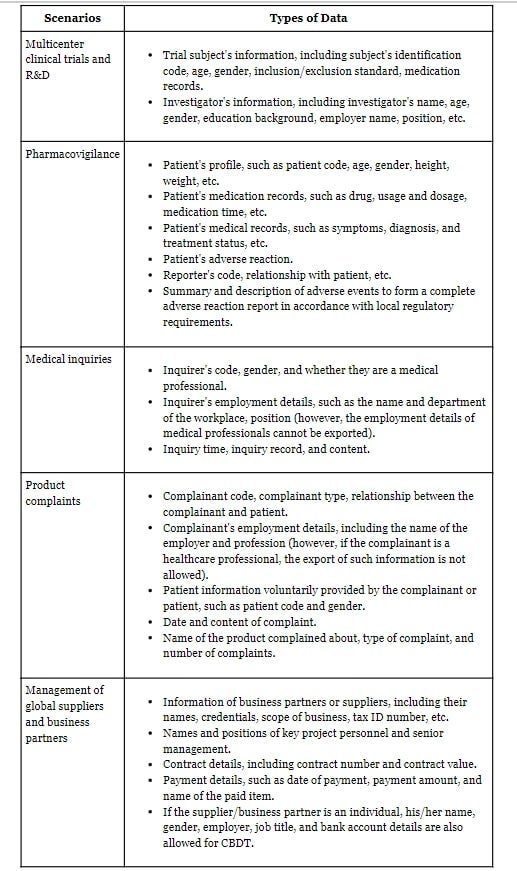

The current Lingang Whitelist for the biomedical sector addresses the CBTD needs in five typical scenarios: (i) multicenter clinical trials and research and development (R&D), (ii) pharmacovigilance, (iii) medical inquires, (iv) product complaints and (v) management of global suppliers and business partners, and covers following types of data:

Notably, the Lingang Whitelist still mandates the de-identification of personal data, particularly those pertaining to trial subjects, patients, inquirers, and complainants, prior to export.

| 2. | Applicability |

The Lingang Area Whitelist applies to data exporters registered in the Shanghai FTZ whose cross-border flow activities occurred in the Lingang Area, by which means the node of data export needs to be located within the area.

For the whitelist to apply to the biomedical sector, the data processor should be an enterprise, public institution, association, or organization engaged in R&D, production, and sales of products and services related to biomedical and pharmacology. This includes pharmaceuticals, medical devices, diagnostic reagents, biological preparations, and other related services.

In alignment with China’s existing data security and privacy framework, the Lingang Area Whitelist is not applicable under the following conditions: (i) if the data exporter has been designated as a “Critical Information Infrastructure Operator” (CIIO) by Chinese government authorities, (ii) if the data exporter, in any given year starting from Jan. 1, is exporting personal data of at least 100,000 individuals or any sensitive personal data, and (iii) the export of human genetic resources information, which is subject to clearance by China's National Health Commission.

| 3. |

Filing Procedures |

Prior to CBDT, the data exporter must prepare and submit specific filing materials, including a description of the intended export activities, to the Lingang Area Management Committee. The Management Committee will then conduct a formal review to confirm whether the types of data slated for export are included in the Whitelist. If the review is successful, the Management Committee will issue a filing certificate, valid for one year, to the data exporter.

After receiving the certificate, the data exporter must document and back up the data exportation records. The Management Committee reserves the right to conduct random checks or on-site inspections. If it finds discrepancies between the actual data export and the data export activities recorded in the filing (for instance, if the data exporter is exporting certain types of data that were not previously filed), the Management Committee will suspend the data transfer. The data exporter will then be required to rectify the discrepancies and re-file CBDT with the Management Committee.

| 4. |

Next Steps |

As outlined in a policy introduction conference held in June, the Lingang Area Management Committee plans to expand the existing Whitelist with the goal of including more scenarios and categories of data, thereby further facilitating CBDT. The committee welcomes opinions and feedback from industry stakeholders to ensure the updates are beneficial and relevant.

Conclusion

While recent developments may have impacted investment in China’s life sciences sector, policy makers have taken action to attract foreign investments. Multinational corporations operating in the biomedical sector within China may find it advantageous to utilize the Lingang Whitelist mechanism for their CBDT needs. This mechanism could streamline their data transfer processes and enhance their operational efficiency. The Chinese government’s efforts to develop a cost-efficient launch pathway aims to reignite foreign companies’ interest in China.

Hong Zhang also contributed to this article.

/>i

/>i