Since it came into force on 1 July 2011, the impact of the UK Bribery Act 2010 (the Act) on the giving of corporate hospitality, gifts and other expenses has raised concerns among those who fall under the Act’s jurisdiction. This is because the offences in the Act are drafted so broadly that, at first glance, it appears the provision and acceptance of many types of corporate hospitality fall within the scope of the offences and consequently may be illegal.

While the US Foreign Corrupt Practices Act 1977 contains a defence for certain legitimate promotional expenses, that is, reasonable and bona fide expenditure, such as travel and lodging expenses, incurred by or for a foreign official, party, party official, or candidate, that are directly related to the promotion, demonstration, or explanation of products or services or the performance of a contract, the Bribery Act contains no corresponding defence.

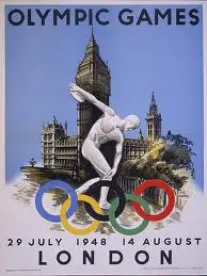

In light of the forthcoming 2012 Olympic Games in London, many have expressed concern that those subject to the Act will be unable to accept or receive corporate hospitality. It has been suggested that simply purchasing tickets for the Olympic Games at their face value for a client could constitute an offence. However, since the Act came into force last year, a growing body of guidelines has been produced by the UK Government to assist organisations with managing their policies on the provision and acceptance of corporate hospitality. The Ministry of Justice published, on 30 March 2011, its guidance on the Act, with further commentary on what the Act terms as “adequate procedures” for the prevention of bribery. The Serious Fraud Office (SFO), as the investigating and prosecuting authority, has also produced guidance.

What are The Offences?

There are four offences under the Act: the general offences of paying and receiving bribes, the bribery of foreign officials, and the failure of commercial organisations to prevent bribery. The most notable, and controversial, offence is the new offence that can be committed only by “commercial organisations” (i.e., companies and partnerships).

It is an offence for a commercial organisation to fail to prevent a person associated with it (i.e., its employees, consultants and advisers) from bribing on its behalf (Section 7(1)). The organisation has a defence if it can show it had adequate procedures in place to prevent bribery (Section 7(2)).

How Can Organisations Manage the Risk of Falling Foul of The Bribery Act?

Chris Walker, Head of Policy at the SFO, commented in February 2011:

Sensible and proportionate promotional entertainment expenditure is not an offence under the Act. However, when hospitality is done so that people will be induced to act in a certain way — when the expenditure is beyond what is sensible and proportionate, the relevant provisions of the Act will be triggered.

The key message is that corporate hospitality should be both offered and accepted in a manner that is, and is perceived to be, proportionate and sensible. This will depend on a number of factors such as industry practice, the seniority of the persons involved and the timing of the corporate hospitality, i.e., part of ongoing good client relations, or an isolated episode to “buy” new client work or influence its future reward.

The SFO has stated that it will look to see whether or not

- The company has issued a clear policy on gifts and hospitality.

- The scale of the expenditure in question is within the limits set out in the policy and, if not, whether the person making it asked a senior colleague for permission to make it.

- The expenditure was proportionate, based on who received it.

- There is evidence that the company recorded the expenditure.

- The recipient was entitled to receive the hospitality under the law of that recipient’s country.

In this regard, the SFO has suggested that what is sensible and proportionate will be judged by reference to the context in which it is given. For example, the effect of the Act does not mean that an organisation must take extreme anti-avoidance measures such as prohibiting employees from attending drinks hosted by a client, or preventing an employee from taking a key existing customer to a Six Nations rugby game.

In the context of the forthcoming Olympics, it would seem proportionate for a manager to make a request to its senior management to use tickets obtained by the company to take an existing client to an event to maintain good client relations. It perhaps would not be proportionate for a mining company to offer a Russian public official a five-day, all-expenses paid trip to London to attend an Olympic event, with a view to also discussing the grant of a related Russian mining licence that pertains to the mining company’s proposed strategic investment.

Practical Steps

Organisations should consider issuing guidelines to all staff on how to deal with any offers of Olympic tickets they receive, or they might consider offering to their own clients. These guidelines should include appropriate reporting procedures to notify senior management and/or the relevant compliance personnel. These could include, for example, completing a prescribed form requesting approval for accepting or offering hospitality above a certain value. Senior management should consider these requests with regard as to whether or not the hospitality is proportionate in the context of their business environment. Other factors to consider would be whether there are any “add-ons,” such as travel and accommodation, and the timing of the offer, i.e., in expectation of actual or anticipated business. Consideration also should be given to whether the hospitality is permissible under the laws of the country in which the recipient is based. All corporate hospitality should be reported accurately in the organisation’s books and records.

To be prepared for the Olympics, the winning formula for all organisations is clear: ensure that proper procedures and policies are in place, encourage transparent reporting, document all decisions, and take proportionate and well-considered actions.

/>i

/>i