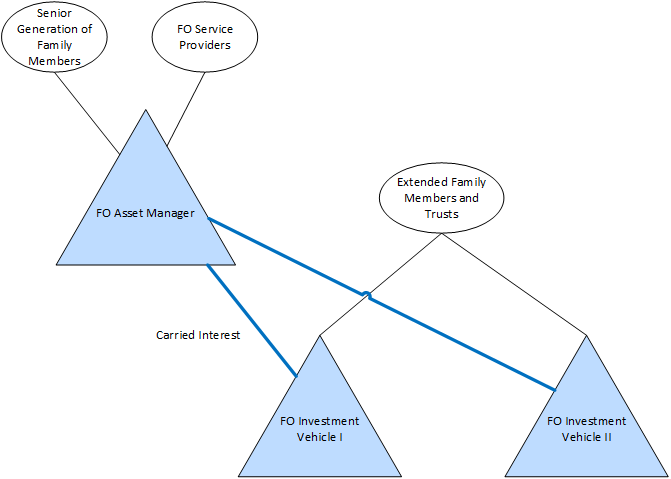

Should a family office asset manager receive a carried interest from the family investment vehicles it manages? If yes, how does the carried interest align with the intergenerational planning of the family office? If no, what is the tax cost of using a fee instead? These basic questions are common to nearly all family offices, and ones that family offices would do well to revisit from time to time.

The key question: what is the right decision for your family office? We outline important considerations below.

The Argument for a Carried Interest

The argument in favor of carried interest is fairly straightforward: it achieves the economic equivalent of full deductibility for the expenses of the family office asset manager.

Under the structure above, an allocation of profit away from the family investment entities to the family asset manager means that the investment entities never take into income the amounts used to pay the asset manager. This can be thought of as the economic equivalent of a full deduction for these expenses. Prior to 2018, family offices that did not use a carried interest but paid a management fee would have had a miscellaneous itemized deduction for the fee (subject to a floor of 2% of AGI). This might not have been equivalent to a full deduction due to the various limits on itemized deductions and the alternative minimum tax, but it was for many an acceptable result. The Tax Cuts and Jobs Act (the “TCJA”) changed all that by disallowing miscellaneous itemized deductions until January 1, 2026. Therefore, the cost of the family office, without a carried interest, is now fully non-deductible.

The changes made by the TCJA happily coincided with a significant decision of the Tax Court – Lender Management LLC v. Commissioner. In Lender, the Tax Court held that a family office asset manager that managed assets for a group of family investment vehicles was engaged in a trade or business. Just as important as the legal holding in Lender, however, was the Tax Court’s implicit blessing of a structure that used a carried interest to compensate the family office asset manager.

Confronted with the Lender case and the TCJA limit on deductions, many family offices began to consider if they could make a carried interest work for them.

Caution: Roadblocks Ahead

Unfortunately for many family offices, the carried interest could work too well. If the investment manager entity hits a home run, does it take too much profit away from the trusts and other family members who make up the family investment vehicle? Could a carried interest result in the movement of wealth to the most senior generation who would typically control the asset manager?

A common instinct in such a circumstance is to try to cap the carried interest. Caps, however, are less than ideal as it begs the question of whether the entire carried interest arrangement will be respected by the IRS. If the carried interest is capped and made out of a predictable income stream, it may not be respected as a carried interest at all. Instead, it would be recharacterized as a guaranteed payment, which would be akin to a non-deductible fee under these circumstances.

Another approach might be to have the family office asset manager owned in the same proportions as the family office investment vehicles. This approach also poses challenges as identity of ownership could make it harder to respect the “separateness” of the asset manager from the investment vehicle. Moreover, identity of ownership is impractical or unfeasible in many family office structures as the family investment vehicles paying the carry will themselves have varied ownership.

Threading the Needle

In light of the above, crafting the terms of a carried interest to satisfy the various and at times conflicting needs of a family office must be done elegantly. Consideration should be given to a waterfall with various tiers, catch-ups, and hurdles, which may need to be refined from time to time, to achieve the benefits of full deductibility without the downsides of a straight carried interest.

/>i

/>i