Current state

Brazil, “o país do futebol”, is arguably the country most synonymous with football. Yet despite the national team’s continuous success, and some of the largest, most ardent, fan bases in the world, Brazilian football clubs trail European clubs significantly in financial fire power. Brazilian clubs generate just 2% of global football revenue.

The COVID pandemic has significantly weakened the already poor financial position of Brazilian clubs. A recent study of 23 Brazilian clubs by EY identified that:

-

Debt levels in 2020 stood at R $10.3bn (US $1.9bn), up 19% from 2019, an average of R $450m (US $83m) per club; and

-

Combined Revenue fell 14% year-on-year (YoY) to R $5.3bn (US $998m). Further, commercial revenue made up just 13% of total income compared to an average of 43% amongst European clubs analysed in the Deloitte Money League.

On top of the precarious financial position, for decades Brazilian clubs have been stricken with poor governance by elected officials, who are often unpaid, appointed based on popularity and who offer short-term fixes. As a result Brazilian football has been an unattractive proposition for many outside investors.

Law change

In a bid to improve the ownership structures of clubs and open them up to investment opportunities, Law No.14,193 was promulgated on August 6th, 2021.

This law created a new corporate structure, Sociedade Anônima do Futebol (SAF, “football corporation”), which may be constructed in three ways:

-

The club can be directly transformed into a SAF;

-

The club can transfer only its assets and the football operations to a SAF; or

-

A new SAF may be established.

The SAF has to issue a special type of share, similar to a “golden share”, to the original founding legal entity which retains certain veto rights such as changes to the SAF’s name and symbols or movement of its location.

Given the indebtedness of Brazilian football clubs, a key area of the new law is that the original club, not the SAF, retains the clubs’ debts with an obligation to settle them, generally within 10 years. In exchange for the debt remaining with the founding entity, the SAF has to pay the original club a percentage of current revenues and dividends as a shareholder of the SAF.

How will the new law help attract investment?

-

Improved governance and transparency – the new law requires disclosure of owner and beneficiary details from entities with 5% or more equity in the SAF. Additionally, corporations will need to publish corporate and financial information often.

-

Simplified Tax Regulations – for the first five years from incorporation, football corporations will pay an aggregated tax of 5% of their total revenues, excluding revenue from the sale of players. After this period, the tax rate drops to 4% with no exclusions.

-

More robust valuation – the assets of football departments that are to be transferred to the new corporation, such as player contracts and club-owned stadiums, will need to be valued by specialist firms using proper procedures. This could be a useful tool in negotiations with the original club where passionate views may not always reflect economic reality.

Opportunity for investors

There were 874 active Brazilian professional clubs in 2019. The quality of football talent in Brazil is evidenced by the FIFA Global Transfer Report 2021 which shows that Brazil nationals comprise by far the highest levels of international transfers out of any nationality. For men’s professional football, Brazilian nationals made up 1,749 transfers out of a total of 18,068 international transfers for 2021.

Brazilian football has a huge fan base of an estimated 126 million people providing vast commercial opportunities to potential investors. Particular areas of potential revenue growth are:

-

Broadcasting income - Brazilian clubs have agreed on broadcast contracts individually since 2011 and significant disparities in the allocation of broadcasting revenues still remain. The TV rights contract for the main national tournament (Brasileirão) expires in 2024. Accordingly, there is scope for new broadcasting rights to be collectively negotiated by leveraging joint bargaining power;

-

Commercial income - including sponsorships, merchandise, and matchday revenues;

-

New league – top clubs have expressed the belief that the new breakaway league, Liga Do Futebol Brasileiro (Libra), run by a new league body independent of the CBF, will generate a better financial outlook through:

-

Improved commercial structure;

-

Amended revenue distribution model to level the financial playing field; and

-

Better organization.

It’s unclear whether an increased investment will result in increased competition. This has generally not been the case in major European leagues over the past decade, with a handful of “super clubs” continuing to win the majority of domestic trophies despite independent governing bodies.

Investing activity

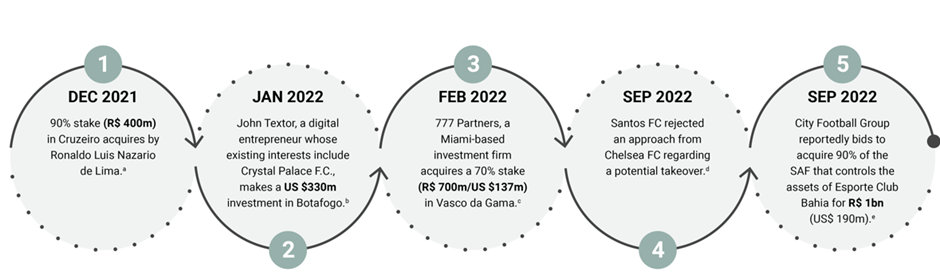

The new law has already attracted significant investment from high-net-worth individuals, investment companies, and international football clubs.

Risk considerations for investors

These huge investment opportunities are not without risk and investors should take a robust approach to due diligence, which assesses factors beyond the club’s finances and operations and is mindful of the unique risks of the Brazilian market.

Due diligence should also assess reputational, integrity, legal, and regulatory risks, as such issues that could cause an erosion of financial value in the future if they emerge.

Below are a few key questions that investors should look to answer:

Integrity and reputation:

-

What is the reputation of existing shareholders who will be the recipient of investment funds? Are there potential issues around political exposure, sanctions,corruption, or other regulatory risks?

-

Are those tasked with governance and stewardship over the management of the club going forward trustworthy? Do they have any reputational issues which could threaten the culture, image, and future success of the club?

-

Do any of the major third-party vendors or partners have any reputational or regulatory issues?

-

Has there been sufficient scrutiny of financial information to ensure it is truly reflective of the club’s position? Is there a comprehensive understanding of how revenues and cash flows are generated? Has there been a review and verification of quality of earnings to ensure they are sustainable and correctly reported?

-

Is there comfort that the corporation has policies and controls to ensure proper stewardship over investment funds? Are controls appropriate to mitigate the risk of financial leakage and misappropriation?

-

What checks have been conducted to ensure bribes or kickbacks have not been concealed in everyday transactions?

Legal and regulatory:

-

Are there any unforeseen risks for the football corporation relating to the debts of the original club? Is there a possibility that new owners become jointly liable if debt reduction targets are missed?

-

Have all existing contracts been terminated upon the transfer of assets to the new football corporation? If not, are there any contractual obligations to be considered?

-

What are the regulatory requirements of the administrative entities governing the football corporation, such as FIFA and the CBF? Are there any disciplinary sanctions that can be imposed for issues such as overdue payables?

Assessment of such factors in addition to financial due diligence will assist investors in obtaining a better understanding of the football corporation. This will reduce uncertainty and identify potential issues impacting the deal pricing.

Reecha Patel also contributed to this article.

/>i

/>i