On December 28, 2015, the U.S. Department of Commerce, Bureau of Industry and Security (“BIS”) published a proposed rule revising its guidance on charging and penalty determinations in administrative enforcement actions under the Export Administration Regulations (“EAR”). The proposed changes would bring the agency’s guidance closely in line with the Economic Sanctions Enforcement Guidelines promulgated by the Department of the Treasury, Office of Foreign Assets Control (“OFAC”) and provide greater predictability and transparency to BIS administrative penalties. The proposed revisions to the BIS’s Guidance on Charging and Penalty Determinations (Supplement No. 1 to part 766 of the EAR) are open for comment until February 26, 2016.

Alignment with OFAC Guidelines

BIS implements the EAR under the International Emergency Economic Powers Act (“IEEPA”), the same statutory authority by which OFAC implements most of its sanctions programs. Under IEEPA, criminal penalties can reach 20 years imprisonment and $1 million per violation, and administrative monetary penalties can reach $250,000 or twice the value of the transaction, whichever is greater.

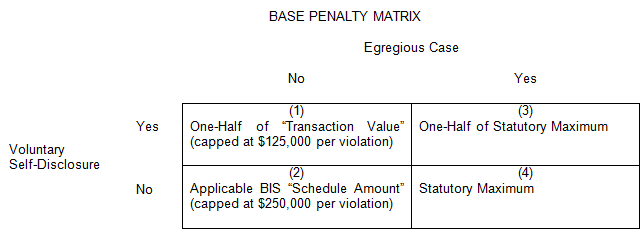

The proposed rule significantly revises BIS’s Guidance on Charging and Penalty Determinations and sets forth the factors which BIS would consider: (i) when setting penalties in settlements of administrative enforcement cases; and (ii) in deciding whether to pursue administrative charges or settle allegations of apparent EAR violations. Following OFAC’s lead, base penalty assessments under the proposed rule would largely turn on whether a case is “egregious” or “non-egregious” and whether the case resulted from a voluntary self-disclosure (“VSD”).

Egregious v. Non-Egregious Cases

In cases in which a civil monetary penalty is considered, BIS would make a determination as to whether a case is “egregious” for purposes of the base penalty calculation. Similar to the OFAC Guidelines adopted in 2009, the egregiousness determination of a case would be based on an analysis of several factors with substantial weight given to considerations of: (i) willful or recklessness violation of law; (ii) awareness of the conduct giving rise to an apparent violation; (iii) harm to regulatory program objectives; and (iv) individual characteristics of the parties involved. Cases determined to be egregious would represent those cases involving the most serious violations and would face higher civil penalties. BIS anticipates that the majority of violations it investigates under the revised BIS Guidance would rather fall into the non-egregious category.

In cases in which a civil monetary penalty is considered, BIS would make a determination as to whether a case is “egregious” for purposes of the base penalty calculation. Similar to the OFAC Guidelines adopted in 2009, the egregiousness determination of a case would be based on an analysis of several factors with substantial weight given to considerations of: (i) willful or recklessness violation of law; (ii) awareness of the conduct giving rise to an apparent violation; (iii) harm to regulatory program objectives; and (iv) individual characteristics of the parties involved. Cases determined to be egregious would represent those cases involving the most serious violations and would face higher civil penalties. BIS anticipates that the majority of violations it investigates under the revised BIS Guidance would rather fall into the non-egregious category.

Voluntary Self-Disclosures Submissions

As with the OFAC Guidelines, the second most significant component to the base penalty calculation is whether a VSD has been submitted. Although no longer listed as a mitigating factor in and of itself, the credit accorded to a VSD would be built into the determination of the base penalty amount under the proposed rule. In keeping with BIS’s longstanding policy of encouraging voluntary notifications of violations, violations disclosed in a complete and timely VSD would be afforded more significant deductions in the base penalty amount than it would otherwise receive were BIS to discover the matter independently. In non-egregious cases, submitting a VSD would reduce the base penalty to one-half of the transaction value (capped at $125,000 per violation). In egregious cases, submitting a VSD would reduce the penalty to one-half of the statutory maximum penalty. However, failing to submit a VSD in an egregious case would result in a base penalty based on the full applicable statutory maximum, and a base penalty based on the full applicable schedule amount (capped at a maximum base amount of $250,000 per violation) for non-egregious cases.

BIS’s formula for assessing penalties follows the following formula:

Adjustments to Base Penalty

Once the base penalty amount has been determined, BIS would consider factors set forth in the proposed BIS Guidance to determine whether the base penalty amount should be adjusted downward or, subject to the statutory maximum, upward. The proposed rule further stipulates that BIS will generally reduce the base penalty amount between 25 and 40 percent for exceptional cooperation, and up to an additional 25 percent for first offenses and for transactions where a license was likely to be approved.

Other Notable Proposed Changes

The proposed rule seemingly provides BIS greater flexibility in considering factors most relevant to a particular case. The proposed rule would allow BIS, in appropriate cases in the context of settlement negotiations, to suspend or defer payment of a civil penalty, taking into account whether the Respondent has demonstrated a limited ability to pay, whether the matter is part of a global settlement with other U.S. government agencies, and/or whether the Respondent will apply a portion or all of the funds suspended or deferred for purposes of improving its internal compliance program.

Penalties for settlements reached after the initiation of an enforcement proceeding and the filing of a charging letter would generally be higher than those described by BIS Guidance for pre-enforcement settlements.

In summary, the proposed BIS Guidance repeats a frequent BIS admonition to industry: When confronting a violation of the EAR, limit and cabin-in potential penalties by submitting a timely and complete voluntary self-disclosure of the violation. We will continue to monitor developments closely and will issue additional updates as appropriate.

/>i

/>i