Number of Bankruptcy Filings

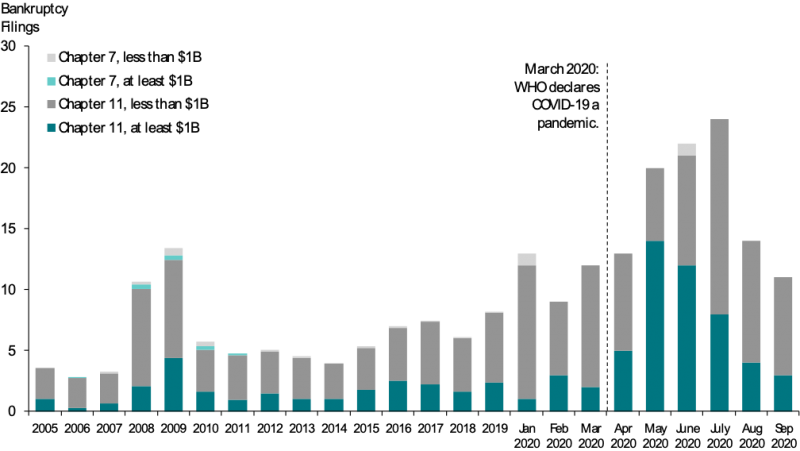

As of September 30, 2020, 138 companies with over $100 million in assets have filed for Chapter 7 or Chapter 11 bankruptcy in 2020.

The number of bankruptcy filings increased sharply following the start of the COVID-19 pandemic in March 2020.

138: Number of bankruptcy filings in Q1–Q3 2020.

From April 2020 to September 2020, the average number of monthly bankruptcy filings was 17. This is considerably higher than the monthly averages following the onset of the 2008 financial crisis (11 in 2008 and 13 in 2009).

In July 2020, 24 companies with over $100 million in assets filed for bankruptcy, nearly four times the average rate of 6 filings per month in 2005–2019. This is the second-highest number of bankruptcy filings in a single month since 2005, behind only the 25 bankruptcy filings in March 2009.

The number of bankruptcy filings by companies with over $100 million in assets appears to have returned to lower levels after peaking in July 2020. There were 14 and 11 such bankruptcies in August 2020 and September 2020, respectively.

Figure 2 Monthly Chapter 7 and Chapter 11 Bankruptcy Filings 2005–Q3 2020

Source: BankruptcyData

Note: Only Chapter 7 and Chapter 11 bankruptcy filings by companies (both public and private) with over $100 million in assets are included. For 2005–2019, values are monthly averages. For companies where exact assets are not known, the lower bound of the estimated range is used. Asset values are not adjusted for inflation. The World Health Organization (WHO) declared COVID-19 a pandemic on March 11, 2020.

Mega Bankruptcies

There were 52 mega bankruptcies (over $1 billion in assets) in the first three quarters of 2020. This was more than the number of mega bankruptcies in any full year during 2005–2019 except for 2009, which had 57 mega bankruptcies.

52 Number of mega bankruptcies in Q1–Q3 2020, more than any full year since 2005 except for 2009.

The Mining, Oil, and Gas industry experienced 20 mega bankruptcies in the first three quarters of 2020. Oil prices collapsed in March and April and still remain depressed, posing substantial challenges to the oil and gas industry.

The Retail Trade industry experienced 10 mega bankruptcies in the first three quarters of 2020. The pandemic has created an increasingly difficult environment for traditional retailers.

The top two industries—Mining, Oil, and Gas; and Retail Trade—accounted for 30 mega bankruptcies or 58 percent of all mega bankruptcies in the first three quarters in 2020. The number of mega bankruptcies in the Mining, Oil, and Gas industry has remained high since the 2014–2016 collapse in oil prices, and the industry experienced an increase in mega bankruptcies starting in 2019, prior to the COVID-19 pandemic. In contrast, there were few mega bankruptcies in the Retail Trade industry before the pandemic.

Figure 3: Heat Map of Mega Bankruptcies by Industry 2005–Q3 2020

Source: BankruptcyData

Note: Only Chapter 11 and Chapter 7 bankruptcy filings by companies with over $1 billion in assets are included. The SIC Industry Division “Mining” is labeled as “Mining, Oil, and Gas” to reflect the specific industries under the Industry Division. The SIC Industry Division “Transportation, Communications, Electric, Gas, and Sanitary Services” is labeled as “Transportation, Communications, and Utilities.” There are no bankruptcies in two SIC Industry Divisions—“Public Administration” and “Nonclassifiable.” These two SIC Industry Divisions are therefore not shown. For companies where exact assets are not known, the lower bound of the estimated range is used. Asset values are not adjusted for inflation. 2020 includes January 1, 2020, through September 30, 2020

Executive Summary: COVID-19 Pandemic Spurs Wave of Mega Corporate Bankruptcies

Read the report: Trends in Large Corporate Bankruptcy and Financial Distress: 2005–Q3 2020.

/>i

/>i