On February 5, several trade groups, including the American Bankers Association, the Independent Community Bankers of America, and the U.S. Chamber of Commerce, filed suit against the Federal Reserve Board, the FDIC, and the OCC accusing the regulators of exceeding their authority under federal law when promulgating new rules under the Community Reinvestment Act (CRA).

The new rules, adopted in October 2023, are an effort by federal regulators to increase the CRA’s scope and rigor as well as modernize it for the digital age by better accounting for banks internet and mobile banking services. While previous CRA exams focused on the low- and moderate-income lending that banks do around their physical branches, the new rules add the possibility of new assessments in places where banks have online customers.

The trade associations have argued that these new rules conflict with the CRA itself on the grounds that federal regulators should be limited to evaluating bank activity in the vicinity of a bank’s physical branch location. By expanding the statute’s reach to online banking, the trade groups allege the agencies exceeded their statutory authority with the changes likely to impose enormous costs on banks and ultimately reduce lending to low- and moderate-income borrowers. The trade groups also challenged other provisions of the new rules, including one that would allow for assessments of deposit products to factor into larger banks’ CRA exams. For example, the rules evaluate whether banks offer deposit products with low-cost features such as low monthly maintenance fees or no overdraft fees, changes that depart from the statute’s focus on “credit.”

With the rules set to take effect on April 1, the plaintiffs are seeking an injunction to stay its implementation.

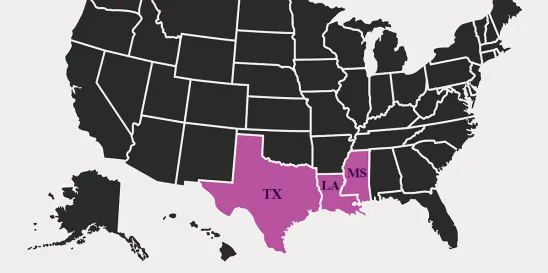

Putting it into Practice: The lawsuit underscores the increasingly confrontational posture between the banking industry and its federal banking regulators. Moreover, it is no surprise that the action was filed in Texas, as the Fifth Circuit has provided plaintiffs early wins in challenges against regulators (as discussed here and here). With numerous challenges still pending, including the CFSA v. CFPB case before the Supreme Court, the regulatory landscape is still uncertain. Institutions should play close attention to the outcomes of these cases as they will provide better clarity regarding the scope of their regulatory requirements going forward.

/>i

/>i