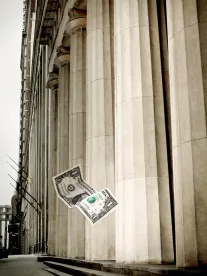

A recent decision from the Fourth Circuit, Federal Deposit Insurance Corporation v. Rippy, No. 14-2078 (4th Cir. Aug. 18, 2015), may signal a weakening of the business judgment rule’s long-standing protections for corporate officers.

The case surrounds the failure of a community bank, which closed in June 2009 during the depths of the Great Recession. After its closure, the FDIC was appointed receiver and filed claims against each former officer and director, alleging negligence, gross negligence, breach of fiduciary duty, and seeking damages in amounts of $4.4 to $33 million for sour loans. Judge Boyle in the Eastern District of North Carolina granted summary judgment in favor of the officers and directors, and the FDIC appealed.

The Fourth Circuit affirmed summary judgment with respect to the claims against the directors and gross negligence against the officers. However, the Fourth Circuit remanded for jury determination the FDIC’s claims of negligence and breach of fiduciary duty against the former officers of the failed bank. The Fourth Circuit analyzed the FDIC’s claims for bank officer liability under the business judgment rule, which establishes the presumption that the corporate officers acted in good faith and with due care. However, this presumption can be rebutted with evidence demonstrating the officers:

(1) did not avail themselves of all material and reasonable available information (i.e., they did not act on an informed basis); (2) acted in bad faith, with a conflict of interest, or disloyalty; or (3) did not honestly believe that they were acting in the best interest of [the bank].”

Here, the Fourth Circuit held the FDIC presented sufficient evidence to rebut this presumption by presenting a banking expert’s affidavit, stating the officers did not follow generally accepted banking practices. Specifically, the affidavit cited instances in which the bank officers “approved loans over the telephone, without first examining the documents,” “did not receive the loan documents until after the phone calls, and sometimes not until after the loans had already been funded,” and “failed to address warnings and deficiencies in the [b]ank’s examination reports.” The Fourth Circuit recognized the bank had previously performed well on banking regulators’ evaluations; however, these same reports also contained warnings that the bank’s credit administration and audit processes needed improvement. The Fourth Circuit concluded the evidence presented by expert affidavit was sufficient to present a question of fact as to whether the bank officers acted with due care on an informed basis. Thus, the court determined summary judgment was inappropriate and remanded for jury determination on these issues.

The bank officers argued, among other things, that the FDIC “failed to produce evidence that the defendants, rather than the Great Recession, proximately caused the loan defaults pled.” The Fourth Circuit disagreed stating:

Certainly, it is convenient to blame the Great Recession for the failure of Cooperative, and in turn for the losses sustained by the FDIC-R when it took over the Bank. However, there is evidence in the record, as outlined above, that suggests that “in the exercise of reasonable care,” the Bank officers could have “foreseen that some injury would result from their acts or omissions, or that consequences of a generally injurious nature might have been expected.” Even before the Recession, exam reports from both of Cooperative’s regulators indicated that the Bank was utilizing unsafe practices. And while the Recession undoubtedly contributed to the failure of the Bank, it may have been only one of many contributing factors. This is a genuine issue of material fact, and thus this is a question for a jury.

Traditionally, the business judgment rule has shielded officers from liability for a corporation’s losses when those officers acted in good faith and with due care. Rippy may point to a loosening of business judgment rule protections, opening the door for personal liability claims against officers to proceed to the jury. Bank boards and officers would be well served to review their policies and procedures to ensure important business decisions are made deliberately and in accordance with established banking practices.

/>i

/>i