Accounting Allegations

This analysis examines accounting allegations related to issues among securities class actions involving Rule 10b-5 claims: alleged Generally Accepted Accounting Principles (GAAP) violations, violations of other reporting standards, auditing violations, or weaknesses in internal controls over financial reporting.[i] For further details regarding settlements of accounting cases, see Cornerstone Research’s annual report on Accounting Class Action Filings and Settlements.[ii]

- The proportion of settled cases alleging GAAP violations in 2019 was 44 percent, continuing a five-year decline from a high of 67 percent in 2014.

Settled cases with restatements are generally associated with higher settlements as a percentage of “simplified tiered damages” compared to cases without restatements. In 2019, the median settlement as a percentage of “simplified tiered damages” for cases with restatements was 5.2 percent, compared to 4.1 percent for cases without restatements.

Among cases settled in 2019 with accounting-related allegations, only 6 percent involved a named auditor codefendant. This was the lowest rate in the past decade and a decline from a high of 24 percent in 2015.

The proportion of cases with accounting-related allegations that also involved associated criminal charges was 27 percent in 2019, well above the rate of 11 percent among cases settled during 2010–2018.

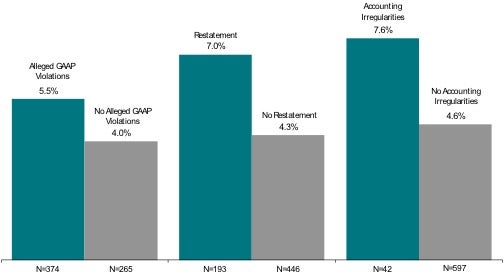

Figure 8: Median Settlements as a Percentage of “Simplified Tiered Damages” and Accounting Allegations 2010–2019

Note: N refers to the number of observations.

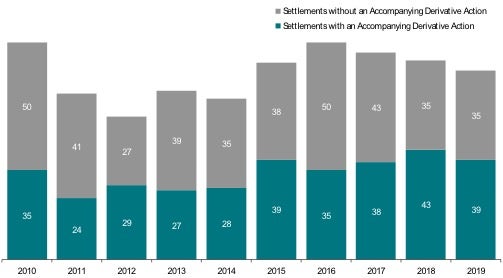

Derivative Actions

While settled cases involving an accompanying derivative action are typically associated with both larger cases (measured by “simplified tiered damages”) and larger settlement amounts, this was not true in 2019.

The median settlement among cases with an accompanying derivative action was $10 million compared to $14.8 million for cases without a derivative action.

This may be due at least in part to a substantial increase in derivative actions involving smaller issuers. In 2019, 70 percent of cases involving issuers with less than $250 million in total assets also had an accompanying derivative action, compared to only 46 percent over the prior nine years.

53 percent of settled cases involved an accompanying derivative action, the second-highest rate over the last 10 years.

Many larger settlements in 2019 involved non-U.S. issuers (44 percent of settlements above $25 million), which have been associated with derivative actions far less frequently than cases involving U.S. issuers. During 2010–2019, only 22 percent of cases involving non-U.S. issuers had accompanying derivative actions.

In 2019, 36 percent of derivative actions were filed in Delaware, the highest proportion in the past decade. The second most common filing state for derivative suits was California.

Figure 9: Frequency of Derivative Actions 2010–2019

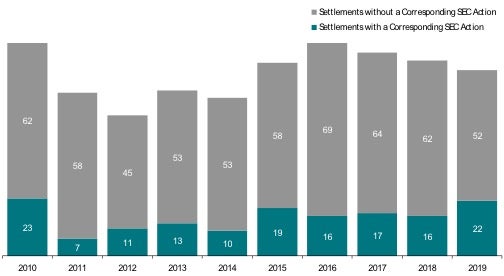

Corresponding SEC Actions

Cases with an SEC action related to the allegations are typically associated with significantly higher settlement amounts and higher settlements as a percentage of “simplified tiered damages.”[iii]

In 2019, the median total assets of issuer defendant firms at the time of settlement was $1.3 billion for cases with corresponding SEC actions compared to $1.5 billion for cases without a corresponding SEC action. This was consistent with the overall increase in the asset size of issuers.

For cases settled during 2015–2019, 42 percent of cases with a corresponding SEC action involved issuer defendants that had either declared bankruptcy or were delisted from a major U.S. exchange prior to settlement.

Cases with corresponding SEC actions have involved accounting-related allegations less frequently in recent years. From 2010 to 2016, 88 percent of settled cases involved accounting-related allegations, compared to 75 percent from 2017 to 2019.

Cases involving corresponding SEC actions may also include allegations of criminal activity in connection with the time period covered by the underlying class action. In 2019, more than 40 percent of cases with an SEC action had related criminal charges.

30 percent of settled cases involved a corresponding SEC action, the highest rate over the last 10 years.

Figure 10: Frequency of SEC Actions 2010–2019

Institutional Investors

Institutional investors, including public pension plans (a subset of institutional investors), tend to be involved in larger cases, that is, cases with higher “simplified tiered damages.”

Median “simplified tiered damages” for cases involving a public pension as a lead plaintiff in 2019 were more than three times higher than for cases without a public pension plan as a lead plaintiff.

In 2019, median market capitalization (measured prior to the settlement hearing date) for issuer defendants in cases involving an institutional investor as a lead plaintiff was $1.6 billion compared to $459.4 million for cases without institutional investor involvement.

The proportion of settlements with a public pension plan as lead plaintiff reached its lowest level in the decade.

Over the last 10 years, institutional investor lead plaintiffs have also been associated with lower attorney fees in relation to “simplified tiered damages.” This may reflect their tendency to be involved in larger cases, in which attorney fees often represent a smaller percentage of the total settlement fund, as well as their potential ability to negotiate lower fees.[iv]

Among 2019 settled cases that do have an institutional investor as a lead plaintiff, 50 percent involved a parallel derivative action and 22 percent involved a corresponding SEC action.

Figure 11: Median Settlement Amounts and Public Pension Plans 2010–2019 (Dollars in millions)

Read Cornerstone Research report Securities Class Action Settlements—2019 Review and Analysis.

Read more on settlement size in the Cornerstone Research Report: Securities Class Action Settlements--2019 Review and Analysis.

[i] The three categories of accounting issues analyzed in Figure 8 of this report are: (1) GAAP violations; (2) restatements—cases involving a restatement (or announcement of a restatement) of financial statements; and (3) accounting irregularities—cases in which the defendant has reported the occurrence of accounting irregularities (intentional misstatements or omissions) in its financial statements.

[ii] See Accounting Class Action Filings and Settlements—2018 Review and Analysis, Cornerstone Research (2019). Update forthcoming in March 2020.

[iii] See, e.g., Lynn A. Baker, Michael A. Perino, and Charles Silver, “Setting Attorneys’ Fees in Securities Class Actions: An Empirical Assessment,” Vanderbilt Law Review 66, no. 6 (2013): 1677–1718.

[iv] It could be that the merits in such cases are stronger, or simply that the presence of a corresponding SEC action provides plaintiffs with increased leverage when negotiating a settlement. For purposes of this research, an SEC action is evidenced by the presence of a litigation release or an administrative proceeding posted on www.sec.gov involving the issuer defendant or other named defendants with allegations similar to those in the underlying class action complaint.

/>i

/>i