On November 1, 2018, the Centers for Medicare & Medicaid Services (CMS) released the CY 2019 Revisions to Payment Policies Under the Physician Fee Schedule and Other Revisions to Medicare Part B [CMS-1693-F] Final Rule, which includes policy changes related to Medicare physician payment and the Quality Payment Program (QPP). The final rule also implements provisions of the Bipartisan Budget Act of 2018 (BBA) and addresses policies related to the Medicare Shared Savings Program (MSSP), Medicare Part B drugs, Appropriate Use Criteria and the laboratory fee schedule, among other topics. It will be published in the Federal Register on November 23, 2018. Comments solicited on certain provisions of the Final Rule are due on December 31, 2018.

A topline summary of the major provisions follows.

2019 Medicare Physician Fee Schedule Changes

In the 2019 Physician Fee Schedule (PFS) Final Rule, CMS continues to emphasize the themes of providing regulatory and administrative relief for clinicians, modernizing payment policies to promote services such as virtual care, and saving Medicare beneficiaries’ time and money while improving their access to high-quality services. CMS projects that the rule will save clinicians $87 million in reduced administrative costs in 2019 and $843 million over the next decade.

1. 2019 Medicare Physician Conversion Factor Remains Essentially Flat

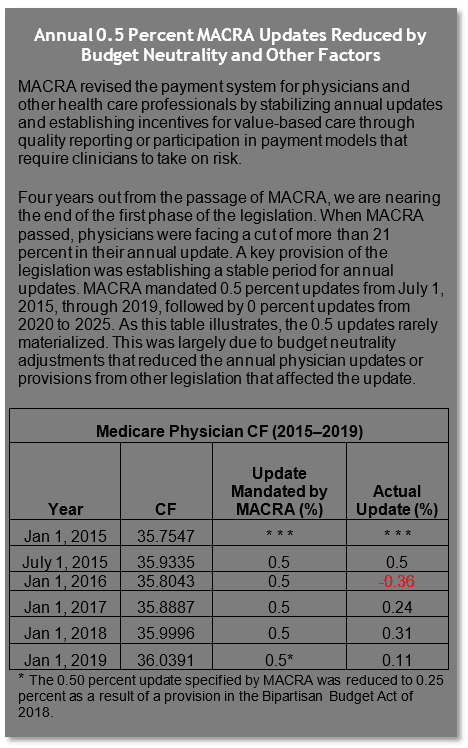

√ The 2019 Medicare Physician CF is $36.0391.

The 2019 final physician conversion factor (CF) is $36.0391, a slight increase from the 2018 PFS CF of $35.9996. The 2019 anesthesia CF is $22.2730, a slight increase from the 2018 anesthesia CF of $22.1887.

The 0.50 percent update specified by the Medicare Access and CHIP Reauthorization Act (MACRA) was reduced to 0.25 percent as a result of a provision in the BBA of 2018. The CF was then further reduced by a relative value unit (RVU) budget neutrality adjustment (-0.14 percent). In addition, in 2019, Merit-Based Incentive Payment System (MIPS) eligible clinicians’ Medicare fee-for-service (FFS) payments will be affected by their 2017 MIPS performance, which by statute, was scheduled to affect 2019 Medicare payments by +/- 4 percent. Yet, due to budget neutrality adjustments, it is expected that the top positive MIPS 2019 adjustment, with the inclusion of the exceptional performance bonus, will be just below 2 percent.

MIPS is a budget-neutral program. This means that the dollar amounts for positive and negative payment adjustments must balance out. CMS clarified in the final rule that the reduction from the maximum positive adjustments set forth by statute is the result of where the agency has set the MIPS performance threshold. The MIPS performance threshold represents the score that is necessary to receive a neutral to positive payment adjustment for the year. For 2017, clinicians needed three out of 100 points to avoid a negative payment adjustment. The agency stated that if it had set a higher performance threshold, there would have been more dollars available for positive payment adjustments.

Physician payment is based on the application of the dollar CF to work, practice expense (PE) and malpractice RVUs, which are then geographically adjusted. PE RVUs capture the cost of supplies, equipment and clinical personnel wages used to furnish a specific service. CMS finalized a proposal to update input prices for supplies and equipment based upon a large survey conducted by a market research firm under contract to CMS. CMS will phase in these new inputs over a four-year period beginning in 2019. These supply and equipment prices were last systematically developed in 2004–2005. Based on public comments, CMS revised inputs for several items from what was originally proposed based on the contractor’s findings. These changes are summarized in Table 9 of the final rule.

2. Proposed E/M Overhaul Scaled Back and Delayed

√ CMS delays changes to the coding and payment structure for E/M services until 2021, but will implement several documentation policies in 2019.

For 2019, CMS originally proposed sweeping changes to evaluation and management (E/M) payment and documentation requirements, including creation of a single payment for level 2–5 office codes and significantly reduced documentation requirements. In this final rule, CMS delays changes to the coding and payment structure for E/M services until 2021, but implements several documentation policies in 2019.

Because E/M services make up approximately 40 percent of allowed charges under the PFS (office/outpatient E/M services comprise approximately 20 percent of allowed charges), any changes would have a wide-ranging impact across different specialties. For years, there has been significant concern around the complexity and burden of documenting E/M services. While the proposal for reductions in documentation requirements was generally welcomed, CMS faced significant criticism from the provider community on the proposal for a single payment for level 2–5 E/M codes. Letters requesting withdrawal of the proposal signed by a coalition of 170 groups were submitted to both congressional leadership and CMS.

CMS finalized the following policies for 2019:

-

Removed the need to justify providing a home visit instead of an office visit

-

Changed the required documentation of the patient’s history to focus only on the interval history since the previous visit

-

Eliminated the requirement for physicians to re-document information already documented in the patient’s record by practice staff or by the patient

CMS also declined to move forward on a proposal to reduce payment for office visits when performed on the same day as another service. Nor did CMS establish separate coding and payment for podiatric E/M visits.

CMS finalized the following payment and coding policies but delayed implementation until 2021:

-

Reduction in the payment variation for E/M office/outpatient visit levels by paying a single rate for E/M office/outpatient visit levels 2 through 4 for established and new patients while maintaining a higher payment rate for E/M office/outpatient visit level 5

-

Implementation of several changes allowing greater flexibility and reduced burden in documentation, including allowing clinicians to use medical decision-making or time instead of applying the current 1995 or 1997 E/M documentation guidelines

-

Implementation of add-on codes that describe the additional resources inherent in visits for primary care and particular kinds of non-procedural specialized medical care (not specialty-specific; reported with level 2–4 codes; generally would not impose new documentation requirements)

-

Adoption of a new “extended visit” add-on code for use only with E/M office/outpatient level 2 through 4 visits to account for the additional resources required when practitioners need to spend extended time with the patient

CMS posted a chart on E/M payment amounts here.

3. CMS Makes Historic Change by Establishing Payment for Virtual Check-Ins and Other Technology-Based Services

√ CMS finalizes separate payment for multiple communication-technology-based services that would not be subject to the limitations placed on Medicare telehealth services.

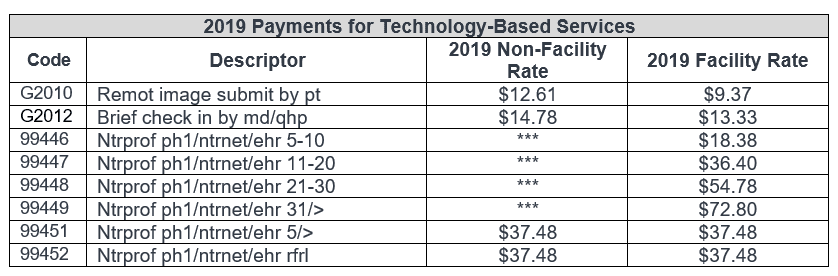

In establishing payment for services utilizing technology-based services, CMS acknowledges that recent innovations in health care have given rise to the development of services that inherently require the use of communication technology but do not necessarily fit into the telemedicine category. In the 2019 PFS Final Rule, CMS establishes payment for a discrete set of services that are defined by and inherently involve the use of communication technology.

-

Brief Communication Technology-Based Service,g., Virtual Check-In (HCPCS code G2012): This code describes brief check-in services furnished using communication technology that are used to evaluate whether an office visit or other service is warranted. This service would be limited to established patients, and verbal consent is noted in the medical record for each billed service. If the service originates from a related E/M service provided within the previous seven days by the same physician or other qualified health care professional, or leads to an E/M service, it would be considered bundled and not separately billable.

-

Remote Evaluation of Pre-Recorded Patient Information (HCPCS code G2010): This code describes physician use of recorded video and/or images captured by a patient in order to evaluate a patient’s condition. The follow-up with the patient could take place via phone call, audio/video communication, secure text messaging, email or patient portal communication. This is a stand-alone service that could be separately billed to the extent that there is no resulting E/M office visit and there is no related E/M office visit within the previous seven days of the remote service being furnished. This service would be limited to established patients, and verbal consent is noted in the medical record for each billed service.

-

Interprofessional Internet Consultation (CPT codes 99446, 99447, 99448, 99449, 99451 and 99452): These codes describe interprofessional consultations (between the treating practitioner and a consulting physician or a qualified health care professional) performed via communications technology such as telephone or internet. The patient’s verbal consent is required for these services. These interprofessional services may be billed only by practitioners that can bill Medicare independently for E/M services.

CMS also finalized policies to pay separately for new coding describing chronic care remote physiologic monitoring (CPT codes 99453, 99454 and 99457).

Additionally, CMS finalized changes to its Medicare telehealth services list:

-

Adding HCPCS codes G0513 (Prolonged preventive service(s) beyond the typical service time of the primary procedure, first 30 minutes) and G0514 (Prolonged preventive service(s) beyond the typical service time of the primary procedure, each additional 30 minutes) to the Medicare telehealth list

-

Implementing a provision in the BBA of 2018 to expand access to home dialysis therapy through telehealth and expand access to individuals with stroke

-

Expanding Medicare Telehealth Services for the Treatment of Opioid Use Disorder and Other Substance Use Disorders

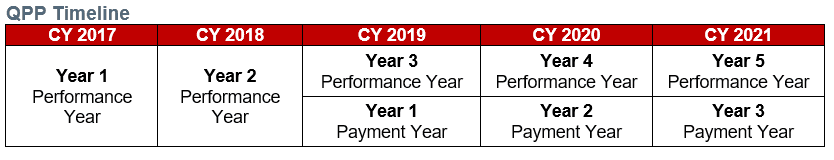

2019 QPP Changes

Beginning in 2019, eligible clinicians (including most physicians) will be paid for Medicare Part B services under the new QPP (based on 2017 reporting activities), and they will continue to elect either to be subject to payment adjustments based upon performance under the MIPS or to participate in the Advanced Alternative Payment Model (APM) track. Eligible clinicians choosing the MIPS pathway will have payments increased, maintained or decreased based on relative performance in four categories: quality, use of information technology, clinical improvement activities and cost. Eligible clinicians choosing the Advanced APM pathway will automatically receive a bonus payment once they meet the qualifications for that track.

This year’s QPP rulemaking continues the ramp-up for MIPS-participating clinicians, with CMS expanding the number of clinicians included in MIPS, increasing the threshold score for avoiding a MIPS penalty and increasing the weight of the MIPS cost component. Advanced APM track policies remained fairly stable, with some modest policy changes intended to streamline the program and reduce burden for participants. CMS also indicated that in response to feedback from stakeholders, it has begun a series of strategic planning sessions to assess the current value of the program for clinicians and beneficiaries alike and to implement the program in a way that is understandable to beneficiaries.

4. CMS Expands the Number of Clinicians Eligible to Participate in MIPS

√ CMS estimates 798,000 MIPS-eligible clinicians for the 2019 MIPS Performance Period.

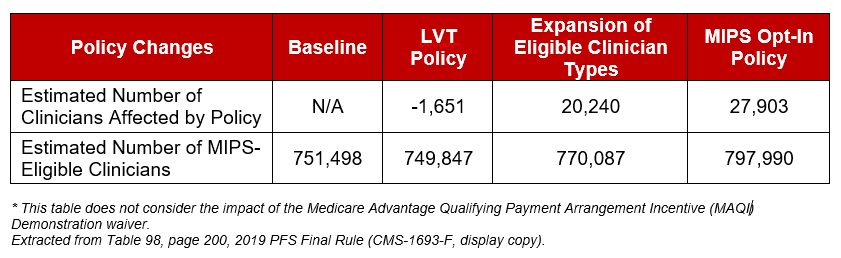

CMS estimates that approximately 798,000 clinicians will be MIPS-eligible clinicians in the 2019 Performance Period, an increase of almost 148,000 from the estimate provided in the proposed rule. The number also represents an increase from the 2018 Final Rule, in which CMS estimated that approximately 622,000 clinicians would be MIPS eligible for the 2018 MIPS Performance Period. This change is driven by an expansion in the types of health care professionals eligible to participate in MIPS, a change in the Low Volume Threshold Exception and a new finalized MIPS opt-in policy.

Currently eligible clinician types include physicians, physician assistants, nurse practitioners, clinical nurse specialists, certified registered nurse anesthetists and groups that include such professionals (required by statute). Consistent with the MACRA statute, CMS is expanding participation in MIPS to include: physical therapists, occupational therapists, qualified speech-language pathologists, qualified audiologists, clinical psychologists, and registered dieticians or nutrition professionals. CMS estimates that this change will expand the pool of MIPS-eligible clinicians by 20,240.

The Low Volume Threshold (LVT) excludes certain clinicians and groups from participating in MIPS. In 2019, CMS adds a third criterion to the low volume exclusion test that would be based on the number of covered professional services provided. Per the 2019 LVT policy, to be excluded from MIPS, clinicians or groups will need to meet one of the following three criteria: have ≤ $90,000 in Part B allowed charges for covered professional services, provide care to ≤ 200 beneficiaries or provide ≤ 200 covered professional services under the PFS. CMS estimates that this proposed 2019 policy will remove an additional 1,165 MIPS-eligible clinicians in comparison to the 2018 LVT policy.

Finally, CMS will implement a MIPS opt-in policy for the first time in 2019. Starting in Year 2019, clinicians or groups would be able to opt in to MIPS if they are exempt from MIPS based upon one or two, but not all three of the LVT criteria. CMS estimates an additional 27,903 MIPS-eligible clinicians as a result of this policy.

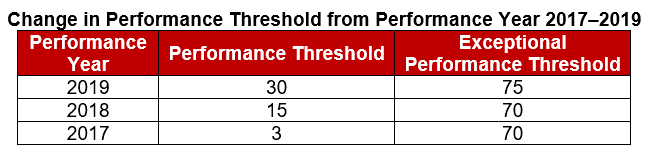

5. CMS Doubles Minimum Score Necessary to Avoid a Negative MIPS Adjustment

√ MIPS Performance threshold increases from 15/100 points to 30/100 points.

The “performance threshold” represents the score that is necessary to receive a neutral to positive payment adjustment for the year. A score below the performance threshold will result in a negative payment adjustment, while a score above the payment threshold will result in a positive payment adjustment. A score at the payment threshold will result in a neutral payment adjustment.

MACRA authorized an additional $500 million each year from 2019 to 2024 to award “exceptional performance” bonuses to MIPS providers with the highest composite performance scores. CMS sets a separate exceptional performance threshold to award these higher payment adjustments. For 2019 CMS has finalized the following policies:

-

An increase to the performance threshold from 15/100 points to 30/100 points

-

An increase to the exceptional performance threshold from 70/100 points to 75/100 points

6. CMS Increases the Weight of the Cost Component in MIPS Final Score

√ Weight of Cost Performance Category on MIPS final score increases from 10 to 15 percent in 2019.

The MIPS final score is based on performance in four categories: Quality, Promoting Interoperability (previously known as Advancing Care Information), Improvement Activities and Cost. For 2019, CMS will increase the weight of the Cost Performance Category for the final MIPS score from 10 percent (2018) to 15 percent (2019). This change results in the following allocations of the four performance categories for the 2019 Payment Year: Quality (45 percent), Promoting Interoperability (25 percent), Improvement Activities (15 percent) and Cost (15 percent).

Currently the Cost Performance Category is based on two measures: Total Per Capita Cost and Medicare Spending Per Beneficiary. In the final rule, CMS is adding eight recently developed episode-based cost measures: Elective Outpatient Percutaneous Coronary Intervention (PCI), Knee Arthroplasty, Revascularization for Lower Extremity Chronic Critical Limb Ischemia, Routine Cataract Removal with Intraocular Lens (IOL) Implantation, Screening/Surveillance Colonoscopy, Intracranial Hemorrhage or Cerebral Infarction, Simple Pneumonia with Hospitalization, and ST-Elevation Myocardial Infarction (STEMI) with Percutaneous Coronary Intervention (PCI).

7. Meaningful Measures Initiative Drives Changes to Make Quality Reporting More Meaningful and Less Burdensome

√ Changes include deletion of quality measures, revision of the definition of high-priority measures and implementation of facility-based reporting.

The Meaningful Measures Initiative launched in October 2017 with the aim of identifying the highest priority areas for quality measurement and quality improvement to advance the agency’s work to improve patient outcomes. Since then, CMS has been reviewing quality measures across Medicare and Medicaid under the lens of this initiative. CMS has also indicated that as part of its review, it is considering whether collecting information is valuable to clinicians and whether it is worth the cost and resources. For the 2019 MIPS Performance Period, CMS will add eight new quality measures and remove 26 current quality measures. Stakeholders have raised concerns about the number and pace of quality measures being removed from the program. They have urged CMS to ensure there are a sufficient number of meaningful measures available for various specialties to participate in MIPS.

In response to the opioid epidemic across the United States, CMS revises the definition of a high-priority measure to include quality measures that relate to opioids and to further clarify the types of outcome measures that are considered high priority. CMS is defining high-priority measure to mean an outcome, appropriate use, patient safety, efficiency, patient experience, care coordination or opioid-related quality measure.

CMS will implement facility-based scoring for 2019, whereby facility-based clinicians can use their facility’s Hospital Value-Based Purchasing score as a proxy for their Quality and Cost Performance Category scores. The clinician or group must meet the definition of facility-based finalized in this rule to be eligible for this option.

8. CMS Maintains Stable Advanced APM and Other Payer Advanced APM Options

√ The agency finalizes relatively minor proposals, continuing Advanced APM implementation.

CMS proposed several updates to the Advanced APM and Other Payer Advanced APM options. Beginning with the 2019 performance year, eligible clinicians either use their

Advanced APM participation in traditional Medicare alone or can combine their participation in traditional Medicare Advanced APMs with participation in other payers’ Advanced APM models to qualify for the Advanced APM 5 percent payment bonus. CMS proposed several relatively minor modifications to the qualifying criteria. In general, CMS finalized its proposals, including:

-

Increasing the requirement related to use of certified electronic health records technology (CEHRT) from 50 percent of eligible clinicians in each advanced APM entity in 2018 to 75 percent of eligible clinicians in each APM entity in 2019

-

Maintaining the generally applicable nominal amount standard (one measure of the amount of risk an APM bears to satisfy the requirement that risk be in excess of a nominal amount) through 2024

-

Allowing payers and eligible clinicians seeking approval of Other Payer Advanced APMs to submit evidence that CEHRT is used by the requisite percentage of eligible clinicians (50 percent in 2019 and 75 percent in 2020) in the arrangement (as opposed to requiring explicit documentation in the terms of the payment arrangement)

-

Adding a third alternative to allow qualifying participant determinations at the TIN level (in addition to the eligible clinician and APM entity levels) for Other Payer Advanced APMs in certain circumstances

The regulatory changes in the final rule maintain relatively stability in the Advanced APM and Other Payer Advanced APM landscape. However, complexity and the limited options for participation persist. For example, so far, CMS has approved only a handful of Other Payer Advanced APMs nationwide: six Medicaid arrangements and two multi-payer initiatives. The pace of Advanced APM development on the traditional Medicare side has similarly slowed.

9. CMS Finalizes Time-Sensitive Provisions from MSSP Proposed Rule

√ 2016 ACO starters will have an optional six-month extension from January 1 through June 30, 2019.

In August 2018, CMS issued the Medicare Program: Medicare Shared Savings Program (MSSP); Accountable Care Organizations – Pathways to Success proposed rule, which proposed fundamentally to restructure the MSSP. In the PFS final rule, CMS finalizes certain time-sensitive provisions from the proposed rule. The remainder of the MSSP proposed rule provisions will be addressed in a subsequent rulemaking.

Notably, CMS offers a voluntary six-month extension for existing MSSP ACOs whose participation agreements expire December 31, 2018. This was necessary because CMS proposes to start the new Pathways to Success MSSP on July 1, 2019 rather than January 1, 2019. Without this extension, MSSP ACOs that started in 2016 would have faced a six-month gap period. CMS also finalized the methodology for determining financial and quality performance for the six-month extension period.

In this final rule, CMS also finalizes modifications to the definition of primary care services used in assigning beneficiaries to ACOs to reflect recent code changes, implements certain BBA 2018 provisions on voluntary alignment which allows ACO beneficiaries to designate a clinician responsible for their care, provides relief for clinicians affected by extreme and uncontrollable circumstances, and makes certain revisions to the program to promote interoperability among ACO providers and suppliers to align with the QPP.

CMS also finalized a number of changes to the MSSP quality program, including the elimination of nine measures and the addition of two for the MSSP quality measure set, resulting in a set of 23 measures on which ACO quality performance will be assessed in 2019.

10. CMS Finalizes MAQI Demo, Rejects PTAC Recommended Models

√ MAQI demonstration qualifies participants for a MIPS exemption, but not a 5 percent bonus. CMS is unlikely to implement approved PTAC models in their entirety.

The agency finalized its proposal to implement the MAQI demonstration project using its waiver authority to waive certain requirements for participating clinicians. Clinicians participating in this demonstration may use their risk contracts in Medicare Advantage in combination with Advanced APMs to receive an exemption from MIPS reporting and payment consequences. Stakeholders had requested that clinicians participating in this model also receive the 5 percent Advanced APM incentive payment. CMS responded that including a bonus payment would add significant costs to CMS without adequate evidence that the demonstration could save an equal or greater amount of money. Therefore, the agency declined to incorporate bonus eligibility in the MAQI demonstration. CMS states that it will collect MAQI-related information in 2018, and eligible clinicians will be exempt from MIPS adjustments in 2020.

As noted in our analysis of the proposed rule, CMS was silent on the topic of the Physician Focused Payment Model Technical Advisory Committee (PTAC). In the final rule, CMS noted that many commenters asked that CMS implement and test PTAC-recommended models. CMS responded that while it “seems unlikely that all of the features of any PTAC-reviewed proposed model will be tested exactly as presented in the proposal, certain features of proposed models may be incorporated into new or existing models.” CMS also indicates that it will continue to work with stakeholders to design and implement new APMs.

The pace of development of new models has been modest. Many stakeholders will be closely watching the Center for Medicare and Medicaid Innovation over the next several months and the first quarter of 2019 in anticipation of a direct contracting model and other Advanced APM options.

Directionally, the Trump Administration continues to pursue policies that relieve administrative burden and streamline health care regulations and policies. Stakeholders were relieved that

CMS backed off of a proposed sweeping reform to payment for E/M services. However, downward pressure on payment rates is likely to continue in future rulemaking.

The Administration continues to advance implementation of the QPP, with modest ramping up of various requirements in both the MIPS and the Advanced APM tracks. The pace of implementation of new Advanced APM options continues to be slow, with new models anticipated between now and the end of the first quarter of 2019.

/>i

/>i