The results of Citigroup’s 2015 Law Firm Leader’s Peer Monitor Report were examined by a highly informative panel[i] at Thomson Reuters’ recent 20th Annual Law Firm Leaders Conference in New York. The detailed discussion outlined overall marketplace trends and reviewed the strategies of law firms who are profitably navigating today’s turbulent legal market.

State of the U.S. Business Law Marketplace

State of the U.S. Business Law Marketplace

Market conditions for law firms are stabilizing in 2015 but a fragile global economy / geopolitical climate, and changing legal department purchasing behavior are leading to continuing flat demand for purchasing legal services. Current marketplace conditions include: more work being done in-house or by non-law firm outsourced providers and law firms coming in from other markets who are competing aggressively on price and / or who are buying business growth by lateral attorney hires.

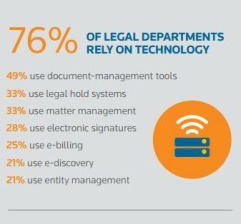

Lower demand for law firms’ services is also being driven by a decreased appetite for costly litigation and developing technology which performs more cost effectively commodity type legal work.[ii]. The most common reasons for moving work in house is more control over costs and increased efficiency.[iii] In a 2015 survey of over 300 in-house counsel from 22 industries over 47% of the companies surveyed reported an increase in the number of law department lawyers employed.[iv]

Larger Business Trends Lead to a Less of an Appetite for Litigation and a Push for More Cost Effective Service Delivery

General Counsel manage their departments in tandem with the overall goals of the business. Unresolved legal issues can have a negative impact on a company’s stock price and reserves set aside for lengthy litigation could be deployed for other business activities. Accordingly, there is an ongoing trend of companies settling earlier than before, and being more open to pursue alternatives to expensive and drawn out courtroom trials.[v] Also, the increased cost of conducting complex litigation due to e-discovery, is also causing companies to think twice about how hard and how long they want to fight.

Since the great recession many law firms have become adept at trimming administrative overhead costs but seem to forget that corporate law departments are corporate overhead. In a 2013 survey of 238 managing partners and law firm chairs, over 44 percent indicated that their firms had taken steps to improve the cost effectiveness of legal service delivery, mostly in the form of changing project staffing models to include part-time and contract lawyers and outsourcing an increasing number of non-lawyer functions at their firms. [vi] Alternative service providers in the legal arena cover functions such as discovery management, document creation, dispute resolution alternatives to litigation, and talent management services. Legal process out sourcing (LPO) through alternative service providers has a predicted growth of 30% in 2015 and it is estimated that there is currently $20 billion of outsourceable legal work in the U.S. legal marketplace.[vii] It is estimated that the LPO market has only captured 5.5% or $1 billon of the estimated $437billion U.S. legal market.[viii]

Since the great recession many law firms have become adept at trimming administrative overhead costs but seem to forget that corporate law departments are corporate overhead. In a 2013 survey of 238 managing partners and law firm chairs, over 44 percent indicated that their firms had taken steps to improve the cost effectiveness of legal service delivery, mostly in the form of changing project staffing models to include part-time and contract lawyers and outsourcing an increasing number of non-lawyer functions at their firms. [vi] Alternative service providers in the legal arena cover functions such as discovery management, document creation, dispute resolution alternatives to litigation, and talent management services. Legal process out sourcing (LPO) through alternative service providers has a predicted growth of 30% in 2015 and it is estimated that there is currently $20 billion of outsourceable legal work in the U.S. legal marketplace.[vii] It is estimated that the LPO market has only captured 5.5% or $1 billon of the estimated $437billion U.S. legal market.[viii]

Practice Areas Where Demand Is Consistent or Growing for Law Firms

While businesses may have less of appetite for costly litigation, demand remains strong in certain areas due to more domestic regulatory investigations and U.S. lead examinations stemming from cross-border activities. [ix] In a survey released this month, 48% of law departments predicted an increase in regulatory work in the next year.[x] Other growth practice areas include: Intellectual Property/Patent; Cybersecurity/Data Privacy; Bankruptcy; Healthcare/Pharmaceutical, Financial Services and Mergers/Acquisitions. [xi]

While businesses may have less of appetite for costly litigation, demand remains strong in certain areas due to more domestic regulatory investigations and U.S. lead examinations stemming from cross-border activities. [ix] In a survey released this month, 48% of law departments predicted an increase in regulatory work in the next year.[x] Other growth practice areas include: Intellectual Property/Patent; Cybersecurity/Data Privacy; Bankruptcy; Healthcare/Pharmaceutical, Financial Services and Mergers/Acquisitions. [xi]

Common Features of Underperforming Law Firms in Today’s Marketplace

To address the buying needs of corporate clients, firms which are surviving are becoming more efficient and predictable in their pricing and service delivery. Firms who are underperforming tend to have:

-

The lowest overall leverage rate (partner to associate) and less cost effective use of leverage;

-

A higher reliance on income partners, and a declining income partner contribution;

-

A high use of Other Lawyers but the use of these lawyers make a negative contribution to the firm’s bottom line;

-

A lower overall equity partner productivity and a decline of equity partner equity during 2009-14;

-

The lowest realized rates and lowest growth in those rates during 2009-14;

-

A heavier litigation reliance;

-

Less rocket science work and more commoditized work; and

-

Firm brands that are not as sharply differentiated or recognized.[xii]

What a Hyper-Competitive Legal Market Marketplace Means Operationally

General Counsel are generalists, who manage the legal needs of a company but are limited in the legal tasks they can and should do on behalf of their client, the company. Accordingly, there is always a set group of work that won’t be done in-house or for which third party specialized expertise is advisable. Outsourcing of ‘rocket science’ work and going to law firms who have established reputations for certain types of work are easier sells for in-house counsel who have to sell their outsourcing decisions to company management. Marketplace trends are resulting in more of a concentration of high end work in a smaller group of law firms. Notable legal market predications / observations made by the panel:

-

Clients will further segment the market (“financial and reputational tiering”);

-

Firms will further consolidate;

-

Lateral activity will remain high; and

-

Brand differentiation will help attract the right laterals and grow market share in a flat demand environment.

With continued cost pressures, the panel commented that profitable law firms will:

- Use systems and processes to improve:

-

Matter management;

-

Practice management;

-

Workforce management; and

-

Partner performance measurement.

In order to demonstrate a concern for efficiency, successful law firms need to facilitate better collaboration between the firm and client. In order to leverage internal resources and grow deeper, more stable and more profitable relationships with clients, law firms need to improve or better communicate their client service offerings and share information about legal developments. The panel identified the following ways to stay or become known for expertise and to demonstrate concern for law firm department budgets:

-

Knowledge sharing;

-

Client relationship teams, strategic and well thought-out cross selling; and

-

Developing associates and younger partners to ensure a sustainable business and cost effective service delivery structure.

Take-Aways

You have to have a brand – “We’re cheaper – but still really good and can do whatever you need, especially the easy stuff” isn’t working. Established brands make law firms an easier sell for in-house counsel to their management or management may even advocate for well know legal brands to their law departments. Company management does suggest particular law firms and attorneys and they pass on to the law department relevant thought leadership that they were sent by law firms or that they have come across. Executive management approves the law department’s budget. The general counsel should not be your only contact point. If you want to be considered for the less than 10% of litigation work that’s considered bet the company, shouldn’t management know you and feel comfortable that you know their needs?

According to David Cruickshank of Edge International, 96% of firms say lateral hires are part of their growth strategy[xiii]. Great legal brands help recruit great associates and laterals, as well as clients. How do you keep the attention of attorneys at regulatory agencies, high potential law grads and star attorneys with established practices? Share your knowledge. Many legal recruiters scour publications as a starting point for finding lateral candidates in niche practices. Your knowledge and service are your brand. How do you build or maintain a brand? Share your knowledge, write, speak, repeat.

How do you convey to clients and potential clients that you mean what you say – that you have deep expertise, that you can manage things in a cost effective manner, that you collaborate, that you are committed to technology – you show them. Jay Hull, Chief Innovation Partner at Davis Wright Tremaine mentioned during the conference that you go for wins on small projects with name brand clients, for proof of concept. Per Jay if you want to show a commitment to technology and innovation, you bring a legal technologist to a pitch meeting. Don’t drag your client into inter partner quarrels if you want to build confidence in your ability to manage complex multi-jurisdiction litigation. Want show deep expertise, include multiple authors on articles, rainmakers should bring along associates or new partners to speaking engagements or networking events – be a team and grow and show your depth.

[i] Panel members included: Paul W. Theiss, Chairman of Mayer Brown LLP, J. Henry Walker IV, Chairman of Kilpatrick Townsend & Stockton LLP, Mike Abbott, Vice President, Client Management & Thought Leadership at Thomson Reuters, Dan DiPietro, Managing Director & Chairman of Citi Private Bank Law Firm and panel moderator, Bradford W. Hildebrandt – Chairman, Hildebrandt Consulting LLC.

[ii] Citi 2015 Law Firm Leaders Survey.

[iii] A Look Inside: 2015 Thomson Reuters Legal Department In-Sourcing and Efficiency Report.

[iv] 2015 HBR Consulting Law Department Survey - the Center for the Study of the Legal Profession at the Georgetown University Law Center and Thomson Reuters Peer Monitor.

[v] 2015 Client Advisory 2014: Great News for Some, Mixed Results for Others Citi Private Bank and Hildebrandt Consulting.

[vi] 2013 Law Firms in Transition: An Altman Weil Flash Survey, Thomas S. Clay Altman Weil, Inc., May 2013

[vii] Altman Weil Chief Legal Officers Survey 2014.

[viii] Revenues estimated using AmLaw 200 data, Peer Monitor, Hackett Group Report and New York Times; Expenses from Peer Monitor Corporate Legal Dept is based on internal spend on legal matters.

[ix] A Look Inside: 2015 Thomson Reuters Legal Department In-sourcing and Efficiency Report.

[x] 2015 HBR Consulting Law Department Survey.

[xi] Citi 2015 Law Firm Leaders Survey.

[xii]2015 HBR Consulting Law Department Survey - the Center for the Study of the Legal Profession at the Georgetown University Law Center and Thomson Reuters Peer Monitor.

[xiii]7 Thoughts About The Lateral Hiring Process, Above the Law, April 15, 2014.

/>i

/>i