On December 28, 2022, the Internal Revenue Service (the “IRS”) and the Treasury Department released proposed regulations (the “Proposed Regulations”) under sections 892 and 897 of the Internal Revenue Code (the “Code”).[1] If finalized as proposed, the Proposed Regulations would prevent a non-U.S. person from investing through a wholly-owned U.S. corporation in order to cause a real estate investment trust (“REIT”) to be “domestically controlled”. The ability of a non-U.S. person to invest through a U.S. corporation to cause a REIT to be domestically controlled had been approved in a private letter ruling, and is a structure that is widely used. The Proposed Regulations would also apply to existing REITs that rely on a non-U.S. owned U.S. corporation for their domestically-controlled status, and suggest that the IRS could attack such a structure under current law (i.e., even if the Proposed Regulations are not finalized).

The Proposed Regulations also clarify that in determining a REIT’s domestically controlled status, a foreign partnership would be looked through and “qualified foreign pension funds” (“QFPFs”) and entities that are wholly owned by one or more QFPFs (“QCEs”) would be treated as foreign persons. Lastly, the Proposed Regulations also provide a helpful set of rules for sovereign wealth fund investors that indirectly invest in U.S. real estate.

Section 897 and Domestically Controlled REIT

Background

Section 897 of the Code, which is commonly referred to as “FIRPTA”, subjects a non-U.S. person to U.S. tax on any gain recognized upon a disposition of a “United States real property interest” (“USRPI”) at regular U.S. tax rates. A USRPI includes not only real property located in the United States, but also equity interests in a domestic “United States real property holding corporation” (“USRPHC”), which is generally a corporation whose assets consist of 50% or more USRPIs by value.

Section 897 provides a key exception that equity interests in a “domestically controlled” REIT are not USRPIs. Therefore, a non-U.S. investor may sell shares in a domestically controlled REIT without being subject to U.S. income tax under the FIRPTA rules.

A REIT is domestically controlled if less than 50% of its stock by value is held “directly or indirectly” by foreign persons at all times during a five-year period ending on the date of a sale of shares in the REIT (i.e., 50% or more of its stock is held by U.S. persons). Prior to the Proposed Regulations, neither the Code nor the Treasury Regulations provided any guidance on what it means for stock to be held “directly or indirectly” for this purpose.

However, there exist some authorities—including a widely-relied-upon private letter ruling[2] and legislative history to the 2015 revisions to the Code[3] that specifically and favorably refers to this private letter ruling—that suggested a domestic C corporation would not be looked through for purposes of determining whether a REIT would be domestically controlled. Thus, a common structure for REITs with foreign investors is to create a domestic C corporation (typically 100% owned by the foreign investors) which would hold 50% or more of the shares in a REIT (or a lower percentage, to the extent other direct investors in the REIT were themselves U.S. persons), which would ensure domestically controlled status for the non-U.S. investors.

Proposed Regulations on Determining Whether a REIT is Domestically Controlled

The Proposed Regulations provide a new set of look-through rules in determining whether a REIT is domestically controlled under section 897.[4] These rules have the effect of looking through domestic C corporation owners of a REIT that are 25%-or greater owned by non-U.S. owners (such corporations, “foreign-owned domestic corporations”). More specifically, under the new look-through rules, a direct or indirect shareholder of a REIT is categorized as either a “look-through person” or a “non-look-through person”. To determine whether a REIT is domestically controlled, a taxpayer must look through each look-through person and determine the ultimate ownership of the REIT by non-look-through persons.

A non-look-through person is an individual, a domestic C corporation (other than a foreign-owned domestic corporation, discussed in more detail below), a publicly traded REIT, a nontaxable holder, a foreign corporation (including a foreign government), a publicly traded partnership (domestic or foreign), an estate (domestic or foreign), an international organization, a QFPF, and a QCE, while a look-through person is simply any person that is not a non-look-through person.

A few special rules apply to certain persons in applying the look-through rules. For instance, a person that holds a less than 5% equity interest in a publicly traded REIT is treated as a U.S. non-look-through person, unless the REIT has actual knowledge that such person is not a U.S. person.[5] Also, a publicly traded REIT is treated as a foreign person by default, unless it is domestically controlled (which is determined by applying the foregoing rule that less than 5% equityholders are treated as U.S. non-look-through persons). Additionally, an international organization, a QFPF and a QCE are each treated as a foreign person for purposes of the domestically controlled test.

Under the Proposed Regulations, a “foreign-owned domestic corporation” must be looked through to determine whether a REIT is domestically controlled. A foreign-owned domestic corporation is any non-public domestic corporation where foreign persons hold directly or indirectly 25% or more of the fair market value of the corporation’s stock. As noted above, many real estate funds that invest through REITs have utilized a domestic blocker structure for their non-U.S. investors, such that the REIT’s U.S. ownership is maintained at 50% or higher. Because the domestic C corporation in this structure is typically 100% owned by non-U.S. investors, the domestic C corporation would be a foreign-owned domestic corporation and would be looked through under the Proposed Regulations.

The Proposed Regulations would also treat a foreign non-publicly traded partnership as a look-through person. Because a partnership is a “person” under the Code, many practitioners have treated direct or indirect ownership of REIT shares by a foreign partnership as being owned entirely by a foreign person for purposes of the domestically controlled test, even if some of the partners of the foreign partnership are domestic persons. This rule in the Proposed Regulations may potentially increase U.S. ownership percentage for purposes of the domestically controlled test to the extent a foreign partnership owner of the REIT is partly or wholly owned by U.S. non-look-through persons.

Although the Proposed Regulations would apply only to transactions occurring on or after the regulations are finalized, once they are finalized they could effectively apply retroactively because in order for a REIT to be domestically controlled, it needs to have less than 50% of foreign ownership at all times during a five-year period ending on the date of a disposition and the Proposed Regulations do not contain any grandfathering relief for existing REITs. For example, if the Proposed Regulations are finalized (as currently proposed) on January 1st, 2024 and there is a disposition of REIT shares on January 10th, 2024, the new look-through rules may potentially apply in determining whether the REIT had less than 50% foreign ownership at all times beginning on January 10th, 2019. Furthermore, the IRS specifically states in the preamble to the Proposed Regulations that it may challenge positions contrary to the proposed look-through rules even before the regulations are finalized.

We expect the IRS will receive a significant amount of comments opposing the new look-through rules. However, in light of the language in the preamble to the Proposed Regulations regarding the IRS’ potential challenge prior to the finalization of the rules and the possible retroactive effectiveness of the look-through rules, real estate fund sponsors and non-U.S. investors that have relied on foreign-owned U.S. corporations to achieve domestically-controlled REIT status should reevaluate their existing investment structures and explore alternatives to potentially satisfy the domestically controlled test under the new look-through rules in the Proposed Regulations.

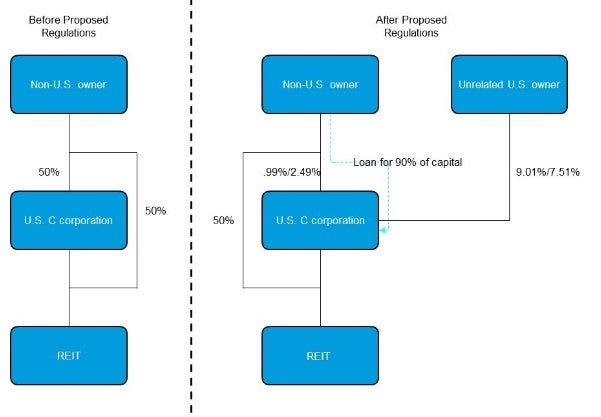

An alternative structure would replace the foreign-owned domestic C corporation in the following structure with a 9.9%- or 24.9%-foreign-owned leveraged U.S. corporation (with the remainder owned by an unrelated U.S. owner).[6] For example, if, in the existing structure, the non-U.S. investor had contributed $100 to the REIT directly and $100 to the domestic C corporation, under the new structure (assuming that 90% leverage is respected as indebtedness for U.S. federal income tax purposes), the non-U.S. investor would contribute $100 to the REIT directly, would loan $90 to the domestic C corporation, and would contribute $0.99 or $2.49 to the domestic C corporation, while the unrelated U.S. owner would contribute $9.01 or $7.51 to the domestic C corporation.

However, this structure would change the economics because the unrelated U.S. owner would capture between 75.1% and 90.1% of the profits of the domestic C corporation (after payment of interest and income tax). This alternative structure is shown below.

Section 897 and Section 892 Investors

Background

Under section 892, “foreign governments” (which include their “integral parts” and certain “controlled entities,” such as sovereign wealth funds) are generally exempt from U.S. tax on income from investments in certain securities, including stock of a USRPHC. However, the exemption under section 892 does not apply to income derived from the conduct of “commercial activities” (which generally includes profit-making activities other than investments in securities) by a foreign government directly or income received from a “controlled commercial entity” (a “CCE”), including dividends received from a CCE or gain from a sale of ownership interests in a CCE. A CCE is an entity that is controlled by the foreign government, by majority vote or value ownership or because the foreign government otherwise exercises effective control, and that conducts commercial activities.

Under the current temporary regulations, if a foreign government controls a USRPHC (or a foreign corporation that would be a USRPHC if it was a U.S. corporation), the USRPHC is automatically treated as a CCE, even if the USRPHC is only making investments in securities (which would not typically count as a commercial activity). Thus, assume that a sovereign wealth fund owns a 50% interest in a USRPHC that in turn owns only minority interests in other USRPHCs (that are not otherwise controlled by the sovereign wealth fund or its government sponsor). Under the existing temporary regulations, the USRPHC would be a CCE and the sovereign wealth fund would be subject to tax on any dividends received from the USRPHC or capital gains on a sale of equity interests in the USRPHC.

Proposed Regulations on USRPHCs as Deemed CCEs

The Proposed Regulations introduce a new exception from the temporary regulations under section 892 that treat foreign government-controlled USRPHCs as CCEs. Under the Proposed Regulations, a USRPHC (or a foreign corporation that would be a USRPHC if it were a U.S. corporation) that is controlled by a foreign government would not automatically be deemed a CCE if it is a USRPHC solely by reason of its interests in other USRPHCs that are not controlled by the foreign government. Therefore, under the Proposed Regulations, if a sovereign wealth fund owns a 50% interest in a USRPHC that in turn owns only minority interests in other USRPHCs (that are not otherwise controlled by the sovereign wealth fund or its government sponsor), the USRPHC would not be a CCE and the sovereign wealth fund would not be taxed on dividends received from the USRPHC, or capital gains on the sale of interests in the USRPHC. These rules would also apply to controlled entities that are QFPFs or QCEs.

These rules, if finalized, would be helpful guidance for foreign government investors because they would eliminate the need for foreign government investors to structure their investments in USRPHCs to avoid the deemed CCE status and would alleviate planning burdens involving structures with multiple corporate blockers (as an entity holding a non-controlling interest in a blocker that is a USRPHC would no longer be treated as a CCE under the Proposed Regulations).

These rules would be effective only after the date on which the regulations are finalized, but taxpayers may rely on them in the interim.

FOOTNOTES

[1] All section references are to the Code and the Treasury Regulations thereunder unless otherwise stated.

[2] Private Letter Ruling 200923001 (June 5, 2009). While private letter rulings may not be relied upon by taxpayers other than the taxpayer that requested the letter ruling, private letter rulings generally indicate IRS’ view.

[3] Joint Committee on Taxation, General Explanation of Tax Legislation Enacted 2015 (JCS-1-16), March 2016, p. 280.

[4] The look-through rules in the Proposed Regulations would also apply in determining the “foreign ownership percentage” for purposes of calculating how much gain would be recognized if a domestically controlled REIT were to distribute USRPI with built-in-gain. Under section 897(h)(3), a domestically controlled REIT is required to recognize gain in a distribution of USRPI equal to the foreign ownership percentage of the built-in gain of the distributed USRPI.

[5] The Proposed Regulations are unclear on how this rule would apply if the REIT has actual knowledge that a domestic partnership holder has foreign partners or a domestic C corporation holder has foreign shareholders. As drafted, it appears that the REIT could treat the domestic partnership or domestic C corporation as a U.S. non-look-through person.

[6] If the non-U.S. owner is resident in a jurisdiction with a tax treaty with the United States that provides for a zero rate of withholding on interest, the non-U.S. owner could own up to 24.9% of the domestic C corporation. Otherwise (and absent a “decontrol” structure for the domestic C corporation), the non-U.S. owner would be limited to 9.9% in order to receive interest on its loan to the domestic C corporation free of U.S. withholding tax.

/>i

/>i