Congress passed the Merger Filing Fee Modernization Act of 2022 (“Filing Fee Modernization Act”) on December 23, 2022 as part of a broader omnibus spending bill. It was signed into law by President Biden on December 29, 2022. The Filing Fee Modernization Act substantially alters the framework for filing fees under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“HSR Act”) for the first time since 2001. Filing fees for the largest transactions will increase to $2.25 million, substantially higher than the current highest filing fee of $280,000. Smaller transactions will see a slight decrease in their filing fees. The Federal Trade Commission (“FTC”) is expected to announce the effective date of the new fees shortly. The Filing Fee Modernization Act also imposes new disclosure requirements related to entities that are strategic or economic threats to the United States.

The HSR Act requires parties to mergers and acquisitions that meet jurisdictional thresholds to file an HSR premerger notification with the FTC and the Antitrust Division of the Department of Justice (“DOJ”) and to observe a statutorily prescribed waiting period prior to closing. The notification process requires the parties to pay a filing fee based on the “size of the transaction.”

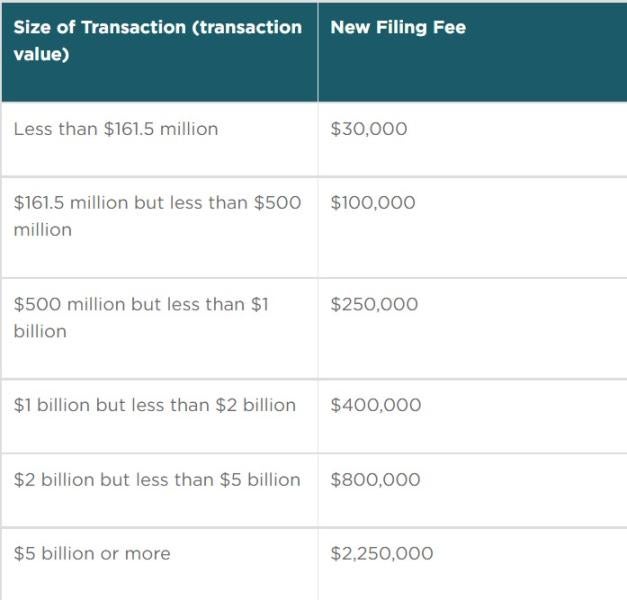

The revised filing fee structure under the Filing Fee Modernization Act will be as follows:

After the new fees are implemented, they will be adjusted annually based on the consumer price index.

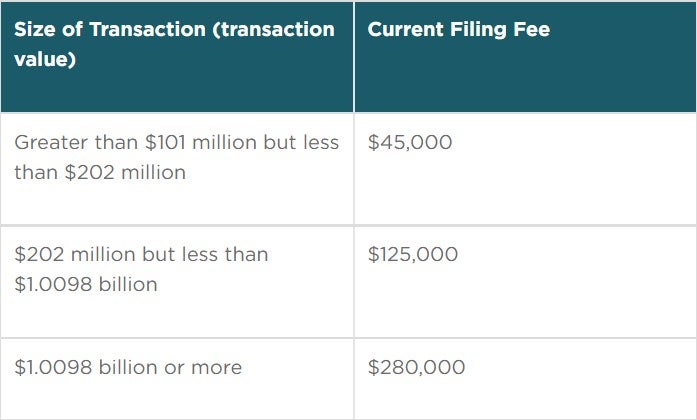

For comparison, the current filing fees are as follows:

The increased filing fees for larger transactions may impact the strategies of parties to such deals. Parties may more actively negotiate who is responsible for payment of the increased filing fees. The higher fees may also lead parties to delay filing their HSR premerger notifications until they have an executed definitive agreement rather than filing on a less-certain letter of intent.

The Filing Fee Modernization Act makes other changes to the premerger notification process, including a requirement that parties disclose information concerning subsidies received from countries or entities that are strategic or economic threats to the United States (“Foreign Entities of Concern” under section 40207 of the Infrastructure Investment and Jobs Act (42 U.S.C. 18741(a))). This includes the following:

-

Entities owned by, controlled by, or subject to the jurisdiction or direction of China, Iran, North Korea, or Russia

-

Entities designated as foreign terrorist organizations

-

Entities on the Office of Foreign Assets Control of the Department of the Treasury’s list of specially designated nationals and blocked persons (“SDN List”)

-

Entities alleged by the DOJ to have been involved in activities for which a conviction was obtained under the Espionage Act, Economic Espionage Act of 1996, the Arms Export Control Act, the Atomic Energy Act, the Export Control Reform Act, or the International Emergency Economic Powers Act

-

Entities determined to be engaged in unauthorized conduct that is detrimental to the national security or foreign policy of the United States

“Subsidy” is defined to include direct subsidies, grants, loans, loan guarantees, tax concessions, preferential government procurement policies, and government ownership or control. The scope of the required disclosures will be determined by upcoming rulemaking.

/>i

/>i