Like all businesses, law firms must balance their service offerings with profitability. However, many law firms still have a gross fees mentality, and measuring profits beyond the firm level is challenging. Many lack the systems or staff to make these calculations and interpret the results. Additionally, political concerns can inhibit the development of these systems in many firms. Overcoming these concerns and utilizing profitability information can help in:

- Pricing client work

- Evaluating client relationships

- Evaluating overhead

- Evaluating staffing efficiency

- Compensating equity owners

- Adjusting ownership percentages

In a legal market where there are rapidly rising costs, a shortage of available talent, workload imbalances, and evolving work/life expectations, shedding work for unprofitable clients is a strategic option.

Practical Considerations

When calculating the profitability of a client or matter, a firm must decide whether to use worked, billed, or collected hours and dollars in the analysis. We recommend conducting this analysis at the billing stage and adjusting for collected realization as a final line item. Our rationale for this approach is as follows:

- Revenue is typically considered realized when it is billed, even though it may have been earned earlier.

- As hours move from work in progress to accounts receivable (AR), it is easier to attach costs

- A firm has more control over the timing of billings than collections;

- Most firms do not have sophisticated cost accounting systems that would allow for attaching and storing costs as hours are entered into work in progress;

- For most hourly billing firms, the timing difference between when an hour is worked and billed is not material;

- Accounting for accounts receivable write-offs and setting reserves for older AR will approximate a cash result.

- Payroll and overhead costs are attached to all billed hours, including those billed at zero (WIP write-down)

Some clients ask us about substituting collections instead of billings and leaving all cost information unchanged. While this sounds simple and more applicable to compensation uses, it creates a probable mismatch of revenues and associated costs (collections often result from prior period results). For example, a client may have a matter worked in one year and paid in another. In this instance, the client will appear to have lost 100% in the billing year and show a 100% profit in the collection year.

One final note of caution: costing hours when billed creates a potential loophole because no costing applies to hours that remain in WIP. We suggest policies that cost hours in WIP at specific intervals.

The Best Tools for the Job

Having worked with most time and billing systems, we know that most systems track hours and dollars billed by client/matter with timekeeper-level detail. For firms that track originations, it is easy to create a file that apportions profits by the originator.

Historically, we preferred a database application to prepare more extensive studies. However, spreadsheets, particularly Excel coupled with Power BI, continue to add functionality and integrate AI, likely replacing the need for custom databases. Reporting flexibility, historical data management, and query and search capabilities help streamline results analysis.

The next step is to gather payroll data, which often proves more challenging because most firms use independent payroll systems, and creating a payroll master file with actual earned compensation requires manual intervention.

Finally, you’ll need to calculate overhead costs per hour, described in the chart presented later. Apportioning overhead is typically a manual exercise that requires a spreadsheet. The spreadsheet results in an overhead cost by timekeeper applied to each hour billed. Some firms have a profitability module associated with their time and billing system. While these systems can do much of the work, manually calculating costs per hour and loading them into the system is often necessary.

Calculating Cost per Hour Detail

In the chart below, each timekeeper's various costs are allocated and divided by their billable hours for the period. All overhead items are grouped and reported as a single number when compiling the report. Many of our clients appreciate a detailed hourly breakdown of costs per hour, which is easy to do from this point.

In this example, equity partner timekeeper pay is 35% (adjusted to market) of billings. Some firms prefer to set an amount per hour or some amount based on the firm's compensation plan. It is necessary to apportion only part of an equity owner's pay to timekeeping because their total compensation reflects other awards. The method used in this example assumes a market value approach to timekeeper pay. We use total compensation when calculating hourly payroll costs for associates and paralegals.

Fine Tuning the Analysis

Notice that we use billable hours when calculating profit per hour. We do this to match current-period costs with current-period hours worked.

Compiling Data into a Useful Format

Once the cost data is collected and allocated and the hours and billing data are in a usable format, the profitability analysis is easy to prepare.

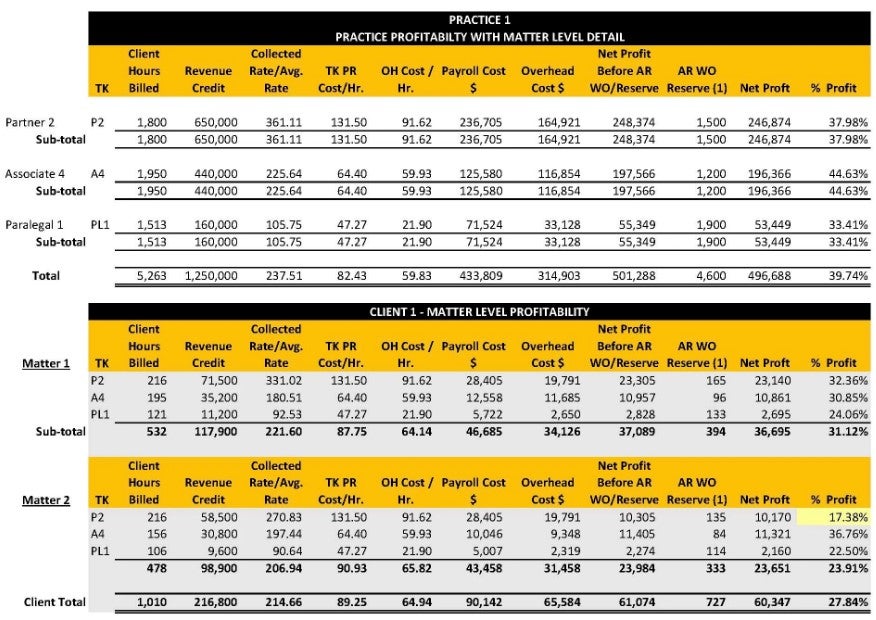

Consider the example below for a client with two open matters.

The practice-level detail provides information for hours billed and revenue credit. The collected average rate is informational and does not factor into the analysis. The cost allocation summary is the TK PR Cost/Hr source. (timekeeper payroll cost per hour) and OH Cost/Hr. (overhead cost per hour). Multiplying the Cost/Hr. data by the Client Hours Billed (hours billed, billed hours, fees relieved, etc.) results in the Payroll Cost $ and Overhead Cost $.

Net Profit Before AR WO/Reserve is the net profit before considering any accounts receivable (AR) write-offs, resulting from subtracting Payroll Cost $ and Overhead Cost $ from Revenue Credits (fees billed in most cases).

When analyzing profitability at the billed stage, it is necessary to consider amounts subsequently written off. As AR write-offs are often related to a prior period, we recommend factoring them in after computing the current year's net profit. Firms that regularly perform client/matter profitability analysis can review results over extended periods, providing a more accurate picture of the economic client relationship value (strategic value is different and not considered here) and smoothing out timing differences.

Interpreting Results

In our experience with clients analyzing client/matter profitability data for the first time, just having the information is exciting and informative for them. However, with this new information, the focus quickly turns to improving results.

An annual calculation of transaction-level profitability (clients, matters, sections, timekeepers, type of work, etc.) is better than not doing it at all; it has limited value. Performing this analysis at the end of a period (year) means it is only a look back, and corrective action can only affect next year’s results. Several of our clients now want this data on a more frequent basis. Quarterly is ideal, but semi-annually also helps. Relevant data from the current year expedites corrective action and provides pertinent pricing and pay decisions.

For some, these calculations may seem like a button push, but most firms never reach that stage. Even with significant progress on the part of some vendors in creating client profitability modules to augment time accounting systems, a trained eye is necessary to ensure correct overhead allocations and manage the nuances of different practice models. A poor cost allocation system can result in counterproductive behaviors and unintended consequences. Finally, many firms eschew adding new third-party applications into their environments for cybersecurity reasons.

Depending on the size of the firm and the number of open matters, interpreting profitability results can overwhelm busy lawyers. Most attorneys have a full schedule, and the last thing they want to do is read another 100 + page document. Choosing the right tools for the job will eliminate much of the work related to analyzing the results.

Strategically Interpreting Results

How to improve results is only sometimes obvious or practical. For example, poor profitability related to a short-term situation with a bad file, staffing inefficiency, or some other unique factor requires different solutions. Reviewing the historical client performance and particular circumstances will likely provide these answers.

Strategic reasons may compel a firm to keep an underperforming client. For example, if there is no ready replacement for the unprofitable client, putting the relationship at risk may require other intermediate actions, especially when the client revenue is enough to cover salaries and part of the firm’s fixed overhead. In this situation, sacking the client will likely require layoffs, which usually hurt the firm, and profitability suffers because the fixed overhead remains. A marketing plan to replace this underperforming client is a better long-term decision.

The value of regularly evaluating these data is significant. Our only caution is to take a constructive approach to interpreting results and effecting corrective action. Using these data to help attorneys improve profitability and increase income is better than a critical or penalty-based approach.

/>i

/>i