Spring is nearly here, and for most people, this new season brings a sense of revival and motivation.

Even if your 2022 New Year's resolutions have long since gone by the wayside, as most have, now can and should be a time of renewed focus on family and self-betterment. In the midst of economic uncertainty, geopolitical conflict, political divisiveness, and continued public health challenges, we should devote time to important matters that are within our control. At or near the top of that list is planning for the inevitabilities of death and incapacity. There is no time like the present to evaluate the estate planning that we have (or have not) undertaken.

Relevant considerations for you and your family may include

-

Is my current estate plan structured in a way that will promote efficient administration and minimize family effort and expense, or even controversy, at my death?

-

What federal economic and tax policy changes are likely to come out of Congress, and how might new policy impact or undermine my existing estate planning?

-

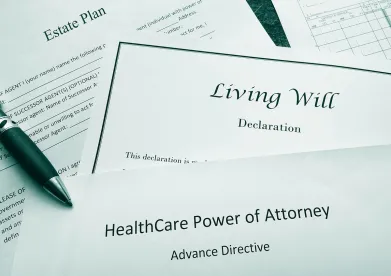

Do I have Powers of Attorney and a Living Will that express my wishes and allow my family or designees to make financial, business, and health care decisions in the event of my incapacity or absence?

-

Have my adult children executed the necessary basic legal documentation that would allow me to assist with their affairs in the case of accident or illness?

-

Are my assets structured in a way that limits my exposure to potential liability?

-

Will my qualified retirement account(s) pass to my beneficiaries in a protected and tax-efficient manner, in light of changes to applicable law?

-

Have I implemented planning that will allow my business to continue operating after my incapacity or death?

Significant tax law changes; past, present, and future

Federal gift and estate tax exemptions were altered significantly effective starting in 2018. Efforts in Congress last year to enact landmark changes to the gift and estate tax law appear to have stalled for the time being, but negative changes to the law are scheduled to occur January 1, 2026, and could happen earlier if Congress does not intervene. Income tax deferral opportunities with regard to inherited retirement accounts have been limited under current law. For those individuals who implemented their estate plan without proper consideration of recent or future legislation, new laws could lead to unintended consequences and even tax inefficiencies. Our attorneys regularly lead seminars and advise clients about planning during uncertain times, and we are fully prepared to discuss the potential ramifications with you.

Non-tax concerns

While tax minimization is a result that most any client would prefer, non-tax-related issues and objectives may be even more important for many of us. In today's bureaucratic (and often litigious) legal environment, a thoroughly-considered estate plan is vital to a family's future. Careful planning can help ensure: (a) that the time leading up to your death is less difficult and stressful for your family, (b) that your estate is able to be settled in an efficient and cost-effective manner, and (c) that your beneficiaries and assets are better protected against subsequent lawsuits or divorce. These issues are central in the planning efforts that our attorneys undertake with clients.

Suggested Action

Place a renewed focus on family, health, and estate-related planning. There is no time like the present to implement or update a plan that will be meaningful to your family.

/>i

/>i