When a family business owner's goal is to ultimately pass ownership of the business on to the next generation, business succession planning and the owner's estate planning are inextricably linked.

The most difficult issues and decisions presented in the family business succession planning context often relate to business control and personnel—identifying or choosing who will control and manage the business and how to keep key employees in place. This article will not address these difficult topics. Rather, this article will illustrate how, after ownership, personnel and management succession decisions have been made, careful estate planning through lifetime transfers might lessen the family's eventual estate tax burden.

The focus of this article will be lifetime transfers of closely-held business interests, and how transferring (partial) ownership of a family-owned company during lifetime might significantly reduce the estate tax that will be owed at death. It is important to note that intra-family business transfers and transactions are complex and that this article does not purport to address all (or even most) types of transactions or the issues and risks that require careful analysis before undertaking lifetime transfers. Instead, the discussion below provides a simplified example of the potential federal estate tax savings associated with lifetime transfers in one specific family business situation. All real-life business succession situations are unique. If your situation is different than that set forth below, that is to be expected—estate tax planning for your family might be structured differently. The point is that good estate planning can result in substantial estate tax savings.

A key point of this article relates to the relative uncertainty of the future of U.S. federal estate tax law. Generally speaking, under current federal estate tax law each U.S. citizen can give, during life or at death (or some combination thereof), up to $11,400,000.00 ($10,000,000.00, indexed to inflation to $11,400,000.00 in 2019) of assets to non-spousal beneficiaries free of federal gift or estate tax. This exclusion from gift and estate tax is often referred to as the "Gift and Estate Tax Basic Exclusion Amount" (the "Exclusion Amount"). However, current law also provides that, absent intervention by Congress, the Exclusion Amount will be reduced to pre-2018 levels, or $5,000,000.00 per donor (indexed to inflation), starting on January 1, 2026. This tax law provision is referred to as a "sunset clause." With current federal estate tax law being about as taxpayer-friendly as it has ever been, and in light of the impending sunset date and the divisive current political climate, business owners and affluent individuals may want to consider taking advantage of their increased Exclusion Amount before it is a thing of the past.

Here are the family facts that we will use for purposes of our illustration:

-

Wanda and Harry are married and have three children: Adam, Betsy, and Chris.

-

Wanda currently owns and manages 100% of ABC Co., LLC (the "Company"), a successful distribution company valued at $20,000,000.00. (Important Note: Small and mid-sized family businesses often have a higher value, as determined by the IRS, than the owners anticipate. While we will use a business valuation of $20,000,000.00 for this illustration, your business need not be valued that high in order to achieve savings from careful estate planning.)

-

Wanda and Harry want their three children ultimately to become equal owners and to take over management of the Company.

-

Wanda and Harry currently own assets, other than the Company, totaling $5,000,000.00 in value.

-

Wanda and Harry will pass away 20 years from now.

Here are important legal and financial assumptions that we will make for the purposes of our illustration.

-

The Company, and Wanda and Harry's other assets, will appreciate at a rate of 4% annually.

-

The Exclusion Amount, which currently is $10,000,000.00 (indexed to inflation at $11,400,000.00 for 2019) per donor, will revert back to pre-2018 amounts ($5,000,000.00, per donor, indexed to inflation), as of January 1, 2026. We will assume further that the Exclusion Amount will be $6,500,000.00 per donor when Wanda and Harry pass away in 20 years. (Important Note: As discussed above, this assumption is consistent with the sunset clause provision of the current law. Without action by Congress, the recently-increased Exclusion Amounts will decrease to pre-2018 levels as of January 1, 2026).

Below are illustrative calculations and explanations of the potential federal estate tax consequences of two different estate planning scenarios, as applied to the above facts and assumptions:

Scenario (1):

Wanda and Harry do not undertake lifetime transfers of the Company to their children, and instead, when they die in 20 years, their Wills leave Wanda's ownership interest in the company to the three children, or to trusts for the three children, in equal shares.

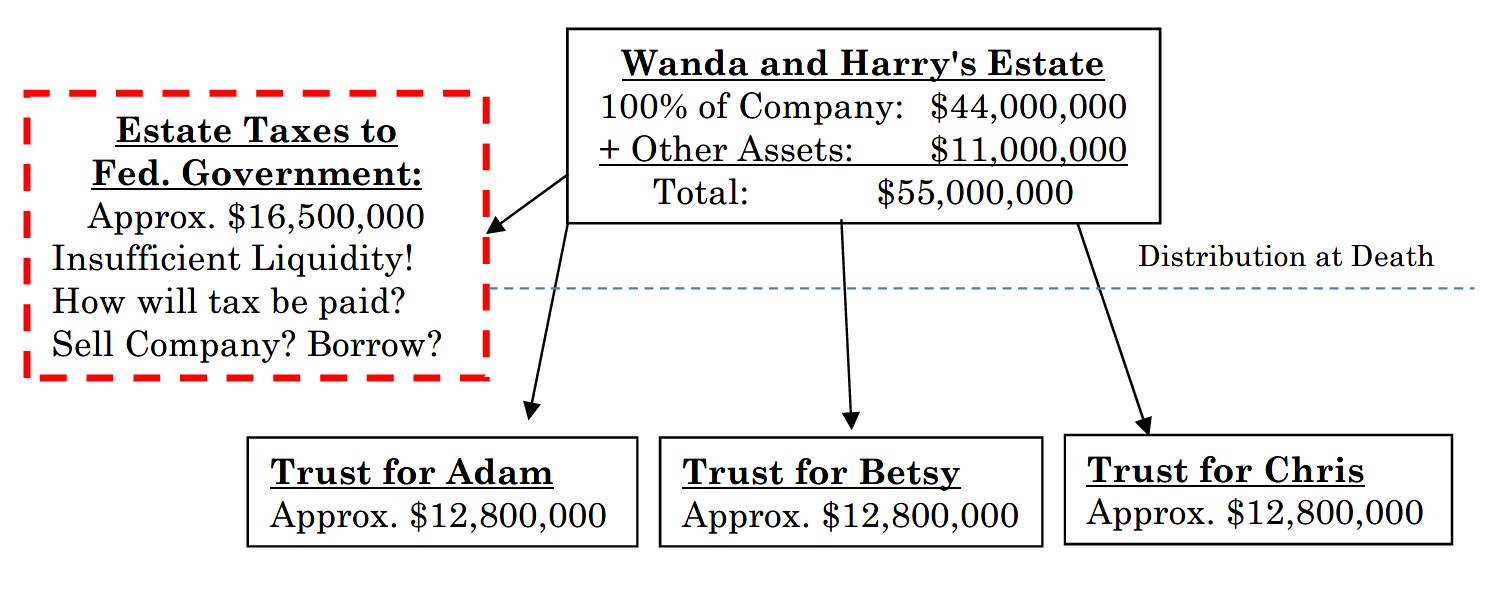

The result under Scenario (1):

Due to the appreciation of Wanda and Harry's estate, more than $16,500,000.00 of estate tax is owed when they pass away in 20 years. Based on the assumptions made above, Wanda and Harry's taxable estate will have appreciated to nearly $55,000,000.00 over the course of 20 years—with nearly $44,000,000.00 of that value being attributable to the Company. In that case, Wanda and Harry's estate will exceed their combined available Exclusion Amounts ($13,000,000.00) by more than $40,000,000.00. Applying that figure to a 40% estate tax rate is how we arrive at an estate tax estimate of $16,500,000.00. Note that the amount of estate tax owed under this scenario exceeds the value of the non-Company assets that pass as part of Wanda and Harry's estate—creating a liquidity crisis that may be a very difficult problem for the kids to sort out.

Illustration of Scenario (1):

Scenario (2):

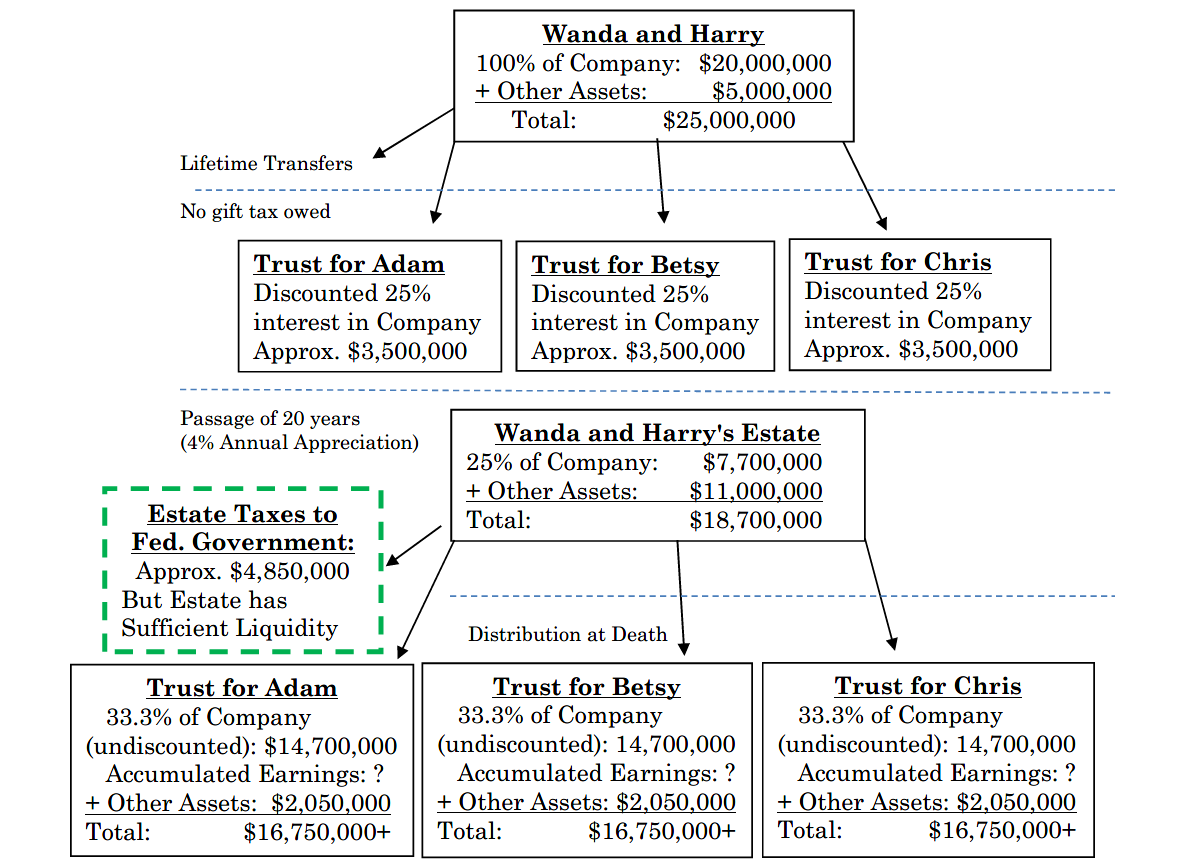

With the advice and assistance of their professional advisors, Wanda and Harry undertake carefully planned lifetime transfers of Wanda's interests in the Company to the children or to trusts for their benefit.

Result under Scenario (2): Due to the removal of future appreciation on the business ownership interests (and income therefrom) achieved through lifetime transfers to the three children, less than $5,000,000.00 of estate tax is owed—that is more than $11,500,000.00 in estate tax savings as compared to Scenario (1). Here is how:

Wanda works with her attorneys to recapitalize the Company into voting and non-voting LLC interests. After the recapitalization, all of the voting rights associated with Company ownership are contained in 1% of the LLC ownership interests, and the other 99% of the ownership interests have economic rights to Company earnings but no voting authority with regard to business management. As a result of this recapitalization, the non-voting interests in the Company are worth less, with the IRS having approved valuation discounts for non-voting interests equal to at least 30%. Wanda then gives 25% of the Company ownership interests to each child (or to a trust for each child) and retains 25% of the Company—including the 1% voting interest so that she can continue to control the Company. After applying a 30% discount, the gifts of 25% of the Company ownership interests to each child will have a discounted value for gift tax purposes equal to approximately $3,500,000.00 (or $10,500,000.00 in total, for all three gifts), but no gift tax is owed at the time of the transfers because Wanda applies her increased Exclusion Amount to the gifts. After the transfer of the 25% ownership interest to each child (or to his or her trust), those interests continue to appreciate outside of Wanda and Harry's Estate. Ultimately, under this scenario, Wanda and Harry's estate is valued for estate tax purposes at approximately $18,700,000.00 (rather than $55,000,000.00, as in Scenario (1)) at the time of their deaths 20 years later. After applying Harry's $6,500,000.00 Exclusion Amount to Wanda and Harry's remaining estate, only about $4,850,000.00 of tax would be owed. The remainder of the estate, and the previously gifted ownership interests in Company (as well as all appreciation thereon and all income produced therefrom), pass to the children.

Illustration of Scenario (2):

As you can see, under the right circumstances, lifetime transfers can generate tremendous estate tax savings. In addition, if the transfers are made to trusts for the children (rather than to the child, outright) it may be possible to achieve additional benefits, including increased protection against lawsuits, dissolving marriages, and future estate taxes. However, these types of transactions are not without risk and downside and must be carefully vetted by experienced tax and legal advisors. One very important downside to lifetime gifting is that, unlike assets that pass as part of a donor's estate, gifted assets do not receive a basis adjustment for income tax purposes at the time of the donor's death. Another downside is that the donor generally is not able to benefit economically from the gifted assets after they are transferred. However, in cases where the donor is concerned about divesting his or herself of the transferred asset (and the income therefrom), it is possible that the transfer could be structured as a sale, rather than a gift, in order to provide increased cash flow back to the transferor.

Lifetime transfers are not a silver bullet for all situations. However, given the uncertain future of federal estate tax law, business owners and affluent individuals should consider making lifetime transfers to take advantage of their increased Gift and Estate Tax Exclusion Amount before it becomes a thing of the past.

/>i

/>i