Law2020™ The Future Starts Now

We approach temporal landmarks — the turn of a millennium, a century or sometimes even a decade — rather as we approach a precipice like the Grand Canyon, feeling both exhilaration and dread. At the turn of the millennium, we encountered both extremes. These were the end-times, according to some; and the future was about to begin, according to others.

For the law business in the coming decade, this sort of geologic comparison seems especially appropriate. Taking it perhaps a bit too far, the preceding decade was, at least until its waning 18 months, a high plain indeed. That decade marked unprecedented revenue and profit growth, the latter driven by annual price increases that for some firms reached double digits. The year 2007 was, for many in the AmLaw 200, the best year on record.

We all know what happened next. The mortgage crisis hit in 2008, then the credit markets collapsed, and global equities began a months-long decline. The Great Recession rose up like a storm cloud and everything changed, perhaps forever.

Exhilaration or Dread?

Until the recession turns, not much is certain. The law business is as stressed as it has been at any time in the last 50 years. But what will come of that stress? Should we be exhilarated, or full of dread?

Commentators such as Richard Susskind believe the coming decade will be one of dramatic change:

When the storm lifts, the terrain is going to look wildly different . . . Those who think the techniques they must adopt to survive over the next few months will be irrelevant to the future are fundamentally mistaken. They are with us for life.

Implicit in such pronouncements is a certain kind of mortal dread: Some firms will fail. Only those that adapt will succeed. Susskind’s last book did not leave his conclusion implicit, by the way. It was titled The End of Lawyers. Point taken.

At the other end of the spectrum are those curmudgeons, including, apparently, a number of law firms, who think that we have experienced a disruption, not a major shift, and that everything will soon be just peachy again. In a recent Altman Weil survey, for example, 75 percent of corporate chief legal officers (CLOs) reported that, in spite of unprecedented pressure for change, law firms had “little or no interest” in changing the traditional law firm model. Implicit in that position is the assumption that, given enough time, the industry will get back up on its high plain of profitability and continue happily onward.

So, which will it be — exhilaration or dread? What will the coming decade bring? We will begin to answer that question in this article by comparing the legal industry’s current position with that of another industry — the newspaper business. A decade ago, it too stood on a precipice. What happened next is a lesson in the costs of complacency in the face of a rapidly changing marketplace.

Following that object lesson, we will begin addressing the questions that relate to a rapidly changing marketplace. How can we manage profound change and do so not only to cope with the stresses it imposes, but to positively thrive in the coming decade? What skills for lawyers and professional staff will be imperative for the firms that will emerge as leaders? What technologies will be paramount? What will the law firm of 2020 look like and how will it differ from the firm of today? In coming months and years, we will explore these and other critical questions as part of the ILTA’s Law2020 initiative. But before we look forward, let us first look back, in the spirit of Santayana: "Those who cannot remember the past are condemned to repeat it."

Stop the Presses

John Morton, an observer of the newspaper industry, wrote this in the American Journalism Review in October 1994:

Newspapers are renowned, and sometimes vilified, for their high profits. Even during recessions, when the profits of many other businesses fall sharply or disappear, newspapers usually still post more-than-respectable earnings.

The 1990s bore out that prediction. Newspapers and media companies the world over seemed to manufacture cash. Perhaps foremost among those, at least in the eyes of the investing public, was the Washington Post Company. Warren Buffet, recognizing the cash potential of the media business, first began investing in The Washington Post in the ‘70s. By the mid-‘90s, it had become one of the best in a long series of spectacular Buffet investments, one he often proclaimed a stellar choice.

Newspaper and media company shareholders, board members and executives had every reason to be optimistic as the new millennium approached. The euphoria was bolstered by a history of revenue growth and increasing returns that few other industries could match. What possibly could go wrong?

The first decade of the new century killed that euphoria. Advertising revenue, by far the main source of revenue for newspaper and media companies, peaked in 2000. But as the new decade progressed, those revenues began to oscillate, and then they crashed. By 2009, newspaper advertising revenues had fallen, in real dollars, to 1965 levels, as illustrated in the chart below (source: Columbia Journalism Review).

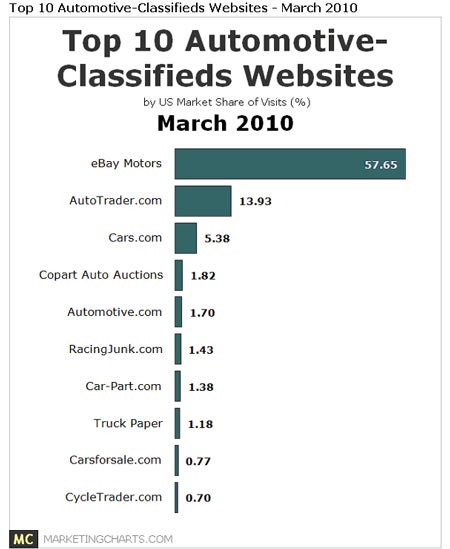

The cause for this decline was twofold. Changing demographics undercut circulation, as younger and more suburban consumers migrated from print to online media. But the key factor undoing print media was the migration of classified advertising to online outlets. As much as 80 percent of a newspaper’s ad revenue comes from classifieds — new and used car ads, real estate ads, employment ads, and the like. Advertisers in most of those areas have now shifted the bulk of their advertising dollars online. Between 2000 and 2009, nearly 70 percent of classified advertising shifted to online outlets. A good example is auto advertising. The following chart from MarketingCharts.com illustrates the problem. eBay now dominates automotive advertising, and other major sites siphon off still more print advertising revenue.

As a consequence of these steep declines in circulation and ad revenue, the newspaper industry has become an ongoing tale of woe, of death by the proverbial 10,000 cuts. Newsrooms have been double- and triple-decimated, major dailies have perished the world over, and even flagships such as the New York Times have suffered the indignities of the changing marketplace. The shape of a centuries-old industry has shifted dramatically in the blink of a decade.

It is interesting to note that even in the midst of all this woe there were hopeful moments and those who, with almost all evidence to the contrary, seized on that hope. The first waves of staff and other expense cuts in the industry did indeed restore some papers to profitability. But the detrimental impact on editorial content of all those cuts merely exacerbated long term declines in readership.

The Rise of the Realists

The newspaper industry in particular and traditional media in general suffered greatly over the last decade, but there were winners. Some media companies anticipated the coming shift in demand among readers, the fall of circulations and the flight of advertisers. Those few exhibited great flexibility and agility in shifting their businesses into areas such as cable and online outlets where demand was growing. These companies made realistic assessments of market conditions. They sought ways to syndicate content across media formats, and invested in new outlets, even entire new lines of business. Epitomizing such forward-looking businesses are companies like Rupert Murdoch’s News Corporation, which now has stakes in all forms of broadcasting, cable and satellite TV, new media outlets, as well as a small remaining stake in newspapers. Many of the top media companies have moved almost entirely out of the traditional newspaper business.

It is also worth noting the impact of entirely new lines of business on the habits of news consumers and advertising cash flows. What media company has grown the most over the last decade? Google. It is the world’s largest “content mediator” (note well, the term is not “publisher”). Its ability to connect content with consumers enabled it to generate nearly $23 billion in advertising revenue in 2009, an amount roughly equal to the combined newspaper advertising revenue for the top 100 media companies in the world.

All Along the Watchtower

Many signposts in the legal industry point to a coming transformation of significant magnitude, perhaps even one as deep and dramatic as that which befell the newspaper industry. Principal evidence of such change is the pivotal shift of attitudes among the people who are responsible for hiring and paying law firms. In a recent LexisNexis survey, 58 percent of corporate counsel believe that law firms are too profitable.

That “too profitable” message is not, on its face, terribly nuanced. However, a broader look at the marketplace adds a gloss. Many law department lawyers and CLOs say that they are happy to see firms profit from their activities. But they want firms to maintain or increase profits through innovation and changing the value proposition for their services, not through regular price increases. This reality has prompted one leading law industry consultant, Hildebrandt Baker Robbins, to observe:

The fact is that the extraordinary prosperity of the legal market in the 1998-2007 period was largely driven by one factor — the ability of firms to raise their rates 6-8 percent every year. If, as we believe, the era of such easy year-on-year rate increases is over, then the implications for the economics and structure of law firms are quite serious. (Source: 2010 Client Advisory)

So, large and regular price increases may be a thing of the past. However, what may become the central impetus for a shake up in the legal industry is both deeper and broader than “mere” price resistance. There is emerging now a powerful formalization and organization (using “organize” in the sense it might be used by, say, a union) of the discontent now widespread among clients. That formal response is a collective and highly structured initiative called the Value Challenge, which is engendered by the Association of Corporate Counsel (ACC) — “the world’s largest organization serving the professional and business interests of attorneys who practice in the legal departments of corporations, associations and other private-sector organizations around the globe.”

Firms Under the Microscope

The ACC’s Value Challenge is founded on the premise that year after year of price increases with no increased innovation and efficiency has severed the connection between the value of legal services delivered by most law firms and the price of those services. The Value Challenge is an effort to restore balance between value and cost.

As part of the initiative, the ACC has also kicked off a project of key performance measures. Its Value Index, launched in October 2009, endeavors to compare law firms based on simple post-work assessments by in-house counsel. Participants rate the firms from 1 to 5 with 1 being poor and 5 being excellent — and then indicate whether they would use the firm again. There is a spot for comments, and respondents can choose whether to keep their name and information anonymous. By the end of 2009, the ACC had collected 1,800 evaluations of 600 different law firms. Consumer Reports for law firms has arrived.

The Value Challenge initiative has been accompanied by a number of vocal pronouncements by leading CLOs concerning the need for law firms to change their ways. These CLOs and others are also putting their money where their mouths are. Recent surveys have noted a significant uptick in the number of fee arrangements based on something other than the billable hour. (Sources: Altman Weil, Inc. Report to Legal Management, January 2010; Altman Weil, Inc. 2010 Billing Rates Survey). And some companies have gone still further. For example, in late 2009, Levi Strauss & Co. allocated all of its legal work (except IP work) to a single firm for a flat monthly fee, and other companies are following suit by outsourcing entire legal functions to single firms.

Both as a consequence of the Value Challenge and of the underlying dissatisfaction that necessitated it, the legal market has over the last year and a half seen a significant shift in buying habits. A number of surveys now show a sharp rise in demand for non-hours-based fee structures. (Sources: Altman Weil, Inc. Report to Legal Management, January 2010; Altman Weil, Inc. 2010 Billing Rates Survey). A recent ACC survey reports that four out of five in-house lawyers expressed a desire to increase their spending on alternative fee arrangements (AFAs). Companies have also accelerated already-established trends toward reducing the number of law firms approved to provide services and toward introducing purchasing disciplines (such as RFPs) into the buying process. Law departments have also considerably elevated pressure on rates over the last year, with the result that rate increases have slowed considerably.

Law firm responses to these signals of marketplace change have been very . . . um . . . newspaper-like. They include radical reductions in force at all levels within law firms as well as other aggressive cost-cutting measures. These bar charts from Hildebrandt Baker Robbins capturing metrics from over 100 leading law firms illustrate the extent of those cost-cutting efforts and, at least for the year 2009, the immediate beneficial impact of those cuts on profitability.

What law firms have not done in response to the very clear messages emerging from their customer base is engage in widespread or radical innovation. There are pockets of innovation, and some new business models are emerging. Indeed, these may become the seeds of success for the firms that will thrive over the next decade. But what is striking is how pervasive passivity is as a response to such challenges — passivity remarkably similar to that exhibited by newspapers facing the eradication of their business model.

The Client’s the Thing

Those media companies that survived and even thrived through the first decade of this century did so as a consequence of extraordinary attention to both the preferences and needs of their customers. You could argue that the shift in preferences in the newspaper industry was easy to miss because no one understood new media and its emerging users, but in the law business we have customers who are in no way subtle about expressing their preferences. The ACC Value Challenge is tantamount to clients grabbing us by our lapels, shaking us and saying, “Pay attention to us!” It is hard to imagine that in the wake of such ardent lapel grabbing the law business will simply resume its old path.

It is a very safe prediction to say that those firms that thrive through the next decade will pay extraordinary attention to clients’ preferences and needs. Now, most lawyers will respond to such a pronouncement by saying something like, “I already pay attention to my clients’ needs. That’s what I do every day.” And that is doubtless true for most lawyers. But it misses the point of the Value Challenge. Our clients are telling us that we charge too much for the value of the services we deliver. They are asking us, quite pointedly, to rethink how we structure, price and manage our services.

The firms that will thrive over the next decade are beginning to understand that request and move in that direction. For example, some firms are restructuring the delivery of e-discovery services in order to completely revise existing price and effectiveness models. These firms understand that fulfilling client needs means more than just returning phone calls. It can mean changing your business.

Institutional Agility and Flexibility

The media companies now dominating the media marketplace did not lie back and wait to see what others were doing. Most were extremely aggressive in expanding into online, cable and other new markets both by means of acquisitions and through original creations. They showed great agility in acting on opportunities and great flexibility, especially in terms of how they viewed their core businesses. Those whose view of themselves was defined by what they had always done and who therefore could not adapt with flexibility and agility are now gone, or nearly so.

The “horizontal” structure that characterizes law firms can often be an advantage. Individual lawyers themselves can sometimes act with great flexibility and agility. But the challenge to “rethink how we structure, price and manage our services” is an institutional one, the meeting of which will require institutional agility and flexibility. Abundant business school case studies examine how various corporate businesses responded to marketplace challenges with agility and flexibility. It’s safe to say that there are not so many studies concerning law firms.

The horizontal structure that proves such an advantage in some circumstances does not lend itself to rapid movements in new directions. Perhaps by 2020, there will be some inspiring and instructional case studies of the firms that have managed to overcome the limitations of horizontal structures and answer the new demands of this decade’s legal marketplace. Of course, there will likely be case studies of the firms that failed to overcome such limitations.

Process Improvement and Quality Assurance

The newspaper industry and the law business both have elements of the guild about them. Apprenticeship features strongly in their professional development cultures — whether it is the cub reporter becoming a journeyman journalist or the associate becoming a partner, learning is most often accomplished in very small group settings and through close interpersonal relationships. That is an advantage in both settings, and part of the charm of each.

Those guild-like working relationships continue into the main of legal practice. Most legal projects have been and continue to be managed through small teams that interact without a lot of what lawyers like to call “corporate” hierarchy. In the environment of the last several decades, such relatively informal working relationships have functioned well. The billable hour certainly adds some cushion to such a work environment, which has been fairly tolerant of inefficiencies.

All that changes significantly as legal projects increase in scale and especially when they must be done for a fixed price or in a manner that otherwise shifts considerable risk to the law firm. Inefficiencies become expensive in such a setting. Couple that with increasing demands by clients that firms be able to not just budget but to schedule as well, and law firm work begins to look much more like work in mainstream industry.

The ACC’s President, Fred Krebs, is fond of pointing out that many law firm clients have taken project management, process control and quality assurance to a high art. Can you imagine, he asks, building a transport airplane or a skyscraper using the management and pricing approaches of law firms? It is a rhetorical question, though the follow-up question is not: Why can’t law firms adopt the very same controls that their clients use?

Adoption of client business management techniques has increased in the legal industry. Some firms are very sophisticated in how they manage, for example, advanced technologies. Law firms now regularly appear in rankings of the top IT organizations in the world. And you can bet that those organizations have taken, say, project management to an advanced state, at least within the IT organization.

By 2020, however, we will see a number of firms that have thrown open the doors to their project management offices and applied the techniques that have let them manage IT so well to their own legal services. Indeed, we might expect IT executives to exert leadership influences outside of their traditional domains. They know valuable things. Law firm economics are now shifting so as to provide incentives for recognizing and fully utilizing such skills.

Incentives are also increasing toward the use of process control and quality assurance. We have already seen at least one U.S. firm adopt elements of the Six Sigma discipline. (Source: Value Practice: Use of Tailored Six Sigma Methodologies at Seyfarth Shaw). By 2020, we can expect to see much more of that.

Expanding the Service Platform

As the decade continues and some law firms adopt staffing, project management, process control and quality assurance innovations from mainstream industry, we might expect them to expand their service offerings beyond traditional legal services. Indeed, we have already seen some of this as firms reposition IT services and, more recently, e-discovery services as stand-alone service organizations.

We have already seen and can expect to see more of the “cost center” phenomenon that was especially evident in industry through the 1970s and 1980s. Back then, many businesses sought to convert cost centers within their companies into revenue generating entities. Most efforts folded under their own weight because companies underestimated the resource and financial commitments necessary to turn an internal service organization into one that stands on its own.

But then there were the exceptions. Foremost among those is what used to be known as Andersen Consulting and is now known as Accenture. It grew out of an internal IT consulting service and, after splitting with Arthur Andersen and Company in 1989, has grown to become one of the largest consulting organizations in the world.

By 2020, we may well see a significant percentage of law firm revenues coming from nontraditional realms such as IT consulting, strategic consulting, e-discovery and due diligence services as well as other areas. Indeed, some firms are already very active in these areas.

By the time of the split, Andersen Consulting’s per partner profitability far outstripped that of Andersen proper. Indeed, that was a factor in the split (as well as the liability that arose from Andersen’s audit activities). We see some firm e-discovery consulting arms already moving toward extraordinary profitability while, at the same time, radically lowering the cost of e-discovery and otherwise much improving service levels for clients. This is also true in other areas, such as legislative consulting.

Firms that manage to create such entities either within or alongside their organizations will be in a much better position to endure an environment of increased downward pressure on rates. Indeed, over the next decade, one might predict the demise of firms that, like some since-lapsed newspapers, could not diversify their revenue sources. Those perished papers clawed ever deeper into expenses trying to maintain historic levels of profitability, without ever touching their 100-year-old business model. It is not at all difficult to imagine a similar picture in our industry.

The Telescope and the Crystal Ball

We can go much further than we have here in raising our hand to our forehead and squinting at the horizon in an attempt to identify productive paths to the future. ILTA’s Law2020 initiative will continue this effort, but we can also be hopeful that through the proven “power of the crowd” that is inherent in ILTA’s peer-to-peer model, Law2020 will bring to the task both a “telescope” of foreseeable events and a crystal ball to portend the future. The content in this issue of Peer to Peer will amplify these explorations in various ways. And the Law2020 sessions at ILTA’s annual conference in August will continue the effort. But expect much more in the years to come. Whether standing on a precipice or climbing out of a valley, we will look with clear vision at the path that lies ahead.

This article was orignially published in the June issue of Peer-to-Peer , the quarterly magazine of ILTA, and is republished here with permission.

Mark Chandler, Senior Vice President, General Counsel & Secretary, Cisco Systems, Inc. (April 2008); Value-Based Staffing Practices: Focus on Communications Skills and Tools At AmerisourceBergen Corporation, John Chou, Senior Vice President, General Counsel & Secretary, AmerisourceBergen Corporation (March 2010);Yes, 'Small Law' Can: Alternative Fee/Value-Based Arrangements at Wolverine World Wide, Inc.

Ken Grady, General Counsel and Secretary for Wolverine World Wide, Inc. (January 2010); Achieving Alignment Inside and Out: Portfolio of Legal Services on Flat Fee and Disciplined Internal Planning Process, Christopher Reynolds, Group Vice President and General Counsel for Toyota Motor Sales, USA, Inc. (September 2009); Creating Value By Selecting Strategic Practice Area Providers - Practices at GE Canada, Bruce Futterer, Vice President, General Counsel and Secretary, General Electric Canada (July 2009); ACC Value Challenge: The Driving Force Behind Value and Change, Jeffrey Carr, Vice President, General Counsel and Secretary for FMC, Technologies (February 2009); ACC’s Value Challenge: Re-Connecting Legal Costs to their Value, Laura Stein, Senior Vice President and General Counsel for The Clorox Company and ACC 2008 Board Chair, (October 2008)

/>i

/>i