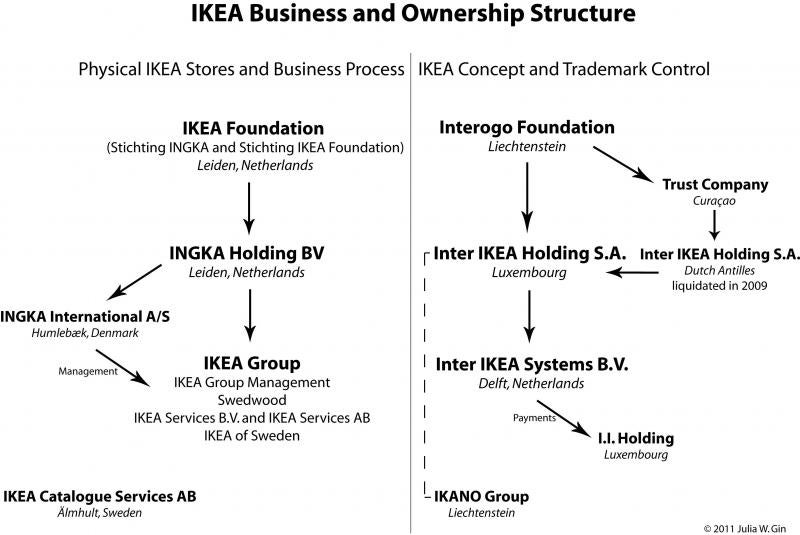

Since its first store in Sweden in 1958, IKEA has rapidly become an international household name. The large Swedish flag-inspired blue and yellow buildings are a beacon for anyone searching for a wide selection of affordable modern furniture for varying tastes. On its face, IKEA appears as any other large corporation that has taken the world by storm but with a few notable exceptions. Firstly, the physical IKEA stores and business operations are owned by an untaxed two-pronged nonprofit foundation in the Netherlands: the Stichting INGKA Foundation and the Stichting IKEA Foundation. Secondly, the IKEA Concept and IKEA trademark rights are owned by Inter IKEA Systems B.V., which is operated through a variety of companies based in the Dutch Antilles, Luxembourg, and Liechtenstein that are all controlled by IKEA founder Ingvar Kamprad himself and his three sons through the untaxed Interogo Foundation. Thirdly, Kamprad moved from his hometown in Sweden to Denmark and finally to Switzerland, successfully benefitting from ideal tax regulations, especially the generous Swiss tax breaks for wealthy foreigners.[1] This is only a brief summary of what is so unique about IKEA, aside from its eccentric founder.

The intricate corporate structure was created to give IKEA eternal life through lessening the international tax impacts and maintaining the foundational IKEA corporate culture. This paper will disentangle the numerous organizations within the IKEA system while delineating their interrelationships, and explore the current tax practices of IKEA and the tax-induced reasons for this particular setup.

International IKEA Business Structure and Tax Practices

Kamprad registered IKEA as a company in Sweden in 1943. Soon after IKEA’s booming success within Sweden, Kamprad became concerned with the high Swedish inheritance and wealth taxes, and family squabbles that could potentially tear the company apart.[2] In his own words, “as an emerging global company, I also had to ensure that we were structured in tax efficient ways to avoid the burden of double taxation.”[3] Kamprad met with the National Tax Board in Stockholm to discuss IKEA’s departure from Sweden and then with Denmark’s tax board to clarify what the tax benefits would be if he moved IKEA across the Drogden Strait.[4] In 1973, Kamprad moved the company to Denmark and began the plan to secure IKEA’s immortality. In his own words:

When the family and I moved abroad, we automatically received permission from the National Bank [of Sweden] to take with us 100,000 kronor[5] per member of the family. That half-million was enough to start a foundation in Switzerland, where real estate may not be owned by foreigners, and to found a whole series of companies in different countries with different tax regulations—from Switzerland and Holland to Panama, Luxembourg, and the Dutch Antilles. Our many lawyers quite often had completed registration of companies in their back pockets in reserve, so the process was soon completed and not particularly expensive. Many of the companies have never been used.[6]

It is unknown how many companies are still unused and in reserve, but there are many organizations currently active in IKEA operations.

The international IKEA business structure involves the following main entities:

- Stichting INGKA and Stichting IKEA Foundation—will refer to as the IKEA Foundation (Netherlands)

- INGKA Holding B.V. (Luxembourg)

- Inter IKEA Systems B.V. (Netherlands)

- Inter IKEA Holding S.A. (Luxembourg)

- Inter IKEA Holding (Dutch Antilles)

- I.I. Holding (Luxembourg)

- IKANO Group (Liechtenstein)

- Interogo Foundation (Liechtenstein)

More IKEA entities are involved within the main controlling bodies and there are likely additional IKEA related companies that have either ownership or an interest in IKEA business.[7]

IKEA Foundation (Stichting INGKA and Stichting IKEA Foundation)

Formed in 1982 in Leiden, Netherlands, the IKEA Foundation, made up of the Stichting[8] INGKA and Stichting IKEA foundations, has been the world’s biggest charity since 1984 when Kamprad gave the Foundation the irrevocable gift of 100% of his equity in the company.[9]

The Netherlands was chosen as an ideal country by a team of lawyers from Switzerland, Denmark, Sweden, France, and England because it had “the oldest and most stable legislation on foundations.”[10] As an added incentive, Dutch foundations have loose regulations, little oversight, and “are not, for instance, legally obliged to publish their accounts.”[11]

The IKEA Foundation is based on the double Dutch foundation system. The Stichting INGKA and Stichting IKEA are technically one foundation but operate as two, with Stichting INGKA as the owner foundation and Stichting IKEA as the charitable foundation.[12] Stichting INGKA holds all the shares in the for-profit INGKA Holding B.V., which is the group of companies that controls all of the IKEA stores worldwide and will be discussed below.[13] Stichting IKEA is to receive money from the Stichting INGKA arm for distribution towards the fulfillment of the IKEA Foundation’s mission: “to promote and support innovation in the field of architectural and interior design.”[14] The IKEA Foundation must also “ensure ‘the continuity and growth’ of the IKEA Group” and is required to maintain INGKA Holding B.V.[15] To ensure this mission is carried out, the IKEA Foundation is run by a five-person executive committee with two seats reserved for the Kamprad family[16] (which is chaired by Kamprad and has also included Kamprad’s wife, Margaretha Stennert) that appoints its own committee members and also appoints the board of directors of INGKA Holding B.V.[17]

The IKEA Foundation is registered in the Netherlands as an “Institution for the General Good”[18] charitable foundation, which is the equivalent of a 501(c)(3) in the United States.[19] Qualification as a charitable foundation under Dutch law is relatively simple with only a few conditions that need to be met:

- A request for charitable foundation status filed with the Dutch tax authority

- The purpose of the foundation is not to generate profit and has a charitable purpose

- An individual or entity may not use assets as if owned by the individual or entity

- Board members may not receive remuneration other than costs

- If dissolved, all funds must go towards a charitable purpose

- The foundation’s assets must not exceed what is required for a reasonable fulfillment of the foundation’s charitable purpose.[20]

In addition, Dutch charitable foundations receive the following benefits:

- Gifts are tax deductible for Dutch income and corporate income tax purposes, and are not subject to the Dutch gift tax,

- Inheritances are not subject to Dutch inheritance tax, and

- Are not subject to Dutch corporate income tax on any income.[21]

With the IKEA Foundation categorized as a Dutch charitable foundation, they are not required to pay taxes on any income from the IKEA business. In 2010, IKEA earned almost $4.1 billion[22] and as of 2006 the IKEA Foundations net worth was at least $36 billion[23]. In order to fulfill the mission of “innovation in the field of architectural and interior design”, the IKEA Foundation gave one grant in 2005 to the Swedish Lund Institution for $1.7 million.[24] [25] Additionally, IKEA’s new BoKlok flat-pack housing could be seen as a contribution to innovating architecture.[26]

Ultimately, any profit made from the INGKA Foundation through its ownership of INGKA Holding B.V. is not taxed in the Netherlands.

INGKA Holding B.V.

INGKA Holding B.V. may be owned by the IKEA Foundation, but is itself a private company registered in Leiden, Netherlands.[27] INGKA Holding B.V. has physical ownership of the entire IKEA business. This currently includes “more than 300 stores in 35 countries and more than 130,000 co-workers.”[28] It is the parent company for the IKEA Group which includes, but is not limited to: IKEA Group Management[29], Swedwood[30], IKEA Services B.V. and IKEA Services AB[31], and IKEA of Sweden[32].[33] To manage the IKEA Group, INGKA Holding B.V. assigns INGKA International A/S, headquartered in Humlebæk, Denmark, to run the executive functions of INGKA Holding B.V. and to manage international store business. This includes “purchasing, product range, distribution, sales, and sometimes manufacturing.”[34]

INGKA Holding B.V.’s ownership and control of the physical IKEA stores and business operations is entirely separate from the IKEA Concept, which is exclusively owned by Inter IKEA Systems B.V.

Inter IKEA Systems B.V.

Inter IKEA Systems B.V. is registered in Delft, Netherlands. It owns the IKEA concept and trademark, and controls the IKEA Concept franchise.[35] This “Sacred Concept” controls the brand name, copyrights, regulations, and anything else related to the idea of IKEA.[36] The root of the Concept can be found in Kamprad’s Testament of a Furniture Dealer[37], “to create a better everyday life for the many people by offering a wide range of well-designed, functional home furnishing products at prices so low that as many people as possible will be able to afford them.”[38]

Inter IKEA Systems B.V. is the entity that approves or denies a franchise permit to run any IKEA store.[39] It also ensures that every franchisee follows the exact IKEA Concept with very specific store designs including the children’s playroom, the restaurant, and the set-up that leads the shopper around the store in a guided pathway.[40] Store managers must send a written request to deviate from the IKEA Concept, and if the rules are broken without permission Inter IKEA Systems B.V. has the power to stop supplies and have the rogue store’s IKEA sign taken down.[41]

For its efforts as the IKEA Concept franchisor, Inter IKEA Systems B.V. receives a generous 3% royalty from the global sales from all the IKEA stores worldwide[42], an income of 80 billion Swedish Kronor[43] in the last 20 years.[44] This figure is expected to rise considering in 2010 “IKEA’s sales grew by 7.7% to 23.1 billion [Euros] and net profit increased by 6.1% to 2.7 billion [Euros].”[45] Inter IKEA Systems makes large payments to another company registered in Luxembourg called I.I. Holding (unknown ownership and no website), and both companies paid 19 million Euros in taxes in 2004 of a combined profit of 328 million Euros.[46]

Inter IKEA Systems B.V. itself is owned by parent company Inter IKEA Holding S.A. which is registered in Luxembourg, and is also a part of the identically named Inter IKEA Holding S.A. that is registered in the Dutch Antilles.[47] Until its liquidation in 2009[48], a “trust company” headquartered in Curaçao operated the Inter IKEA Holding S.A. of the Dutch Antilles[49]. Inter IKEA Holding S.A. had post-tax profits of $1.7 billion in 2004.[50] Further details on Inter IKEA Holding S.A. are discussed below within the context of the Interogo Foundation.

Inter IKEA Systems B.V. is assisted in preserving the IKEA Concept by the IKANO Group, which is a company owned and controlled by Kamprad’s three sons, Peter, Jonas and Matias.[51]

IKANO Group

The IKANO Group was founded in 1988 and is owned by the Kamprad family with fund assets of 3.4 billion Euros in 2009.[52] [53] The IKANO Group is based in Liechtenstein, with the vision “to inspire our people to build profitable companies that dare to be different and are fun to work for.”[54] The IKANO Group contains all of the Kamprad-owned companies that were not given to the IKEA Foundation[55] and is primarily concerned with managing the Kamprad family fortune[56]. Peter, Jonas and Matias are currently on the IKANO Board of Directors with Kamprad listed as a Senior Advisor.[57] Kamprad gave IKANO to his sons to run as they see fit[58] as separate but in support of the IKEA entity.

“IKANO fundamentally safeguards the same virtues—simplicity, thrift, and so on—that mark IKEA” through its activities in finance, insurance, retail and property.[59] Though the finance division is most profitable, the property stock of the IKANO Group will ensure the Kamprad family’s economic security.[60] Most notably, IKANO had made early investments in shopping centers near IKEA stores[61], which must be extremely lucrative at present day considering the rapid development of the surrounding areas that generally radiates from the opening of new IKEA stores. Though IKEA and IKANO had absolute ties when Kamprad chaired both entities until 1998[62], it will be no surprise if the two continue a close business relationship.

Initially, it was believed that IKANO was the Kamprad family’s covert ownership and controlling interests in IKEA. However, with the recent discovery of the Interogo Foundation, it appears that IKANO is indeed an independent and merely supporting entity of IKEA.

Interogo Foundation

According to Kamprad himself, the “Interogo Foundation, based in Liechtenstein, is the owner of the Inter IKEA Holding S.A., the parent company of the Inter IKEA Group…[and] is controlled by my family…”[63] The Inter IKEA Group includes Inter IKEA Systems B.V. (controls and owns the lucrative IKEA Concept) and Inter IKEA Holding S.A. (which owns Inter IKEA Systems B.V.). As discussed earlier, the identically named Inter IKEA Holding S.A. of the Dutch Antilles that was operating in Curaçao was liquidated, which can only be done by the owner of the company[64], now known to be the Interogo Foundation.

The Interogo Foundation was created by Kamprad in 1989[65] [66] with the purpose of investing in the expansion of IKEA to ensure its longevity as a method of financial security.[67]

Liechtenstein is a strategic choice for many companies because of its closed system of rules and regulations which lead to its reputation as an international tax-haven[68]. Furthermore, Liechtenstein has “liberal principles of [ ] foundation law” with the purpose of attracting lucrative investments.[69] Some of the advantages of Liechtenstein foundations include:

- Political and economic stability, and a central European location

- A liberal and business-oriented legal system

- Stringent professional secrecy regulations for banks and trustees

- Effective methods of preserving family wealth over generations

- Efficient protection of assets from third parties

- Efficient international tax planning

- Flexibility regarding the advancement of charitable purposes, and

- Discretion and anonymity with regard to the founder’s wishes.[70]

These benefits create the perfect environment for the foundation envisioned by Kamprad to ensure his family would not be plagued by the high inheritance taxes in Sweden.

“[Interogo] Funds could also be used to support individual IKEA retailers experiencing financial difficulties and for philanthropic purposes”[71] as an additional safeguard to IKEA’s immortality. Liechtenstein law governing charitable foundations follows a “Criterion of Preponderance” which allows a foundation to be classified as charitable if the majority of activities are dedicated to charitable versus private purposes.[72] The current law defines “charitable” as:

…purposes which help fostering the public benefit… This is especially the case if the activities of the foundation foster the public benefit in the charitable, religious, humanitarian, scientific, cultural, moral, social, sporting or ecological field, even if the activities are only in favour of a determined circle of persons.[73]

A Swedish documentary aired on the Swedish public network SVT on January 26, 2011 by the Uppdrag granskning investigative news program[74] stated that the Interogo Foundation has $15.4 billion in funds.[75] 2010 was the first year in the last two decades of its existence that the foundation published detailed figures on sales, profits, assets, and liabilities.[76]

The Uppdrag granskning documentary further stated that the 3% of IKEA sales royalties from all IKEA stores worldwide that are supposed to go to Inter IKEA Systems B.V. for use of the IKEA Concept and franchise actually goes directly to the Interogo Foundation and is tax-free.[77] Interogo’s purpose of ensuring IKEA’s prolonged existence and assisting in IKEA’s philanthropic ventures would seem to indicate a mixed family foundation[78] which supports the Kamprad family while also contributing to charitable institutions. However, if the tax treatment of Interogo’s business venture through Inter IKEA Systems B.V. holds true, this would signify Interogo’s treatment as a purely charitable foundation under Liechtenstein law. Liechtenstein law does acknowledge that that this is not a typical allowance for foundations:

Foundations, in principle, may not engage in commercial activities. However, the foundation may pursue commercial trade when this serves the attainment of its non-commercial purpose, or the nature and extent of the foundation’s assets (e.g. the holding of participations) necessitates business operations.[79]

If Interogo’s goal of supporting IKEA’s possible philanthropic projects is upheld by Liechtenstein as its main non-commercial purpose and the ownership of Inter IKEA Systems B.V. necessitates business operations, Interogo would legally not be taxed.

There is also a supreme focus for Liechtenstein foundations on the intent and purpose of the founder. The founder provides the purpose of the foundation, which is fixed and unchangeable once the foundation has its own legal personality, and has the sole power to revoke the foundation.[80] If the founder chooses to revoke the foundation, the assets of the foundation revert to the founder.[81] The founder may name an “ascertainable class of beneficiaries”, be assisted by a family council, and manage the foundation’s assets personally.[82] A Liechtenstein foundation may exist indefinitely or until the founder’s purpose is realized.[83] With Interogo founder Kamprad’s goal of IKEA’s eternal life, Interogo will be in operation for as long as IKEA is in existence, aided by both IKANO and Interogo.

Additionally, certain bylaws of the foundation leave little doubt that Interogo was intended to be left to its own devices:

- Documents about the foundation are not allowed be shown to outsiders or foreign authorities

- Proceeds may be paid in the form of grants to individuals or organizations related to architecture, interior design, and consumer products

- The Kamprad family has “total control” over the executive board of the Inter IKEA Group[84]

The revelation of Interogo’s existence, control over IKEA, and ownership by the Kamprad family is unfortunate for the founder considering his consistent stance that “he and his family no longer controlled the global furniture giant.[85]” He has further stated “that his influence over the company is limited and that a Dutch charitable foundation, Stichting INGKA Foundation, directed [IKEA].[86]” [87]

If the Inter IKEA Group owns the IKEA Concept, and the Kamprad-owned Interogo controls the Inter IKEA Group, it follows that Kamprad still has control over the essential part of the IKEA system. This same ownership is what the public had been led to believe was gifted to the IKEA Foundation that still owns the physical IKEA business, which is arguably worthless without the IKEA Concept.

Impact to the International Community

Despite the tax-free status of both the IKEA Foundation and the Interogo Foundation, according to Kamprad, the Inter IKEA Group (Inter IKEA Holding S.A. and Inter IKEA Systems B.V.) and the IKEA Group companies pay taxes like any other corporation in every country of operation.[88] He emphasizes that those operations comply with relevant laws and regulations.[89]

The unique corporate structure of IKEA is likely one of a kind. However, other companies that may have a similar complex and international configuration would be a challenge for the international community to identify. Whatever the case, it is clear that international corporations are constantly operating in new and innovative ways leaving lawmakers in all countries racing to keep up.

[1] Kamprad is considered the richest man in the world and benefits from Switzerland’s lump-sum taxation that is only offered to a few thousand foreigners living in Switzerland. With this taxation system, Kamprad pays 200,000 Swiss francs in taxes annually, which is approximately $215,933 USD according to XE Currency on April 5, 2011 with 1 Swiss franc worth a little over $1 USD. The Public Eye Awards, IKEA Group (2007), http://www.evb.ch/cm_data/

Ikea_e.pdf

[2] Bertil Torekull, Leading by Design 88 (ed. Wahlström & Widstrand 1998) (1999).

[3] IKEA, Ingvar Kamprad comments, (Jan 28, 2011), available at http://www.ikea.com/at/de/about_ikea/newsitem/

statement_Ingvar_Kamprad_comments.

[4] Id. at 91.

[5] Would be around $15,816.95 USD according to XE Currency on April 4, 2011 with 1 Swedish Kronor worth almost 16 cents USD.

[6] Torekull at 89.

[7] For example, IKEA Catalogue Services AB which is based in IKEA birthplace Älmhult, Sweden is where the 300 plus page IKEA catalogue is created. It is unknown who owns, controls, or pays IKEA Catalogue Services AB.

IKEA, The IKEA Catalogue – the world’s largest free publication (2003), http://www.ikea.com/ms/en_GB/

about_ikea/press_room/thecatalogue.pdf.

[8] Stichting is Dutch for “foundation”.

[9] IKEAFANS, IKEA Corporate Structure,available at http://www.ikeafans.com/ikea/ikea-corporate/ikea-corporate-structure.html.

[10] Torekull at 92.

[11] Economist, Flat-pack accounting, (May 11, 2006), available at http://www.economist.com/node/6919139/.

[12] Id. at 99.

[13] Id.

[14] Economist, Flat-pack accounting.

[15] Id.

[16] IKEA, Ingvar Kamprad comments.

[17] Economist, Flat-pack accounting.

[18] Algemeen nut beogende instelling, acronym ANBI, is Dutch for “institution for general benefit”.

[19] Rich Cohen, Nonprofit Newswire of The Nonprofit Quarterly: The biggest and stingiest foundation in the world, (October 19, 2009), available at http://www.nonprofitquarterly.org/index.php?option=com_content&view=

article&id=1554:nonprofit-newswire-october-19-2009&catid=155:nonprofit-newswire&Itemid=986

[20] Spigthoff Law Firm, The Legal 500: The Use of Foundations in the Netherlands, (Aug 2008), available at http://www.legal500.com/c/netherlands/developments/5049.

[21] Id.

[22] Deutsche Welle, Swedish documentary alleges tax fraud by Ikea founder, (Jan 27, 2011), available at http://www.dw-world.de/dw/article/0,,14799699,00.html.

[23] Economist, Flat-pack accounting.

[24] Cohen, Nonprofit Newswire.

[25] IKEA won a Public Eye Global Awards through nominations by SOMO (Stichting Onderzoek Multinationale Ondernemingen, literal English translation: Foundation Research Multinational Companies) in the Netherlands and the Berne Declaration (a corporate social responsibility NGO in Switzerland). The award cites payment of taxes as a central element of corporate social responsibility and criticizes IKEA’s lack of tax payment for Kamprad’s individual gain and lack of contributions to charitable purposes. Id. and The Public Eye Awards, IKEA Group.

[26] The BoKlok venture is a joint-project between IKEA and the Skansa company to provide cost efficient, sustainable, and low energy consumption track apartments and housing at a low cost for the consumer based on the IKEA model of construction. BoKlok housing is currently in operation in Sweden, Denmark, Norway, Finland, and the United Kingdom.

BoKlok, The Product Family, available at http://www.boklok.com/UK/About-BoKlok/The-BoKlok-Products2/.

[27] Economist, The secret of IKEA’s success: Lean operations, shrewd tax planning and tight control, (Feb 24, 2011), available at http://www.economist.com/node/18229400.

[28] Inter IKEA Systems B.V., The IKEA Concept: How the IKEA Concept Began 2, http://franchisor.ikea.com/

showContent.asp?swfId=concept3.

[29] IKEA Group Management contains the executives of IKEA, including the President and CEO, Vice President, Head of Human Resources, and other corporate leadership positions.

[30] Swedwood is the group of industrial companies responsible for manufacturing all IKEA products. This group has concentrated manufacturing in Poland, Slovakia, and Russia but have plants around the world.

[31] IKEA Services B.V. and IKEA Services AB are located in Sweden and the Netherlands and serve to support all the work of the IKEA Group companies.

[32] IKEA of Sweden is located at the birthplace of IKEA in Älmhult, Sweden and is the hub for all of the designers that create and develop the range of IKEA products.

[33] IKEAFANS, Ikea Corporate Structure.

[34] Torekull at 99.

[35] IKEA Fans, Ikea Corporate Structure.

[36] Torekull at 100.

[37] Kamprad wrote The Testament of a Furniture Dealer at the behest of the IKEA staff in Sweden before he emigrated to Denmark. It includes nine “commandments”: 1. The Product Range is Our Identity, 2. The IKEA Spirit is Strong and Living Reality, 3. Profit Gives us Resources, 4. Reaching Good Results with Small Means, 5. Simplicity Is a Virtue, 6. Doing It a Different Way, 7. Concentration Is Important to Our Success, 8. Taking Responsibility Is a Privilege, and 9. Most Things Still Remain to Be Done—A Glorious Future. These Kamprad principles serve as a textbook for manager training. The Testament is published by Inter IKEA Systems B.V. and is given to all new employees. Torekull at 111-114 and Bloomberg Businessweek, Ikea: How the Swedish Retailer became a global cult brand, (Nov. 14, 2005), available at http://www.businessweek.com/magazine/content/05_46/b3959001.htm.

[38] Ingvar Kamprad, The Testament of a Furniture Dealer and A Little IKEA Dictionary 6(2007), http://www.emu.dk/

erhverv/merkantil_caseeksamen/doc/ikea/english_testament_2007.pdf.

[39] Torekull at 100.

[40] Id.

[41] Id.

[42] Economist,The secret of IKEA’s success.

[43] Would be over $12 billion USD according to XE Currency on April 4, 2011 with 1 Swedish Kronor worth almost 16 cents USD.

[44] Magnus Svenungsson, Svt.se: Uppdrag Granskning (Mission Review), Granskningen av Ikea ett brett samarbetsprojekt (The review of Ikea, a broad collaborative), (Jan 26, 2011), available at http://svt.se/2.150075/1.2304474/granskningen_av_ikea_ett_brett_samarbetsprojekt.

[45] Economist, The secret of IKEA’s success.

[46] Economist, Flat-pack accounting.

[47] IKEAFANS, IKEA Corporate Structure.

[48]Magnus Svenungsson, Svt.se: Uppdrag Granskning (Mission Review).

[49] The Public Eye Awards, IKEA Group.

[50] Economist, Flat-pack accounting.

[51] Torekull at 103-4 and 107.

[52] IKANO, Facts & Figures, available at http://www.ikanogroup.com/the-group-facts-and-figures.html.

[53] The 1988 foundation date is according to the IKANO Group website, however, in Torekull’s book on IKEA Leading by Design IKANO is said to be one of the many companies founded by Kamprad and his lawyers before his departure from Sweden to Denmark in the 1950s. Torekull at 104.

[54] IKANO, Our essence, available at http://www.ikanogroup.com/the-group-our-essence.html.

[55] Torekull at 104.

[56] IKEAFANS, Ikea Corporate Structure.

[57] IKANO, Group Board, available at http://www.ikanogroup.com/the-group-group-board.html.

[58] Torekull at 103-104.

[59] Id. at 105-106.

[60] Id. at 106.

[61] Id.

[62] Id.

[63] IKEA, Ingvar Kamprad comments.

[64] Magnus Svenungsson, Svt.se: Uppdrag Granskning (Mission Review).

[65] The Local: Sweden’s News in English, Ikea founder admits to secret foundation, (Jan 26, 2011), available at http://www.thelocal.se/31650/20110126.

[66] This date is different from the 1980 foundation date that was in a statement by Kamprad released ahead of the documentary according to Deutsche Welle in Swedish documentary alleges tax fraud by Ikea founder.

[67] IKEA, Ingvar Kamprad comments.

[68] Deutsche Welle, Swedish documentary alleges tax fraud by Ikea founder.

[69] Marxer & Partner Rechtsanwälte (Lawyers), The New Liechtenstein Foundation Law: An Overview on the Important Changes, available at http://www.marxerpartner.com/fileadmin/user_upload/marxerpartner/pdf-downloads/Stiftungsrecht_new_e.pdf. Note: though there were revisions to Liechtenstein Foundation laws (Art. 552-570 Persons and Companies Act (PGR)) that entered into force on Apr 1, 2009, none of these revisions impact foundations created prior to that date. Additionally, the changes were intended to clarify rules but in no way limit or initiate forceful regulations on Liechtensteiner foundations (ex. the new law necessitates the appointment of an auditor for charitable foundations, which does not apply to Interogo). The intent was to maintain the country’s attractive laws.

[70] Kaiser Ritter Partner, The Liechtenstein Foundation: Responsibility in Wealth, available at http://www.kaiser-ritter-partner.com/uploads/media/Liechtensteinische_stiftung_eng_01.pdf.

[71] IKEA, Ingvar Kamprad comments.

[72] Marxer & Partner Rechtsanwälte (Lawyers), The New Liechtenstein Foundation Law: An Overview on the Important Changes.

[73] Id. (emphasis added)

[74] The Local: Sweden’s News in English, Ikea founder admits to secret foundation.

[75] Deutsche Welle, Swedish documentary alleges tax fraud by Ikea founder.

[76] Economist, The Secret of IKEA’s success.

[77] Deutsche Welle, Swedish documentary alleges tax fraud by Ikea founder.

[78] Kaiser Ritter Partner, The Liechtenstein Foundation: Responsibility in Wealth.

[79] Id.

[80] Kaiser Ritter Partner, The Liechtenstein Foundation: Responsibility in Wealth.

[81] Marxer & Partner Rechtsanwälte (Lawyers), The New Liechtenstein Foundation Law: An Overview on the Important Changes.

[82] Kaiser Ritter Partner, The Liechtenstein Foundation: Responsibility in Wealth.

[83] Id.

[84] The Local: Sweden’s News in English, Ikea founder admits to secret foundation.

[85] The Local: Sweden’s News in English, Ikea founder admits to secret foundation.

[86] Id.

[87] Despite this claim, it is known that the IKEA store managers are still “trained and groomed by Kamprad himself” at workshops in IKEA mecca, Älmhult. Bloomberg Businessweek, Ikea: How the Swedish Retailer became a global cult brand, (Nov 14, 2005), available at http://www.businessweek.com/magazine/content/05_46/b3959001.htm.

[88] IKEA, Ingvar Kamprad comments.

[89] Id.

/>i

/>i