ON JUNE 9, 2020, HHS ANNOUNCED ADDITIONAL DISTRIBUTIONS FROM THE PROVIDER RELIEF FUND FOR MEDICAID PROVIDERS AND SAFETY NET HOSPITALS, AND A SECOND ROUND OF FUNDING FOR HOSPITALS IN HOTSPOT AREAS.

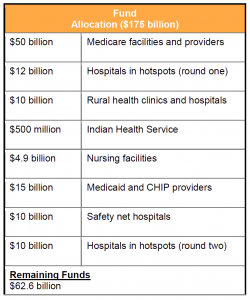

On June 9, 2020, the US Department of Health and Human Services (HHS) announced additional distributions from the Provider Relief Fund for Medicaid providers and safety net hospitals, and a second round of funding for hospitals in hotspot areas. The Coronavirus Aid, Relief, and Economic Security (CARES) Act (P.L. 116-136) established the Fund to provide $100 billion to support healthcare providers affected by the Coronavirus (COVID-19) pandemic. The Paycheck Protection Program and Health Care Enhancement Act (P.L. 116-139) provided an additional $75 billion to the Fund. With this and previous Fund distributions, HHS has committed approximately $112.4 billion, leaving $62.6 billion uncommitted.

KEY TAKEAWAYS

-

HHS expects to distribute approximately $15 billion to Medicaid providers that did not already receive payment from the Fund’s previous general distributions.

-

HHS expects to distribute an additional $10 billion in targeted funding to safety net hospitals.

-

HHS announced an additional application window, through June 15, 2020, for $10 billion to hospitals in hotspots.

HELPFUL LINKS

OVERVIEW

The CARES Act and the subsequent Paycheck Protection Program and Health Care Enhancement Act allocated a total of $175 billion for the Provider Relief Fund. To date, HHS has distributed, or committed to distribute, approximately $112.4 billion in payments, including $50 billion in general distribution for Medicare fee-for-service (FFS) providers, and targeted distributions for hospitals in high COVID-19 impact areas (hotspots); rural providers; skilled nursing facilities; and tribal hospitals, clinics and urban health centers. The general distribution payments are based on the lesser of 2% of a Medicare FFS provider’s 2018 (or most recent complete tax year) net patient revenue or the provider’s incurred losses for March and April 2020.

HHS has indicated an intention to target Medicaid providers for several months now. With its June 9 announcement, HHS established a payment process for these providers similar to that under the current general distribution for Medicare FFS providers. HHS also acknowledged the need for additional support for hospitals in high-impact or hotspot areas.

Medicaid Provider Relief Fund Distribution

HHS committed to distribute approximately $15 billion from the Provider Relief Fund to eligible Medicaid and Children’s Health Insurance Program (CHIP) providers. Providers are eligible for this distribution if they did not previously receive payments from the Fund’s $50 billion general distribution and directly billed either their state Medicaid and CHIP programs or their Medicaid managed care plans for healthcare-related services from January 1, 2018, to May 31, 2020.

Providers seeking a portion of this distribution must submit annual patient revenue information to a new Medicaid and CHIP Targeted Distribution Provider Relief Fund Payment Portal. The application form requires significantly more information from Medicaid providers than HHS required from Medicare fee-for-service (FFS) providers, including calculating lost revenues due to COVID-19, payer mix information, and any other funding received through the Paycheck Protection Program. Providers have until July 20, 2020, to submit their application. The payment will be at least 2% of reported gross revenue, similar to the approach announced in the second tranche of the Fund’s $50 billion general distribution, but potentially more generous, as it sets 2% as the floor.

As with other distributions, providers must attest to terms and conditions if they wish to receive and retain funds. Eligible recipients should review these closely, as well as the Fund’s frequently asked questions, as they consider attestation. The terms and conditions and supplemental materials contain valuable information about provider eligibility, how to apply, how funds can be used, reporting requirements, rules related to executive compensation and restrictions on balance billing. Providers should keep careful record of their COVID-19 expenses and revenue losses, and how they use the funds. As with other tranches, the amount a provider receives may become public, according to the terms and conditions. Stakeholders should view all materials submitted to HHS through the portal as potentially public-facing material.

HHS has yet to answer certain questions about the timing and process for this distribution. For example, it is unclear how easily providers will be able to apply and how quickly the funds will be distributed. Some Medicare providers have experienced a significant lag from the time of submission to receipt of payment.

As an added layer of complexity, HHS will seek to ensure that providers do not double dip into the Medicaid and Medicare distributions. It is uncertain how HHS will monitor the process, and how this issue may complicate the distribution to Medicaid-based providers.

SAFETY NET HOSPITAL FUNDING

HHS also committed a targeted distribution of $10 billion to “safety net” hospitals. Qualifying hospitals must have:

-

A Medicare disproportionate payment percentage of 20.2% or greater;

-

Average uncompensated care per bed of $25,000 or more (for example, a hospital with 100 beds would need to provide $2.5 million in uncompensated care in a year to meet this requirement); and

-

Profitability of 3% or less, as reported to the Centers for Medicare and Medicaid Services in the hospital’s most recently filed cost report.

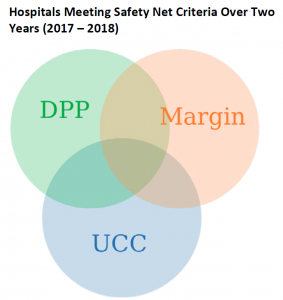

The first two criteria used to determine eligibility for the safety net hospital targeted funding are measures of how much care a hospital is providing to low-income Medicare, Medicaid, underinsured, and uninsured patients. While a hospital’s DPP is relatively stable year-to-year, the amount of uncompensated care (UCC) can vary significantly, and also is subject to reporting variance. The third criteria is likely intended to direct funding to those safety net hospitals that are most vulnerable financially. However, like the variation seen in uncompensated care, hospital profitability can also vary substantially from year-to-year. With such year-to-year variability in two of the three criteria, the year HHS uses to determine eligibility will dramatically affect who receives funds from the safety net hospital targeted funding. A McDermottPlus analysis of the two most recent years of Medicare cost report and other data (2017 and 2018) indicate that more than 900 hospitals would meet the criteria in one of the two most recent cost report years, less than 50 percent would meet the criteria in both years. A formal list of qualifying hospitals under the targeted safety net hospital funding distribution is not yet available, but HHS reported that 761 hospitals will receive this funding.

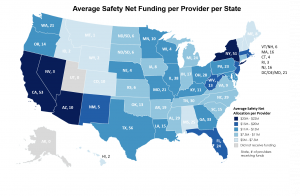

Recipients will receive a minimum distribution of $5 million and a maximum of $50 million. HHS states that the distribution amount for an eligible safety net hospital is the proportion of the individual facility score (number of facility beds multiplied by DPP) to the cumulative facility scores for all safety net hospitals, times the $10 billion safety net distribution.

HOTSPOTS

HHS will allocate an additional $10 billion to hospitals in areas highly affected by the COVID-19 outbreak. HHS previously allotted $12 billion to these hospitals on May 1, 2020. Hospitals received a communication from HHS on June 8, 2020, asking them to provide updated COVID-19 data, which will be used to determine the hospitals’ eligibility for the funding. Hospitals have until 9 pm EDT on June 15, 2020, to submit their data.

OUTLOOK

The Medicaid targeted distribution announcement comes on the heels of a bipartisan, bicameral congressional letter urging HHS to increase the pace of funding distributions to Medicaid providers. HHS has now committed to distributing approximately $65 billion to providers based on previous revenue: $50 billion in general distribution for Medicare FFS providers and $15 billion for Medicaid providers. Ultimately, however, this distribution is a limited panacea for providers. The American Hospital Association issued a report in May 2020 anticipating a “total financial impact of $202.6 billion in losses resulting from COVID-19 expenses and lost revenue for hospitals and health systems over the four-month period from March 1, 2020 to June 30, 2020—or an average of over $50 billion in losses a month.” If HHS’s target is 2% of revenues for a year, providers will need to continue to advocate for further assistance.

Stakeholders should consider examining the additional $100 billion allocated to the Fund through the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, which passed the House on May 15, 2020. While HEROES was assembled by House Democrats and advanced on party lines, with only one Republican voting in its favor, it remains the only major piece of legislation for the next recovery in the public domain. Stakeholders should note not only the overall amount of funding, but also the specific legislative conditions and process that Democrats proposed for distribution of the additional funds.

Moving forward, providers will be eager to see how HHS will distribute the remaining $62.6 billion in the Provider Relief Fund. HHS has indicated that some of this funding will be dedicated to reimbursing treatment for uninsured individuals, but the department has not said how much will be set aside for this purpose. HHS has also said that further support is needed for dentists. Stakeholders should continue to advocate their need for additional financial relief—now and in the future—with the Administration and Congress.

/>i

/>i