United States

| A. |

Federal Trade Commission (FTC) |

| 1. |

FTC challenges New Jersey hospital merger between RWJBarnabas Health and Saint Peter’s Healthcare System; parties abandon deal. |

On June 14, the FTC responded to the announcement that RWJBarnabas Health (RWJ) and Saint Peter’s Healthcare System (Saint Peter’s) abandoned their proposed merger.

Bureau of Competition Director Holly Vedova said: “I am glad that rival hospital systems RWJ and Saint Peter’s have terminated an anticompetitive merger that would have harmed patients in Middlesex County, New Jersey. The transaction would have combined two hospitals located less than a mile from each other, which also happen to be the only two hospitals in the city of New Brunswick, New Jersey. With combined shares of approximately 50 percent for inpatient general acute care services in Middlesex County, New Jersey, the transaction was presumptively unlawful and would have resulted in higher prices and lower quality of care for New Jersey residents.”

In its third challenge of a hospital merger in 2022, on June 2 the FTC voted 5-0 to file an administrative complaint to block the proposed transaction. The complaint alleged the proposed acquisition would eliminate important head-to-head competition, significantly increase concentration for general acute care services in Middlesex County, and leave insurers and patients with fewer alternatives. Specifically, the complaint alleged the combined health system would be able to demand higher reimbursement rates and/or more onerous contractual terms, harming consumers. The Commission also disclosed that internal documents showed that RWJ and St. Peter’s routinely identify the other as the most significant competitor when assessing competition and strategizing on providing general acute care services in Middlesex County.

RWJ, headquartered in West Orange, New Jersey, is a nonprofit that operates 12 general acute care hospitals, several ambulatory surgical centers, a pediatric rehabilitation hospital, and a freestanding behavioral health center in New Jersey. Saint Peter’s is a nonprofit headquartered in New Brunswick that operates an independent hospital, which includes a state-designated children’s hospital.

| 2. | FTC challenges Utah hospital merger between HCA Healthcare and Steward Health Care System; parties abandon deal. |

On June 16, the FTC responded to the announcement that Utah hospital systems HCA Healthcare and Steward Health Care System abandoned their proposed merger.

Director Vedova said: “For the second time in a week, parties who proposed an anticompetitive hospital merger have called their deal off after the FTC filed a complaint to block the deal. This should be a lesson learned to hospital systems all over the country and their counsel: the FTC will not hesitate to take action in enforcing the antitrust laws to protect healthcare consumers who are faced with unlawful hospital consolidation. Had this transaction been allowed to proceed, it would have combined the second and fourth largest healthcare systems in Salt Lake City and the Wasatch Front region of Utah, resulting in higher prices, less innovation, and lower quality care for patients.”

On June 2, 2022, the Commission voted 5-0 to file an administrative complaint to block the proposed transaction. The complaint alleged the proposed acquisition would reduce the number of health care systems offering inpatient general acute hospital services in the Wasatch Front region of Utah, where approximately 80% of Utah residents live, and would eliminate Steward as a “low-cost” competitor. The FTC contended that HCA and Steward compete for inclusion in insurer networks, and for health care quality, service lines, and nurse and physician recruitment. The complaint alleged that HCA would, as a result of the acquisition, be able to command higher reimbursement rates, which costs would be passed on by commercial insurers to employers and health plan members in the form of increased premiums, deductibles, co-pays, and other out-of-pocket expenses.

HCA is a Nashville, Tennessee-based for-profit health care system with 182 hospitals in the United States and abroad. Steward is a for-profit health care system headquartered in Dallas, Texas. Steward has 41 hospitals in the United States and abroad.

| 3. | Commissioner Slaughter recommends merger enforcement tools to address “broad and deep inequities” in society. |

In remarks before the Florence Competition Summer Conference in Florence, Italy, FTC Commissioner Rebecca Kelly Slaughter said that antitrust enforcers should begin collecting demographic data when reviewing potentially anticompetitive mergers to map out how communities of color may be adversely affected by the transaction, in order to help address “broad and deep inequities” in society.

“We should start these efforts with data. We need to make a concerted effort to collect demographic data where possible in our investigation so we can understand where and how communities of color are affected,” Slaughter said.

While the Commission’s Bureau of Consumer Protection has prioritized cases that disproportionately affect communities of color, such as student debt relief schemes, this typically has not been true for merger enforcement.

As examples, Commissioner Slaughter cited noncompete clauses to limit worker mobility and lack of access to capital as an entry barrier for black and minority-owned businesses. “This might also mean considering the marginal value of a dollar to those affected,” Slaughter said. “For instance, there’s a material difference between a merger that results in $100,000 of harm to grocery store consumers in a food desert versus $100,000 of harm to high-end jewelry consumers.”

| 4. | FTC settles two acquisitions by JAB Consumers Partners related to specialty and emergency veterinary clinics, imposing divestitures as condition to close and requiring prior notice and approval in future acquisitions. |

The FTC issued two orders for public comment in June 2022 settling allegations that JAB Consumer Partners’ $1.1 billion acquisition of SAGE Veterinary Partners and $1.65 billion acquisition of the parent of veterinary clinic owner Ethos violated federal antitrust laws. The FTC alleged that both transactions would reduce competition in several local markets for specialty and emergency veterinary clinics, which are allegedly already highly concentrated.

The FTC on June 13 issued an order for public comment related to JAB’s proposed acquisition of SAGE that would require JAB to divest six clinics to United Veterinary Care, including three SAGE facilities in Austin, Texas and three clinics operated by a subsidiary of JAB located in San Mateo, Berkeley, and Fairfield, California. Then, the FTC on June 29 issued an order for public comment related to JAB’s proposed acquisition of Ethos that would require JAB to divest three clinics to United Veterinary Care, including one clinic in Richmond, Virginia and two in the D.C. Metro area, and two clinics to Veritas, including one clinic in Denver and one in San Francisco. Both divestiture buyers must obtain FTC approval before transferring any of the divested assets to any buyer for 10 years after acquiring the divestiture assets, except in the case of a sale of all or substantially all of the company’s business.

In addition to divestitures, the orders require that JAB seek prior approval for an acquisition of a specialty or emergency veterinary clinic located within 25 miles of a JAB-owned veterinary specialty or emergency clinic anywhere in California, Colorado, District of Columbia, Maryland, Virginia, and Texas. In a first-of-its-kind mandate, JAB must also provide the Commission with 30 days’ prior notice for an acquisition of a specialty or emergency veterinary clinic located within 25 miles of a JAB-owned veterinary specialty or emergency clinic anywhere in the United States for any transaction not otherwise HSR reportable. The prior approval and prior notice requirements extend for 10 years.

The goal of the nationwide prior notice requirement is to capture and review transactions by private equity firms engaged in a “roll-up” strategy for a health care portfolio company, wherein incremental acquisitions may not require filing under the HSR Act. “Private equity firms increasingly engage in roll-up strategies that allow them to accrue market power off the Commission’s radar,” Director Vedova said. “The prior notice and approval provisions will ensure the Commission has full visibility into future consolidation and the ability to address it.”

| 5. | FTC launches inquiry into pharmacy benefit manager practices. |

On June 7 the FTC announced that, after a failed vote prior to the appointment of the agency’s fifth commissioner, Democrat-appointee Alvaro Bedoya, the agency is launching an inquiry into the pharmacy benefit manager (PBM) industry, requiring the six largest PBMs to provide information and records regarding their business practices, sending compulsory orders to CVS Caremark; Express Scripts, Inc.; OptumRx, Inc.; Humana Inc.; Prime Therapeutics LLC; and MedImpact Healthcare Systems, Inc.

“Although many people have never heard of pharmacy benefit managers, these powerful middlemen have enormous influence over the U.S. prescription drug system,” FTC Chair Lina M. Khan said. “This study will shine a light on these companies’ practices and their impact on pharmacies, payers, doctors, and patients.”

The Commission’s inquiry will examine the role of PBMs at the center of the pharmaceutical system, specifically with respect to rebates and fees with drug manufacturers in connection with drug formularies and surrounding policies, and reimbursing pharmacies for patient prescriptions. The largest PBMs are vertically integrated with the largest health insurance companies and wholly owned mail order and specialty pharmacies.

The Commission announced its focus on the following topics:

-

fees and clawbacks charged to unaffiliated pharmacies;

-

methods to steer patients towards PBM-owned pharmacies;

-

potentially unfair audits of independent pharmacies;

-

complicated and opaque methods to determine pharmacy reimbursement;

-

the prevalence of prior authorizations and other administrative restrictions;

-

the use of specialty drug lists and surrounding specialty drug policies; and

-

the impact of rebates and fees from drug manufacturers on formulary design and the costs of prescription drugs to payers and patients.

The Commission voted 5-0 to issue the orders and conduct the study.

| 6. | FTC orders divestitures as condition to Buckeye Partners’ acquisition of Magellan Midstream Partners’ terminals. |

The FTC on June 2 issued an order for public comment settling allegations that Buckeye Partners, L.P.’s proposed $435 million acquisition of 26 fuel terminals from Magellan Midstream Partners, L.P. violated federal antitrust laws.

Under the terms of the settlement, Magellan must sell to divestiture buyer U.S. Venture five terminals and associated assets, which include two light petroleum product (LPP) terminals and associated assets in the North Augusta, South Carolina market, two terminals in the Spartanburg, South Carolina market, and one terminal in Montgomery, Alabama. Terminals are a critical link in the supply chain for gasoline, diesel, and jet fuel, and generally consist of storage tanks and loading racks that pump fuel into tanker trucks for further delivery. Terminaling services include off-loading, temporary storage, and dispensing of LPPs into trucks.

Buckeye also must seek prior FTC approval for 10 years before it acquires any LPP terminal (including the divested terminals) within a 60-mile radius of the divested assets. Finally, the divestiture buyer must obtain Commission approval for a three-year period prior to selling any of the divested assets to any buyer, and for a seven-year period prior to selling to any buyer with an interest in any LPP terminal in any of the relevant geographic markets. The Claro Group has been appointed as an independent third-party monitor to oversee the parties’ compliance with the requirements of the proposed order, including asset maintenance.

The complaint alleges the transaction as proposed would have anticompetitive effects, focusing on the loss of a subset of independent market participants – firms that are not vertically integrated and also sell LPPs to commercial and retail customers. The transaction allegedly would reduce the number of competitive alternatives from seven to six but further reduce the number of independents to two. The parties are each independent terminal operators.

Houston-based Buckeye owns more than 115 LPP terminals, mostly in the Northeast, Southeast, and Midwest. Headquartered in Tulsa, Oklahoma, Magellan operates terminals and pipelines in central United States, and terminals in the southeastern United States.

| 7. |

FTC approves final order protecting patients who rely on medical instruments used in sinus procedures. |

As discussed in the June 2022 issue of Competition Currents, on June 30, 2022, at the conclusion of the public comment period, the FTC announced its approval of a final order settling the complaint it filed in May 2022 relating to Medtronic, Inc.’s proposed acquisition of Intersect ENT, Inc. Per the final order, Medtronic must divest Intersect subsidiary Fiagon as a condition of Medtronic’s proposed acquisition. The FTC alleges the deal as originally structured would lead to higher prices and reduced innovation in the ear, nose, and throat market.

| B. |

Department of Justice (DOJ) |

| 1. | Deputy AAG’s Forman warns private equity acquirers contemplating “roll-up” acquisitions. |

At the American Bar Association’s Antitrust in Healthcare Conference on June 3, DOJ Deputy Assistant Attorney General Andrew Forman remarked that private equity firms engaged in mergers and acquisitions activity in the health care space warrant additional scrutiny.

Forman said: “[W]e are focused on potential antitrust enforcement on private equity ‘roll-ups,’ namely whether in particular circumstances a series of often smaller transactions can cumulatively or otherwise lead to a substantial lessening of competition or tendency to create a monopoly. Similarly, we will analyze whether private equity companies may violate the antitrust laws with investments creating or enhancing power across a ‘stack’ of technology or other products/services.”

Forman also questioned “whether certain private equity investments may chill fierce competition on the merits” and “either blunt the incentive of the target company to act as a maverick or a disruptor in health care markets or otherwise cause the target company to focus solely on short-term financial gains and not on advancing innovation or quality.”

He also noted that given “some HSR filing deficiencies in the private equity space” the Antitrust Division is considering “whether private equity companies may not be taking seriously enough their obligations under the HSR Act. We are evaluating our next steps on that front.”

| 2. | Justice Department sues to block Booz Allen Hamilton’s proposed acquisition of EverWatch. |

On June 29, 2022, the DOJ announced its challenge to Booz Allen Hamilton Holding Corporation’s proposed acquisition of EverWatch Corp. In its civil antitrust complaint, the DOJ argues that both the proposed transaction and the merger agreement itself would decrease competition in government contracts relating to operational modeling and simulation services provided to the National Security Agency (NSA). The DOJ alleges the transaction would leave NSA with only one monopoly bidder left if the deal were to be consummated, and the merger agreement itself reduced incentive for the parties to competitively bid on an imminent request for proposal. The DOJ views these government contracts as a market vital to national security.

| 3. | Commercial flooring contractor and former president plead guilty to bid rigging and price fixing. |

On June 9, 2022, a flooring contractor and its former president were charged and pleaded guilty to bid rigging and price fixing in violation of the Sherman Act. According to the felony charge and plea agreements filed in federal court in Chicago, from at least 2009 until mid-2017, defendants conspired to suppress and eliminate competition by agreeing with competitors to submit complementary bids so that a selected company would win the contract. In addition to the one-count plea, the contractor, Commercial Carpet Consultants Inc., also agreed to pay a criminal fine of $1.2 million. This was the fourth flooring contractor and seventh individual charged in DOJ’s investigation of the commercial flooring industry.

| 4. |

Military contractor and executives indicted for $7 million fraud scheme. |

On June 23, 2022, one military contractor and three executives were indicted for fraud and conspiracy to defraud the United States by allegedly preparing and procuring “competitive quotes” that were in fact “sham quotes” submitted to the government to ensure the defendants’ lower price proposals would be awarded valuable government contracts. The indictment alleges that the sham-quote conspiracy operated from at least September 2014 through November 2016 and involved defendants concealing their preparation of the cost estimates and other material documents, in order to falsely portray “competition” while ensuring they were awarded more than $7 million in contracts. A federal grand jury in the Northern District of Georgia returned the indictment, which contains three counts against Envistacom LLC, its President Alan Carson and a vice president, Valerie Hayes, and Philip Flores, the owner of another company. This follows several indictments and plea agreements in March, April, and May 2022 based on other alleged anticompetitive conduct in the U.S. government contracting process.

| C. | U.S. Litigation |

| 1. | In re Generic Pharm. Pricing Antitrust Litig., No. MDL 2724, 2022 U.S. Dist. LEXIS 101212 (E.D. Pa. June 7, 2022). |

Several state attorneys general alleged that pharmaceutical companies violated federal antitrust laws by engaging in a scheme or schemes to fix, maintain, and stabilize prices, rig bids, and engage in market and customer allocations of certain generic pharmaceutical products. On a Rule 12(b)(6) motion, defendants asked the court to dismiss the states’ claim for disgorgement under federal law, as well as parens patriae damages claims under federal law. The court granted the motion, holding that disgorgement was not available under section 16 of the Clayton Act and allowing damages claims would violate Illinois Brick.

| 2. |

In re Surescripts Antitrust Litig., No. 19-cv-06627, 2022 U.S. Dist. LEXIS 109387 (N.D. Ill. June 21, 2022). |

Pharmacies sued under sections 1 and 2 of the Sherman Act, alleging that two health information technology companies conspired to monopolize the market for e-prescribing services. Defendants moved to dismiss, arguing that the claims were barred under the direct purchaser rule set forth in Illinois Brick. Relying on an exception to the direct purchaser rule, the court denied the motion to dismiss, explaining that “[i]f manufacturers and distributers have entered into a conspiracy that makes an otherwise indirect purchaser the ‘first innocent purchaser,’ Illinois Brick will not bar the claim, as the ‘first buyer from a conspirator is the right party to sue.’” Defendants also argued that the Sherman Act claims were based on predatory pricing, and plaintiffs failed to allege the elements of the price-cost test. The court rejected this argument, concluding that plaintiffs’ allegations were based on an allegedly anticompetitive loyalty scheme and thus were based on exclusive dealing, which required a rule of reason analysis. The court noted that plaintiffs alleged facts supporting a reasonable inference that the exclusive-dealing provisions could foreclose a substantial portion of the market and reduce output.

| 3. | Deslandes v. McDonald's USA, LLC, No. 17-cv-4857, 2022 U.S. Dist. LEXIS 113524 (N.D. Ill. June 28, 2022). |

This case involved a challenge to a so-called “no poach” provision in a restaurant franchise agreement. The judge issued an order and opinion granting McDonald’s motion for judgment on the pleadings in a pair of consolidated cases brought by former workers Leinani Deslandes and Stephanie Turner, finding that an amendment would be futile.

The court held that plaintiffs failed to allege the relevant market in which she sold her labor or that defendants had market power in that relevant market. The judge found previously when denying a class certification that plaintiffs needed to show that McDonald’s had power over the local labor markets at issue, because the contract at issue had to be analyzed under a full rule-of-reason test to determine if they violated the antitrust laws. The court refused to allow plaintiffs to replead, stating that the plaintiffs would have failed to properly allege market power because the relevant geographic market is a small, local area that also includes quick-service restaurants other than McDonald’s.

| 4. | Arandell Corp. v. Xcel Energy, Inc., No. 07-cv-076-wmc, 2022 U.S. Dist. LEXIS 113805 (W.D. Wis. June 28, 2022). |

A Wisconsin federal court certified a class of buyers suing natural gas companies for allegedly conspiring to raise prices in the early 2000s. Plaintiffs in this long-running multi-district litigation are commercial and industrial consumers of natural gas who claim that defendants conspired to fix the price of natural gas between 2000 and 2002. The court granted plaintiffs’ motion for class certification, ruling that plaintiffs had fulfilled the commonality and predominance requirements because their claims were based on a single conspiracy to manipulate an interrelated market for natural gas by sharing price information and engaging in “washing” or “churning” activities to cause demand to appear artificially high.

Among other arguments, the gas companies contended it would be too difficult to calculate the actual harm suffered by each class member for the case to move ahead as a class action. But the judge said there is always some individual inquiry needed when deciding the degree of individual injury, pointing to the Ninth Circuit’s ruling on the issue that said, “[T]he amount of damages is invariably an individual question and does not defeat class treatment.”

| 5. | Siva v. Am. Bd. of Radiology, No. 21-2334, 2022 U.S. App. LEXIS 17741 (7th Cir. June 28, 2022). |

The Seventh Circuit affirmed dismissal of antitrust claims against a nonprofit provider of medical certification challenging the providers “maintenance of certification” program, which plaintiff alleged was an illegal tying arrangement under § 1 of the Sherman Act. Plaintiff alleged that the provider leveraged its monopoly in the certification market to force radiologists to purchase a “maintenance of certification” program, a separate, continuing-education product some radiologists would prefer to purchase elsewhere. To allege tying, the Seventh Circuit explained that plaintiff must allege facts that “permit an inference of what economists call ‘cross-price elasticity’ between [maintenance of certification products] and other [continuing education] offerings, such that—in a world without the tying arrangement—an increase in the price of other [continuing education] products relative to [maintenance of certification products] would shift sales.” The court further explained, “the two products must be ‘reasonably interchangeable’ in the minds of relevant consumers, meaning that a radiologist shopping for [continuing education products] might see the Board’s [maintenance of certification] program as a viable option for filling that need.” The court held that plaintiff failed to make this showing because the Board did not offer continuing education products in that the maintenance of certification requirement simply required professionals to take continuing education programs offered by others. Thus, the products were not substitutes, and there was no tying.

The Netherlands

A. Dutch ACM decisions, policies, and market studies

| 1. |

ACM conditionally approves proposed merger between two Dutch supermarket chains. |

The Netherlands Authority for Consumers and Markets (ACM) approved a proposed merger between two Dutch supermarket chains (Plus and Coop) in December 2021, subject to certain conditions. To ensure sufficient competition in the relevant (regional) markets, 12 supermarkets had to be sold to a competitor.

In May 2022 ACM approved the divestment of eight supermarkets. In June, the ACM approved the transfer of the franchise agreement relating to another supermarket to the biggest supermarket chain in the Netherlands, Albert Heijn. For Plus and Coop to meet ACM’s conditions to approve the proposed merger, three supermarkets remain to be sold to a competitor.

| 2. |

ACM advocates for competition law exemptions for cooperation relating to sustainability. |

In 2021, ACM published a second draft of its Guidelines on Sustainability Agreements on the interaction between sustainability and competition. At the Swedish Competition Authority’s annual seminar, the ACM argued that competition law should allow competitors to cooperate if this contributes to the reduction of greenhouse gas emissions and the prevention of climate change. Therefore, according to the ACM, this kind of cooperation should be exempted from the cartel prohibition if the benefits of cooperation outweigh the negative effects on prices and choice for consumers of the cooperating companies.

However, the European Commission does not appear to fully support the ACM’s position, and maintains that only a proportionate part of the total benefits relative to the group of affected consumers can be used to outweigh the negative effects, and that the balance should be at least neutral. The ACM does not deem this to be “fair and efficient” and urges to European Commission to clarify its views in its draft Horizontal Guidelines.

| 3. | ACM allows collaboration of competitors due to sustainability benefits. |

The ACM has allowed two competitors active in the fuel sector, Shell and TotalEnergie, to collaborate in relation to CO2 capture and storage in depleted gas fields in the North Sea. According to the ACM, this collaboration will contribute to the prevention of climate change.

In line with its Guidelines on Sustainability Agreements mentioned above, the ACM argues that cooperation and substantial investment is necessary for the initiative to achieve various benefits and that the restriction on competition is therefore justified. Furthermore, the ACM states that benefits to customers, companies, and society outweigh any negative competitive effects (due to sustainability efficiencies). Any contemplated joint venture for additional services would still be subject to merger review, if applicable.

B. Dutch Courts

Dutch Trade and Industry Appeals Tribunal overrules minister’s decision on merger of PostNL and Sandd.

In September 2019, the ACM prohibited Sandd’s acquisition by PostNL (Dutch postal market competitors). However, then Dutch Minister of Economic Affairs and Climate overturned this ban by granting the parties a license for the contemplated acquisition, finding the benefits of the deal outweighed the harm to competition.

The Rotterdam District Court subsequently annulled the minister’s decision on the grounds that the minister was wrong to override the ACM’s earlier decision and approve the consolidation. Both the minister and PostNL appealed this annulment and, moreover, the minister granted a new license for the contemplated acquisition.

On June 2, 2022, given that multiple parties appealed this new license, the Dutch Trade and Industry Appeals Tribunal (CBb) overturned the minister’s approval, ruling that the minister should have followed the ACM’s findings regarding the investigation into economic benefits. Pursuant to article 47, section 1 of the Dutch Competition Act, the minister is bound by the ACM’s decision and may not identify important reasons of public interest to the extent that they may be contrary to ACM’s decision. Currently, appeals are pending, and it is yet to be seen whether Sandd and PostNL will merge.

United Kingdom

| A. | UK Merger Control |

In the UK, parties may complete a transaction that is subject to the UK merger regime without awaiting clearance and without notifying it to the Competition and Markets Authority (CMA).

| 1. | Phase 1 investigation - dental services. |

On June 28, 2022, after a two-month information-gathering exercise, the CMA announced the launch of a formal, 40-working-day Phase 1 merger investigation of the completed acquisition by Riviera Bidco of Dental Partners Group Limited. As is the case in the majority of completed mergers (including those mentioned below), the CMA imposed an initial enforcement order requiring suspension of the integration of acquirer and acquired business until the outcome of the CMA’s investigation. The order was imposed on April 28, 2022, and the deadline for the CMA’s Phase 1 decision is Aug. 23, 2022, although this may be extended.

| 2. | Phase 2 investigation – provisional divestment remedy – software and technology solutions. |

On May 18, 2022, the CMA announced provisional findings following its Phase 2 investigation of Dye & Durham’s acquisition of TM Group (UK) Limited, which was completed in July 2021. The CMA has provisionally found that the acquisition results in a substantial lessening of competition in the supply of property search reports in England and Wales, given that the merged business has the highest share of a concentrated market, with only two other significant competitors. Based on this finding, the CMA has provisionally identified that the only remedy is for Dye & Durham to divest the entire TM Group. The acquisition was completed in July 2021, and the CMA imposed an initial enforcement order suspending integration of the parties on Sept. 1, 2021. Its Phase 1 investigation began on Oct. 4, 2021, and the merger was referred to a Phase 2 investigation on Dec. 9, 2021. The deadline for the parties to challenge the CMA’s provisional findings is early July 2022, and the CMA must issue its final decision by Aug. 16, 2022.

| 3. | Phase 2 investigation – provisional divestment remedies – water and non-hazardous waste management services. |

On May 19, 2022, the CMA issued its provisional findings of serious concerns about the impact of the completed acquisition by Veolia of competitor Suez on seven water and waste management markets in the UK. It found that the two parties are the only suppliers in the UK that operate across the whole waste management chain and comprise very few suppliers able to perform large, complex waste management contract with public authorities. Citing customer concerns about higher costs and lower service standards, the CMA has consulted on full divestiture of one of the parties’ waste management businesses and of parts of one of their water businesses. It is due to issue its final report by July 17.

| 4. | Phase 2 investigation – unwind order – helicopter services. |

On June 1, 2022, the CMA ordered CHC to unwind its completed acquisition from Babcock of four oil and gas offshore helicopter services businesses, which it had acquired on Aug. 31, 2021. The CMA found that the acquisition would substantially lessen competition in the supply of oil and gas offshore transportation businesses in the UK, by reducing the number of competitors from four to three, and that the only effective remedy was a full divestiture of the acquired business.

| 5. | Phase 2 reference – dough. |

On June 15, 2022, the CMA referred for a Phase 2 investigation Cérélia’s acquisition of the Jus-Rol business of General Mills, completed on Jan. 31, 2022. The CMA’s concerns are that the overlaps between the parties in the supply of branded and private-label ready-to-bake dough products to grocery retailers in the UK will enable the merged business to increase prices and degrade non-price offerings such as quality, range, and innovation. The CMA is due to issue its Phase 2 decision by Nov. 29, 2022.

| 6. | Phase 1 investigation – undertakings to avoid a Phase 2 reference – veterinary services. |

On June 27, 2022, the CMA accepted undertakings from CVS Group plc, one of the largest integrated veterinary services providers in the UK, to avoid a Phase 2 investigation of CVS’s acquisition of smaller competitor Quality Pet Care, completed on Aug. 19, 2021. CVS has undertaken to complete the divestment of the whole of Quality Pet Care in order to remedy the CMA’s concerns about overlaps between the parties’ operations in the supply of standard small animal veterinary services in the local areas of Bristol, Nottingham, Portsmouth, Southampton, and Warrington.

| B. | UK Antitrust |

| 1. | Competitor capacity sharing – ferry services. |

On June 13, the CMA announced its intention to accept commitments DFDS and P&O Ferries offered relating to their agreement to provide a “turn-up and go” service to freight customers, operated on the basis of a single schedule that spaces their sailings at regulator intervals. In response to CMA concerns that the arrangement could lead to a reduced number of sailings and cancellations, each party has committed to decide independently on the number of sailings it operates, limit cancellations, and amend the agreement to make it clear that its provisions do not fix the number of freight customers either party can carry. The CMA will decide whether to accept these commitments in July or August 2022.

| 2. | Resale price maintenance – replica sports kits. |

On June 7, the CMA announced it had issued a Statement of Objections (SO) setting out its provisional findings that Elite Sports, JD Sports, and Rangers Football Club had fixed the retail prices of Rangers-branded clothing. The SO is not a public document, but the CMA’s announcement indicates that Rangers became concerned that JD Sports was selling the Rangers replica adult top at a lower price than Elite, which manufactured the kit, sold it through the Rangers online store, and was treated as Rangers’ “retail partner.” The three parties allegedly reached an understanding that JD Sports would increase its price for the top to align it with the price Elite charged. Rangers’ involvement ended there, but the CMA alleges that JD Sports and Elite fixed the retail prices of other Rangers-branded clothing over a longer period, by aligning prices and the timing of discounts. The next steps are for the parties to respond to the SO and attend an optional oral hearing. The CMA’s final decision may be issued at the end of 2022. The CMA is also investigating similar arrangements between Leicester City Football Club and JD Sports relating to Leicester City-branded replica sports kits and other items.

| C. |

UK Litigation |

| 1. | Collective proceedings order awarded – trucks. |

On June 8, 2022, the UK Competition Appeal Tribunal (CAT) granted a collective proceedings order (CPO) to the UK Road Haulage Association (RHA) to pursue cartel damages claims against a number of truck manufacturers. The CPO is the first to be awarded on an opt-in basis. The claim is a follow-on claim, based on European Commission findings in its 2016 Truck cartel decision, which settled its investigation of exchanges of information among several truck manufacturers relating to future prices and the passing on of costs incurred as a result of new EU emission technologies requirements. Fines imposed totaled approximately EUR 2.9 billion after the 10% settlement discount. After a detailed analysis, including of the scope of each application and the methodologies to be used for calculating damages, the CAT granted the CPO to the RHA over a competing application by UK Truck Claims.

| 2. | Time bar – smart card chips. |

On June 10, 2022, the Court of Appeal dismissed digital security company Gemalto’s appeal against a High Court finding that Gemalto’s claim for EUR 288 million in cartel damages against two chipmakers was time-barred. The claim was based on a 2014 European Commission decision finding that the chipmakers had engaged in price fixing and sharing of competitively sensitive information. The Court of Appeal ruled that the six-year time limit for bring a damages claim had been triggered not when the Commission had issued its decision on Sept. 3, 2014, but on April 22, 2013, when the Commission announced it had issued a statement of objections against the chipmakers. At that earlier point, Gemalto already had sufficient information to start its claim, and it did not need to wait for the Commission’s decision.

Poland

Polish Court Upholds Approval of PKN Orlen’s Acquisition of Polska Press

As reported in previous editions of Competition Currents, on Feb. 5, 2021, the Office of Competition and Consumer Protection (UOKiK) president unconditionally approved PKN Orlen’s acquisition of Polska Press. This was despite the objections of several competitors and organizations, including the Polish Ombudsman, which claimed the acquisition would lead to concentration of a significant part of the press market – press publishing, printing, distribution, and retail – in one entity.

The decision presents limited arguments in terms of the transaction’s vertical effects or the concentration’s effects on competition in relation to individual markets of regional newspapers where Polska Press dominates. At the Ombudsman’s formal request, on April 8, 2021, the Competition and Consumer Protection Court suspended execution of the UOKiK’s decision.

Subsequently, the Ombudsman also appealed the decision, arguing the UOKiK president wrongly approved the acquisition without examining the possible restriction on freedom of the press and that such concentration violated the constitutional principle of freedom and pluralism. The Ombudsman requested the Competition and Consumer Protection Court invalidate the UOKiK president’s decision.

On June 7, 2022, the Competition and Consumer Protection Court dismissed the Ombudsman’s appeal, ruling that while freedom of speech and media pluralism are constitutional values, the court need not consider them when evaluating concentration in Poland as they are not related to the UOKIK president’s scope of competence. According to the court, when assessing a transaction, the criteria set out in the provisions of the Act on Competition and Consumer Protection must be considered, as opposed to circumstances and criteria not covered by the Act’s provisions. Freedom of the press and media pluralism are not covered by the SIEC (“significant impediment to effective competition”) test, which is solely economic in nature. Moreover, the court stated there is no risk of violation of the principle of media pluralism given that it is the consumers who have the right to choose and shape the media market through their decisions on the press.

The Polish Ombudsman announced his intent to file a request for a written justification of the judgment because without knowing the details of the court’s reasoning, it is difficult to assess whether there are grounds to appeal. Public statements typically mention the vertical aspects, i.e., that Orlen has gained a significant position in the whole chain—from printing to publishing and distribution of the press. Therefore, the full version of the written justification of the court is needed to see how the court addressed other charges (other than the threat to freedom of speech and media pluralism) against the Orlen/Polska Press acquisition.

Italy

| Italian Competition Authority (ICA) |

| 1. | ICA fines Ryanair and a leading Italian consumer association for unfair business practices for lack of clear communication to consumers relating to an ADR procedure and a consumer-friendly certification. |

Following a Federconsumatori report, ICA initiated an investigation against airline Ryanair DAC and, subsequently, against leading Italian consumer association CODACONS and affiliated entity Termilcons. On June 14, 2022, ICA sanctioned Ryanair for a total of EUR 100,000, and CODACONS and Termilcons jointly and severally for a total of EUR 10,000 euros, for unfair commercial practices toward consumers.

The alleged infringement consisted, first, in the presentation of an alternative dispute resolution procedure CODACONS ran as impartial and transparent, while failing to disclose Ryanair partly financed it and that its functioning was the result of an agreement with the latter. Specifically, consumers had not been informed that Ryanair was not bound by the outcome of the ADR procedure and that the agreement between Ryanair and CODACONS excluded the ADR procedure’s applicability to certain predetermined exceptional cases. The overall trend of the procedure showed reduced success for consumers.

Second, in ICA’s view, CODACONS was not transparent in its promotion of the “Ok Codacons” seal awarded to Ryanair, certifying the quality of Ryanair’s service. Indeed, Ryanair itself partly funded the initiative and obtained the seal based on consumer survey findings, which the airline largely produced. ICA’s decision can be appealed before the Lazio Regional Administrative Court within 60 days.

| 2. | ICA on unfair commercial practices – Facile Energy – unsolicited activation of contracts. |

On June 6, 2022, the ICA ordered a precautionary measure against Facile Energy S.r.l. for alleged unfair commercial practices. Facile Energy allegedly activated contracts for the supply of gas and/or electricity through teleselling without the expression of the consumer’s will to enter into the contract. ICA also alleged that Facile Energy engaged in the dissemination of false, incomplete, or misleading information about its operations, which improperly induced consumers to agree to its contracts.

Moreover, Facile Energy allegedly imposed expensive and disproportionate burdens on the consumers who wished to exercise their right to reconsider or withdraw from the contract, and disconnected supplies in the event of pending complaints.

Based on an analysis of the documents acquired during the investigations, the ICA concluded that the consumer complaints appeared prima facie grounded (fumus boni iuris), and that the aforementioned conduct was serious and ongoing (periculum in mora), thus justifying the order for their suspension.

European Union

| A. | European Commission |

| 1. | European Commission raids water purification plants. |

In October 2021, the European Commission announced it had carried out unannounced inspections, i.e., “dawn raids,” to counteract behavior allegedly in breach of the cartel prohibition provision of Article 101 TFEU.

On June 12, 2022, the European Commission engaged in its seventh organized dawn raid of 2022 at various water purification plants. The purification plants are suspected of manipulating tenders involving EU funds.

| 2. | The new Vertical Block Exemption Regulation. |

On May 10, 2022, the European Commission adopted the new Vertical Block Exemption Regulation and accompanying Vertical Guidelines, which entered into force June 1, 2022. The new and modernized VBER is valid for 12 years and offers more clarity with regard to the online world of sales. For a more comprehensive overview, see GT Alert, The New VBER and Vertical Guidelines Explained: Key Takeaways.

| 3. | European Commission suspects cartelization through boycott in long-distance rail passenger transport. |

On June 10, the European Commission accused a Czech and Austrian train operator of forming a cartel to hinder competition in long-distance rail passenger transport by means of a collective boycott, especially between 2012 and 2016, with the entry of competitor RegioJet into the Czech Republican market and in relation to the international rail route between Vienna and Prague.

| 4. | European Commission launches investigation into possible abuse of dominance of Vifor Pharma. |

On June 20, the European Commission announced its investigation into Vifor Pharma for allegedly spreading misleading information about direct competitor Pharmacosmos. This alleged dominance abuse conduct would violate Article 102 TFEU and could restrict competition by unfairly and illegally disparaging the competitor’s good name and reputation. It is only the second time the European Commission has launched such an investigation based solely on allegedly spreading misleading information about a direct competitor.

| B. | European Decisions |

European General Court sustains Tata Steel/ThyssenKrupp joint venture block.

Major steel producers Tata Steel and ThyssenKrupp attempted to establish a joint venture in 2017 to increase their share in the European steel market. Completion of the joint venture would have resulted in the largest steel producer in the EU, after competitor ArcelorMittal. The European Commission blocked the proposed joint venture at the time due to possible infringement at the horizontal competition law level.

On June 22, 2022, the EU General Court approved the Commission’s ban on the joint venture. The steel producers argued that the determination of the relevant market should not have been based on the various market studies but rather on the “significant and non-transitory increase in price” test (the so-called “SNIPP-test”). The General Court upheld the prohibition and held that the parties did not offer sufficient remedies to address the competition law infringement concerns of the European Commission.

Greater China

China’s Anti-Monopoly Law Undergoes First Revamping Since 2008

On June 24, 2022, China’s top legislature passed and published the long-awaited amendment to the Anti-Monopoly Law (AML), which amendment will officially take effect Aug. 1, 2022 (2022 Amendment). As the first overhaul of China’s AML since taking effect in 2008, the 2022 Amendment is considered the culmination of over a decade of experience from law enforcement by the State Anti-Monopoly Bureau (SAMB) and its predecessors confronting an evolving national economy.

Immediately following publication of the 2022 Amendment, SAMB published drafts to amend three AML rules, including the Draft Regulation of Prohibition on Monopoly Agreement (Draft Monopoly Agreement Regulation), the Draft Regulation on Thresholds for Filing of Concentration of Undertakings (Draft Filing Thresholds Regulation), and the Draft Regulation on Review of Concentration of Undertakings (Draft Concentration Review Regulations), soliciting public comment through July 27, 2022. The draft regulations aim to implement the changes contemplated under the 2022 Amendment.

| 1. | Proposed adjustments to thresholds of merger control filing. |

China’s AML requires mandatory filing with SAMB for transactions that qualify as “concentrations” under AML if either set of the following thresholds are met:

-

the combined worldwide turnover of all the undertakings concerned in the preceding financial year is more than RMB 10 billion (approx. USD 1.5 billion), and the nationwide turnover within China of each of at least two of the undertakings concerned in the preceding financial year is more than RMB 400 million (approx. USD 59.7 million); or

-

the combined nationwide turnover within China of all the undertakings concerned in the preceding financial year is more than RMB 2 billion (approx. USD 298.5 million), and the nationwide turnover within China of each of at least two of the undertakings concerned in the preceding financial year is more than RMB 400 million (approx. USD 59.7 million).

The above turnover-based thresholds have been criticized as incompatible with China’s evolving economy in the following two areas: (i) the above turnover thresholds were set forth in 2008 in consideration of the size of economy at that time, and applying the thresholds today would capture many small-to-medium-sized transactions with no competition concerns, increasing transaction cost for market players, and (ii) certain competition-sensitive transactions such as “killer acquisition,” i.e., acquisition by dominant market players of “nascent” startups whose technology or business mode has market potential, will escape SAMB’s review because the revenue of such startups would fall short of the turnover thresholds. In response to the criticisms, 2022 Amendment and the Draft Filing Thresholds Regulation introduce three changes.

First, through the 2022 Amendment, SAMB is empowered to mandate merger control filings for any concentrations falling short of the specified filing thresholds if there is evidence that the concentration has or may have anti-competition effect.

Second, through the proposed Draft Filing Thresholds Regulation, the existing turnover triggers would be uplifted substantially with an increment from 20% to 100%. Under the proposed new thresholds, a concentration must be reported to SAMB if (i) the combined worldwide turnover of all the undertakings concerned in the preceding financial year is more than RMB 12 billion (approx. USD 1.79 billion), and the nationwide turnover within China of each of at least two of the undertakings concerned in the preceding financial year is more than RMB 800 million (approx. USD 119.4 million); or (ii) the combined nationwide turnover within China of all the business operators concerned in the preceding financial year is more than RMB 4 billion (approx. USD 597 million), and the nationwide turnover within China of each of at least two of the undertakings concerned in the preceding financial year is more than RMB 800 million (approx. USD 119.4 million). This proposed change, if adopted, would exempt transactions between parties without substantial China-originating turnovers from the mandatory filing, thus reducing the transaction costs for market players.

Third, in addition to the existing turnover-based thresholds, SAMB is proposing to introduce a new set of filing thresholds requiring the transaction falling short of the above turnover-based thresholds to be reported to SAMB if both of the following thresholds are met: (i) one of the undertakings concerned has a nationwide turnover in China of more than RMB 100 billion (approx. USD 14.925 billion); and (ii) the other undertakings concerned in the concentration has market capitalization or valuation of more than RMB 800 million (approx. USD 119.4 million), and its nationwide turnover in China accounts for more than one-third of their global turnover in the preceding financial year. Once adopted, these proposed thresholds combining both market valuation and China-originating turnovers would capture certain “killer acquisitions” between dominant market players and nascent startups with high valuation.

| 2. | Introduction of exemptions to prohibited vertical restraints. |

Certain specified vertical restraints, including fixing resale prices, are prohibited monopoly agreements under the AML. However, it has been long debated whether the prohibition on vertical restraints should be analyzed under the “illegal per se” rule or the “rule of reason” approach should be followed. The 2022 Amendment inserts a new section to exempt the vertical restraints if the defendants can prove the restraint has no anti-competitive effect, shifting the statutory position to the “rule of reason” approach.

In addition, the 2022 Amendment formally introduces a “safe harbor” rule to the prohibition against vertical restraints. Through the Draft Monopoly Agreement Regulation, SAMB proposes to exempt a vertical agreement between a business operator and its counterparties from the prohibition, if the business operator can prove that: (1) each of the business operator and the counterparties has a market share in their respective relevant market below 15%, and (ii) there is no countervailing evidence that the vertical agreement has anti-competitive effect. The Draft Monopoly Agreement Regulation also permits SAMB to set forth a different percentage point from the above 15% for any particular relevant markets. The above exemptions, including the “safe harbor” rule once formally adopted, would provide more certainty to market players when negotiating vertical agreements with counterparties.

| 3. | SAMB permitted to “stop the clock” during its merger control review. |

Under the AML, SAMB’s review of a merger case is divided into two phases with a possible extension, with a cumulative time frame up to 180 days following case acceptance. However, in practice, this fixed time frame proved insufficient in complex cases and, the parties to those transactions would have to withdraw and resubmit the case to allow more time for SAMB to continue its review and for the parties to negotiate potential remedies with SAMB.

To address this issue, the 2022 Amendment formally introduces the “stop-the-clock” regime, allowing SAMB to extend the deadline for different phases of review in any of the following circumstances: (i) the parties fail to provide documents and information as required, making it impossible to carry on the review; (ii) new circumstances or new facts with a significant impact on the review arise, and it is necessary to verify the new circumstances or facts in order to proceed with the review; and (iii) the restrictive conditions (i.e., remedies) to be attached to the transaction need further evaluation, and the parties have applied for suspension of review. The time frame will continue to be counted once the above triggering circumstances are removed. This new tool will enable SAMB to suspend the review without the need to require withdrawal of the case, thus helping expedite the review of complex cases. The Draft Concentration Review Regulations further supplement that in case any material factual changes happen to those in the application documents, or the undertakings are aware of new situations or facts that may have a material impact on the review (circumstance (ii) above), the undertakings are obliged to notify SAMB.

| 4. | Prohibition against Coordinative or Facilitative Monopoly Agreements. |

The 2022 Amendment introduces a new Article 19 to address the so-called “hub-and-spoke arrangements,” prohibiting business operators from orchestrating with other business operators to reach a monopoly agreement or otherwise providing material assistance for other business operators to reach a monopoly agreement. This new article will enable SAMB to investigate and prohibit coordinating or facilitative behavior when the business operator is not a party to the prohibited monopoly agreements.

In the Draft Monopoly Agreement Regulation, it is proposed that a business operator will be found to have “orchestrated” in the other business operators’ behavior if: (1) the business operator is not a party to the agreement, but is assuming a role to determine or decisively influence the scope, content, and performance conditions of the agreement; or (2) the business operator is entering into agreements with multiple counterparties competing with each other, and is purposefully facilitating communications or information exchange between such competing counterparties to enter into cartels. A business operator will be found to have provided “material assistance” to the illegal monopoly agreement if it has engaged in other behavior that has causal relationship with the anti-competitive effect.

| 5. | Penalty increases for AML violations. |

As discussed in the November 2021 Competition Currents, the 2022 Amendment increases the limit of administrative fines for AML violations. The details are summarized in the following chart.

| Types of Violations | Administrative Fines under the current AML |

Increased Fines under the 2022 Amendment |

| Violation relating to concentration (e.g., failure to file the concentration for review, implement a concentration without approval, violation of restrictive conditions attached to SAMB’s approval) |

No more than RMB 500,000 | No more than RMB 5 million, if the concentration does not restrict competition, and no more than 10% of the annual turnover of the last year, if the concentration restricts or may restrict competition |

| Conclusion and implementation of illegal monopoly agreements | 1% to 10% of the annual turnover of the last year | 1% to 10% of the annual turnover of the last year, or no more than RMB 5 million if there is no turnover last year |

| Conclusion of illegal monopoly agreements without acts of implementation |

No more than RMB 500,000 | No more than RMB 3 million |

| Personnel who are found to be personally responsible for concluding monopoly agreements |

None | No more than RMB 1 million |

| Abuse of market dominance |

1% to 10% of the annual turnover of the last year | 1% to 10% of the annual turnover of the last year |

In addition, in cases where the violation is “extremely severe” with “particularly serious consequences,” the 2022 Amendment allows the SAMB to impose a “superfine” on the violators up to an amount that equal 500% of the limits set forth in the chart above. However, further guidance over how such extremity and severity are interpreted is lacking.

Japan

Summary of the JFTC FY 2021 Annual Report

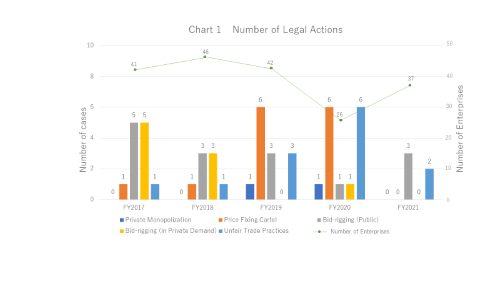

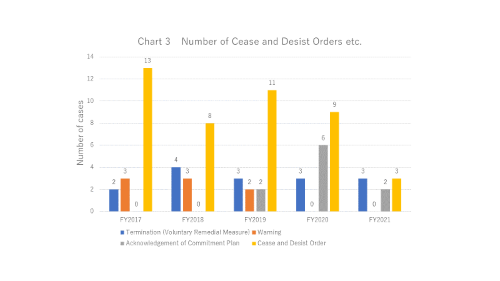

On June 1, 2022, the Japan Fair Trade Commission (JFTC) issued its annual report for fiscal year 2021. According to the report, in FY 2021, as depicted in the charts below, five legal actions (cease and desist orders, surcharge payment orders, and approval of commitment plans) were taken. Organized by type of action, there were three cases of bid-rigging (public) and two cases of unfair trade practices (see Chart 1 below). As for surcharges, a total of 2,180,260,000 yen in surcharge payment orders were issued to a total of 31 enterprises (see Chart 2 below). Additionally, for the three cases in which examination was terminated after receiving voluntary improvement measures reported by the enterprises, the outline of the cases was made to enhance transparency in the operation of the law and predictability for business operators (private monopolization, etc.: one case; other restraints and exclusive conditions transactions: one case; abuse of superior bargaining position: one case).

/>i

/>i