The U.S. Environmental Protection Agency (EPA) has substantially raised its fees for most actions under the Toxic Substances Control Act (TSCA). In a final rule published on February 21, 2024, 89 Fed. Reg. 12961, EPA increased all the fees in 40 C.F.R. Part 700, Subpart C. The new fees take effect on April 22, 2024, and will apply through fiscal year 2026.

EPA originally proposed a fee increase for fiscal years 2022-2024 in January 2021, which EPA then supplemented in a 2022 proposed rule. EPA has now finalized its 2022 rule with some changes. The final rule reduces some of the fees from the 2022 proposed rule while still more than doubling almost every TSCA fee when compared to the previous fees. Overall, EPA has reduced its estimated TSCA program costs by 19% from the 2022 proposed rule due to “efficiencies gained through implementation experience.”

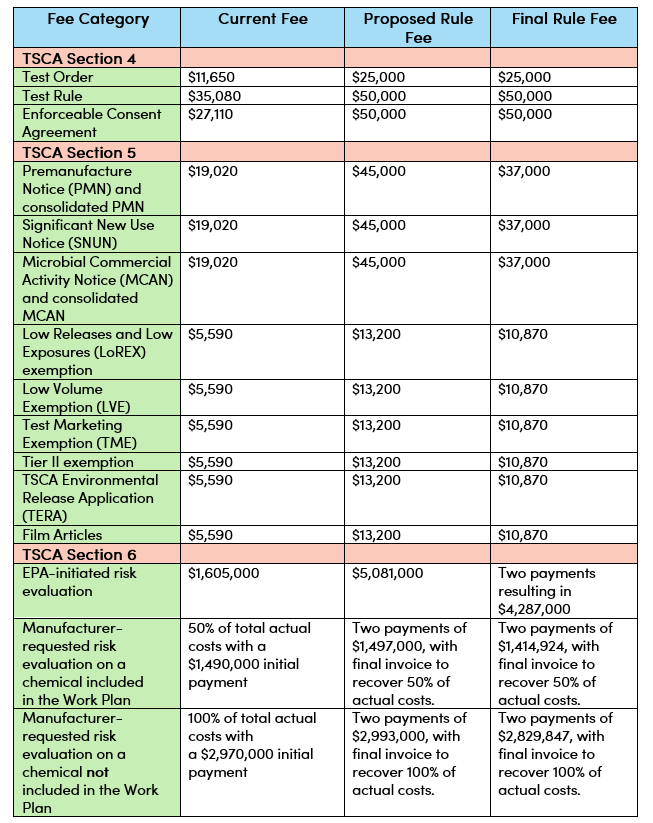

The fees aim to capture a full 25% of EPA’s costs of administering the TSCA program, as authorized by TSCA § 26(b). EPA estimates that the current rule has captured roughly half the costs, resulting in EPA resource constraints. See the table below for a comprehensive comparison of EPA’s current, proposed, and final TSCA fees. Lower fees apply to small businesses.

Of particular note:

- The fee for a premanufacture notice (PMN) goes from the current $19,020 to $37,000.

- The fee for a low-volume exemption application goes from the current $5,590 to $10,870.

- The fee for a test order goes from the current $11,650 to $25,000 (shared among test order recipients)

- The fee for an EPA-initiated risk evaluation goes from the current $1,605,000 to $4,287,000 (shared among manufacturers of risk evaluation chemicals)

Section 6 – Risk Evaluations

The increase for EPA-initiated risk evaluations does not apply to the first 20 high-priority substances, for which fees were paid years ago. They will likely apply to manufacturers of the five chemicals which EPA announced as candidates for designation as high-priority substances, 88 Fed. Reg. 87423 (Dec. 18, 2023) (see our alert here). Those five are:

- Acetaldehyde

- Acrylonitrile

- Benzenamine

- Vinyl chloride

- MBOCA

They could also apply to manufacturers of the ten additional chemicals that EPA indicated in the same notice that it is considering for prioritization under section 6(b)(1) in 2025 and thereafter:

- 4-tert-Octylphenol(4-(1,1,3,3-tetramethylbutyl)-phenol)

- Benzene

- Bisphenol A

- Ethylbenzene

- Naphthalene

- Styrene

- Tribromomethane

- Triglycidyl isocyanurate

- Hydrogen fluoride

- 6PPD

The final rule includes the exemptions proposed in 2021 and 2022 for manufacturers of high-priority substances where the substance was manufactured in the previous five years (and will be manufactured for the next five years) only as an impurity, byproduct (unless used for a separate commercial purpose), nonisolated intermediate, R&D chemical, as part of an imported article, or in amounts below 2,500 pounds per year (unless no other manufacturer produced the chemical above that amount).

EPA adopted changes to the self-identification requirements in the current rule for manufacturers of high-priority substances to reflect some of those exemptions.

The final rule retains a fee allocation system from the 2022 proposed rule for EPA-initiated risk evaluations where there are more than three fee payers. Fee payers will be ranked based on their reported production volume, then assigned fees based on those rankings. For example, if a manufacturer is in the top 20th percentile ranking (based on volume of production), they would pay 80 percent of the total fee. EPA stated that this ranking system will “ensure that the manufacturers of the largest quantity of production volume for a chemical undergoing risk evaluation pay the majority of the obligated fee.”

Payments for EPA-initiated risk evaluations are not due upon prioritization. The final fees rule changes the timing for those payments from the current rule (100% due 120 days after EPA publishes the final scope of a chemical’s risk evaluation) to the following schedule:

- 50% due 120 days after EPA publishes the final scope of a chemical’s risk evaluation

- 50% due 545 days after EPA publishes the final scope of a chemical’s risk evaluation

Section 5 – PMNs and Other Notices

EPA predicts it will receive about 216 PMNs and other full notices and 266 exemption applications (e.g., for low volume exemptions) each year.

Section 4 – Test Orders and Other Testing Requirements

Under the final rule, for the first time, processors will have to pay fees for test orders and enforceable consent agreements (ECAs). Under the current rule, only manufacturers must pay fees for test orders and ECAs.

The final rule added the same exemptions for manufacturers of chemicals subject to a test rule (but not a test order or ECA) that it adopted for manufacturers of high-priority substances. For test rule substances, the threshold is 1,100 pounds per year rather than the 2,500 pounds per year for high-priority substances.

EPA adopted changes to the self-identification requirements in the current rule for manufacturers (but not processors) of test rule substances to reflect some exemptions.

EPA estimates that section 4 costs (test orders, test rules, and enforceable consent decrees) will be $7,678,352. EPA has based this estimate on assuming that approximately 14 test orders per year will be initiated between FY 2024 and FY 2026. EPA expects approximately 10 of these test orders to be associated with the Agency’s actions on per- and polyfluoroalkyl substances (PFAS) per EPA’s implementation of the National PFAS Testing Strategy. EPA also assumed one test rule and one enforceable consent agreement between FY 2024 and FY 2026. EPA decreased its estimate of the number of issued test orders from the 2022 Supplemental Notice, where EPA originally estimated there would be 75 test orders per year between FY 2023 and FY 2025.

/>i

/>i