- The FTC has finalized significant changes to the information and level of detail that will be required in premerger antitrust filings under the HSR Act. The new rules will take effect in early 2025.

- Among other changes, the new rules will require merging parties to affirmatively identify any business overlaps or supply relationships between the parties, will increase the parties’ obligations to provide information about their minority investors, and will expand the categories of documents that need to be submitted.

- Going forward, parties to mergers and acquisitions should anticipate that the new rules will significantly increase the time, effort, and costs required for making HSR filings, and should ensure that deal timelines and transaction terms are updated accordingly.

Summary

On October 10, 2024, the Federal Trade Commission (FTC), with the concurrence of the Department of Justice Antitrust Division (with the FTC, “the Agencies”), announced the culmination of a multiyear effort to reform premerger notification practice under the Hart-Scott-Rodino Antitrust Improvements (HSR) Act. The FTC finalized new rules that will significantly increase the scope, burden, and detail required in HSR filings. According to the Agencies, the goal of the changes is to provide the Agencies with more substantive information, earlier in the merger process, about the parties, their stakeholders, and their customers, all to help the Agencies use the initial, 30-day HSR “waiting period” to maximal advantage. The new rules will go into effect in January 2025 (but the exact date is currently uncertain).

Although the changes will substantially increase the time and complexity that will be required for HSR filings, the FTC, to its credit, did not go forward with some of the most extreme revisions that it had been considering. For instance, the FTC decided not to require parties to submit every single “draft” version of every single Item 4(c) document (e.g., analyses of the transaction with respect to markets or competition) — a proposal that was heavily criticized by this firm and many others. The FTC also decided not to require merging parties to submit information about overlaps they might have in labor markets — a surprising change given the priority the Agencies have recently put on labor in antitrust enforcement. The FTC also declined to adopt e-discovery disclosure and document-preservation duties on parties that make HSR filings and, more broadly, made a number of smaller, procedural changes from the original rulemaking, often in response to comments about unanticipated consequences.

Notably, the comments of Foley & Lardner LLP on the proposed HSR rulemaking appeared to have played a significant role in narrowing the final revisions. Identified anonymously as “one commentator,” Foley’s comments are cited repeatedly for persuading the FTC to scale back vague or problematic proposals that appeared in the original rulemaking notice. For example, Foley & Lardner’s comments are singularly credited for persuading the FTC to allow more flexibility in HSR filings made on the basis of a letter of intent or other non-definitive agreement; to precisely define the concept of a “supervisory deal lead” and to limit that concept to a single individual; to limit the scope of annual reports, organizational charts, and transaction steps charts required for submission; and to abandon a wholly impractical requirement to submit “geolocation” data for operations in overlapping lines of business.

The FTC’s decision to adopt the HSR revisions was unanimous, including the support of the FTC’s two Republican Commissioners. The Republican Commissioners released concurring statements explaining that while the HSR revisions were not the changes they would have adopted on their own, they were vast improvements over the original proposals and generally represent “a lawful improvement over the status quo.” And, in a concession to the business community, the FTC announced it will end its nearly four-year moratorium on grants of “early termination” for non-problematic transactions, effective upon the adoption of the final rules.

Overview of New HSR Forms

The new HSR changes represent the biggest shift in HSR premerger practice in the 46 years that premerger notifications have existed. Some elements of historical HSR practice remain, such as the requirement to submit deal-related documents about competition or markets (so-called “Item 4(c)” documents) and the requirement to report geographic information and prior acquisitions when the parties’ business operations overlap. But the form itself is totally new. In fact, for the first time, there are now two separate forms, requiring different information from the buy side than on the sell side. And the new forms look fundamentally different than the old one. Among other changes, the forms no longer include numbered items; therefore, while the document-submission requirement remains (and, in fact, is expanded), “Item 4(c)” is no longer literally “item 4, subpart (c)” of the form.

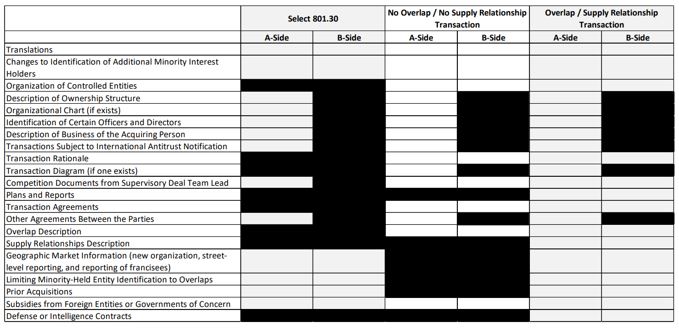

Broadly speaking, the new HSR forms take an “if/then” approach in that different information is required depending on the facts of the transaction. The rulemaking notice includes the chart below to help illustrate when particular information is required, depending on whether the filer is the “A-Side” (buyer) or “B-Side” (seller), whether the parties report an “overlap” or “supply” relationship, and whether the transaction is a so-called “Select 801.30” transaction (e.g., stock acquisitions by executives or open-market purchases of minority interests by passive investors):

For all transactions, the acquiring entity (including its subsidiaries and parent companies) will be required to submit information about its ownership structure and governance, including identifying any 5%-or-greater investors (with some exceptions for passive investors in limited partnerships) and a list of all current officers and directors who currently serve in similar roles for companies in the same industry as the target. The seller also will be required to disclose information about its own minority investors that will be “rolling over” interests as part of the transaction.

For nearly all deals (excluding “Select 801.30” ones), the parties both will be required to include a narrative statement describing their principal lines of business, whether they have any current or planned products or services that compete with the other side, whether they supply $10 million or more of any products or services to the other side or to parties that compete with the other side, and whether they purchase $10 million or more of any products or services from the other side or from parties that compete with the other side. To the extent the parties report any such overlaps or supply relationships, then additional information will be required about the parties’ respective top-10 customers or suppliers for those products or services. Significantly, to address concerns that the proposed instruction would require too much information sharing between the parties, the new HSR instructions say that the parties “should not exchange information for the purposes of answering” these requests. This instruction raises serious questions of how parties are supposed to go about answering these items in practice. The instruction, however, suggests that in some cases buyers and sellers may take inconsistent approaches in their respective responses to these items in the form.

As with prior practice, the new HSR form will continue to require parties to report their U.S. operations by North American Industry Classification System (NAICS) codes and, to the extent these operations overlap, to report additional information about their relevant geographic locations, prior acquisitions, and minority investments. In a change, parties will report their revenues by NAICS code only to the level of certain “ranges” (<$10 million, $10 million to $100 million, $100 million to $1 billion, or >$1 billion) rather than reporting revenues to a precise figure. The requirement to separately report manufacturing revenues by 10-digit North American Product Classification System, in addition to doing so by NAICS codes, has been eliminated. Also, for the first time sellers will be required to report certain prior acquisitions of businesses that post a NAICS-code overlap; previously this requirement was limited only to the buyer.

The HSR form will continue to require the submission of certain documents prepared for the transaction process that analyze markets, market shares, competition, synergies, or other competitively relevant topics. Historically, this document requirement has been limited to submitting relevant “final” documents that were prepared by or for officers or directors, as well as relevant “draft” documents that were provided to the board of directors. These requirements now are expanded to also include any relevant “final” documents that were prepared by or for the “supervisory deal team lead” (defined as the singular individual who was primarily responsible for supervising the strategic assessment of the deal and is not otherwise an officer or director). In addition, the rulemaking notice indicates that a relevant “draft” document “that was shared with any member of the board of directors (or similar body) … should not be considered a draft; rather, it should be treated as a final version and submitted with the HSR Filing.”

Finally, to the extent the parties disclose any overlap operations, they are required to submit certain high-level, ordinary-course business documents that analyze the overlap markets. This requirement to produce ordinary-course business documents applies to “plans and reports” provided to the parties’ respective boards or directors, as well as “regularly prepared” plans and reports provided to the parties’ respective CEOs, in either case within one year of the date of filing.

Other Key Changes

In addition to the key changes described above, other notable changes in the new HSR forms include:

- Stricter requirements for transactions reported on the basis of a letter of intent or non-definitive agreement. In contrast to prior practice, the HSR rules now will require the parties to reach an agreement in principle on certain key business terms before they can file HSR, including “some combination [whatever that means] of the following terms: the identity of the parties; the structure of the transaction; the scope of what is being acquired; calculation of the purchase price; an estimated closing timeline; employee retention policies, including with respect to key personnel; post-closing governance; and transaction expenses or other material terms.”

- A requirement to submit the parties’ full transaction agreements, including exhibits, schedules, and side letters. However, in response to a concern expressed by Foley, the instructions will allow the parties to exclude “clean team” agreements between the parties made for due diligence or integration planning.

- A requirement that both parties provide a narrative description of “each strategic rationale for the transaction discussed or contemplated by the filing person or any of its officers, directors, or employees,” including identifying each document included in the filing that supports the stated rationale. In response to a comment by Foley that sellers often have no strategic rationale for a deal other than the raising of cash, the rulemaking notice allows sellers to submit a “brief” statement of the transaction rationale from their perspective, so long as the statement is accurate and does not conflict with their other documents.

- A requirement to submit translated copies of foreign-language documents. The rulemaking notice indicates that the FTC will accept electronic translations but stresses that the parties “should ensure that translations are faithful to the original documents.”

- A requirement for the buyer to disclose any preexisting contractual agreements between the parties, including any supply agreements, licensing agreements, leases, or agreements with non-competition or non-solicitation terms.

- A requirement to disclose any subsidies received from countries or entities that are strategic or economic threats to the United States, as determined under the Infrastructure Investment and Jobs Act (i.e., China, Iran, North Korea, and Russia). This disclosure requirement was specifically mandated by Congress in the Merger Modernization Act, signed into law in December 2022.

- A requirement to disclose certain pending or awarded defense or intelligence procurement contracts to the extent such contracts involve revenues that pose an overlap between the parties. In response to a concern raised by Foley and others, the instructions provide that “classified information” shall not be disclosed in the filing, but a note should be made that responsive information was withheld on that basis.

More broadly, the revised HSR rules include a number of new requirements and changes from prior practice, and generally reorganize the structure and layout of the form. The FTC’s rulemaking notice includes the following “cross-reference” chart, which summarizes the substantive and format changes from prior HSR practice:

| Current Form Item | New Location | Substantive Changes? |

| Fee Information | Fee Information | No |

| Corrective Filing | General Information | No |

| Cash Tender Offer | General Information | No |

| Bankruptcy | General Information | No |

| Early Termination | General Information | No |

| Foreign Jurisdictions | Transaction Information/Transactions Subject to International Antitrust Notification | Yes |

| Item 1(a) | Ultimate Parent Entity Information/UPE Details | No |

| Item 1(b) | Separate Forms will Identify Acquiring and Acquired Person, No Combined Form | No |

| Item 1(c) | Ultimate Parent Entity Information/UPE Details | No |

| Item 1(d) | Ultimate Parent Entity Information/UPE Details | No |

| Item 1(e) | Ultimate Parent Entity Information/UPE Details | No |

| Item 1(f) | Transaction Information/Parties | No |

| Item 1(g) | Ultimate Parent Entity Information/UPE Details | No |

| Item 1(h) | Ultimate Parent Entity Information/UPE Details | Yes |

| Item 2(a) | Transaction Information/Parties, Transaction Description | No |

| Item 2(b) | Transaction Information/Transaction Details | No |

| Item 2(c) | Transaction Information/Transaction Details (Acquiring Person Only) | No |

| Item 2(d) | Transaction Information/Transaction Details | No |

| Item 3(a) (Entities) | Transaction Information/Parties | No |

| Item 3(a) (Description) | Transaction Information/Transaction Description | Yes |

| Item 3(b) | Transaction Information/Agreements | Yes |

| Item 4(a) | Ultimate Parent Entity Information/UPE Details, Acquiring Person or Acquired Entity Structure | Yes (Natural Persons) |

| Item 4(b) | Ultimate Parent Entity Information/UPE Details, Acquiring Person or Acquired Entity Structure | Yes (Natural Persons) |

| Item 4(c) | Transaction Information/Business Documents | Yes |

| Item 4(d) | Transaction Information/Business Documents | No |

| Item 5(a) | Revenue and Overlaps/NAICS Codes | Yes |

| Item 5(b) | Transaction Information/Joint Ventures (Acquiring Person Only) | Yes |

| Item 6(a) | Ultimate Parent Entity Information/Acquiring Person or Acquired Entity Structure | Yes |

| Item 6(b) | Ultimate Parent Entity Information/UPE Details | Yes |

| Item 6(c)(i) | Revenue and Overlaps/Minority-Held Entity Overlaps | Yes |

| Item 6(c)(i)(i) | Revenue and Overlaps/Minority-Held Entity Overlaps (Acquiring Person Only) | Yes |

| Item 7(a)-(d) | Revenue and Overlaps/Controlled Entity Geographic Overlaps | Yes |

| Item 8(a) | Revenue and Overlaps/Prior Acquisitions | Yes |

Conclusion

The new HSR rules will significantly impact the cost, timing, and effort required of every HSR-reportable transaction. In particular, for transactions where the parties overlap or have supplier-purchaser relationships, the additional information required by the new HSR rules will be significant, and parties will need to allow substantial additional effort and time to thoughtfully prepare these filings.

What remains to be seen is whether the HSR revisions will actually result in any increased merger investigations or challenges. As Foley pointed out in our comments, the previous HSR system worked exceedingly well at providing the Agencies with the information they needed to evaluate competitive effects. In fact, in our review of Agency merger enforcement actions from 2000 to 2021, we identified only one HSR-reportable transaction — out of 39,962 in total — where additional information may plausibly have made a difference to the Agencies’ enforcement decision. Therefore, absent a significant expansion to the Agencies’ legislative mandates, staffing, or resources, we expect the new HSR rules will have limited benefit to the Agencies’ law-enforcement missions while imposing substantial costs and burdens on filing parties throughout the global economy.

Elizabeth Morales-Saucedo, Jacqueline Beveridge and William C. McCaughey contributed to this article

/>i

/>i