These initiatives may be driven by hospital patient throughput concerns, a desire to diversify system operations, and/or value-based care incentives. Hospitals and health systems evaluating these opportunities should be aware of common structuring vehicles and bear in mind certain key considerations.

Market Context

Hospitals traditionally have had mixed results in directly owning and operating (LTC) facilities such as skilled nursing facilities (SNFs) and assisted living facilities (ALFs). Frequently located on or near a hospital campus, many hospitals have divested these LTC facilities over time due to poor financial performance, and other hospitals are evaluating whether to do so. Aside from overhead challenges, one possible reason for this trend is that LTC management requires a significantly different skill set than hospital management.

Recently, however, demand for LTC services is increasing as the population continues to age. While there is an overall preference for aging in place through care in the home, as evidenced by the proliferation of hospital-in-the-home programs, consumer demand is strong for high-quality SNFs, ALFs, and independent living facilities (ILFs). Within the SNF and ALF sectors, there is an emergence of “small home” innovative models of care, such as The Green House Project, focused on resident-empowered care in non-institutional settings.

There are at least three emerging factors that have caused some hospitals and health systems to explore strategic alignment with LTC facilities. First, hospitals urgently need to solve patient throughput challenges that have reached a crisis point, and improved access to SNF and ALF beds may be one solution. In considering this strategic calculus, hospital leadership may consider weighing the costs of sustained inability to timely discharge patients against the costs of a strategic LTC arrangement. Second, health systems are seeking new and innovative ways to continue to diversify beyond their traditional care models. The LTC sector is one such area, and notably, the ALF and ILF sectors are largely focused on private pay residents. Third, hospitals should also consider the trend in favor of incorporating more robust LTC services into value-based care (VBC) arrangements.

Representative Vehicles for Hospital/LTC Integration

Hospitals seeking to explore strategic integration with LTC facilities, owners, or operators have multiple options available:

- Clinical Affiliation and Possible Co-Branding with Existing Third-Party LTC Operator

- Potential co-branding between health system and LTC operator.

- Shared clinical care model with emphasis on coordination of care and hospital admission prevention.

- Potential integration into VBC/Accountable Care Organization (ACO) models of care.

- Priority bed access for hospital discharges, recognizing potential legal and regulatory limitations.

- Third-Party LTC Operator Management of Hospital-Owned SNF/ALF

- Potential co-branding between health system and LTC operator.

- Affords hospital the opportunity to access management expertise specific to LTC sector, with potential offloading or limitation on financial risk of operations.

- Potential for hospital to retain priority bed access for hospital discharges, recognizing potential legal and regulatory limitations.

- Hospital can retain negotiated mission and strategic decisions via management agreement.

- Regulatory approval process may be challenging depending on the structure and jurisdiction.

- Relocation and Replacement of Existing Hospital-Owned LTC Facility

- Potential co-branding between health system and LTC operator.

- May be attractive option if existing hospital-owned LTC facility is on or adjacent to hospital campus or institutional in design.

- May facilitate conversion to small home or Green House model, which may be more attractive to seniors seeking ILF, ALF, or SNF care settings.

- May be pursued in combination with reconfiguration of beds between SNF and ALF licensure categories.

- May be undertaken in combination with retention of third-party LTC operator, with ancillary consideration of reputational, quality, and risk apportionment priorities.

- Require regulatory approvals, which may be significant, along with financing of replacement facility.

- Hospital Investment in or Acquisition of LTC Facility

- Potential opportunities for hospitals to hold an ownership interest in an existing LTC facility or to co-invest in development of a new facility.

- Potential for accompanying clinical affiliation and co-branding with third-party LTC operator.

- May alleviate systemic hospital throughput issues.

- Requires careful assessment of management/quality model, as well as financial forecasting.

- Hospital may potentially retain negotiated mission and strategic decisions.

- Regulatory approval process may be challenging depending on the structure and jurisdiction.

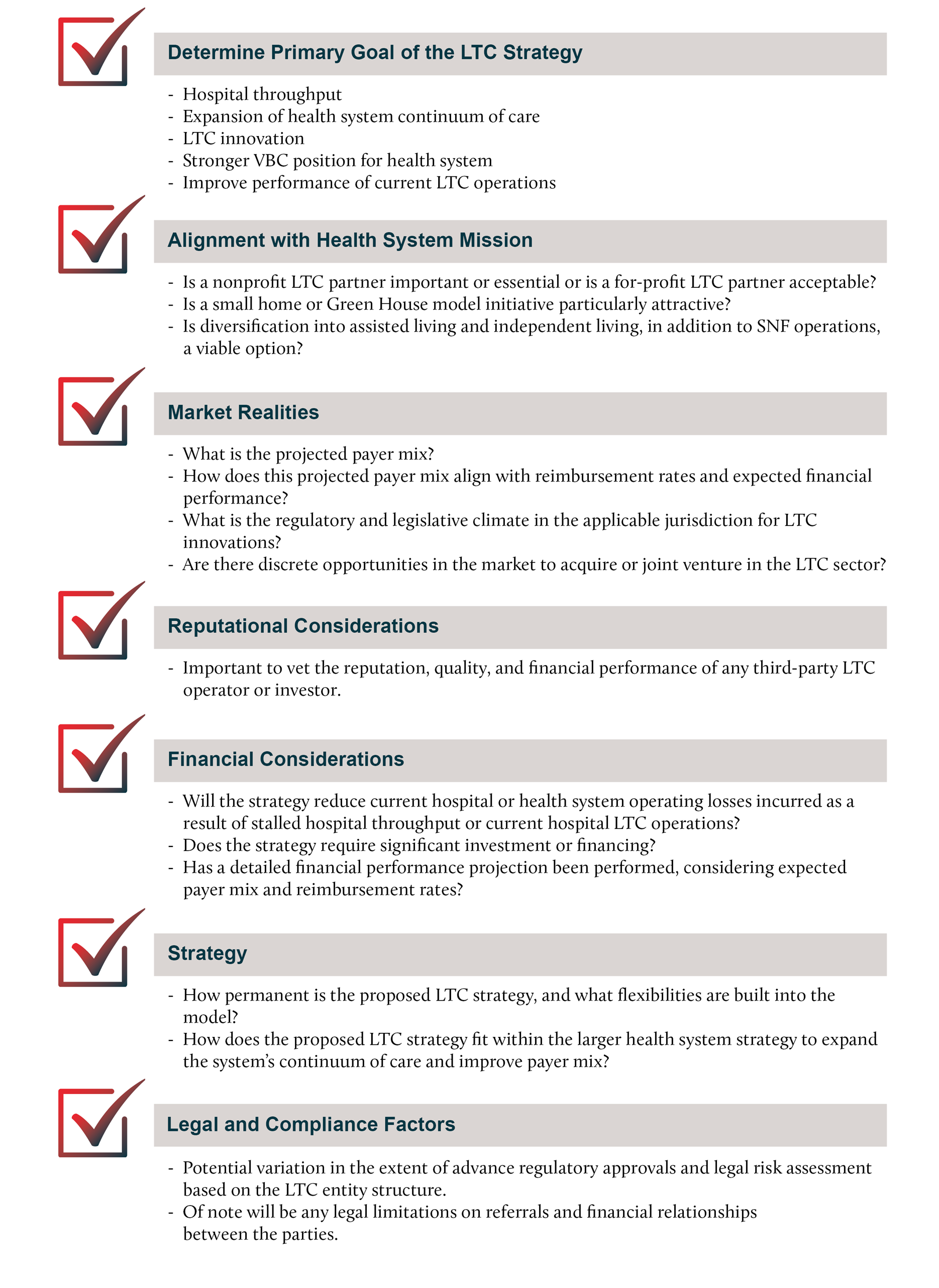

Key Considerations Checklist

Hospitals and health systems interested in strategic participation in the LTC sector should evaluate opportunities through the lens of several key considerations:

Conclusion

As the aging population increases, so too will demand for sub-acute and long term care settings. It is inevitable that hospital throughput issues will also increase, obstructing patients who require transition from an acute care setting to a lower acuity setting. While affiliation and management agreements between hospitals and LTC facilities are a relatively painless means of developing a smooth institutional care continuum, the relationships are contract-based and, as such, fragile. Acute care operators seeking a more permanent and tailored solution may consider the approaches identified above as a roadmap to determining the viability of potential integration strategies.

/>i

/>i