On November 25, 2019, the Centers for Medicare and Medicaid Services (CMS) Innovation Center released the Request for Applications (RFA) for the Direct Contracting Global and Professional Risk models. This model illustrates the Trump Administration’s value based care transformation goals, featuring a greater emphasis on beneficiary engagement and a move to capitated payment models. Organizations interested in applying for the Implementation Period must do so by February 25, 2020.

Direct Contracting Model Overview – the Next Next Gen

In April 2019, CMS announced the Primary Cares Initiative, a new set of payment models intended to help primary care providers transition to performance-based risk while delivering better value to patients. The Primary Cares Initiative included Primary Care First, an advanced primary care medical home model that builds on Comprehensive Primary Care Plus. Direct Contracting, an advanced accountable care model, builds on the Next Generation Accountable Care Organization (NGACO) model.

CMS has defined three different tracks within Direct Contracting:

-

Professional: Offers 50% savings/losses and provides primary care capitation, which is a capitated, risk-adjusted monthly payment for enhanced primary care services

-

Global: Offers 100% savings/losses and provides the option of primary care capitation or total care capitation. Total care capitation is a capitated, risk-adjusted monthly payment for all services provided by Direct Contracting participants and preferred providers with whom the entity has an agreement

-

Geographic: Offers entities an opportunity to assume risk for total cost of care for Medicare fee-for-service (FFS) beneficiaries in a defined target region.

The November 2019 RFA applies only to Professional and Global risk. CMS issued a request for information on Geographic Direct Contracting earlier this year. The Geographic model is on a longer development timeline, and the agency has not publicly indicated when stakeholders should expect to see an application for that model.

The Direct Contracting Global and Professional models begin with an optional implementation period in 2020, during which participating entities may take certain steps to align beneficiaries, but there will be no change to payments. The payment model will begin with the first performance year (PY) in 2021 and will run through 2025. Interested organizations may apply for the Implementation Period (applications are due February 25, 2020) or for PY 1 (applications available later in 2020).

Direct Contracting is intended to count as an advanced Alternative Payment Model (APM) for Quality Payment Program purposes (i.e., eligible to receive the 5% bonus payment if other criteria are met) beginning in 2021. Implementation Period performance is not eligible for advanced APM treatment. Organizations that are currently participating in qualifying advanced APM models should take that into account as they consider their participation options, including participation in multiple models.

Types of DCEs – A Focus on Differentiating New Entrants

The Administration has made it clear that one goal of the Direct Contracting model is to bring new entities and new provider types into performance-based risk in traditional Medicare. In particular, one area of focus is medical groups that historically have provided care to mostly or only Medicare Advantage beneficiaries. These groups could not previously participate in Medicare ACOs because the beneficiary alignment thresholds were too high and would be prohibitive given the small size of these groups’ fee-for-service populations.

Consistent with its goal, CMS differentiates between three types of Direct Contracting Entities (DCEs) in the model:

-

Standard DCEs: Organizations with experience serving traditional Medicare beneficiaries, including dual eligibles. These organizations may have experience in the Medicare Shared Savings Program, NGACO or Pioneer ACO models. These DCEs may also be new organizations consisting of existing FFS providers and suppliers.

-

New Entrant DCEs: Organizations that have not traditionally provided services to a traditional Medicare population and would have less than 3,000 beneficiaries aligned to them through claims-based alignment in the baseline years. An example would include medical groups that have provided all or most of their care to Medicare Advantage beneficiaries with a very small fee-for-service population.

-

High Needs Population DCEs: Organizations that serve traditional Medicare beneficiaries with complex needs, including duals, who are aligned through voluntary alignment or claims-based alignment. These DCEs will provide care to individuals with complex needs, similar to the model employed by the Programs of All-Inclusive Care for the Elderly (PACE).

Each of these models has specific features, including different financial models, beneficiary alignment requirements and payment mechanisms that are intended to attract a broad range of participants.

Direct Contracting Evolves the ACO Payment Model by Requiring Capitation

In an advancement from previous ACO models, the Direct Contracting Professional and Global models require the use of capitated payments. The model offers two types: primary care capitation and total cost of care capitation.

In both models, Medicare Part A and B expenditures for the DCE’s aligned beneficiaries will be compared to the DCE’s benchmark to determine savings or losses. CMS will make a per-beneficiary-per-month payment to the DCE. The DCE will then pay its downstream contracted providers and suppliers (DCE participant providers and DCE preferred providers).

In these capitated payment models, providers will still submit claims to CMS. For services subject to the capitation arrangement with CMS (which vary by model), the agency will zero out those claims and will not make fee-for-service payments to the physician. For non-capitated services, fee-for-service payments will be made, although providers can also participate in a claims reduction model. Additional details are provided below.

Primary Care Capitation

Primary Care Capitation is available to DCEs participating in Global or Professional risk. Under this payment mechanism, DCEs will receive a monthly payment covering a specific set of primary care based services (listed in the application on page 36) furnished to aligned beneficiaries by Direct Contracting participant providers. Participant providers will continue to receive fee-for-service reimbursement for their non-primary care based services.

The Primary Care Capitation will be equal to 7% of the DCE’s monthly performance year benchmark. The 7% capitation payment is expected to be higher than the expenditures for the identified primary care based services. CMS indicates that it will recoup the difference between the 7% and the DCE’s historical claims expenditures for primary care services. For example, if 3% of the DCE’s historical claims expenditures are for primary care services, CMS would recoup 4% (the difference between 7% and 3%) as part of the final reconciliation.

DCEs electing Primary Care Capitation have additional flexibility to use claims reductions for non-primary care services provided by participant providers and services provided by preferred providers. CMS will reduce the claims and make a monthly Advanced Payment to the DCE in the amount of the claims reduction.

Total Care Capitation

Total Care Capitation is available to DCEs participating in the Global Risk model. Total Care Capitation encompasses Medicare Part A and B services furnished to aligned beneficiaries. In this option, participant providers agree to a 100% claims reduction, and preferred providers may elect a claims reduction between 1% and 100%. The Total Care Capitation payment encompasses services provided by Participant Providers and services provided by Preferred Providers that have agreed to a claims reduction.

Claims paid for services to aligned beneficiaries that occur outside of the Total Care Capitation agreement will be debited from the DCE’s Total Care Capitation amount. To protect against extreme scenarios, CMS will withhold funds. CMS will determine a withhold amount for each DCE and at the end of the year will reconcile the actual expenditures against that withhold.

Direct Contracting Emphasizes Beneficiary Engagement and Voluntary Alignment

Consistent with the general approach in Next Gen, the Direct Contracting model will use two methods to align beneficiaries to DCEs:

- Claims-based alignment, in which a beneficiary is aligned based on where he receives a plurality of his primary care services

- Voluntary alignment, where a beneficiary indicates that she wants to be aligned to the DCE by selecting her main doctor.

Voluntary alignment will take precedence over claims-based alignment.

Voluntary Alignment Overview

Beginning in the implementation period, beneficiaries will voluntarily align to a DCE by designating a DCE’s participant provider as their primary clinician or main source of care. Voluntary alignment can be completed either online at MyMedicare.gov or through a paper-based alignment option. Electronic elections will take precedence over paper-based alignment.

DCEs will be permitted to proactively communicate with beneficiaries, including providing marketing materials and holding outreach events. CMS may permit DCEs to provide gifts of nominal value for outreach purposes, as long as the gifts do not violate federal laws, including prohibitions on beneficiary inducements. Additional detail on permitted and restricted activities will be provided in the Participation Agreement.

Beneficiaries may reverse their alignment decision or change their care relationship at any time. In the RFA, CMS reiterates its long-held view that DCEs must permit aligned beneficiaries to maintain freedom to choose their providers and suppliers, even if the provider or supplier is not part of the DCE. DCEs will be required to notify aligned beneficiaries that beneficiaries have the freedom to select their own primary care clinician and to receive services from non-DCE providers and suppliers consistent with traditional Medicare rules.

DCEs will have the option of prospective alignment or prospective plus alignment. Under prospective alignment, all claims will be based and voluntary alignment completed prior to the start of each performance year. Under prospective plus alignment, the DCE may have beneficiaries voluntarily aligned on a quarterly basis throughout the performance year. CMS notes that these options were developed in response to stakeholder feedback.

Beneficiary Engagement Incentives

CMS will also permit Direct Contracting participant providers, preferred providers and others to provide in-kind items and services to beneficiaries provided that certain conditions are met. Examples of items and services include:

-

Vouchers for over-the-counter medications recommended by a health care provider

-

Pre-paid, non-transferable vouchers that are redeemable for transportation services to and from an appointment with a health care provider

-

Items and services to support management of a chronic disease or condition

-

Wellness program memberships, seminars and classes

-

Electronic systems that alert family caregivers when a family member with dementia wanders away from home or gets up from a chair or bed

-

Vouchers for those with chronic diseases to assess chronic disease self-management, pain management and falls-prevention programs

-

Vouchers for those with malnutrition to access meal programs

-

Phone applications, calendars or other methods for reminding patients to take their medications and promote patient adherence to treatment regimens

-

Vouchers for certain dental services.

These items and services would be funded by the DCE and would not be included in the calculation of the DCE’s benchmark or performance year expenditures.

In addition, DCEs may enter cost-sharing support arrangements with their participant and preferred providers. Under such an arrangement, the providers would not collect beneficiary cost-sharing amounts (in whole or in part) from certain beneficiaries for certain Part B services. DCEs would make a payment arrangement with their downstream providers. Note that cost sharing flexibility is available as a benefit enhancement in NGACO.

DCEs will also be permitted to provide gift cards to eligible aligned beneficiaries, up to an annual limit of $75, for the purpose of incentivizing participation in a chronic disease management program. Note that a similar sounding Chronic Disease Management Reward is offered as a benefit enhancement in NGACO.

In general, the ACO programs’ experience with voluntary alignment has been that it is difficult to achieve, although there are exceptions. Potential applicants will need to evaluate the tools available to them and their local market dynamics to assess how these tools can contribute to building their aligned population.

Beneficiary Alignment Thresholds

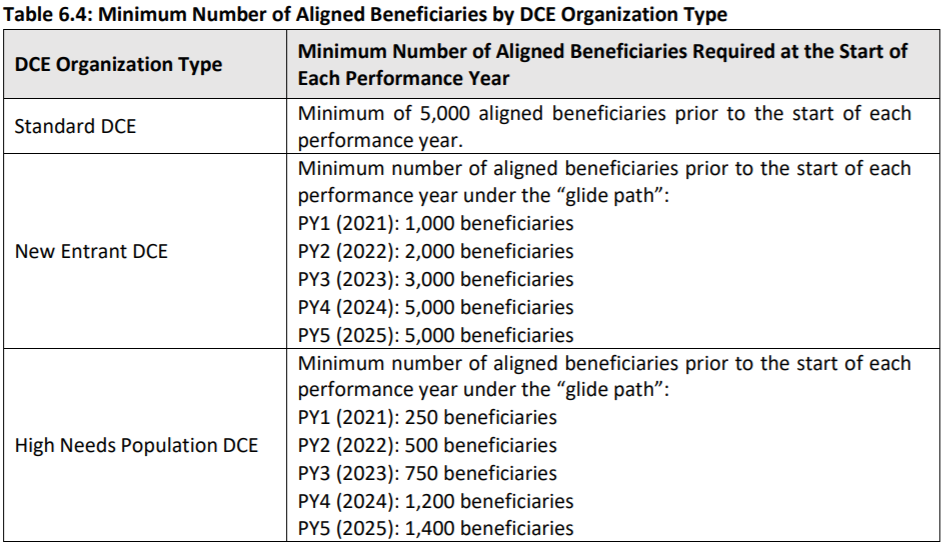

Like other Medicare models, DCEs will be required to meet minimum alignment thresholds: [Table from CMS Request for Applications]:

In general, the NGACO model required ACOs to maintain an aligned population of 10,000 Medicare beneficiaries. The lower thresholds in Direct Contracting are intended to allow additional organizations to participate and to respond to stakeholder feedback that the 10,000 beneficiary threshold was unnecessarily high. Note that new entrant organizations will need to determine whether the thresholds are achievable on relatively short timelines.

Direct Contracting Benchmarking Approach Differentiates Between DCE Types and Beneficiary Alignment Strategies

CMS will use different benchmarking methodologies for the different DCE types to try to address the population experience differences across entity types. The benchmarking methodology also differs for voluntarily aligned beneficiaries versus claims-based aligned beneficiaries.

Standard DCEs

CMS will use a prospective benchmarking methodology for standard DCEs. A per-beneficiary-per-month benchmark will be developed using five steps that are routinely used in the Medicare ACO models:

-

Calculation of historical baseline expenditures: CMS will use the baseline period of 2017, 2018 and 2019. These years will be weighted, giving additional weight to the most recent years. While the years are stable, CMS will update the baseline expenditures using the DCE’s most recent list of participant providers for these years.

-

Trending historical expenditures: CMS will use a prospective trend based on the projected US per capita cost (USPCC) growth trend developed by the CMS Office of the Actuary and announced in the annual Medicare Advantage (MA) rate announcement. CMS will apply the aged and disabled and end-stage renal disease USPCC growth trends to those respective beneficiaries. The trended historical baseline expenditures will be adjusted to reflect the anticipated impact of changes in the regional Geographic Adjustment Factors. CMS notes that it may also make other adjustments in certain circumstances.

-

Blending historical and regional expenditures using Adjusted MA Rate Book: CMS will use the most recent MA Rate Book with certain adjustments (e.g., removing the stars quality bonus, potentially removing the quartile assignment rules, and adjusting for differences between populations eligible to be aligned to DCEs) to adjust the historical benchmark. CMS will calculate weighted average county rates corresponding to where beneficiaries live. Regional expenditures will be blended with historical baseline expenditures to calculate a weighted payment rate. Regional expenditures will initially comprise 35% of the benchmark and will increase over time to 50%. CMS will also impose a ceiling and a floor on the overall upward and downward adjustments from incorporating regional expenditures.

-

Risk adjustment: CMS indicates that it will release information regarding the risk adjustment methodology at a later date.

-

Adjustments for quality and the discount in Global risk:

-

In both Global and Professional, CMS will withhold 5% of the value of the trended, regionally blended, risk-adjusted benchmark for quality performance on a refined set of quality measures. DCEs can earn back the withhold depending on their quality performance and continuous improvement/sustained exceptional performance. CMS will also create a high performers pool that will be funded from quality withholds that are not earned back. The funds in the high performers pool will be distributed to the highest performing DCEs through a bonus based on quality or improvement.

-

In the Global risk model, CMS will apply a discount to the trended, regionally blended, risk-adjusted benchmark. The discount will be 2% for PY 1 and PY 2, and then will increase by one percentage point for each subsequent performance year to reach 5% in PY 5.

-

Standard DCEs: Benchmarking for Voluntarily Aligned Beneficiaries

CMS will test a new benchmarking methodology for the historical component of the benchmark (step one above) for beneficiaries aligned solely through voluntary alignment. For the first three years of the model, the historical component of the benchmark will be based only on the Adjusted MA Rate Book. In PY 4 and PY 5, CMS will use the benchmarking methodology for claims-based alignment, but will use more recent calendar years to calculate that experience. Risk adjustment, the discount for global, and the quality withhold will still apply.

Note that this methodology will apply only to newly aligned beneficiaries. CMS will confirm that the beneficiary has not previously been aligned to the DCE through claims-based alignment. CMS will also establish exclusion criteria to ensure that voluntarily aligned beneficiaries have meaningful primary care relationships with DCEs. Additional clarity from CMS is needed to determine exactly how the rules around “newness” will apply.

New Entrant and High Needs Population DCE Benchmarking

Similar to the approach for new voluntarily aligned beneficiaries in Standard DCEs, for New Entrant and High Needs Population DCEs, their PY 1, 2 and 3 benchmark will not reflect historical spending. CMS will use regional expenditures as the basis for determining the performance year benchmark for all beneficiaries aligned, regardless of how long a beneficiary has been aligned and whether the alignment is through claims or voluntary. Regional expenditures will be determined using the Adjusted MA Rate Book. Historical expenditure information will be incorporated beginning in PY 4. Risk adjustment, the discount for global, and the quality withhold still apply.

Additional information on the financial calculation, including risk adjustment information, will be important for potential applicants to assess the model.

Other Notable Model Elements

-

Benefit enhancements: Direct Contracting adds benefit enhancements to those available in the NGACO model. For PY 1, the benefit enhancements appear to mirror what was available in the NGACO model: the three-day skilled nursing facility waiver, post-discharge home visits, care management home visits and telehealth. In subsequent years, CMS proposes to expand the benefit enhancements. CMS lists potential future benefit enhancements and incentives in the RFA.

-

Withdrawal penalty: The model includes a 2% retention withhold. If a DCE remains in the agreement until final reconciliation (expected to occur around July 31 of the calendar year following the PY), the 2% retention withhold will be refunded as part of the final reconciliation. If the DCE terminates, it forfeits the 2%. The retention withhold applies for PY 1 and PY 2.

-

Provisional financial reconciliation: DCEs may elect reconciliation shortly after the end of the PY. The provisional reconciliation is intended to allow for more timely distribution of provisional shared savings or repayment of losses, but it will not account for full claims processing run-out due to the immediacy of the reconciliation. The provisional reconciliation will include expenditures for the first half of the PY with six months of claims run-out.

-

Risk Corridors and Stop Loss: The aggregate amount of savings or losses for DCEs will be constrained by risk corridors. CMS will also offer an optional stop loss arrangement for Global and Professional participants.

Conclusion

The Direct Contracting model offers a new opportunity for organizations seeking to participate in traditional Medicare advanced APMs. This model features higher levels of risk and potential additional flexibility for certain participants. We expect additional details from CMS in the near future and will continue to provide updates.

/>i

/>i