United States

A. Federal Trade Commission (FTC)

FTC approves final order to prevent interlocking directorate arrangement, anticompetitive information exchange in EQT, Quantum Energy deal.

On Oct. 10, 2023, the FTC announced it had approved a final consent order to resolve its antitrust concerns surrounding a $5.2 billion cash-and-stock deal between private equity firm Quantum Energy Partners and natural gas producer EQT Corporation. Quantum and EQT are competitors in the production and sale of natural gas in the Appalachian Basin. The proposed acquisition would have given Quantum, an investor in natural gas production in the Appalachian region, a seat on EQT’s board of directors, which the FTC alleged would violate the antitrust laws and harm competition in this industry. Under the consent order, Quantum is prohibited from serving on the EQT board to prevent an interlocking directorate and must sell its EQT shares. The FTC noted that this consent decree is the FTC’s first case in 40 years enforcing Section 8 of the Clayton Act (which prohibits interlocking directorates).

B. Department of Justice (DOJ)

Justice Department sues Agri Stats for operating extensive information exchanges among meat processors.

On Sept. 28, 2023, the DOJ announced that it had filed a civil antitrust suit against Agri Stats Inc. for violating Section 1 of the Sherman Act, by allegedly spearheading anticompetitive information exchanges among broiler chicken, pork, and turkey processors (with over 80-90% of each participating). According to the DOJ’s complaint, Agri Stats collected competitively sensitive information related to price, cost (such as work compensation), and output, and then distributed weekly and monthly reports with the information to these competing meat processors, who in turn used the information to set prices and output levels. In response to this action, Assistant Attorney General Jonathan Kanter of the Justice Department’s Antitrust Division noted: “The Justice Department is committed to addressing anticompetitive information exchanges that result in consumers paying more for chicken, pork and turkey.”

C. U.S. Litigation

1. Brown, et al. v. Hartford HealthCare Corp., Case No. HHD-CV22-6152239-S (Superior Court, Judicial District of Hartford, CT)

On Oct. 27, a Connecticut superior court refused to dismiss an antitrust case by commercial insurance customers accusing Hartford HealthCare Corp. (HHC) of forcing “all or nothing” coverage plans on insurers and using other anticompetitive business strategies. The proposed class filed its suit in February 2022, claiming HHC was using its market power over acute inpatient services in four Connecticut areas – Willimantic, Norwich, Torrington, and Meriden – to grow its share of the outpatient services market and to charge exorbitant prices. Plaintiffs also claimed that HHC uses its power in those markets to force insurance plans to include its facilities in Bridgeport and Hartford at inflated prices through an “all or nothing” strategy, and that HHC uses “anti-steering” and “anti-tiering” provisions to prevent insurance plans from offering patients incentives for using other providers and restricts how its providers can make referrals to help further grow its market shares. HHC moved to strike the plaintiffs’ claims for failure to allege sufficient facts to support the asserted causes of action, or alternatively, to dismiss the plaintiffs’ claims for lack of standing.

The court first addressed the motion to dismiss. HHC argued that plaintiffs lacked standing because they did not sufficiently allege (1) they are “efficient enforcers” of the antitrust laws (i.e., they are not directly impacted by the coverage contracts at issue); and (2) they have suffered antitrust injury. Instead, according to HHC, the contracts are between the health system and the insurance companies, who contract with employers to cover their employees, while the plaintiffs are individuals covered under the plans. The court concluded “the plaintiffs have sufficiently alleged antitrust injury to withstand the defendant’s argument at this stage by pleading they have experienced negative economic impacts as a result of the inflated premium, deductibles and copays related to the defendant’s alleged anti-competitive conduct.” The court explained that while indirect purchasers are barred from bringing claims under federal antitrust laws, Connecticut’s statute allows for indirect purchaser claims. Accordingly, “plaintiffs have alleged that the defendant’s use of its monopoly power to stifle competition and inflate its prices has led directly to inflated insurance premiums they share responsibility for and to other inflated out-of-pocket costs” and that “[t]hese injuries are the type the antitrust laws seek to remedy.”

HHC moved in the alternative to strike the allegations, arguing that even if the suit can sufficiently allege a monopoly, it fails to show it was through anticompetitive means, adding that the facilities in question already had monopoly power when HHC acquired them. The court held that “[t]he allegation that these hospitals are ‘must-have’ facilities for health insurers is not the equivalent of an assertion that patients do not have the choice, for example to seek inpatient care outside the relevant market” and found that “[t]he alleged anti-competitive practices are plausibly aimed at reducing or eliminating such choices.” The judge also found the customers had made a sufficient showing, through market share data, to support their attempted monopolization claims and had adequately alleged a tying arrangement that induces insurance plans to cover its Bridgeport and Hartford facilities. For the claims based on the “anti-steering” and “anti-tiering” provisions, the court was not convinced they would be an illegal restraint on trade without the allegations about the “all-or-nothing” negotiation tactics, but it still allowed them to move ahead. HHC further argued the complaint is barred by the “filed rate doctrine,” which blocks claims targeting rates approved by a regulatory agency. The court found this argument only targets some of the claims, since not all of the rates at issue are regulated, and also that there is no appellate authority in Connecticut adopting the doctrine to bar state claims.

2. Skot Heckman, et al. v. Live Nation Ent. Inc., et al., Case No. 2:22-cv-00047 (C.D. Cal.)

On Oct. 18, U.S. District Judge George H. Wu tentatively deferred ruling on the customers’ bid to stop defendants from changing certain terms of use, opting to stay the case pending defendants’ appeal of the court’s denial of their motion to compel arbitration. On Sept. 8, 2023, defendants moved to stay the case pursuant to the Supreme Court’s decision in Coinbase, Inc. v. Bielski, 599 U.S. 736, 744 (2023), which held that a “district court must stay its proceedings while [an] interlocutory appeal on arbitrability is ongoing,” pending resolution of defendants’ appeal of the district court’s denial of their motion to compel arbitration. The court granted the stay, agreeing with both parties that the case should be stayed in light of the Supreme Court’s decision in Coinbase. However, the court deferred ruling on plaintiffs’ pending motion to enjoin, explaining that although “there does not appear to be any bright-line rule preventing it from denying Plaintiffs’ Motion to Enjoin without prejudice in light of the stay, . . . deferring ruling on the Motion is the appropriate course of action and complies with Coinbase’s instructions.” As the Supreme Court held in Coinbase, “[a]n appeal, including an interlocutory appeal, ‘divests the district court of its control over those aspects of the case involved in the appeal.’” And when the order being appealed is a denial of a motion to compel arbitration, “the entire case is essentially ‘involved in the appeal.’”

Mexico

A. Cofece summons company for possible anticompetitive practices in the convenience store market.

The Investigating Authority of the Federal Economic Competition Commission (Cofece or Commission) summoned a company for probable vertical price fixing and/or other relative monopolistic practices by convenience store chains in Mexico. Unlawful practices are set forth in article 56. Section II, of the Federal Economic Competition Law (Ley Federal de Competencia Económica (LFCE)).

According to the National Institute of Statistics and Geography, Mexican families spend more than half of their income on consumer goods such as food, beverages, cleaning articles, and personal care and household items. Due to its importance in the public’s purchasing power, both the food and beverage sector and its distribution channels are priority sectors for the Commission. Furthermore, the Commission invites anyone with knowledge of monopolistic practices to file a complaint before the Investigating Authority.

At trial before the Technical Secretariat of the Commission, the company may offer evidence related to the accusations, present its pleadings, and argue its defense. The plenary of Cofece will then makes its determination in accordance with the LFCE. If a relative monopolistic practice is proven, Cofece may impose penalties.

B. Cofece summons economic agents for alleged commission of anticompetitive conduct in the medical oxygen market.

Cofece summoned several economic agents that allegedly abused their dominant position, either jointly or individually, by carrying out anticompetitive relative monopolistic conduct in the medical oxygen market in Mexico.

At trial, the parties may state what they deem appropriate regarding their rights, offer evidence, and present arguments. Once the proceeding is completed, the plenary of Cofece will make its determination in accordance with the LFCE. If this relative monopolistic practice is proven, the Commission will order the correction or elimination of the illegal practice and potentially fine the offenders up to 8% of their annual income.

With the issuance of this finding of probable responsibility, the Commission seeks to reaffirm its commitment to a competition policy that generates tangible benefits for the Mexican population, as the World Health Organization deems medical oxygen of primary importance.

The health sector is a Cofece priority. According to the National Survey of Household Income and Expenditures of the National Institute of Statistics and Geography (Encuesta Nacional de Ingresos y Gastos de los Hogares del Instituto Nacional de Estadística y Geografía), in 2020 more than half of households in Mexico reported expenditures in items related to health care. Additionally, medical oxygen is widely used in all health care environments.

C. Cofece investigates a possible illicit merger in the real estate services market.

Cofece initiated an ex officio investigation into a potentially unlawful merger in the classified real estate advertisement market in Mexico.

According to the National Institute of Statistics and Geography (Sistema de Cuentas del Instituto Nacional de Estadística y Geografía), in 2020, construction and real estate services accounted for 17.7% of the gross domestic product, and between 2017 and 2020, real estate services grew by 5.5%. Due to its importance to the national economy and its impact on population welfare, the Commission defined this sector a priority in its 2022–2025 Strategic Plan.

The investigation does not prejudge the responsibility of any economic agent; no violations of economic competition regulations have been identified so far. If at the end of the investigation there are elements that presume an LFCE violation, those allegedly responsible may present their case at trial.

If anticompetitive conduct is proven, the responsible economic agent(s) could be fined up to 8% of their income, and the total or partial de-concentration of the possible unlawful merger could be ordered. On the other hand, directors who have participated directly or indirectly in unlawful mergers could be banned for up to five years and fined up to USD 302,000.

The Netherlands

A. Dutch ACM decisions, policies, and market studies.

1. ACM adopts new policy rule on sustainability agreements.

The Dutch competition authority (the ACM) adopted its new policy rule, “ACM’s oversight of sustainability agreements,” which aims to align competition rules with sustainability efforts and not to unnecessarily hinder agreements that contribute to a more sustainable society, following European guidelines and replacing the ACM’s previous draft guidelines.

This policy rule follows the European Commission’s approach for sustainability agreements outlined in its Horizontal Guidelines. See July 2023 GT Alert. Additionally, the ACM will refrain from intervening in two specific situations – provided the companies fulfill all conditions – granting such companies more flexibility:

– companies making agreements to comply with unenforceable national or European sustainability rules, like waste recycling; and

– companies making agreements to efficiently reach environmental goals, provided consumers receive a substantial share of the benefits, such as reduced CO2 emissions.

Companies can contact the ACM with questions about sustainability agreements.

2. ACM, along with Belgian enforcers, raids Dutch IT company.

ACM, in collaboration with the Belgian competition authority, raided an international computer equipment manufacturer, accusing it of price-fixing and obstructing the sale of refurbished devices. Both authorities suspect the company of imposing pricing terms on retailers and dictating which clients they could sell to. They are also investigating the company’s distributors. Additionally, concerns have been raised about the company’s refusal to allow retailers to sell refurbished devices, which could harm competition and sustainability.

This enforcement action demonstrates ACM’s ongoing focus on scrutinizing vertical arrangements, following a prolonged period of inaction in this regard.

Poland

A. UOKiK President imposes fines for obstructing dawn raids.

The Office of Competition and Consumer Protection (UOKiK) President is empowered to conduct, with court consent, unannounced searches at entrepreneurs’ premises (so-called “dawn raids”). Such searches may be conducted within explanatory or anti-monopoly proceedings where there is a justified suspicion that evidence of competition-restricting practices may be found at the searched premises.

Based on publicly available information, the UOKiK President recently imposed fines for obstructing such a search on both Jura, a manufacturer of coffee machines, and Euro-net, a Jura distributor and electrical retailer. The search in question was conducted within explanatory proceedings aimed at establishing whether, among other things, Jura had fixed the prices of its products with its distributors.

According to the UOKiK President, employees of both companies deleted text messages, in particular those related to conversations between Jura and Euro-net representatives. Crucially, the messages were deleted after receiving information that the search was being initiated.

Euro-net was fined PLN 10 million (approx. EUR 2.5 million, USD 2.6 million) and Jura – PLN 1 million (approx. EUR 2.2 million, USD 2.4 million).

The fines were imposed based on regulations, which have since been repealed, that envisaged a penalty of up to EUR 50 million for obstructing a search. Based on the newly introduced law, the UOKiK President may impose a fine for obstructing or rendering a search impossible of up to 3% of an entity’s turnover. In such a case, a fine of 50 times the average monthly salary (approx. EUR 72,000, USD 76,000) may be imposed on a person holding a managerial position or member of the management body of such entrepreneur.

A parallel investigation related to coffee machine price-fixing is still pending. It is currently at the explanatory proceedings stage, which is not yet being conducted against any specific entrepreneur. However, if the evidence collected confirms the UOKiK President’s suspicions, it may launch anti-monopoly proceedings. Under Polish law, an entrepreneur involved in a competition-restricting agreement may be subject to a fine of up to 10% of its turnover for the preceding year, while the managers responsible for effecting the collusion face a penalty of up to PLN 2 million. In addition, a fine of up to 10% of turnover may also be imposed on an entity exercising decisive influence over a participant in such an agreement.

B. UOKiK President issues another conditional clearance.

Under Polish law, the UOKiK President may clear a transaction either unconditionally or conditionally. Conditional clearance is granted if after fulfilling the conditions stipulated in the decision, competition on the market would not be significantly impeded, by creating or strengthening a dominant position in a given market. As a rule, the UOKiK President imposes either structural remedies (i.e., an obligation to divest certain assets or companies) or behavioral remedies (i.e., an obligation to act in a certain way, e.g., to grant a license).

Recently the UOKiK President issued two conditional approvals that illustrate both types of remedies.

The first relates to the acquisition of several pharmacies by Gemini Polska – a pharmacy franchise network operator (approx. 180 pharmacies) and owner of 96 pharmacies. From the geographical perspective, the relevant markets in this case were defined very narrowly as, according to the UOKiK President, pharmacies compete with each other on a very small area with a range of only one kilometer. This resulted in significant geographical overlap in several local markets. The UOKiK President also found that even though all the target pharmacies are already part of the Gemini franchise network, they still compete with Gemini’s own pharmacies. Given the above, the UOKiK President ultimately approved the concentration on the condition that the company divests certain pharmacies on the local markets where competition could have been significantly impeded. This is an example of a structural (divestment) remedy. The potential buyer must be approved by the UOKiK President. For further details of this case, please see the October 2023 issue of Competition Currents.

In the second case, behavioral remedies were applied. The notified transaction concerned roof-tile manufacturer Wienerberger’s acquisition of competitor Terreal Holding. The UOKiK President found that both parties to the transaction are owners of popular tile brands on the Polish market and following the transaction, the acquirer could have achieved a dominant position on the market.

One of the target company’s subsidiaries – Creaton Poland, active in the same relevant market as the acquirer and the target – was not within the transaction perimeter. Therefore, the UOKiK President decided to approve the transaction subject to the condition that the acquirer’s group would still license the Creaton trademark to Creaton Poland. According to the UOKiK decision, the license must be exclusive, free, and cover all permitted uses (e.g., production, distribution, advertising). The length of the license will depend on whether Creaton Poland is acquired by an entity with sufficient resources to ensure the continuity of its business and ability to rebrand.

Italy

A. Italian Competition Authority (ICA)

1. ICA investigates Aci for alleged abuse of dominant position in the national motor sport event market.

On Oct. 10, 2023, following complaints received by some entities active in the organization of non-competitive historic car events, the ICA initiated an investigation into Automobile Club d’Italia-Aci (Aci), Aci Sport S.p.A., and Club Aci Storico regarding an alleged abuse of a dominant position under Article 102 of the Treaty on the Functioning of the European Union (TFEU).

Aci is a dominant operator in the national market for motor sport events, designated by FIA-Fédération Internationale de l’Automobile and the Italian Olympic Committee (Coni) as the entity in charge of the regulation and coordination of activities related to motor sports in Italy.

According to ICA, Aci – including through Aci Sport and Club Aci Storico, both controlled by Aci – hindered or prevented sports promotion bodies, amateur sports associations and automobile clubs not affiliated with Aci from organizing non-competitive events, in order to expand its position on the market and increase the number of its affiliates/members.

Aci allegedly informed public authorities (prefectures, police and/or local authorities), closely before the events started, that the event had not received ACI’s prior authorization and therefore the events would not be held in compliance with the technical-sporting regulations set by Aci. However, the prior authorization was not required by law for non-competitive events, and event promoters were free to choose their own technical regulation. ICA thus argues that Aci unduly used its regulatory and coordinating powers, which resulted, at least since 2016, in relevant damages for numerous amateur motorsport events organized in different Italian regions.

The parties now have 60 days to exercise their right to be heard before ICA.

2. ICA investigates Conou for alleged abuse of dominant position in the lubricating oil recycling market.

On Oct. 2, 2023, ICA initiated investigative proceedings against the National Consortium for the Management, Collection and Treatment of Used Mineral Oils (Conou) to establish an alleged abuse of dominant position, in breach of Article 102 TFEU.

Conou acts as a legal monopolist – and as a dominant operator in the recycling of lubricating oils, coordinating their collection and treatment in facilities recognized by Conou.

According to ICA, Conou would have unjustifiably hindered the operation of two new waste oil regeneration plants not affiliated with Conou, to the advantage of the only two regeneration plants traditionally active on the Italian market and recognized by Conou. Moreover, the new plants would have contributed to reducing treatments costs, thanks to greater technology and proximity to upstream and downstream operators in the waste cycle.

Specifically, Conou allegedly: (1) hindered the activity of a regeneration company that had built a new plant in Lombardy by preventing it from having access to the oils collected by consortium member companies and by not granting it the fees due for the regeneration and collection of oils processed at its plant; and (2) instrumentally challenged in court the environmental permits issued by the competent authorities for the construction of a regeneration plant in Piedmont. In both cases, Conou allegedly abused its dominant position conferred by law, as the only consortium that managed used oils in Italy, responsible for decisions about the regulation and enforcement regarding regeneration and collection fees.

3. Following a whistleblower complaint, ICA launches an investigation into the cast iron mold foundry industry for a potential price cartel.

Following a complaint received through ICA’s whistleblowing platform in April 2023, ICA opened an investigation into alleged anticompetitive conduct by some of Italy’s leading foundries active in the production of cast iron components used for industrial vehicles, automotive, earthmoving and agricultural machinery (C2MAC Group, Fonderia Corrà, Fonderie Orazio e Fortunato De Riccardis, Fonderie Guido Glisenti, Lead Time Pilenga Baldassarre Foundry, and Fonderie Mora Gavardo).

According to the whistleblower, during the first months of 2023, the involved foundries allegedly demanded simultaneous and aligned price increases starting April 1, 2023, which they justified by a generic reference to inflation and rising interest rates or to the increase of some cost elements. Customers would not be able to refuse the proposed increases given the saturation of production capacity by the foundries and, in any case, the significant costs incurred in changing suppliers.

However, comparing the average price indexes published by industry associations, the foundries’ business conduct appeared unrelated to an actual cost increase. Despite the absence of any legitimate need for price increases, during the period at issue the turnover of the investigated companies showed parallel increases that were significantly higher than other companies active in the same sector.

In view of the above, ICA opened an investigation for violation of Article 101(1) TFEU. The involved companies now have 60 days to exercise their right to be heard by ICA.

European Union

A. European Commission

1. European Commission orders Illumina to unwind its completed acquisition of GRAIL.

On Oct. 12, 2023, the European Commission adopted, under the EU Merger Regulation (EUMR), restorative measures requiring Illumina to unwind its already completed acquisition of GRAIL, following its decision to prohibit the transaction in September 2022 due to competition concerns.

The parties completed the acquisition during the Commission’s investigation, resulting in fines for both companies in July 2023.

The adopted restorative measures require Illumina to divest GRAIL, and to ensure that GRAIL’s independence is restored to the same competitive level it had enjoyed prior to the transaction.

According to the adopted measures, Illumina can choose how to accomplish this divestiture, but Illumina must adhere to these principles and submit an approved plan to the European Commission. Non-compliance with the decision may result in fines and penalty payments as per the EUMR.

2. European Commission decides not to extend antitrust block exemption for liner shipping consortia.

After a review process initiated in August 2022 that evaluated the effectiveness of the EU legal framework exempting liner shipping consortia from EU antitrust rules (Consortia Block Exemption Regulation, or CBER) since 2020, the European Commission decided not to extend the CBER, as it no longer promotes competition in the shipping sector. The CBER allowed shipping lines to cooperate under specific conditions for joint cargo transport services.

As a result, the CBER will expire April 25, 2024. However, this does not mean that shipping line cooperation will be illegal under EU competition law. Instead, carriers operating to or from the EU will have to assess their cooperation agreements’ compatibility with EU antitrust rules, guided by the Horizontal Block Exemption Regulation and Specialization Block Exemption Regulation.

3. European Commission issues first pharmaceutical cartel decision.

The European Commission has fined six pharmaceutical companies a total of €13.4 million for their involvement in a global cartel that manipulated the price of an essential stomach cramps medicine.

The infringement continued from November 2005 until September 2019, with penalties based on the duration of the cartel. This decision was the first cartel decision in the pharmaceutical sector, where, according to the European Commission, competition is essential to provide access to affordable medicines.

4. Chemical admixture businesses targeted in cross-border cartel probe.

Several entities are under investigation by the European Commission and competition agencies in the UK and Turkey for suspected cartel violations in the chemical admixture market. These competition authorities jointly conducted searches and are also collaborating with other enforcers, including the U.S. DOJ’s Antitrust Division.

The investigation follows Sika’s £4.5 billion acquisition of MBCC Group, a major player in the chemical admixture market. While the competition authorities did not confirm whether the merger triggered the cartel concerns, Sika had agreed to global remedies to address antitrust issues, including selling MBCC’s admixture business to Cinven, which included Masters Business Solutions. The European Commission and the CMA cleared the deal.

5. European Commission clears Whirlpool/Arçelik joint venture.

The European Commission has unconditionally approved the Whirlpool-Arçelik joint venture following a Phase I probe, citing no competition concerns in the European Economic Area. Arçelik's Beko brand ranks as the second largest home appliance label in Western Europe, while Whirlpool is a global home appliance giant.

Under the deal announced in January, Arçelik will establish Beko Europe, with Arçelik holding a 75% stake and Whirlpool 25%. Beko Europe will acquire various production facilities and subsidiaries across Europe, anticipating 20,000 employees and €6 billion in annual revenue. In contrast, the UK’s regulator initiated a Phase II probe into the deal, concerned about potential negative impacts on competition.

B. European Decisions

1. General Court upholds video game geo-blocking fine.

The EU’s General Court has rejected video game publisher Valve’s appeal of a €1.6 million fine the European Commission imposed in 2021. The European Commission fined Valve for blocking consumers’ ability to purchase video games in specific member states. Valve had made bilateral agreements with rival video game publishers, and the European Commission found that Valve’s geo-blocking codes had caused artificial market segmentation and harmed competition.

Valve challenged the fine, arguing that the decision broadened the concept of agreement, and that Valve was merely a service provider. However, the General Court upheld the European Commission’s decision, stating that Valve played a central role in the relationship between publishers and users and had contributed to artificial market segmentation. Furthermore, the ACM has also shown an interest in practices where under the pretense of “price recommendations” suppliers coordinate price increases of retailers. Therefore, companies should be careful that, in supplier relationships, their commercial practices do not give rise to either online or offline territorial restrictions or constitute resale price maintenance.

2. General Court rejects Teva’s bid to overturn €60.5 million pay-for-delay fine.

The General Court upheld the European Commission’s infringement decision against Teva and Cephalon imposing a total fine of €60.5. This decision resulted from a pay-for-delay deal regarding a sleep disorder drug, which agreement prevented Teva from introducing a cheaper version of modafinil in exchange for money and commercial arrangements, in violation of EU competition law.

The General Court also dismissed the claim that Teva and Cephalon could not have foreseen the EU law breach, asserting they should have known about the problematic nature of the non-compete and non-challenge clauses under EU competition law.

Japan

A. Overview of the Policies Concerning Commitment Procedures

1. What are commitment procedures?

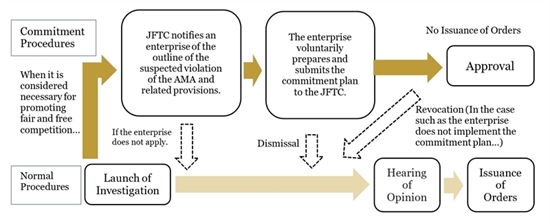

In accordance with Japan’s conclusion of the TPP11 Agreement in 2018, the procedures for voluntary resolution of suspected violations of the Antimonopoly Act (AMA) through consent between the Japan Fair Trade Commission (JFTC) and the enterprise have been introduced.

First, the JFTC notifies the enterprise of the outline of the suspected violation of the provisions of the Antimonopoly Act, and the notified enterprise voluntarily prepares and submits the commitment plan.

If the JFTC approves the commitment plan, the JFTC will not issue any orders against the enterprise.

2. Commitment plan

To ensure the restoration of competition or that the conduct at issue will not be repeated, the commitment plan must meet the following requirements:

- sufficient to eliminate the suspected violation of the AMA;

- expected to be reliably implemented.

3. Subjects of commitment procedures

When necessary for promotion of free and fair competition the JFTC applies the commitment procedures to the suspected violation. However, the following cases are not subject to commitment procedures:

- suspected violations that constitute so-called “hard-core cartel activity, such as bid-rigging, price-fixing cartels;

- cases where an enterprise has violated the same provisions within 10 years;

- cases constituting serious suspected violations that are deemed worthy of a criminal accusation.

B. JFTC approves a commitment plan applied by major movie theater operator.

As reported in the October 2023 Competition Currents, JFTC was investigating a major movie theater operator on suspicion of violating the AMA. The major movie theater operator requested that the distributors give them preferential treatment over other movie theater operators, and informed them that if they did not comply, they would not accept the distributor's offer in the future. JFTC found the movie operators’ requested actions are problematic under the AMA because it could reduce opportunities for theater operators other than the major movie theater operator in question to receive distributor offer to show the film, and thus reduce the opportunities for film distribution.

JFTC determined that the early restoration of competition could be achieved by submitting the commitment plan, and on June 28, 2023, JFTC notified the major movie theater operator of the commitment procedure. In response, the major movie theater operator submitted the commitment plan to JFTC, which approved the plan as sufficient to eliminate the suspected AMA violation. The plan includes stopping the movie operators’ requested actions and also ensuring that employees comply with AMA and applicable legal provisions.

1 Due to the terms of GT’s retention by certain of its clients, these summaries may not include developments relating to matters involving those clients.

/>i

/>i