In a series of announcements meant to quell public concern over COVID-19, federal law enforcement agencies and the U.S. Department of Justice (DOJ) announced the use of aggressive measures to detect, prevent, and prosecute fraudulent actions that prey upon an anxious public struggling to cope with the current health emergency. As a consequence, however, healthcare suppliers and companies conducting cross-border financial transactions may be subject to enhanced scrutiny and business disruption.

In an unprecedented move, the Federal Bureau of Investigation (FBI) and U.S. Secret Service have agreed to coordinate their efforts and focus on internet solicitations and financial transactions that undermine the country’s response to the pandemic or threaten to turn vulnerable organizations and individuals into fraud victims. They also are working closely with the private sector, including internet service providers, social media companies, and financial institutions to track and prevent fraudulent behavior.

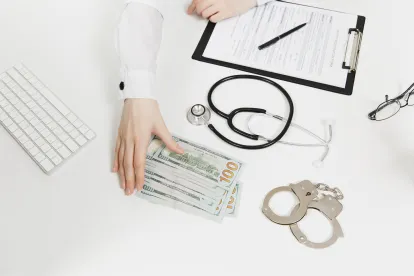

Undercover agents are being deployed to catch unscrupulous purveyors of fake cures for, or those seeking to illegally and unscrupulously profit from, the COVID-19 pandemic. Charges are being pursued, for example, against a California doctor who allegedly committed mail fraud by pitching consumers to purchase bogus “COVID-19 treatment kits” (U.S. v. Staley), and against a Georgia man charged with soliciting kickbacks and health care fraud for ordering unnecessary COVID-19 and genetic cancer tests (U.S. v. Santos).

In addition, federal regulators are tracking consumer protection violations and providing guidance for avoiding and reporting purportedly unscrupulous business offerings and internet solicitations. As a result, internet providers and social media companies are taking down what they determine to be “malicious” websites and accounts, while financial institutions are working with law enforcement to identify “suspicious” transactions, file suspicious activity reports (SARs), and freeze accounts that appear to be used to defraud consumers.

Unfortunately, these well-meaning law enforcement efforts may risk disrupting legitimate businesses that rely upon dependable internet and financial systems to conduct operations. For example, several providers of personal protective equipment (PPE) have had their bank accounts frozen based on transactions with foreign suppliers, apparently driven by the mistaken belief that large purchases of PPE are somehow “suspicious.” Some of these actions have disrupted attempts to provide life-saving medical equipment to health care providers and, in some cases, caused business losses.

Thus, companies providing critical healthcare supplies to the front-line warriors fighting the coronavirus would be well-served to consider notifying their internet providers and financial partners of impending transactions that might trigger regulatory or enforcement scrutiny, especially those involving large cross-border financial transactions. By providing banks and internet providers with advanced notice of such transactions, healthcare providers and other businesses may avoid having legitimate transactions appear “suspicious” to banks or law enforcement. And if contacted by law enforcement, business should consider engaging experienced counsel to ensure that any misunderstandings are promptly dispelled. This, in turn, may increase the chance that businesses will be able to swiftly complete the important work of defeating COVID-19.

/>i

/>i