Efforts by some policyholders to consolidate ongoing insurance coverage lawsuits against four insurers into a business interruption MDL were upended this week when the U.S. Judicial Panel on Multidistrict Litigation denied their requests to consolidate cases, but allowed some to consolidate their cases against a fifth. The business interruption MDL created by the JPML follows the JPML decision in August, where it declined to consolidate a spate of nationwide coverage cases brought largely by restaurants, gyms, salons and dental practices, into a single MDL, but left the door open to insurer-specific MDLs. While acknowledging that “time is of the essence” and that many policyholder plaintiffs impacted by the COVID-19 pandemic are “on the brink of bankruptcy,” the panel ultimately felt it was less efficient to consolidate the majority of claims against the insurers.

After hearing oral arguments in late September, the panel’s ruling determined that consolidation of up to 34 pending cases into a business interruption MDL was warranted against one insurer, Society Insurance Company, which operates in the Midwest. Similar requests for consolidation against Cincinnati Insurance Co., Hartford Financial Services Group Inc., Certain Underwriters at Lloyd’s, and Travelers Cos. were denied. The business interruption MDL created against Society will proceed before U.S. District Judge Edmond E. Chang of the Northern District of Illinois.

Multidistrict Litigation Designed for Efficiency

Multidistrict litigation is designed to centralize cases involving common questions of fact before a single court to avoid duplication of discovery, prevent inconsistent pretrial rulings and to conserve the resources of the parties and court system through a unified management of pretrial proceedings. Examples of the kinds of cases that have been centralized in an MDL include airplane crashes, mass torts cases such as asbestos, and product liability cases involving a single product, among many others.

The Business Interruption MDL Created Promotes Efficiency, Others Do Not

In the action before the JPML, groups of policyholders stung by the COVID-19 pandemic filed claims for the denial of business interruption coverage, a type of business insurance which provides protection for lost income resulting from a covered event that directly or indirectly affects a business’ flow of income. The panel’s order found that business interruption cases against Society presented common factual allegations that the insurer wrongfully denied policyholders’ claims for business interruption coverage of which they are entitled under their insurance policies. The panel framed the central common legal question for the business interruption MDL as whether COVID-19 caused any direct physical loss or damage to property, and whether any of the insurers’ policy exclusions apply to preclude plaintiffs’ claims, a framing which mirrors the central inquiry in COVID-19-related business interruption cases across the nation.

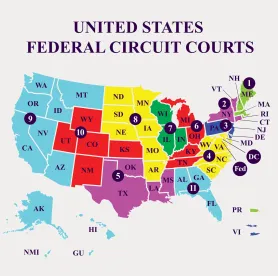

The panel noted that the insurance policies at issue in the cases against Society, as well as Cincinnati, Hartford and Travelers, use standard forms drafted by the Insurance Services Office (ISO) and will involve the interpretation of common policy language between them. Notwithstanding, the panel’s denials to consolidate cases into a business interruption MDL against those insurers turned on the panel’s belief that centralization would not promote efficient resolution of the claims. The panel reasoned that plaintiffs’ pursuit of distinct theories of liability many of which allege unique factual circumstances ultimately creates burdensome complications. Given the wide variety of state laws at issue (claims against one insurer span 24 states), asking a judge overseeing a business interruption MDL to interpret the various policies was counterproductive to the stated goal of case management efficiency. The cases against Lloyds, an “insurance market” encompassing more than 90 “syndicates” including some “split-market” non-Lloyd’s insurers, would introduce the same manageability concerns weighing against a single business interruption MDL against Lloyd’s. What sets the Society litigation apart is the “defined geographical scope of these actions, which implicates only six state insurance laws”, which presented a more manageable scenario for pretrial case management in a business interruption MDL.

What This Means

Ultimately, the panel’s decision to create on a single business interruption MDL for one insurers means continued uncertainty for policyholder restaurants, gyms and other businesses with claims against the other insurers now pending in various state and federal courts across the nation. While a larger number of decisions issued thus far have favored insurers, policyholders have racked up a couple of wins as well. However, the significant majority of cases remain unresolved and the judiciary is likely keeping a close eye on the evolving legal landscape.

/>i

/>i