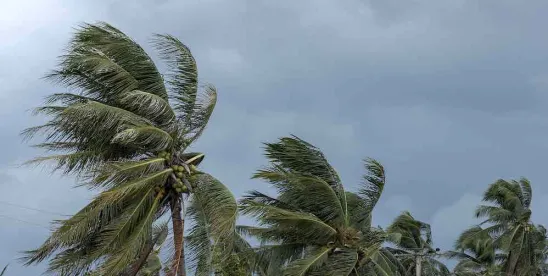

The 2021 Atlantic hurricane season officially kicks off in t-minus 13 days, on June 1, 2021, and runs through November 30, 2021.

If this season is anything like the last, community associations are in for another year of rough, windy seas.

According to the National Oceanic and Atmospheric Administration ("NOAA"), the 2020 season broke records. It featured 30 named storms, including 12 storms that made landfall in the continental United States, and of those 30, 13 developed into hurricanes with nearly half of those six qualifying as "major hurricanes," meaning they topped winds of 111 mph.

As community associations head into another season, there are a number of proactive steps they can undertake now, before storm season, in an effort to maximize storm-preparedness for their communities.

-

Review the association's casualty insurance policy to become familiar with what it covers, its limitations, and its out-of-pocket and upfront expenses for filing a claim (i.e. what's the applicable deductible or deductibles).

Many community association Declarations speak to the required level of insurance coverage and depending on the type of community and when it was formed, North Carolina law may also specify certain minimum coverages. For example, for condominiums created on or after October 1, 1986, N.C.G.S. Chapter 47C applies and requires associations to secure insurance sufficient to cover 80% of the replacement cost of the community's common areas. For planned communities (single-family and townhome communities) created on or after January 1, 1999, N.C.G.S. Chapter 47F applies and likewise requires associations to secure insurance sufficient to cover 80% of the replacement cost of the community's common areas. Under both statutes, the 80% value is required to be measured as of the time the insurance is purchased and at each renewal date.

-

Know and understand the potential parties and players the association is likely to encounter following a hurricane or named storm event.

Immediately following a hurricane or named storm, an association may have reason to interact with emergency responders or code and building officials depending on the severity of the damage. If there is damage and an insurance claim is going to be filed, the association can expect to communicate with its insurance agent/broker, its insurance carrier, a third-party adjuster engaged by its carrier, the repair contractor (and its subcontractors), potentially a public adjuster, and its members, to name a few. Understanding the role each of these individuals and entities play and what responsibilities they may owe to the association (or the association may owe to them) is important to navigating the insurance claims and property restoration process. In addition, the association may have a need to consult with and engage legal counsel. The unfortunate reality is that a number of community associations end up in litigation with their carrier or their contractor. Many of our clients find that a dedicated committee of the Board is useful to manage contact with these players.

-

Make sure the Association has other pertinent insurance coverages in place and is familiar with those policies.

Examples of other pertinent policies that may come into play here are Directors and Officer Liability Insurance, General Liability Insurance, and Umbrella Policies. Among other things, these policies protect the Association and its volunteers at a time when quick and difficult decisions must be made.

-

Assess the financial health of the association.

Take note of the association's reserves and its financial health. Doing this ahead of time is invaluable. Insurance may not cover the full value of the loss that the association is responsible for repairing. Even if insurance ultimately does cover the full value, the claims adjustment process often takes many months and can take years. It is not uncommon for an association's financial obligations to its general contractor and other vendors involved in repairing the property to come due and owing before the association receives a full and final settlement of its insurance claim. Having adequate reserves, developed lending relationships, and/or an emergency line of credit available to turn to better positions the association to see repairs timely completed and to avoid finding itself in a spot where it is negotiating with its carrier against a backdrop of financial desperation.

-

Do your "LAB" homework.

Promptly engage your Legal team, your Adjuster, and your Broker and closely monitor, or have your legal team monitor, the adjustment of the association's claim.

While this list is not exhaustive, it provides a solid starting point for storm-preparedness. For more information and insight on named storm issues, be sure to check out "The Eye of the Storm" webinar, and Don't Jump Without a Parachute! Understanding Community Association Insurance Needs.

/>i

/>i