As any risk manager can tell you, risk knows no market segment. Large businesses with their multi-million dollar losses may get more attention but small- and medium-sized enterprises (SMEs) face risks as well. The difference for these smaller businesses is that the losses they face can’t always be absorbed into their balance sheet. Losses that would be relatively minor for their larger counterparts, could be devastating and could even force an SME to close its doors forever.

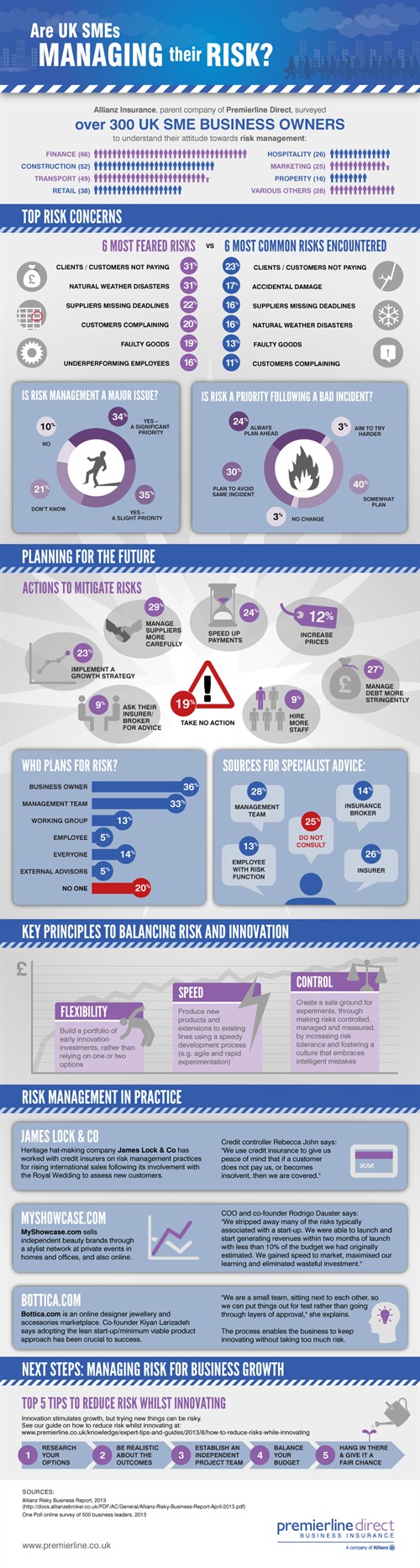

This is why, according to a survey by UK insurer Premierline Direct (part of the Allianz UK Group), it is interesting to see that despite being aware of, and having encountered, many common risks like customer non-payment, supplier issues and natural disaster losses, not all SMEs have been spurred to take action to mitigate future risk. One-fifth of UK SMEs surveyed not only do not have anyone who is responsible for managing risk, but have no plans to manage risks in the future. One-quarter do not consult with any specialists for risk management advice. Of course, the majority of SMEs do take risk management measures but closing the gap for the remaining businesses should be a priority.

To illustrate their findings and offer some tips on how SMEs can manage their risks more effectively, Premierline Direct provided the following infographic.

/>i

/>i