On May 25, 2022, the SEC issued proposed amendments to rules and reporting forms to require certain advisers and funds to provide additional information regarding their environmental, social, and governance (ESG) investment practices. Seeking to mitigate the risk of exaggerated claims of the role of ESG factors in disclosures—known as “greenwashing”—and to enable investors to more easily compare funds and advisers in an area of increased interest, the SEC’s proposal would impose standardized disclosure requirements regarding ESG strategies in fund registration statements, the management discussion of fund performance in fund annual reports and adviser brochures.

The SEC’s proposal contemplates specific disclosure requirements based on certain categories of ESG investment strategies—and subsets thereof—with the level of detail required of any given fund or adviser dependent on the extent to which ESG factors are considered in the investment decision-making process. Additionally, for funds, the SEC’s proposal seeks to implement a layered disclosure approach—i.e., with brief, specified disclosures in the summary section of the prospectus, or for closed-end funds, information that would precede other disclosures in the same item, followed by more detailed information later in the prospectus. The SEC’s proposed categorization scheme and the related disclosure requirements are summarized below.

The proposal was issued on the same day that the SEC voted to propose changes to the fund names rule—Rule 35d-1 under the Investment Company Act of 1940—and reflect the heightened regulatory interest in and scrutiny of disclosures concerning ESG investment practices.

Proposed Fund Disclosure Requirements

To enhance the comparability and reliability of disclosures and enable investors to make more informed investment decisions, the SEC’s proposal would institute a uniform disclosure framework for funds that consider ESG factors in their investment process. The specific requirements would vary depending on whether a fund is categorized as an “Integration Fund,” “ESG-Focused Fund” or “Impact Fund” as follows:

INTEGRATION FUNDS

-Definition. An Integration Fund is a fund that considers one or more ESG factors alongside other, non-ESG factors in its investment decisions, but those ESG factors are generally no more significant than other factors in the investment selection process, such that ESG factors may not be determinative in deciding to include or exclude any particular investment in the portfolio.

-Brief Disclosure Requirement. An Integration Fund must summarize in a few sentences how the fund incorporates ESG factors into its investment selection process, including what ESG factors the fund considers. This disclosure would be required in an open-end fund’s summary section of its prospectus and in a closed-end fund’s general description of the fund in its prospectus.

-

For example, an Integration Fund might include a summary narrative of how it incorporates ESG factors or provide an example illustrating how ESG factors are considered with other non-ESG factors.

-More Detailed Disclosure Requirement. To complement the concise description required in an open-end fund’s summary section or, for a closed-end fund, in the general description of the fund, an Integration Fund must provide a more detailed description of how it incorporates ESG factors in an open-end fund’s statutory prospectus or later in a closed-end fund’s prospectus.

-Additional Disclosure Requirements for Integration Funds That Consider Greenhouse Gas (GHG) Emissions. For Integration Funds that consider GHG emissions, the fund must provide more detailed information in the statutory prospectus, or later in a closed-end fund’s prospectus, regarding how the fund considers the GHG emissions of its portfolio holdings. This additional disclosure must include a description of the methodology that the fund uses as part of its consideration of portfolio company GHG emissions.

-

For example, an Integration Fund that considers GHG emissions might disclose that it considers the GHG emissions of portfolio companies within only certain “high emitting” market sectors, such as the energy sector.

ESG-FOCUSED FUNDS AND IMPACT FUNDS

-Definition—ESG-Focused Funds. An ESG-Focused Fund is a fund that focuses on one or more ESG factors by using them as a significant or main consideration (1) in selecting investments or (2) in its engagement strategy with the companies in which it invests.

-

The proposed definition would include, among others, any fund that: tracks an ESG-focused index; applies a filter to include or exclude investments based on industry and ESG considerations, or has a policy of voting its proxies and engagement with the management of portfolio companies to encourage ESG practices or outcomes.

-

The proposed definition also includes any fund that markets itself as having an ESG focus (e.g., “ESG,” “green,” “sustainable” or “socially conscious”).

-Definition—Impact Funds. An Impact Fund is a fund that seeks to achieve a specific ESG impact or impacts. Impact Funds are a sub-set of ESG-Focused Funds.

-

As examples, the SEC’s proposing release refers to: a fund that invests with the goal of seeking current income while also furthering the fund’s goal of financing the construction of affordable housing; a fund that invests with the goal of seeking to advance the availability of clean water by investing in industrial water treatment and conservation portfolio companies.

Required ESG Strategy Overview Table in Prospectus. ESG-Focused Funds, including Impact Funds, would provide key information about their consideration of ESG factors in a tabular format—an ESG Strategy Overview table—in the fund’s prospectus.

-

An open-end fund would include the table at the beginning of its “risk/return summary”—the section summarizing key information about the fund’s investments, risks and performance.

-

A closed-end fund would include the table at the beginning of the discussion of the fund’s organization and operation.

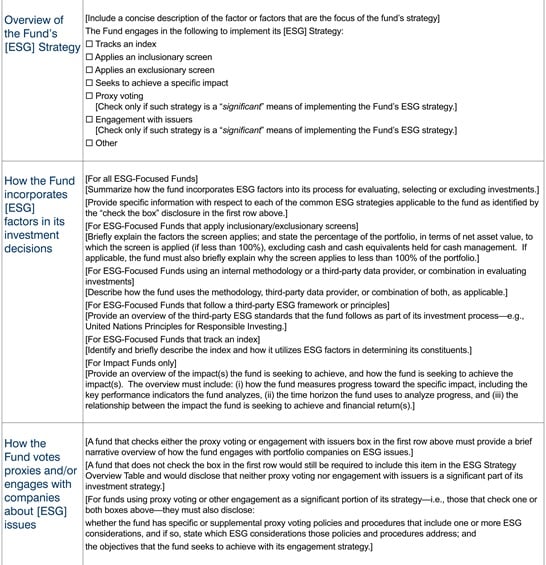

The ESG Strategy Overview table would be included in the format presented below.

The bracketed statements in the table describe the related disclosure requirements for each row.

-ESG-Focused Funds (including Impact Funds) would be required to complete each of the rows above with only the information required by the relevant form instructions.

-

To facilitate a layered disclosure approach, an ESG-Focused Fund would provide lengthier disclosure elsewhere in the prospectus.

-

In electronic versions of the prospectus, the fund would also be required to include hyperlinks in the table to the related, more detailed disclosure elsewhere in the prospectus.

-Impact Fund Investment Objective Requirement. In addition to the additional disclosures required for an Impact Fund in the ESG Strategy Overview table, an Impact Fund would be required to disclose in its investment objective the ESG impact that the fund seeks to generate with its investments.

REQUIRED ANNUAL REPORT DISCLOSURES

In addition to the prospectus disclosure requirements, the SEC’s proposal would create common disclosure requirements in annual reports—within the management’s discussion of fund performance (MDFP) section— specifically tailored to categories of ESG-Focused Funds as follows:

-Impact Funds. Impact Funds would be required to discuss:

-

the fund’s progress on achieving its impact in both qualitative and quantitative terms during the reporting period; and

-

the key factors that materially affected the fund’s ability to achieve its impact.

-ESG-Focused Funds That Use Proxy Voting Significantly. Funds for which proxy voting is a significant means of implementing their ESG strategy would be required to disclose the percentage of ESG-related voting matters during the reporting period for which the fund voted in furtherance of the initiative.

-

The fund would be required to refer investors to the fund’s full voting record filed on Form N-PX by providing a cross-reference/hyperlink to its most recent filing.

-ESG-Focused Funds That Engage with Issuers Significantly. Funds for which engagement with issuers on ESG issues through means other than proxy voting is a significant means of implementing their ESG strategy would be required to disclose:

-

the number or percentage of issuers with which the fund held ESG engagement meetings during the reporting period related to one or more ESG issues; and

-

the total number of ESG engagement meetings.

-

The SEC proposes to define “ESG engagement meeting” as a substantive discussion with management of an issuer advocating for one or more specific ESG goals to be accomplished over a given time period, where progress that is made toward meeting such goal is measurable, that is part of an ongoing dialogue with management regarding this goal.

-All ESG-Focused Funds That Consider Environmental Factors. Must disclose the carbon footprint and weighted average carbon intensity (WACI) of the fund’s portfolio.

-

A fund would not be required to disclose its GHG emissions metrics if it affirmatively states in the ESG Strategy Overview table in the fund’s prospectus that it does not consider issuers’ GHG emissions as part of its investment strategy.

Proposed Adviser Disclosure Requirements

Investment advisers that consider ESG factors as part of their advisory business would be required to include specific, standardized disclosures regarding their ESG strategies (similar to those for registered funds discussed above) in their Form ADV.

-ESG Strategy Disclosure. An adviser would be required to provide a description of the ESG factor(s) considered for each significant investment strategy or method of analysis, including whether and how the adviser incorporates these factors when providing investment advice.

-

Similar to the proposed requirement for funds, an adviser would be required to include an explanation of whether and how it employs integration and/or ESG-focused strategies, and if ESG-focused, whether and how the adviser also employs ESG impact strategies.

-

If an adviser uses, for any significant strategy, criteria or a methodology to evaluate, select, or exclude investments based on the consideration of ESG factors, it must describe those criteria and/or methodologies and how it uses them.

-

Proposed sub-Item 8.D to Form ADV Part 2A (the adviser brochure) would require advisers that consider ESG factors to disclose whether and how they use, among other things, the following:

-

An internal methodology, a third-party criterion or methodology such as a scoring provider or framework, or a combination of both, including an explanation of how the adviser evaluates the quality of relevant third-party data;

-

An inclusionary or exclusionary screen, including an explanation of the factors the screen applies, such as particular industries or business activities it seeks to include or exclude and if applicable, what exceptions apply to the inclusionary or exclusionary screen; and

-

An index, including the name of the index and a description of the index and how the index utilizes ESG factors in determining its constituents.

-ESG Provider Relationships. An adviser would be required to describe any relationship or arrangement that is material to the adviser’s advisory business or to its clients that the adviser or any of its management persons have with any related person that is an ESG consultant or other ESG service provider.

-ESG Considerations in Proxy Voting. Advisers that have specific voting policies or procedures that include one or more ESG considerations when voting client securities must include in their brochures a description of which ESG factors they consider and how they consider them.

WRAP FEE BROCHURE DISCLOSURE REQUIREMENTS

The SEC’s proposal also contemplates ESG disclosure requirements for wrap fee program brochures—i.e., Form ADV Part 2A, Appendix 1.

-Advisers that consider ESG factors in their wrap fee programs must provide a description of what ESG factors they consider, and how they incorporate the factors under each program.

-Advisers that consider ESG factors when selecting, reviewing or recommending portfolio managers within the wrap fee program they sponsor must describe the ESG factors they consider and how they consider them.

-In addition, advisers would be required to:

-

Describe any criteria or methodology they use to assess portfolio managers’ applications of the relevant ESG factors into their portfolio management;

-

Provide an explanation of whether they review, or whether a third party reviews, portfolio managers’ applications of the relevant ESG factors; and

-

If applicable, explain that neither the adviser nor a third party assesses the portfolio managers’ application of the relevant ESG factors into their portfolio management, and/or that the portfolio managers’ applications of the relevant ESG factors may not be calculated, compiled, assessed or presented on a uniform and consistent basis.

TIMING AND COMMENT PERIOD

The SEC has proposed (i) a one-year transition period following the effective date of any adopted amendments for proposed disclosure requirements in prospectuses and adviser brochures; and (ii) an 18-month transition period following the effective date of any adopted amendments for proposed disclosures in shareholder reports.

Comments on the proposal will be due 60 days after publication of the proposing release in the Federal Register.

The SEC’s proposing release is available here, and a fact sheet is available here.

/>i

/>i