On August 14, in case of first impression, the Fourth Circuit Court of Appeals held that the Truth in Lending Act’s (“TILA”) offset provision, which prevents creditors from dipping into consumers’ deposit accounts to offset outstanding payments on their credit card plans, applies to home equity lines of credit (“HELOC”).

Here, the borrower was issued a credit card that he used to obtain cash advances and make purchases using HELOC loan funds. He also had deposit accounts with the bank. In 2019, the bank withdrew amounts from his deposit account to offset an outstanding payment on his HELOC loan. The borrower objected and brought suit, alleging various claims under TILA and Real Estate Settlement Procedures Act (“RESPA”). The case was dismissed by the Maryland federal district court. On appeal, the Fourth Circuit reversed the district court’s decision.

TILA’s offset provision provides that “[a] card issuer may not take any action to offset a cardholder’s indebtedness arising in connection with a consumer credit transaction under the relevant credit card plan against funds of the cardholder held on deposit with the card issuer,” except in certain circumstances. 15 U.S.C. § 1666h(a). The key issue here is whether the rules set forth for credit card plans apply to credit cards issued to access HELOC funds. The Fourth Circuit held that it did, holding, [t]he type of credit (secured, unsecured, home-secured, or secured by something other than a home) is not what matters. What matters is that a card is used to access the credit and that terms and conditions govern the credit.”

In a separate part of the decision, the court rejected the borrower’s argument that the bank violated RESPA by not timely responding when the borrower notified the bank about a mortgage servicing error. The court held that such a requirement does not apply to HELOCs.

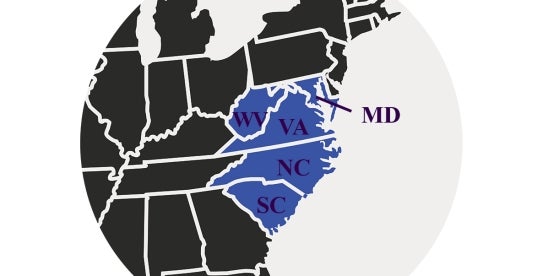

Putting It Into Practice: Given the divided panel’s decision, we were not surprised to learn that the bank filed a petition for rehearing before the entire Fourth Circuit. Separately, while credit cards are commonly available to access HELOCs, that is not universally true. For now, and at least with respect to states in the Fourth Circuit (Maryland, Virginia, West Virginia, North Carolina, and South Carolina), HELOCs that offer a credit card will be subject to Regulation Z’s prohibition on offsets, while HELOCs that do not offer a credit card will retain a right to offset (if contractually permitted). Creditors that offer a credit card with access to a HELOC should take note.

/>i

/>i